Tag Archive: falling interest

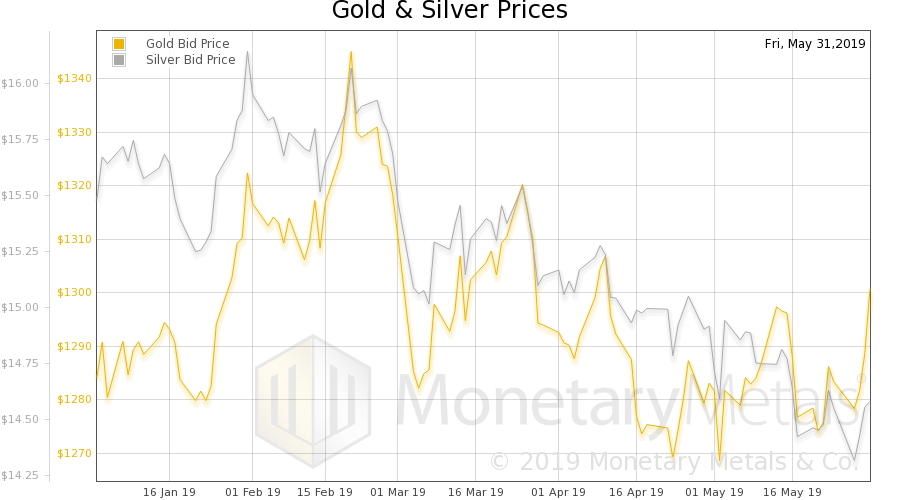

When Is a Capital Gain Capital Consumption? Market Report, 25 May

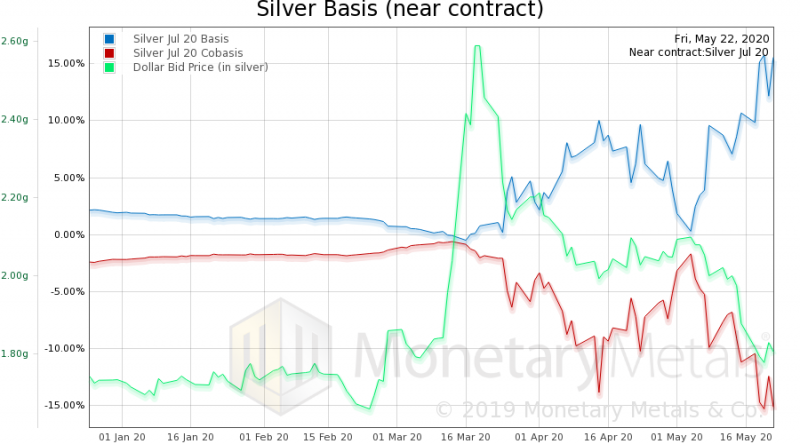

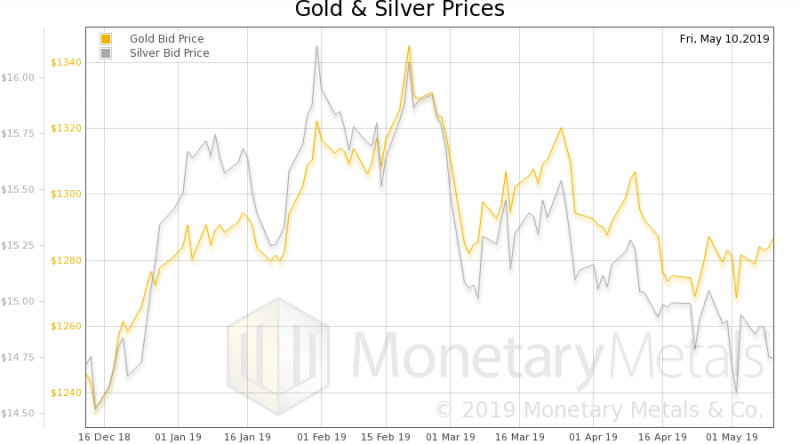

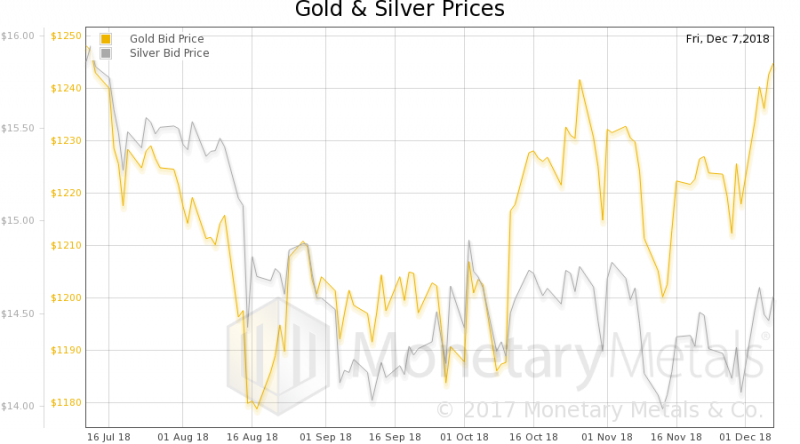

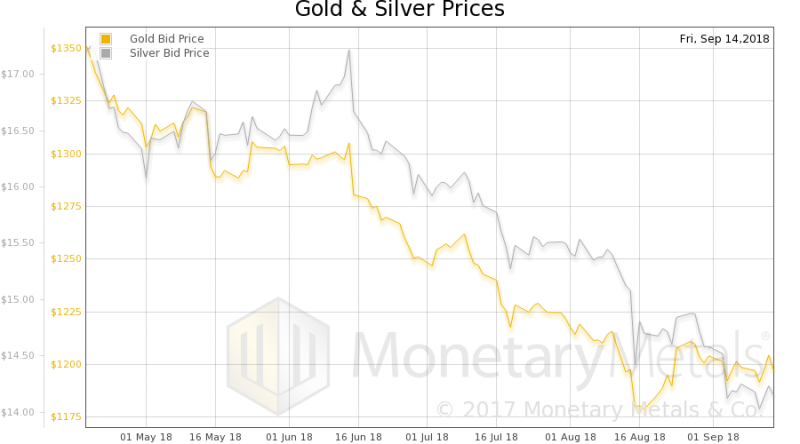

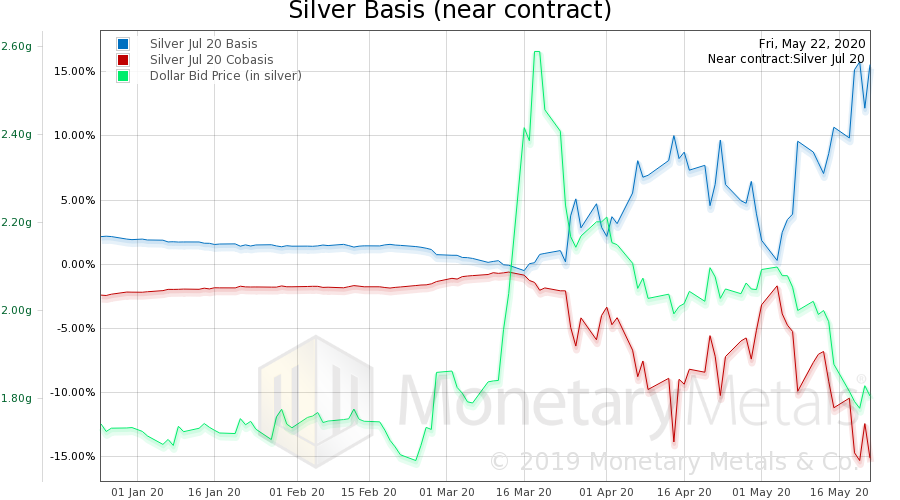

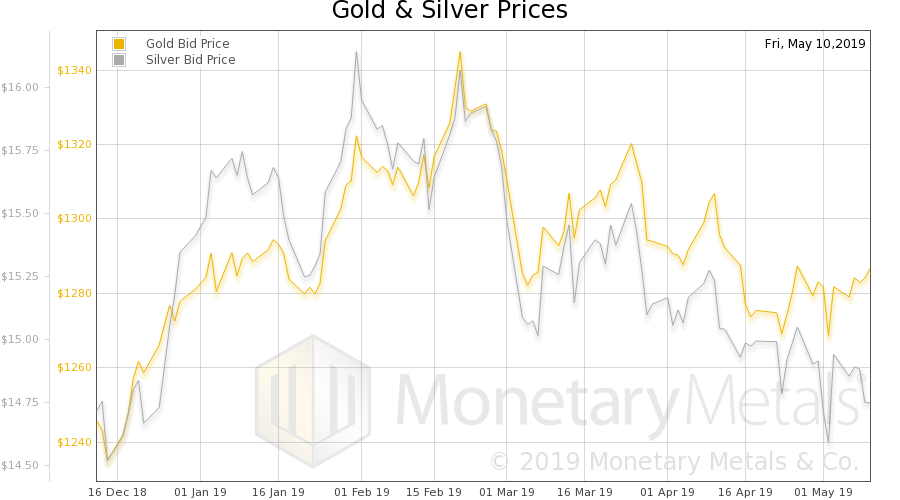

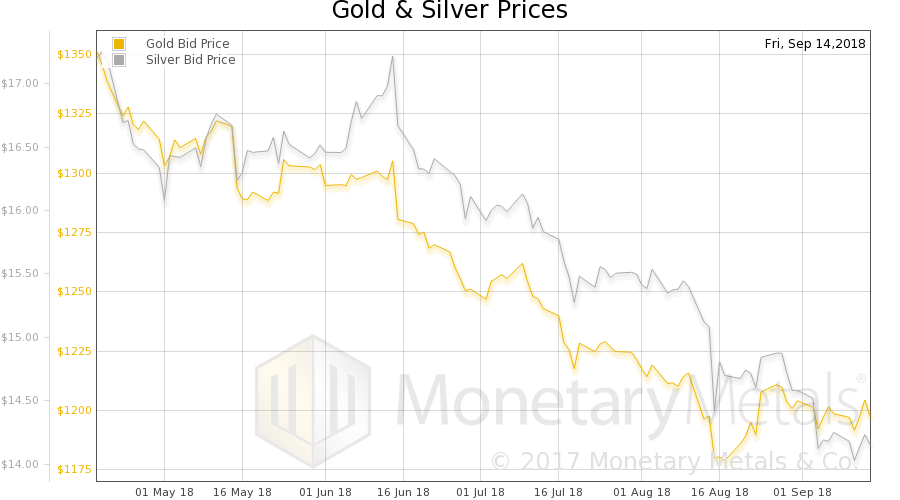

The price of gold dropped a few bucks this week, but the price of silver jumped about half a buck. The drumbeat for the gold bull market is well underway, and it is beginning now for silver. So let’s do a quick update on the supply and demand fundamentals.

Read More »

Read More »

Socialism and Gold

Most people assume that the central bank prints money when it buys bonds. They further assume that this increase in the quantity of money causes an increase in the general price level. And, this leads them to assume that the value of the money is 1 / P (P is the general price level). Therefore, when the central bank prints money to buy bonds, it is diluting the value of the money held by everyone—in proportion to the amount printed divided by the...

Read More »

Read More »

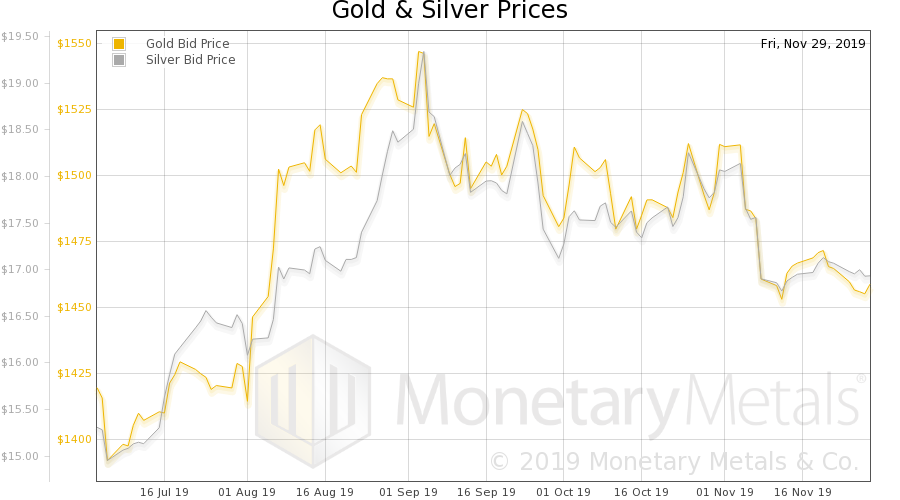

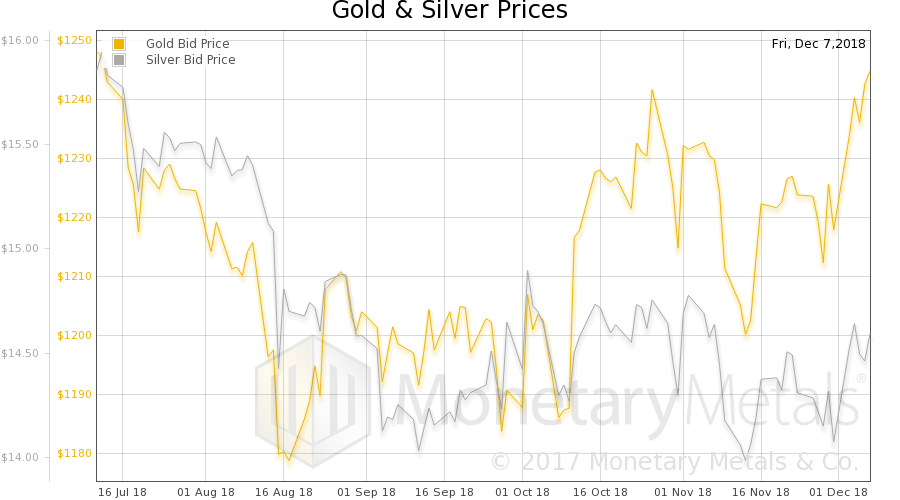

Money and Prices Are a Dynamic System, Report 1 Dec

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation.

Read More »

Read More »

