Tag Archive: Featured

March Madness? The Dollar is Closing in on its Best Week this Month

Overview: The dollar's down trend, which began at least a week before President Trump's second inauguration stalled this week, and preliminary technical signs suggest a bottom may be in the process of forming. The uncertainty over US reciprocal and sector tariff announcement on April 2 is boosting uncertainty among policymakers, investors, and businesses. The greenback is mostly firmer today and near the week's best levels against most of the...

Read More »

Read More »

MISES Podcast: Argentiniens Rückkehr auf den Wachstumspfad

MISES Podcast: Argentiniens Rückkehr auf den Wachstumspfad

21. März 2025 – von Javier Milei (frei übertragen aus dem Spanischen von Stephan Ring)

Die Wachstumsraten des Bruttoinlandsprodukts pro Kopf (BIP/c) sind sehr unterschiedlich. Während sich das Einkommen Indiens alle 50 Jahre verdoppelt, verdoppelt sich das Einkommen in Korea alle 10 Jahre.

Read More »

Read More »

Retail Sales Are Better Than Advertised

Within the headline retail sales figure is a lesser-followed data point called the retail sales control group. Following the trend of both figures is important because although the headline figure receives more attention, the control group is the measure that feeds into the GDP calculation.

Read More »

Read More »

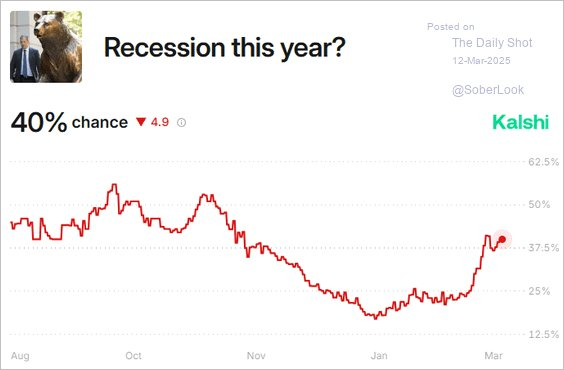

U.S. Recession Risks Not As High As The Media Suggests

U.S. recession risks have been a headline over the last few weeks as the markets sold off. "Goldman Sachs and Moody’s Analytics in recent days joined forecasters raising alarm about the increased likelihood of an economic downturn.

Read More »

Read More »

Trump gegen digitalen Dollar – ABER der digitale Euro kommt! Interview Ex-Investmentbanker

Trump stoppt digitalen (Kontroll-)Dollar – kippt jetzt auch der digitale Euro? | Interview Jürgen Wechsler

Zum Geldtraining: https://thorstenwittmann.com/die-5-groessten-geldrevolutionen

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext-yt

Trump verhindert zunächst einmal den fatalen digitalen US-Dollar, aber was macht Europa?!

Digitale Zentralbankwährungen sind Schrecken für jeden freiheitsliebenden Menschen. Jeder Geldfluss...

Read More »

Read More »

Private Altersvorsorge – 250.000€ mehr

Du willst zusätzlich zur gesetzlichen Rente ein bisschen Geld für's Alter auf die Seite legen? Dann erklärt Dir Saidi, wie Du das am besten machst.

#Finanztip

Read More »

Read More »

Idaho Reaffirms Gold and Silver As Legal Tender

(Boise, Idaho) – For the second time this month, new sound money legislation has become law in Idaho.

Faced with the overwhelming likelihood of a veto override from the legislature, Idaho Governor Brad Little signed the Idaho Constitutional Money Act of 2025 reaffirming gold and silver as legal tender and making a symbolic statement in favor of sound money principles.

Read More »

Read More »

Is the stockmarket facing a radical shift?

European and Asian stocks are outperforming American ones. But investors are also noticing deeper changes too. What’s going on? Our finance correspondent, Joshua Roberts, explains #finance #economics #america #donaldtrump #markets #usa

Read More »

Read More »

Boom: Jetzt kracht es richtig bei der CDU!

✅ Meine Depotempfehlung ? https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Was sind MwSt, Bitcoin & Schuldenbremse? Saidi testet Quiz vom Finanzministerium

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_QUljcrm5w8k

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_QUljcrm5w8k

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_QUljcrm5w8k

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_QUljcrm5w8k

Justtrade* ►...

Read More »

Read More »

Steuerparadox: Die Mitte zahlt, die Ränder profitieren

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch🤝🏽:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen👨🏽🏫:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck📈:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern📘:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Who Really Owns America’s Gold?

The Sound Money Revolution

As the world becomes more unstable and inward-facing, there is a growing surge toward the most timeless and borderless currencies—#gold and silver. These precious metals represent financial sovereignty for individuals, a hedge against chaos, and a path to stability in an uncertain world.

In this episode, GoldCore CEO Dave Russell is joined by #JpCortez, Executive Director of the Sound Money Defense League, who is...

Read More »

Read More »

BUKELE DESTROZA A LOS PROGRES POR LA DEPORTACIÓN DE CRIMINALES

Trump deporta a 238 miembros del Tren de Aragua a El Salvador. Bukele trolea a los woke que critican la medida.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG...

Read More »

Read More »

USA: Elon Musks SCHOCK-Warnung an die Welt!

✅ Meine Depotempfehlung ? https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Kaufe NIEMALS diese Aktie

Mercedes baut großartige Autos, aber taugt die Aktie als Investment? Ich analysiere die langfristige Performance, vergleiche die Aktie dem DAX und erkläre, warum ich Mercedes nicht in mein Depot nehme.

JETZT zum Webinar anmelden:

https://www.jensrabe.de/WebinarApr25

Vereinbare jetzt dein kostenfreies Strategiegespräch:

https://jensrabe.de/Q1Termin25

Aktien kann Jeder - jetzt testen:

https://jensrabe.de/YTAKJ

Optionen kann Jeder - jetzt testen:...

Read More »

Read More »

Maischberger Schock: Tilo Jung dreht komplett frei!

Tilo Jung Video: ?si=26VY91UVqu2u2AqE

✅ Meine Depotempfehlung ? https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit...

Read More »

Read More »

Février 2025 : le commerce extérieur en verve après un début d’année morose

L’évolution très volatile du commerce extérieur s’est poursuivie en février 2025. Après désaisonnalisation, tant les exportations que les importations ont contrebalancé leur revers du mois précédent, avec une croissance de respectivement 6,6 et 7,0%. Une fois de plus, le secteur de la chimie-pharma a grandement influencé le résultat. L’excédent de la balance commerciale a atteint 4,3 milliards de francs.

Read More »

Read More »