Tag Archive: Featured

Take the Deal, President Trump

Deal-making is said to be President Trump’s specialty, yet after five rounds of indirect talks with Iran – most recently just days ago – we seem as far away from an agreement as ever.

Read More »

Read More »

The Cultural Consequences of Inflation

It is easy to think of inflation as just being economic in scope. Yet, as inflation becomes an expected part of the body politic, it affects the culture as well, encouraging everyone to try to live beyond their means.

Read More »

Read More »

USA: Außenminister Rubio mit Schocknachricht an CDU Außenminister!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

US Trade Court Roils Markets: Trump Administration to Appeal

Overview: There is one driver today. The US Court of International Trade ruled against the Trump administration's "Liberation Day" tariffs. The court rules that the 1977 law used to justify the actions did not apply. The ruling also applies to the earlier tariffs on security of the US borders and fentanyl trafficking. The dollar initially …

Read More »

Read More »

Der Broker ist egal #einfachmachen

Der Broker ist egal 📱 #einfachmachen

🎥 Untypische Lektionen, die ich in 10 Jahren Börse gelernt habe:

?si=v9m5cD1mE_WxiDaS

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen...

Read More »

Read More »

Demand is rising for credit default swaps on US govt debt

As debt piles up, the cost of insuring exposure to U.S. government debt has been rising steadily.

Read More »

Read More »

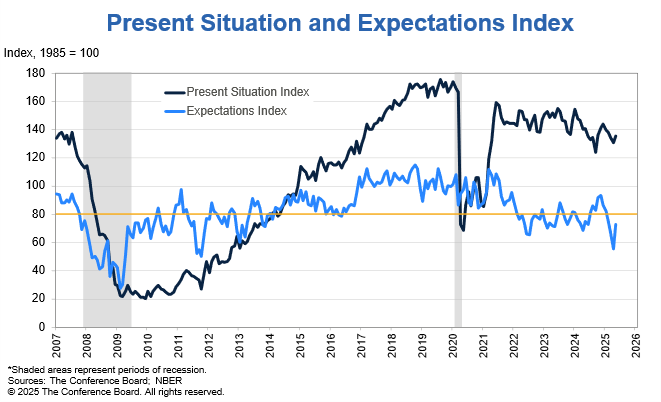

Consumers Are Not As Gloomy

The Conference Board’s consumer confidence index surged from 85.7 to 98.0. Such was the largest one-month increase since 2009! Clearly, progress on trade deals and the delay in implementing tariffs spurred the increase. Moreover, the recovering stock market also boosted consumer confidence. However, bear in mind that the index is coming off its lowest level …

Read More »

Read More »

Poland’s Turn Toward a Market Economy Saved It from Poverty

Polish professor of political theory Łukasz Dominiak joins us to talk about how Poland embraced a market economy after the Cold War ended. We discuss some of the factors behind Poland's rise from poverty.

Read More »

Read More »

The American-Israeli Nineteenth-Century Ways of War

This brief historical sketch brings us to how the American and Israeli militaries of today have adopted a nineteenth-century-style war of extermination against what they consider to be another “lesser race.”

Read More »

Read More »

Brisante Nordstream Entwicklung: Merz mitten im Skandal!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Gold Trading Outlook: Retest or Reversal?| market outlook | 28.05.2025

Gold has rebounded sharply from the $3,200 level, but with a new support forming around $3,300, is it time for traders to reconsider their strategies? This week, we’re eyeing key narratives like the decline in bond markets and a steady increase in commercial traders' positions on the Commitment of Traders report. Will upcoming US GDP and PCE data drive the next big move in gold, or is this just another pause before the next leg higher? Get the full...

Read More »

Read More »

US court blocks Trump from imposing the bulk of his tariffs

MAGA wants a single man to be able to raise taxes without any checks on this power. Fortunately, the courts disagreed.

Read More »

Read More »

The Great Taking!

Interview with James Patrick, TheGreatTakingReport.com

As many of my clients, friends and regular readers know well, I’ve spent the better part of the last decade criticizing all the great evils and trespasses of the State and its crony capitalist accomplices. I’ve written extensive analyses and gave many speeches warning fellow citizens about the dangers that lie in government power grabs and authoritarian transgressions. The most important of...

Read More »

Read More »

Ludwig von Mises on Peace and Social Cooperation

The free market replaces the struggle for survival found in the animal world with social cooperation in which everybody benefits. Capitalism is a system of peace, not war.

Read More »

Read More »

Wie viele 100.000€ reichen für Frührente oder Immobilie? | Saidis Senf

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_SFFCIHN49M4

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_SFFCIHN49M4

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_SFFCIHN49M4

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_SFFCIHN49M4

Justtrade* ►...

Read More »

Read More »

The American-Israeli Nineteenth-Century Ways of War

This brief historical sketch brings us to how the American and Israeli militaries of today have adopted a nineteenth-century-style war of extermination against what they consider to be another “lesser race.”

Read More »

Read More »

Gold Technical Analysis – Stuck in a consolidation awaiting a breakout

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:47 Technical Analysis with Optimal Entries.

2:07 Upcoming Catalysts...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #456

Klicke hier, um Dich direkt gemeinsam mit Oli durchs Trading unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM AUF FACEBOOK (Bisher 6000+ Mitglieder): ►Jetzt Beitreten...

Read More »

Read More »

Vorsicht vor Finanztip Fake-Accounts auf Instagram!

🚨 Auf Instagram gibt es gerade leider ziemlich viele Fake-Accounts von Finanztip. Bitte folgt denen nicht, geht auf deren Anfragen nicht ein und joined auch nicht deren WhatsApp Gruppen.

Von Finanztip gibt es zunächst mal diesen offiziellen Hauptaccount hier. Und dann gibt es noch unseren Female-Finance-Account @aufgeldreise. Von dem gibt es so einige Fake-Profile, von denen einige von Euch auch direkt kontaktiert wurden.

Weder Hermann Josef...

Read More »

Read More »

Ray Dalio’s the Big Cycle Explained in 3 Minutes

Five big forces produce the overall Big Cycle that leads to radical changes in monetary, domestic, and/or world orders. To learn more about where we are at in the Big Cycle, check out my new book, How Countries Go Broke: The Big Cycle here: https://bit.ly/3F5OFvN

#raydalio #principles #politics #economics

Read More »

Read More »