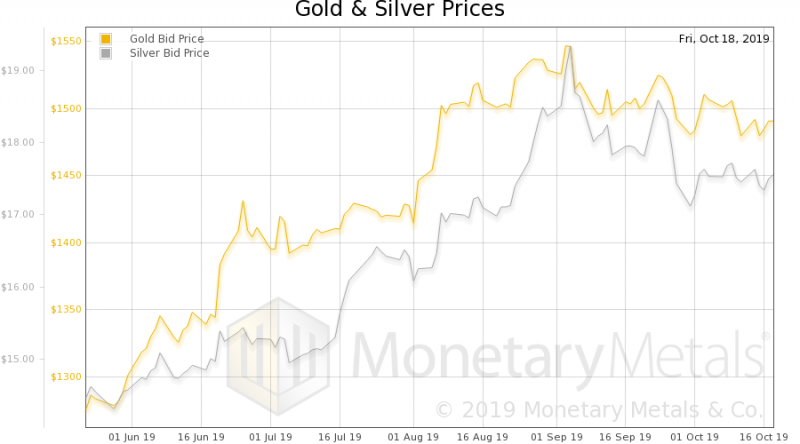

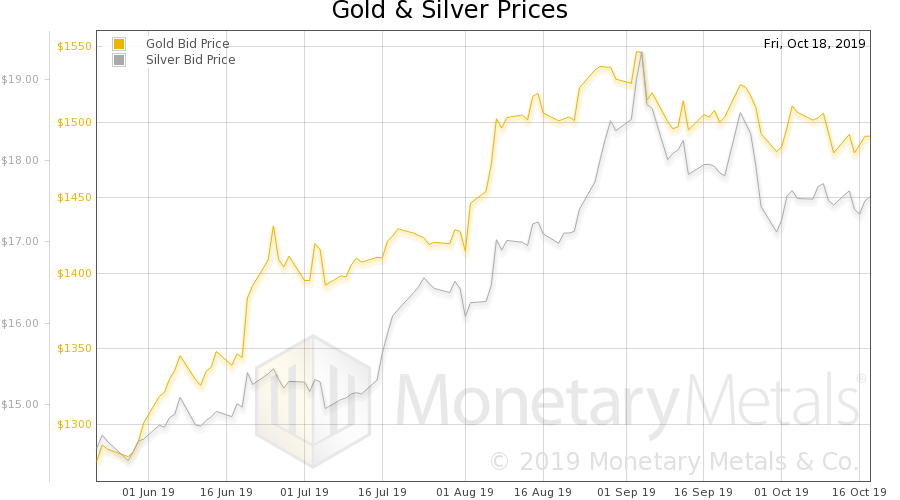

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

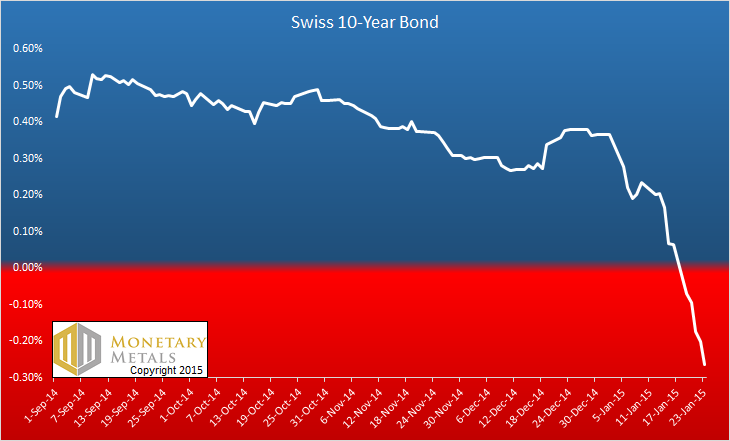

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them.

Read More »

Read More »

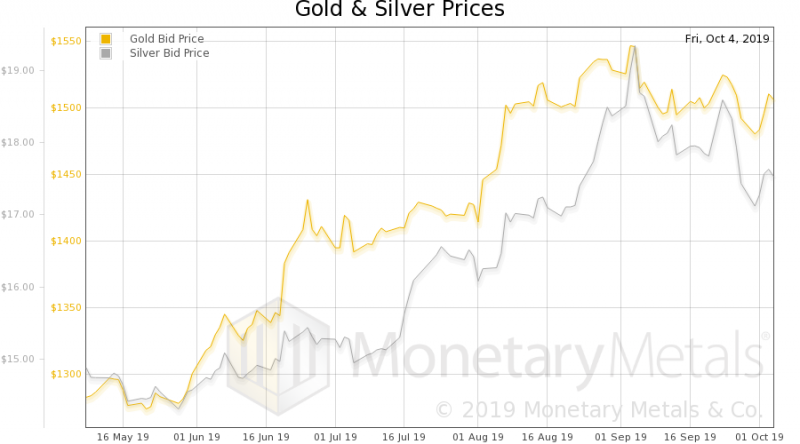

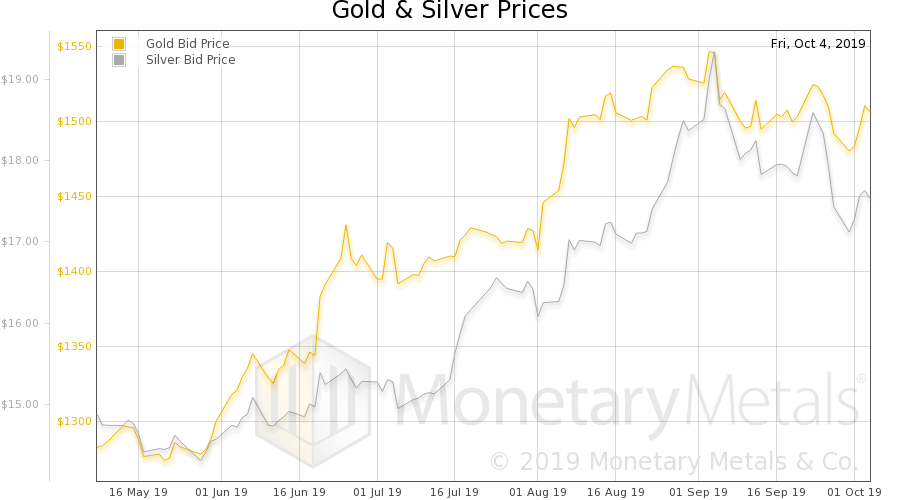

A Wealth Tax Consumes Capital, Report 6 Oct

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July.

