Tag Archive: EuroDollar

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

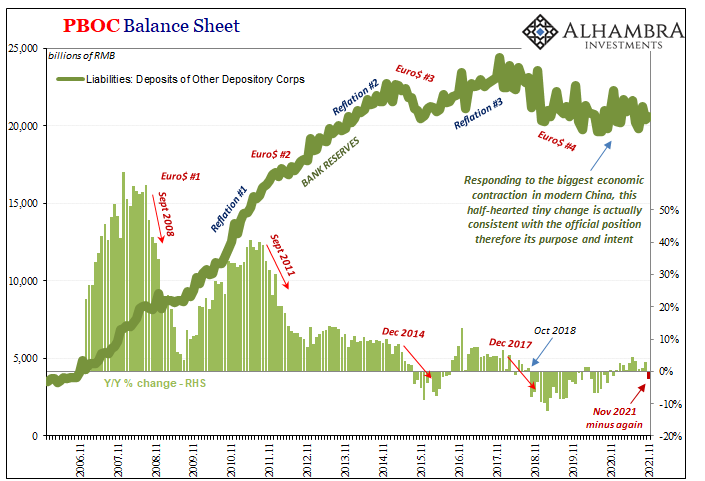

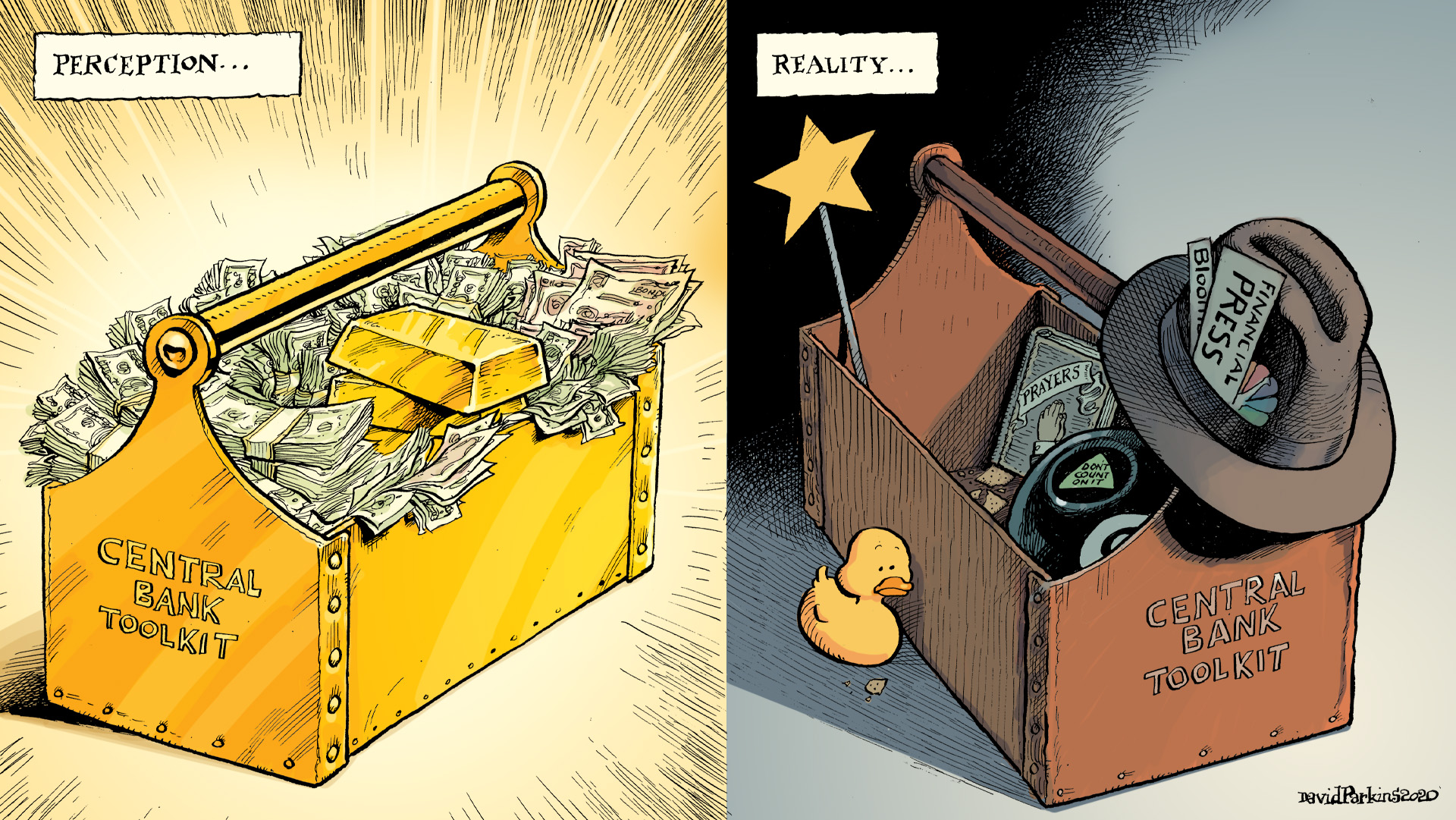

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

Peak Policy Error

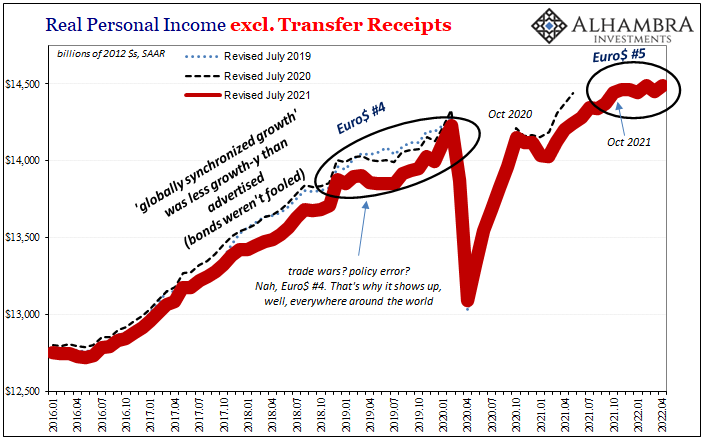

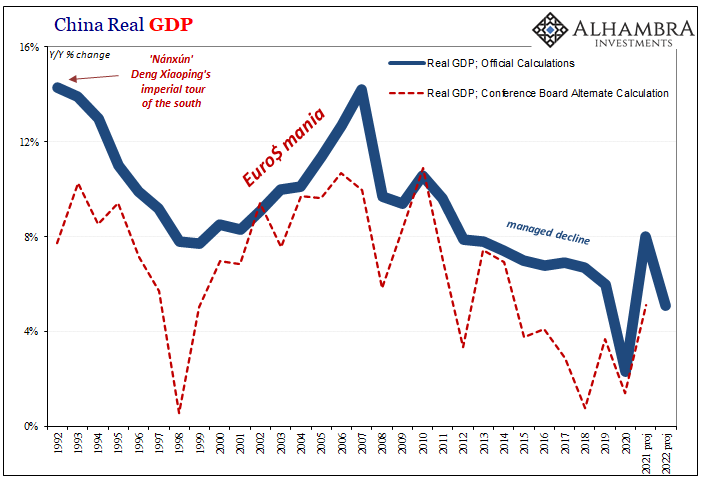

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US.

Read More »

Read More »

Looking Back At Chaotic March Through TIC

March ended up being a pretty wild ride. Lost amidst the furor over Russia’s invasion of Ukraine, the month began with a couple clear “collateral days. T-bill rates along with repo fails echoed that same shortfall before the yield curve then joined the eurodollar futures curve being inverted.

Read More »

Read More »

