Tag Archive: Featured

Basel EuroAirport announces ambitious expansion project

The existing terminal at the hub on the Swiss-French border is to be joined by another, almost as large.

Keystone / Georgios Kefalas

Listen to the article

Listening the article...

Read More »

Read More »

Can the Western alliance be saved?

The transatlantic relationship is crumbling, at least according to one former NATO chief. Is he right? Our geopolitics editor gives his view #geopolitics #trump #defence #nato #europe #security

Read More »

Read More »

Week Ahead: Is the Dollar Bottoming?

After falling steadily since from the end of Q3 24 through the first part of January, the dollar stabilized last week, despite the dovish market takeaway from the Federal Reserve. The median projection for growth was shaved while the inflation project was raised. Still, despite the Atlanta Fed's GDP Now tracking a contraction here in Q1, few are that pessimistic. None of the 58 economists in Bloomberg's survey see a contraction, and only one...

Read More »

Read More »

ETF-Fehler: Aktive ETFs #etf

ETF-Fehler: Aktive ETFs 📉 #etf

🎥 10 teure ETF-Fehler, die du vermeiden solltest! | Häufige ETF-Pannen von Anlegern:

?si=jun8zRArGp1u4LvA

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine...

Read More »

Read More »

Immobilienkauf: Diese Kosten übersiehst Du schnell

Provision und Grunderwerbssteuer: Welche versteckten Kosten kommen noch dazu, wenn Du Dir eine Immobilie kaufen willst? Saidi erklärt's Dir hier im Schnelldurchgang.

#Finanztip

Read More »

Read More »

Is The Correction Over?

Inside This Week's Bull Bear Report Is A Bottom Beginning To Form? Last week, we noted that the market performance, while distressing as of late, has been well within regular correctionary market cycles from a historical perspective.

Read More »

Read More »

Betrug fliegt auf: Wir wurden getäuscht! (und schweigen!!!)

Kostenfreies Video-Training (Durch Trading in 2025 absichern) 👉 https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉...

Read More »

Read More »

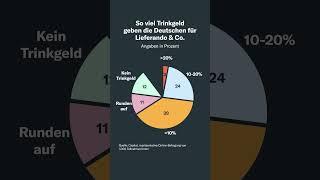

Wie viel Trinkgeld geben wir bei Lieferando & Co.?

Egal ob Lieferando, Wolt oder der eigene Lieferservice Deiner Lieblingspizzeria: Gibst Du den Lieferdiensten Trinkgeld, wenn Du Dir Essen nach Hause liefern lässt? Schreib's uns gerne in die Kommentare.

#Finanztip

Read More »

Read More »

Gold & Silver Cool Slightly After Month-Long Rally

This week, we have the incredible honor of talking to the man who wrote a book on the origins of the Fed called The Creature from Jekyll Island. G. Edward Griffin joins us this week and you will not want to miss the incredible and sketchy story of how the Federal Reserve came to be over a century ago.

Don’t forget to also follow us on social media for more important precious metals updates!

https://www.youtube.com/@Moneymetals |...

Read More »

Read More »

LA POPULARIDAD DE TRUMP EXPLOTA MIENTRAS LOS DEMÓCRATAS SE HUNDEN

A pesar de la desinformación, una encuesta muestra que la popularidad de Trump está en máximos históricos, la de los demócratas en mínimos, y el 70% aprueba sus acciones.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en...

Read More »

Read More »

Deutschland: Reich an Wirtschaft, arm an Vermögen

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch🤝🏽:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen👨🏽🏫:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck📈:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern📘:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Der Aktienmarkt zittert. 🥶 Jetzt USA verkaufen? 🇺🇸 #msciworld

Der Aktienmarkt zittert. 🥶 Jetzt USA verkaufen? 🇺🇸 #msciworld

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Klimaneutralität im Grundgesetz – Fluch oder Segen für Deutschland?

Eine Dekarbonisierung und Demobilisierung unserer Volkswirtschaft, bei gleichzeitiger, massiver Anhebung der Schulden, führt zu einer Verarmung der Gesellschaft und gleichzeitig unvorstellbarem Leid unter den Menschen. Die Folgen der ins Grundgesetz geschriebenen Klimaneutralität ist noch Niemandem richtig bewusst geworden. Ich zeichne mit offiziellen Daten des Umweltbundesamts ein paar Kurven, die den gesamten Schlamassel verdeutlichen.

-

✘...

Read More »

Read More »

Lieber in europäische Aktien investieren? | Saidis Senf der Woche

Hast Du Angst, dass Donald Trump Dich Deine Rendite kostet? Hier findest Du raus, was Saidi dazu sagt.

#Finanztip

Read More »

Read More »

Jahrhundertchance oder Milliardengrab?

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

How to Prevent a U.S. Debt Heart Attack

The US is approaching the end of the long debt cycle with 3 factors that can be combined to prevent the worse case scenario: 1) spending 2) taxes 3) interest rates

Learn more about my proposed 3% solution to the US debt crisis here: https://economicprinciples.org/how-countries-go-broke

#principes #howcountriesgobroke

Read More »

Read More »

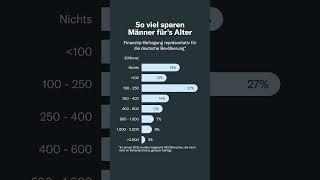

So viel sparen Männer für’s Alter

So viel legen Männer in 🇩🇪 laut einer Finanztip-Umfrage für die Altersvorsorge beiseite.

#Finanztip

Read More »

Read More »

Spy-fall: Trump imperils intelligence pact

America’s international intelligence-sharing relationships have been decades in the making and rely not on a treaty but trust. Could Donald Trump damage (https://www.economist.com/international/2025/03/16/trump-v-the-spies-of-five-eyes?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) the powerful spy alliance? Why we may...

Read More »

Read More »