Read More »

Read More »

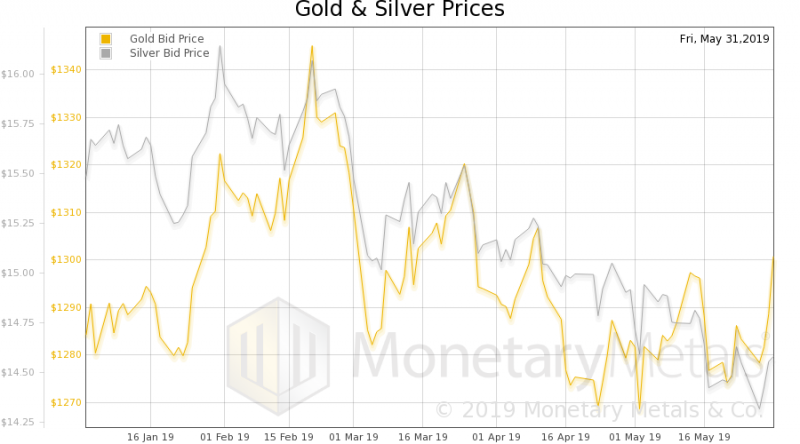

Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market.

Read More »

Read More »

The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good.

Read More »

Read More »

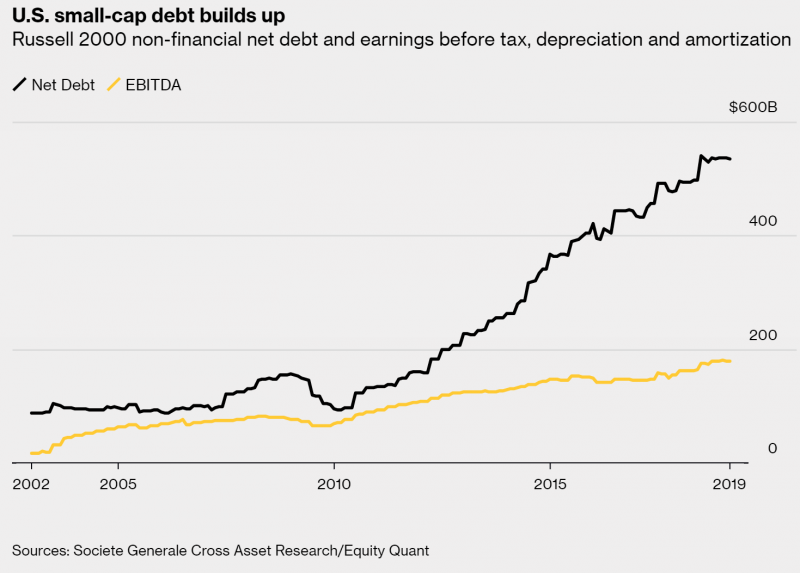

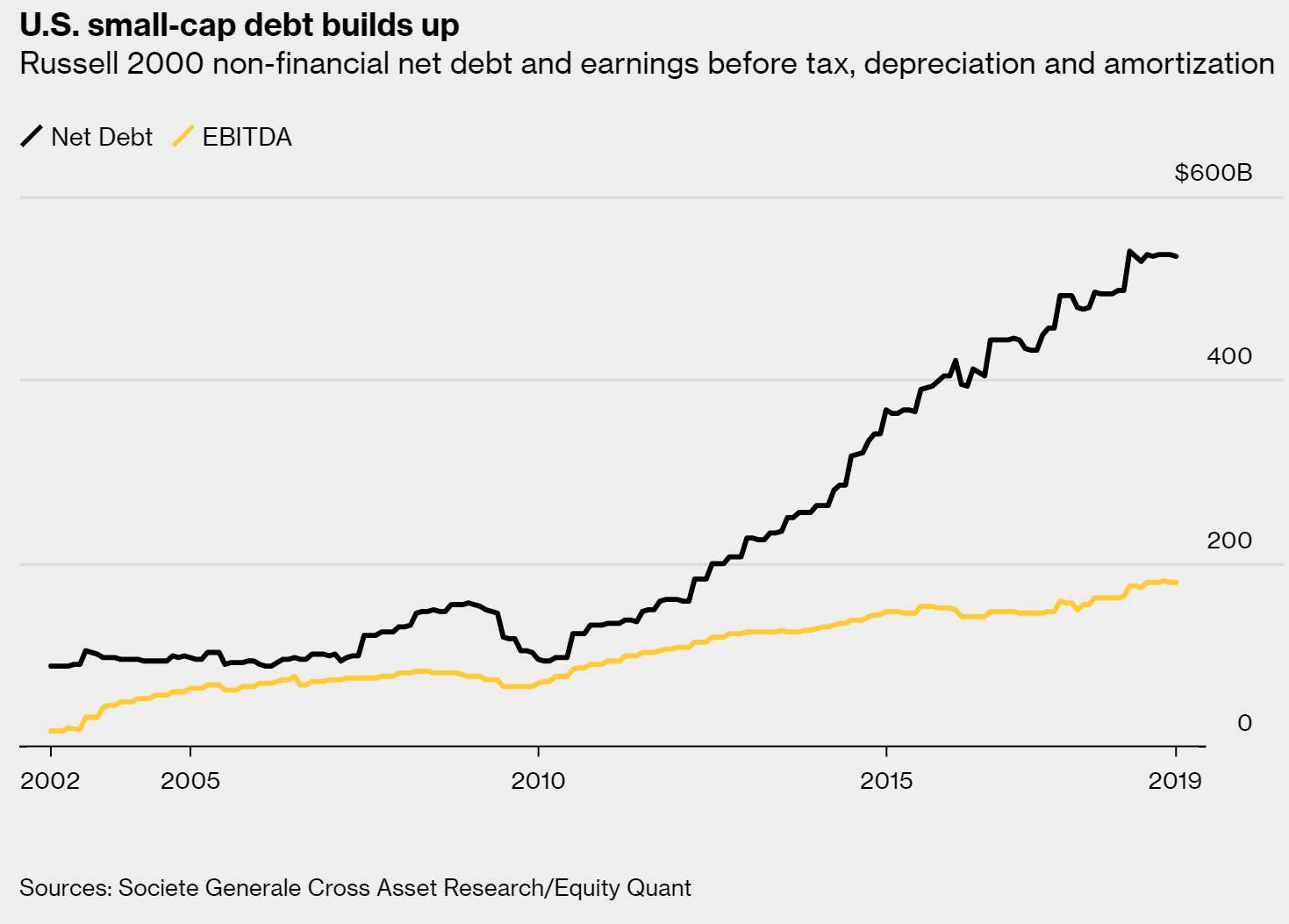

Debt and Profit in Russell 2000 Firms

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic).

Read More »

Read More »

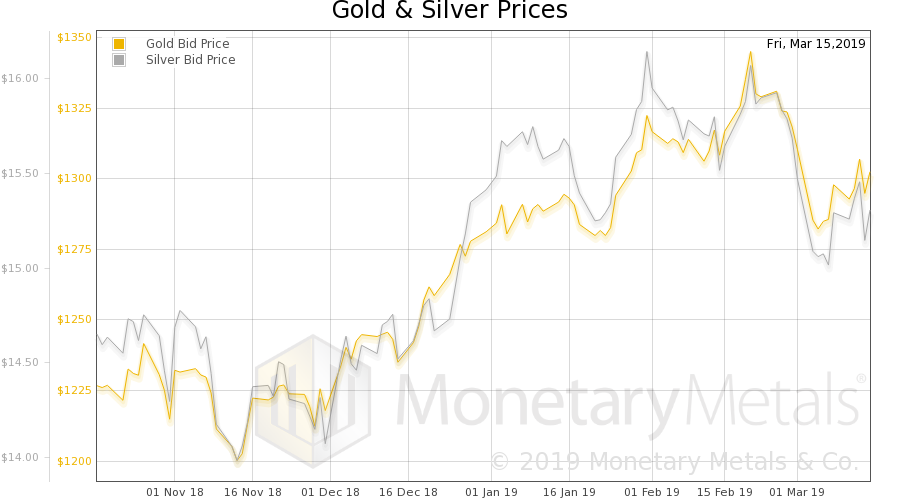

Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers.

Read More »

Read More »

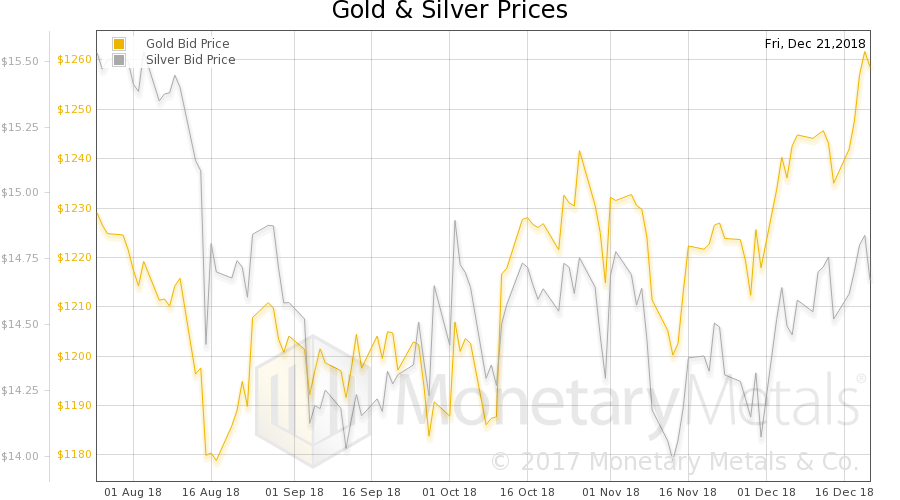

Are Stocks Overvalued, Report 24 Dec 2018

We could also have entitled this essay How to Measure Your Own Capital Destruction. But this headline would not have set expectations correctly. As always, when looking at the phenomenon of a credit-fueled boom, the destruction does not occur when prices crash. It occurs while they’re rising.