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

Industrial Synchronized Demand

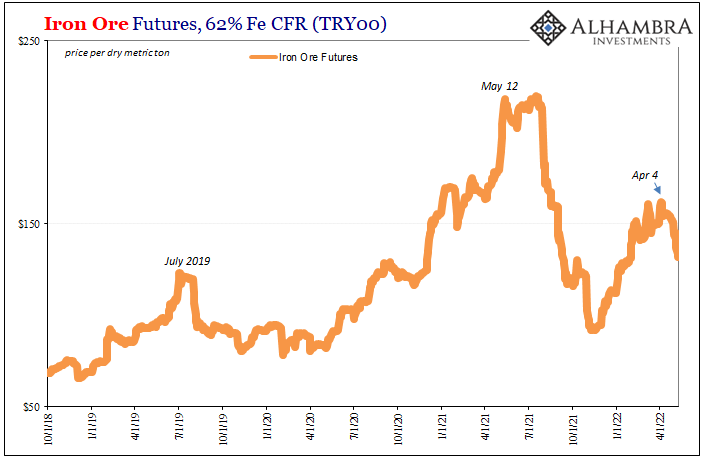

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

Who’s Playing Puppetmaster, And Who Is Master of Puppets

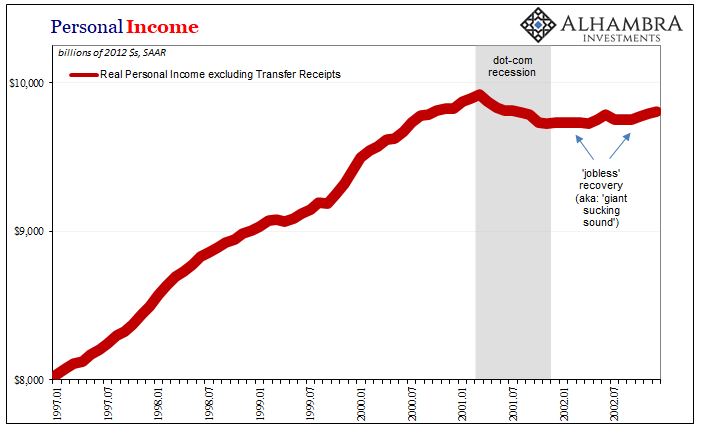

Cue up the old VHS tapes of Bill Clinton. The former President was renowned for displaying, anyway, great empathy. He famously said in October 1992, weeks before the election that would bring him to the White House, “I feel your pain.”What pain? As Clinton’s chief political advisor later clarified, “it’s the economy stupid.”

Read More »

Read More »

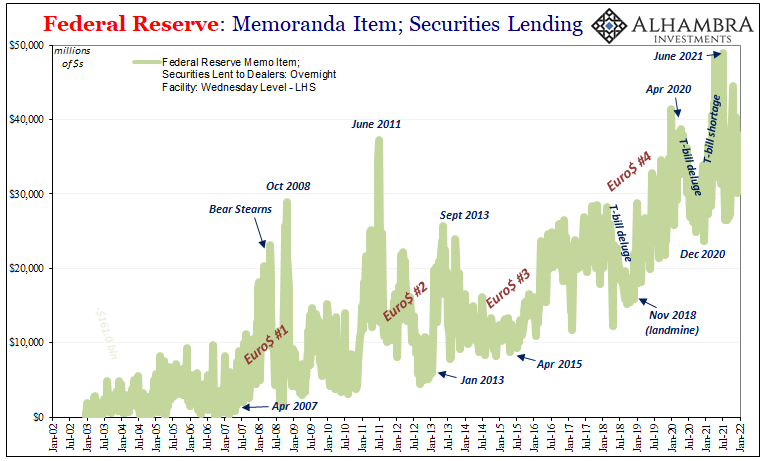

Collateral Shortage…From *A* Fed Perspective

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods....

Read More »

Read More »

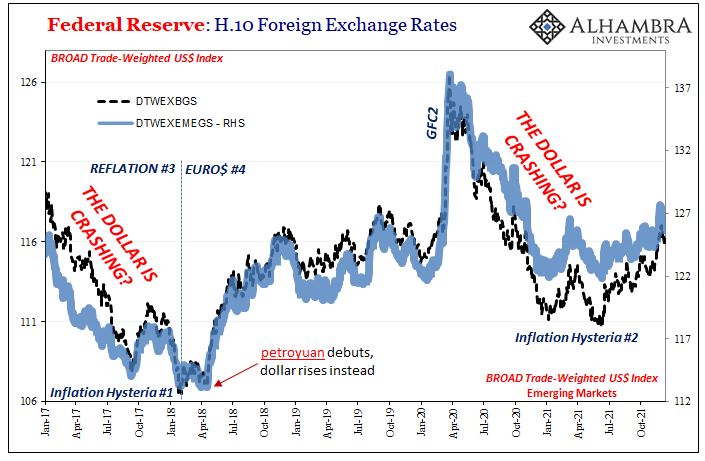

What Really ‘Raises’ The Rising ‘Dollar’

