Tag Archive: Featured

MUSK SE RETIRA: ¿DECEPCIONADO CON EL GASTO?

Aunque los medios difunden tensión entre Elon Musk y Trump, su salida fue pactada; Musk hizo algunas críticas sobre la gestión del gasto público.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a...

Read More »

Read More »

The Tobacco Standard in Colonial America

MMT and chartalism claims that money is a creature of the state and is valued because of state action. The fact that tobacco acted as colonial money independently of the state demonstrates this to be false.

Read More »

Read More »

Merz holt sich CDU-Feind in die Regierung!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Tag 5 – Der Schein trügt

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

Was hältst du von einem Ende der Bonpflicht? 🤔 #quittung

Was hältst du von einem Ende der Bonpflicht? 🤔 #quittung

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Eilmeldung: CDU-Minister völlig außer Kontrolle!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Userfragen: Sorgen einer Familie und der Wahnsinn des Staates

Ein Familienvater hat Sorge um seinen #Arbeitsplatz bei einem #Konzern. Es sieht nicht gut aus. Die volkswirtschaftlichen #Zustände sind furchterregend. Steigende Steuern und Abgaben, steigende Bürokratisierung, und mehr und mehr versagende Institutionen wie das Bildungssystem und das ÖR-PayTV (Öffentlich-rechtliche Medien).

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein Buch Katastrophenzyklen ►...

Read More »

Read More »

Anlegen wie Champions? | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_3MXCgLIkzgE

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_3MXCgLIkzgE

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_3MXCgLIkzgE

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_3MXCgLIkzgE

Justtrade* ►...

Read More »

Read More »

El Salvador’s president is locking up his critics

El Salvador’s President Bukele imprisoned thousands in his crackdown on crime, winning praise from Donald Trump and the American right. But now the president is using repressive tactics on his critics too

Read More »

Read More »

Wow! Alice Weidels spektakuläre Rede vor internationalem Publikum!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

The USD is mixed vs the 3 major currency pairs with prices near MA levels

Traders are waiting for the next shove with lots of data on the calendar including the Core PCE..

Read More »

Read More »

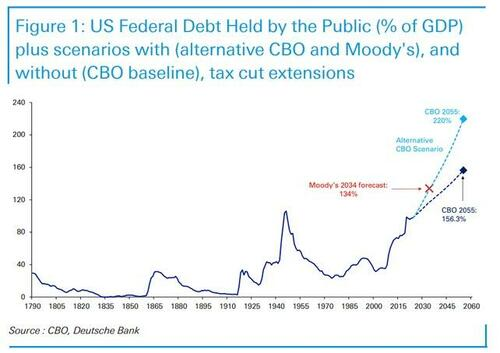

5-30-25 Is This the Year for Your ROTH Conversion?

Is 2025 the ideal time for a Roth conversion?

RIchard Rosso considers future tax rates potentially on the rise and retirement goals in focus, and why converting to a Roth IRA could be a smart move. We’ll break down the rules, potential tax implications, and key strategies to maximize your tax-free retirement income. Whether you’re planning for retirement or looking to optimize your wealth, don’t miss this essential guide to Roth conversions in...

Read More »

Read More »

Comrade Aristotle?

In today‘s Friday Philosophy, Dr. David Gordon looks back upon the ethical views of the late Alasdair MacIntyre. While praising MacIntyre‘s work, Dr. Gordon points out that he never abandoned his Marxist views of economics, making much of his philosophical thinking crucially deficient.

Read More »

Read More »

Budapest: Orbans Schockwarnung an EU mit Alice Weidel!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

On-Again Off-Again US Tariffs are Back

Overview: The on-again, off-again US tariffs are back on, but the judicial process is not over. On top of that, US Treasury Secretary Bessent acknowledged what many have suspected: US-Chinese talks have stalled. The dollar, which was offered yesterday, has come back bid today. It is up against nearly all the G10 currencies. The yen …

Read More »

Read More »

Rückgänge sind Teil des Plans! Mit der Talfahrt nimmt man Schwung auf. #keepquietandstaycalm

Rückgänge sind Teil des Plans! Mit der Talfahrt nimmt man Schwung auf. 🚂 #keepquietandstaycalm

🎥 Untypische Lektionen, die ich in 10 Jahren Börse gelernt habe:

?si=v9m5cD1mE_WxiDaS

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Ray Dalio Is Predicting A Financial Crisis…Again.

Ray Dalio, the former head of Bridgewater Associates, is back in the media, trying to stay relevant by claiming the "deficit has become critical." " “It’s like ... I’m a doctor, and I’m looking at the patient, and I’ve said, you’re having this accumulation, and I can tell you that this is very, very serious, and …

Read More »

Read More »