Read More »

Read More »

The Prodigal Parent, Report 9 Dec 2018

The Baby Boom generation may be the first generation to leave less to their children than they inherited. Or to leave nothing at all. We hear lots—often from Baby Boomers—about the propensities of their children’s generation. The millennials don’t have good jobs, don’t save, don’t buy houses in the same proportions as their parents, etc.

Read More »

Read More »

The Toxic Stew, Report 7 Oct 2018

Last week, we shined a spotlight on a crack in the monetary system that few people outside of Switzerland (and not many inside either) were aware of. There is permanent gold backwardation measured in Swiss francs. Everyone knows that the Swiss franc has a negative interest rate, but so far as we know, Keith is the only one who predicted this would lead to its collapse (and he was quite early, having written that in January 2015).

Read More »

Read More »

Textbook Falling Interest Behavior

This is a textbook case. Well, it would be if there was a textbook that presented the dynamics of the rising and falling interest rate cycles. Costco is spending over a quarter billion dollars, to make a capital investment in chicken processing. This is not the typical entrepreneurial investment, which seeks to increase margins by serving an unserved or underserved demand.

Read More »

Read More »

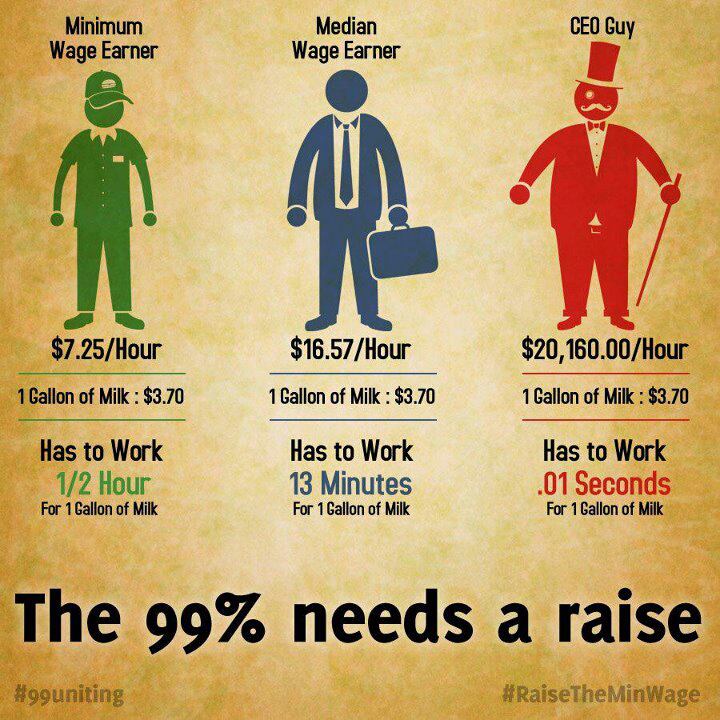

Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language).

Read More »

Read More »

Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 2018

For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance.

Read More »

Read More »

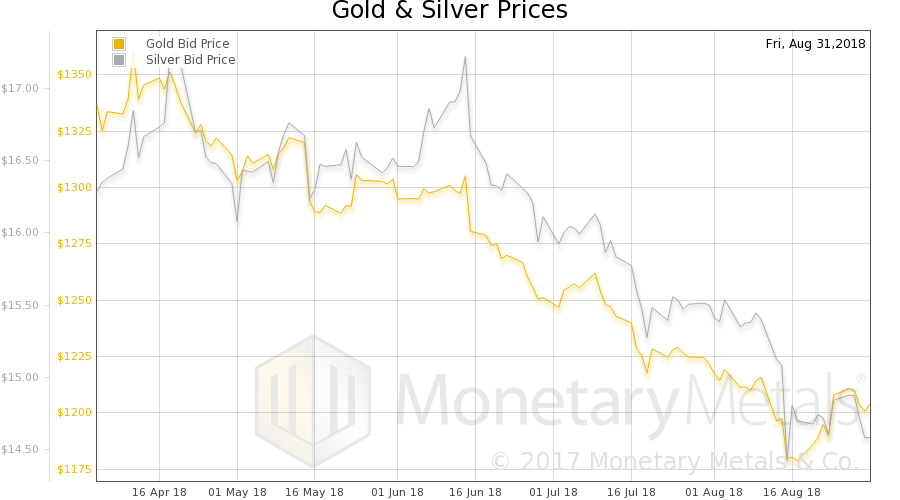

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest rate.