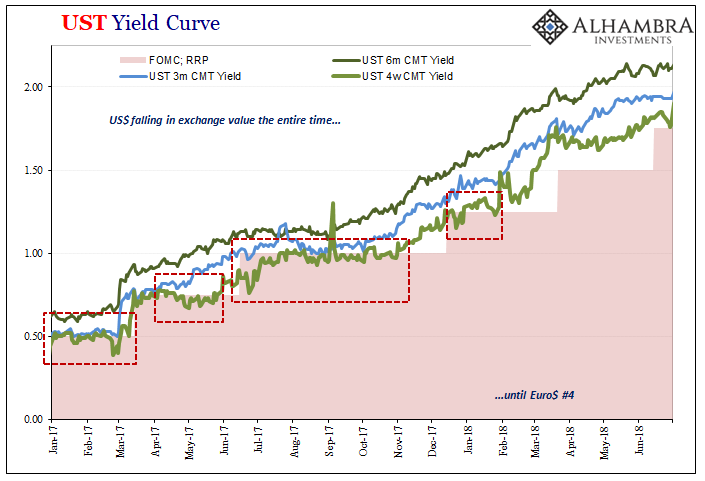

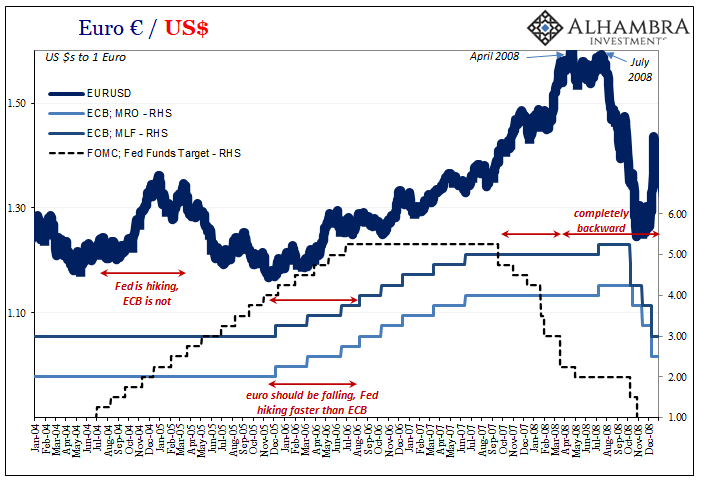

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials.

Read More »

Read More »

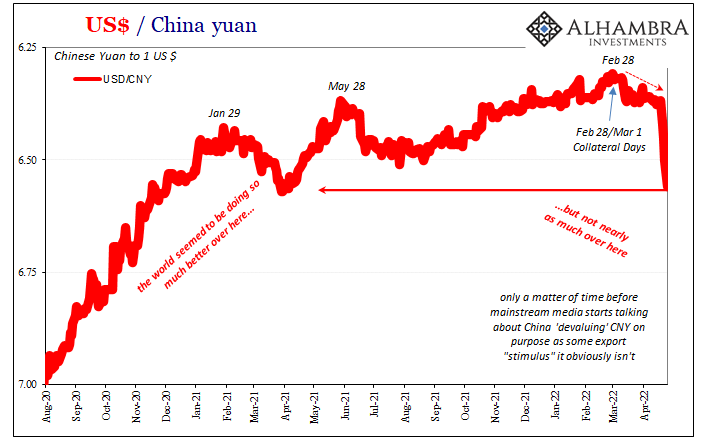

CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss.

Read More »

Read More »

The (less) Dollars Behind Xi’s Shanghai of Shanghai

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth.

Read More »

Read More »

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated.

Read More »

Read More »

SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business.From what little most people know about that essential business, it seems like it has something to do with that thing called...

Read More »

Read More »

China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike.

Read More »

Read More »

Sentiment v. Substance: Checking In On Collateral Via, Yes, The Fed

The Federal Reserve, like other central banks around the world, it does lend out the securities it owns and holds. Sophisticated modern wholesale money markets are highly collateralized, so much so that collateral itself takes on the properties of currency.

Read More »

Read More »

Taper Rejection: Mao Back On China’s Front Page

Chinese run media, the Global Times, blatantly tweeted an homage to China’s late leader Mao Zedong commemorating his 128th birthday. Fully understanding the storm of controversy this would create, with the Communist government’s full approval, such a provocation has been taken in the West as if just one more chess piece played in its geopolitical game against the United States in particular.No. The Communists really mean it. Mao’s their guy again....

Read More »

Read More »

White-Hot Cycles of Silence

We’re only ever given the two options: the economy is either in recession, or it isn’t. And if “not”, then we’re led to believe it must be in recovery if not outright booming already. These are what Economics says is the business cycle. A full absence of unit roots. No gray areas to explore the sudden arrival of only deeply unsatisfactory “booms.”

Read More »

Read More »

The Historical Monetary Chinese Checklist You Didn’t Know You Needed For Christmas (or the Chinese New Year)

If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source.

Read More »

Read More »

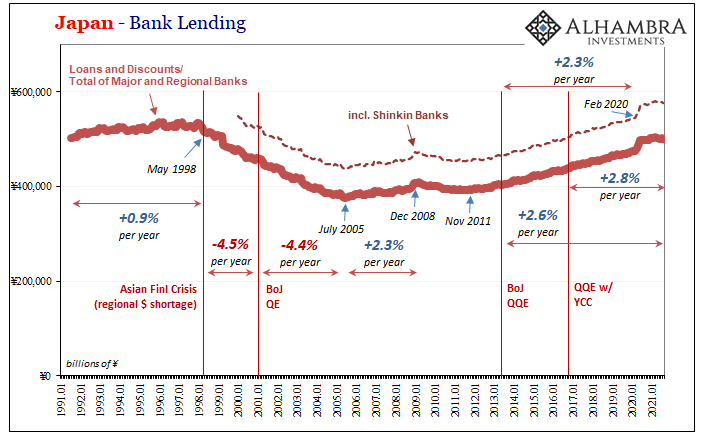

You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s.

Read More »

Read More »