Tag Archive: Featured

Droht jetzt ein Börsencrash wegen der EZB?!

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Correctiv Skandal: Faesers Desolate Entgleisung!

Auch nach 2 Monaten will Nancy Faeser nichts an ihren Entgleisungen nach dem Correctiv Bericht ändern! Meiner Meinung nach ist es der größte Medienskandal der Deutschen Nachkriegsgeschichte!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Belgian Presidency of the Council of the EU 2024 from...

Read More »

Read More »

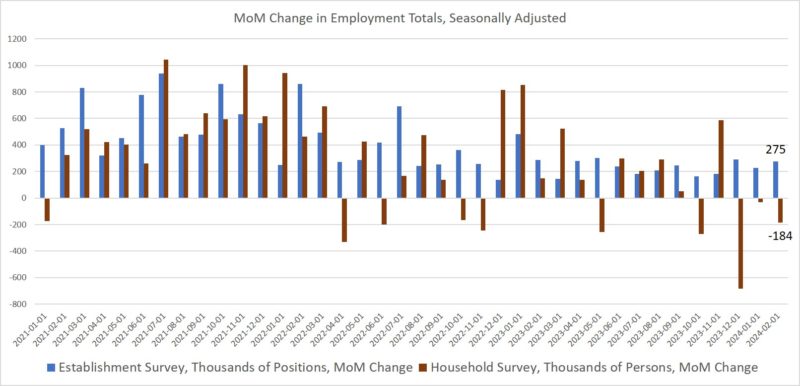

Employment Falls for the Third Month In Spite of 50,000 New Government Jobs

According to a new report from the federal government's Bureau of Labor Statistics this week, the US economy added 275,000 jobs for the month of February while the unemployment rate rose to 3.9%. In what has become a predictable ritual, reporters from the legacy media were sure to declare "another strong jobs report."

Read More »

Read More »

EL TIMO DE LA INFLACIÓN. Los Gráficos de la SEMANA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

#inflacion #economíaespañola #españa #pedrosánchez #daniellacalle

Read More »

Read More »

Holding Long-term Bonds, but not to Maturity

Market Commentary: When will rate cuts hit? Biden's SOTU Address: Get ready for higher corporate taxes and an inflation fight. The Death of the 4% Rule? Not yet...the impact of lower interest rates on a viable distribution plan; how to create one as Recession looms. Dealing with durations: Holding long-term bonds, but not to maturity. Credit risk in bonds, and the importance of portfolio fluidity. Distribution planning and timing: What are...

Read More »

Read More »

Understanding the AI Revolution

The artificial intelligence (AI) revolution is here, and it is bound to change the world as we know it—or so proclaims the hype following the release of OpenAI’s ChatGPT version 3.5 in November 2022, which was only the beginning. Indeed, much has happened since then with the release of the much-improved version 4.0, which was integrated into Microsoft’s Bing search engine, and the recent beta release of Google’s Gemini.

Read More »

Read More »

Unbreakable Spirit

Website of Patrick L Young: https://www.exchangeinvest.com/ipo-vid-livestream/

My Homepage: https://www.rainer-zitelmann.com/

Read More »

Read More »

Marxist Women’s Day

In April 1845, Karl Marx’s mother-in-law sent to the Marx family a nanny named Helene Demuth, known as “Lenchen.” Marx’s long-suffering wife, Jenny, was thrilled. After all, she had long expressed the wish that Karl would “earn some capital rather than just writing about capital.”But Karl refused to earn money. Just as he refused soap and bathing, which spawned boils all over his body.

Read More »

Read More »

The Absurdity and Danger of the State of the Union

On Thursday night, tens of millions of Americans from across the political spectrum tuned in to see how President Joe Biden would perform in his third State of the Union Address. The president’s age and cognitive ability has become a top issue facing his re-election campaign.

Read More »

Read More »

Heftig: Bundesrechnungshof Desaster für Habeck!

Der Bundesrechnungshof vergibt in einem neuen Prüfbericht ein katastrophales Fazit zur aktuellen Politik der Ampel!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Steffen Prößdorf, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=133026892

? Mein Buch! Der Rationale Kapitalist...

Read More »

Read More »

Gold Technical Analysis – All eyes on the US NFP report

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:47 Technical Analysis with Optimal Entries....

Read More »

Read More »

Wie ist Dubai wirklich?? Mein Erfahrungsbericht über diese VERRÜCKTE Freiheitsoase

Freiheit, Luxus und Business: Ein Blick in das moderne und visionäre Dubai

Klartext-E-Letter: https://thorstenwittmann.com/klartext-yt

Events und Reisen: https://thorstenwittmann.com/events/

Was hat Dubai alles zu bieten?

Die einfachere Frage wäre vielleicht eher, was es nicht zu bieten hat.

Dubai hält eine Vielzahl von Weltrekorden, wie z.B. die größte Indoor-Skianlage, das einzige 7-Sterne-Hotel der Welt, weltweit größte künstliche...

Read More »

Read More »

The Great Depression and Great Depression II: Similarities, Differences

Comparing Great Depression I with the current Great Depression II, the cause has been the same, and the responses have been similar.But it’s important to not take the parallels too far. The circumstances differ, so the impacts will differ.First, the similarities.Same Cause, Similar ResponsesBoth depressions, like recessions, originated with unsustainable booms.

Read More »

Read More »

India Could Dominate the World or “Collapse in on Itself” | Jacob Shapiro

India looks amazing on paper: 1.4 billion people, the world’s fastest-growing economy, rapid digitization, and arms wide open to foreign investment.

In this episode of Global Macro Update with Cognitive Investments partner Jacob Shapiro, you’ll hear about the hottest growth sector in India. Jacob gives it a “9 or a 10.”

We also cover Jacob’s predictions about India’s changing position in the multipolar world, which is one of my core investment...

Read More »

Read More »

Sound Money Part 4

PART 4: Are we encouraging the WORLD to change sound money legislation? Our CEO, Stefan Gleason, is on a mission to restore Sound Money ✨ FOLLOW FOR PART 5! Learn about the cause at soundmoneydefense.org

#round #silver #silverstacking #bar #coin #money #metals #moneymetals #investment #financialfreedom #beyourownbank #commodityculture #soundmoney #defense #international #worldwide

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤...

Read More »

Read More »

Mi entrevista MÁS PERSONAL, con José Carlos Díez

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

This is why I founded OceanX

Come with me on a dive off Mahe island, in the Seychelles! I founded @OceanX because I’m on a mission to enable exploration and share it with you. I want to show you, the way Jacques Cousteau showed me what #ocean exploration is like and why it’s so amazing. #environment #deepsea #shorts

Read More »

Read More »

La TRAMA del PSOE y la KOLDOSFERA

#koldo #koldogarcía #psoe #corrupción #corrupciónpolítica

La trama corrupta: el caso Koldo involucra a ministros y la esposa del presidente en un escándalo que sacude a España.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis...

Read More »

Read More »