Read More »

Read More »

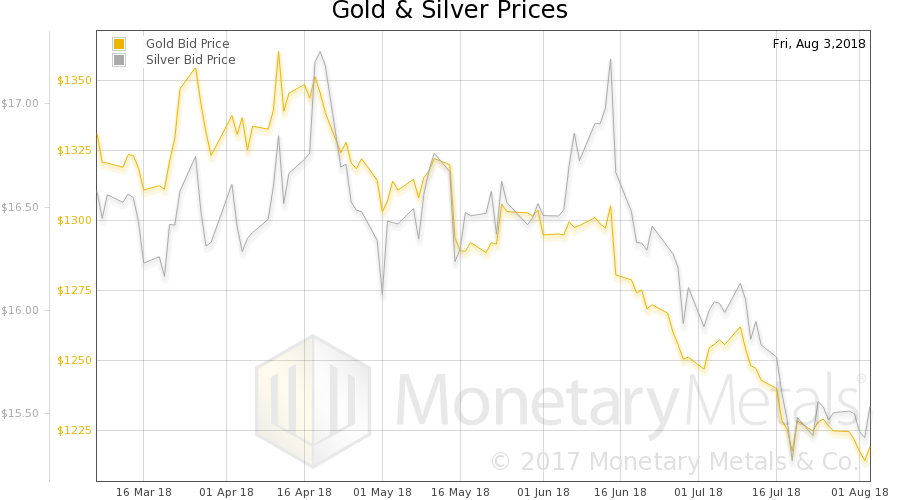

Monetary Paradigm Reset, Report 5 August 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Janet Yellen Fights the Tide of Falling Interest

The Fed is going to have to take back this interest rate hike (Dec 16). The process that sets the interest rate is complex. I have written many words on its terminal decline. However, there are two simple reasons why the trend remains downward.

Read More »

Read More »

Falling Interest Causes Falling Profits

Most people assume that prices move as a result of changes in the money supply. Instead, let’s look at the effect of falling interest. To start, consider a hamburger restaurant. Suppose that the average profit in the burger business is ten percent of invested capital. If MacDowell’s is thinking about expanding, it has to consider the interest rate. Why?

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: decreased by 5.7 billion francs compared to the previous week

2 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 5.7 billion francs compared to the previous week

2 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Ermittlungs-Eifer der Behörden: Meinungsfreiheit in Deutschland bedroht

Ermittlungs-Eifer der Behörden: Meinungsfreiheit in Deutschland bedroht -

Welt-TV: Interview mit Rainer Zitelmann zum Strafverfahren

Welt-TV: Interview mit Rainer Zitelmann zum Strafverfahren -

VW kündigt Massenentlassungen an | Ernst Wolff

VW kündigt Massenentlassungen an | Ernst Wolff -

Kristi Noem’s ‘overdue’ sacking, Trumponomics, and a gravity hoax

Kristi Noem’s ‘overdue’ sacking, Trumponomics, and a gravity hoax -

Der Vittner Report #005 – Germany Small Cap Momentum

Der Vittner Report #005 – Germany Small Cap Momentum -

MUCHO PEOR QUE UNOS ARANCELES

MUCHO PEOR QUE UNOS ARANCELES -

Ein bisschen Frieden?

Ein bisschen Frieden? -

Vergiss die Kuhfürze – Das ist der wahre Grund!

Vergiss die Kuhfürze – Das ist der wahre Grund! -

From fine dining to fast food: Swiss dining cars through the ages

-

Wichtige Morning News mit Oliver Klemm #552

Wichtige Morning News mit Oliver Klemm #552

More from this category

When Is a Capital Gain Capital Consumption? Market Report, 25 May

When Is a Capital Gain Capital Consumption? Market Report, 25 May26 May 2020

Socialism and Gold

Socialism and Gold4 Mar 2020

Money and Prices Are a Dynamic System, Report 1 Dec

Money and Prices Are a Dynamic System, Report 1 Dec3 Dec 2019

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

Wealth Accumulation Is Becoming Impossible, Report 20 Oct22 Oct 2019

A Wealth Tax Consumes Capital, Report 6 Oct

A Wealth Tax Consumes Capital, Report 6 Oct7 Oct 2019

Dollar Supply Creates Dollar Demand, Report 2 June

Dollar Supply Creates Dollar Demand, Report 2 June3 Jun 2019

The Monetary Cause of Lower Prices, Report 12 May

The Monetary Cause of Lower Prices, Report 12 May14 May 2019

Debt and Profit in Russell 2000 Firms

Debt and Profit in Russell 2000 Firms12 Apr 2019

Keynes Was a Vicious Bastard, Report 17 Mar

Keynes Was a Vicious Bastard, Report 17 Mar18 Mar 2019

Are Stocks Overvalued, Report 24 Dec 2018

Are Stocks Overvalued, Report 24 Dec 201827 Dec 2018

The Prodigal Parent, Report 9 Dec 2018

The Prodigal Parent, Report 9 Dec 201810 Dec 2018

The Toxic Stew, Report 7 Oct 2018

The Toxic Stew, Report 7 Oct 20188 Oct 2018

Textbook Falling Interest Behavior

Textbook Falling Interest Behavior4 Oct 2018

Why Are Wages So Low, Report 23 Sep 2018

Why Are Wages So Low, Report 23 Sep 201825 Sep 2018

Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 2018

Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 201817 Sep 2018

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 20184 Sep 2018

Monetary Paradigm Reset, Report 5 August 2018

Monetary Paradigm Reset, Report 5 August 20187 Aug 2018