Tag Archive: Featured

HUYÓ DE UNA GUERRA Y ENCONTRÓ UN SISTEMA QUE LA DEJÓ DESPROTEGIDA

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Keir Starmer set to announce digital ID cards for all UK adults

As in the US, immigration control is used in the UK as an excuse to push more government surveillance and control.

Read More »

Read More »

Greenback Consolidates Yesterday’s Gains

Overview: The foreign exchange market is becalmed today. The greenback is in narrow ranges with a slightly softer bias against most of the G10 currencies, but the Swiss franc and Canadian dollar. The news stream is light, and the leadership of the North American market seems awaited. The US announced a new sectoral investigation into …

Read More »

Read More »

New Online Texts from the Levellers and David Hart

If you’re not familiar with David M. Hart's online library of texts from classical liberals and libertarians, be sure to check it out here.

Read More »

Read More »

Pfizer Tries To Fatten Its Profits With Weight Loss Drugs

Eli Lilly (LLY) and Novo Nordisk (NOVO) dominate the market for weight loss drugs. The monopoly has proven incredibly profitable for both companies. Consider that in the last quarter, LLY reported that $8.58 billion of its $15.56 billion in total revenue came from its two GLP-1 weight loss drugs Mounjaro and Zepbound. Even a greater percentage …

Read More »

Read More »

Deutsche Bank Conducts First Euro Cross-Border Payment via Partior Blockchain

Deutsche Bank has conducted its first euro-denominated cross-border payment using Partior’s blockchain platform.

The transaction was carried out in collaboration with DBS, Southeast Asia’s largest bank by assets, with Deutsche Bank acting as the settlement bank and DBS as the beneficiary bank.

Deutsche Bank invested in Partior in 2024 and finalised a platform agreement in May 2025 to provide real-time, secure, and scalable settlement.

This live...

Read More »

Read More »

Schockmoment im Parlament: AfD-Neuling lässt CDU hochgehen

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Swiss National Bank keeps key interest rate at zero

The Swiss National Bank (SNB) is taking a break from interest rates. After six consecutive interest rate cuts, the key interest rate will remain at 0.00%, the SNB announced on Thursday. +Get the most important news from Switzerland in your inbox Inflationary pressure is practically unchanged compared to the previous quarter, the SNB wrote in …

Read More »

Read More »

Establishment Fears About Trump’s Focus on the Fed Are About Optics, Not Policy

The political establishment is trying to stoke panic that Trump is “politicizing” the Federal Reserve. But it’s already political. The real danger, from their perspective, is not that Trump is changing the Fed; it’s that he’s making its true nature harder to hide.

Read More »

Read More »

So sparst du auf eine Immobilie! #immo

So sparst du auf eine Immobilie! 🏠 #immo

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Napolitano: Free Speech and Its Discontents

"Government at its core is the negation of freedom. Hence it wants to silence those who expose its errors and rid itself of those who challenge it."

Read More »

Read More »

USDJPY Technical Analysis: US labour market data in focus

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook

1:14 Technical Analysis with Optimal Entries

2:20 Upcoming Catalysts...

Read More »

Read More »

The British Healthcare System Remains One of the Worst in Europe

While politicians neglect healthcare and focus on their own public relations, ordinary Britons are increasingly feeling the weight of their own internal health problems.

Read More »

Read More »

Two Swiss parties face dilemma on agreements with EU

The Centre Party and the Radical-Liberal Party are struggling to define their stance on new agreements between Switzerland and the European Union. Much is at stake for both, including their influence. The debate offers significant potential for them to make political gains, our analysis shows. It is the middle of the legislative term. Since June, …

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #492

Klicke hier, um Dich direkt gemeinsam mit Oli durchs Trading unabhängig zu machen 👉 http://oliverklemmtrading.com/bewerbung

►►Mein Zweitkanal (Trading Content): @oliverklemmtrading

►Folge Oli auf Instagram: http://bit.ly/TOInst

►Abonniere Oli auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM AUF FACEBOOK (Bisher 6000+ Mitglieder): ►Jetzt Beitreten & Austauschen: http://bit.ly/TOFBCommunity

Telegram:

Politik...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #492

Klicke hier, um Dich direkt gemeinsam mit Oli durchs Trading unabhängig zu machen 👉 http://oliverklemmtrading.com/bewerbung

►►Mein Zweitkanal (Trading Content): @oliverklemmtrading

►Folge Oli auf Instagram: http://bit.ly/TOInst

►Abonniere Oli auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM AUF FACEBOOK (Bisher 6000+ Mitglieder): ►Jetzt Beitreten & Austauschen: http://bit.ly/TOFBCommunity

Telegram:

Politik...

Read More »

Read More »

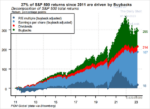

September Blues? Beim Wetter ja, aber nicht an den Börsen

Die September-Schwäche an den Aktienmärkten ist eine alte Börsenweisheit. Doch scheint sie dieses Jahr auszubleiben, obwohl es wirtschaftlich, geopolitisch und mit Blick auf die weltweite Überschuldung vermeintlich viel Raum für Moll-Stimmung gibt. Mehr Volatilität ist zwar einzukalkulieren, aber trotz aller Risiken sollten die Chancen nicht übersehen werden.

Read More »

Read More »

Santander Bank: Du darfst kein Bargeld von deinem Konto abheben!

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »