Tag Archive: Featured

Trump: We Are in Venezuela Now, and We Are Going to Stay

Trump claimed Washington would pay for the occupation of Venezuela with profits from the country’s oil.

Read More »

Read More »

Eilmeldung: Trump hat Maduro angegriffen und entmachtet!

🎁 Erhalte bis zu 20 US-Aktien gratis (im Wert von bis zu 800 USD, bis 31.03.) 👉

https://link.aktienmitkopf.de/Depot *

✅ Meine Depotempfehlung

Investiere global mit dem Freedom24-Broker:

Mehr als 40.000 Aktien und 3,600 ETFs mit transparenter Preisgestaltung

Direkter Zugang zu mehr als 20 globalen Börsen

Kostenloser persönlicher Assistent und Anlageideen

👉 https://link.aktienmitkopf.de/Depot*

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

EL SALVADOR ERA UNO DE LOS PAÍSES MÁS PELIGROSOS

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Was müsst Du bei einem gemeinsamen Konto beachten?

Gemeinsames Konto? Ja, aber bitte mit Plan! 💳👇

👫 Ein Gemeinschaftskonto ist super für Miete, Strom & Co. – vor allem, wenn Ihr zusammenwohnt.

🧍♀️ Einzelkonten sorgen aber dafür, dass Ihr finanziell unabhängig bleibt und nicht für Schulden des:der anderen haftet.

💡 Wenn ihr unterschiedlich viel einzahlt, kann das Finanzamt bei unverheirateten Paaren sogar eine Schenkung vermuten – Freibetrag: nur 20.000 € in 10 Jahren!

1️⃣ Bestes Modell: das...

Read More »

Read More »

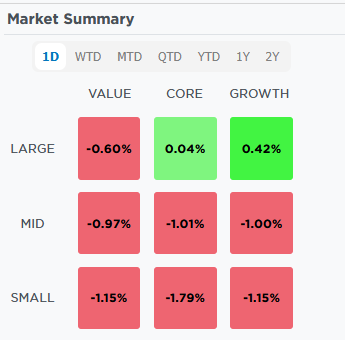

Market Outlook For 2026

🔎 At a Glance 💬 Don't Miss Our Upcoming "Live & In Person" Summit Our 2026 Summit is a limited-seating event, so secure your tickets now before they sell out. Topics Include: I look forward to seeing you there. 🏛️ Market Brief - Strong Year-End Returns Lead to Bullish Market Outlooks Let's start this week … Continue reading...

Read More »

Read More »

Can Switzerland’s power grid keep up with its data centres?

In Switzerland, the number of data centres per capita is among the highest in the world, while the share of electricity they consume is among the highest in Europe. With some power grids already close to the limit, the rapid growth of artificial intelligence (AI) could put them under further strain. Data centres are multiplying …

Read More »

Read More »

Smartphones, streaming, AI: digital tech’s outsized climate impact in Switzerland

Everyday devices and online services sap the planet’s natural resources and contribute to climate change. But there are ways to make digital life greener. More than six billion people – three quarters of the world’s population – are now online. In high-income countries like Switzerland, virtually the entire population has internet access. The Swiss spend …

Read More »

Read More »

Sparkassen-Raub: Es stinkt bis zum Himmel!

🎁 Erhalte bis zu 20 US-Aktien gratis (im Wert von bis zu 800 USD, bis 31.03.) 👉

https://link.aktienmitkopf.de/Depot *

✅ Meine Depotempfehlung

Investiere global mit dem Freedom24-Broker:

Mehr als 40.000 Aktien und 3,600 ETFs mit transparenter Preisgestaltung

Direkter Zugang zu mehr als 20 globalen Börsen

Kostenloser persönlicher Assistent und Anlageideen

👉 https://link.aktienmitkopf.de/Depot*

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

American Indians: Separating Truth from Fiction

Depending upon the narrative, American Indians were either noble creatures who were victims of a genocide by rapacious European settlers or were bloodthirsty savages. The truth is more nuanced.

Read More »

Read More »

Kaufkraftverlust von 1 US-$ über 225 Jahre

So stark hat der US-Dollar an Wert verloren 👇

📉 1 $ im Jahr 1800 hatte so viel Kaufkraft wie heute rund 25 $!

🔥 Bedeutet: Was Du früher für 1 $ bekommen hast, kostet heute das 25-Fache.

📊 Der Grund? Inflation – sie sorgt dafür, dass Dein Geld von Jahr zu Jahr weniger wert ist.

💡 Wer sein Geld nicht clever anlegt, verliert langfristig Vermögen – ganz ohne es auszugeben.

1️⃣ Sparen allein reicht nicht: Auf dem Tagesgeld- oder Girokonto verliert...

Read More »

Read More »

Novo Nordisk: +100%? Mega Comeback in 2026?

► Teste jetzt bei den „Rendite-Spezialisten“ mein Echtgeld-Depot 30 Tage ohne Risiko – 40% Rabatt – nur bis 06.01. → https://www.rendite-spezialisten.de/video/depot/

Ich hätte jetzt beinahe gesagt, das ist der einzige Beitrag, den ihr Euch zu Novo Nordisk überhaupt anhören oder ansehen müsst, aber selbstverständlich besorgt Ihr Euch so viele Informationen wie möglich, um dann eine Entscheidung zu treffen. Ich möchte heute den „deep dive“ in Novo...

Read More »

Read More »

Retail Silver Sales Skyrocketing Yet Money Metals Remains Fully Stocked!

This week, a replay of one of our very best interviews this year, a recent one with Jorge Jraissati, President of the Economic Inclusion Group. Jorge joined Mike Maharrey in an explosive, enlightening and somewhat troubling discussion on the subject of de-banking and much more.

Don’t forget to also follow us on social media for more important precious metals updates!

https://www.youtube.com/@Moneymetals |...

Read More »

Read More »

México va directo al desastre

Sheinbaum presume crecimiento, pero los datos revelan estancamiento: déficit y gasto público hunden el potencial económico del país.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal...

Read More »

Read More »

Junk Silver: The Sound Money “Ping” You Can’t Fake (ASMR)

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Junk Silver: The Sound Money “Ping” You Can’t Fake (ASMR)

Junk silver has a sound you don’t forget. In this video, we pour a pile of classic U.S. Mint “sound money” coins and sift through them by hand so you can hear that unmistakable silver ping—clean, bright, and impossible to fake.

You’ll see (and hear) real, circulated U.S. silver coinage up close, including Mercury...

Read More »

Read More »

Die Pendlerpauschale erhöht sich 2026 erheblich

Die Pendlerpauschale erhöht sich 2026 erheblich 🚗

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

Trump’s National Insecurity Strategy

President Trump’s latest national security initiative is unlikely to make the US secure from outside danger. For that matter, Trump’s own internal policies are making this country less secure.

Read More »

Read More »

Embracing Austrian Economics: A Path Forward for Zimbabwe

Ever since independence more than 40 years ago, Zimbabwe has been wracked with socialism, inflation, and corrupt political leadership. Yet, there is a way forward for the nation, if Austrian Economics can be in its future.

Read More »

Read More »