Tag Archive: employment

No, Chicken Little, the Sky is Not Falling

Overview: The most recent data showed that Japanese investors took advantage of the yen's strength last week to buy foreign bonds and stocks. The US weekly jobs claims to their lowest level in four weeks, suggesting that the slowdown in the labor market remains gradual. The sky is not falling. There is no emergency. With a 28% drop in Japanese bank shares in the first three sessions of the month, stress in Japan was acute, but Japanese official...

Read More »

Read More »

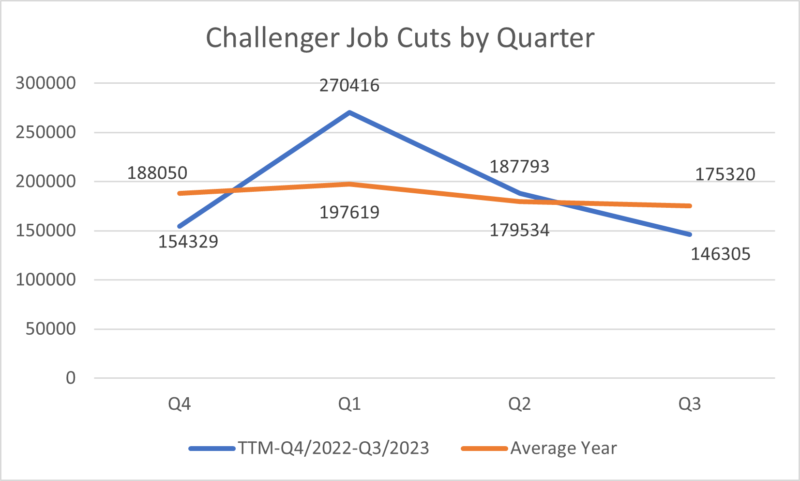

Macro: Challenger Job Cuts — Improvement throughout the year

We had a bad 1st quarter relative to historic averages for job cuts. But the situation has gotten better throughout the year. In the 3rd quarter of 2023 less people are losing their job relative to the average 3rd quarter going back to 1989.

Read More »

Read More »

Surprise-Packed Tuesday: China Cut Rates, Japan’s Q2 GDP Rises Twice as Fast as Expected, and UK Wages Accelerate

Overview: Today's highlights include a surprise rate

cut from China after another series of disappointing data and much stronger

than expected Japanese Q2 GDP (6% annualized pace). The UK reported an

unexpected sharp jump in average weekly earnings, which were sufficient to get

renew speculation of a 50 bp hike by the Bank of England next month. The US

dollar is mixed. The Swedish krona and dollar-bloc currencies are struggling,

while the Swiss...

Read More »

Read More »

Simple Economics and Money Math

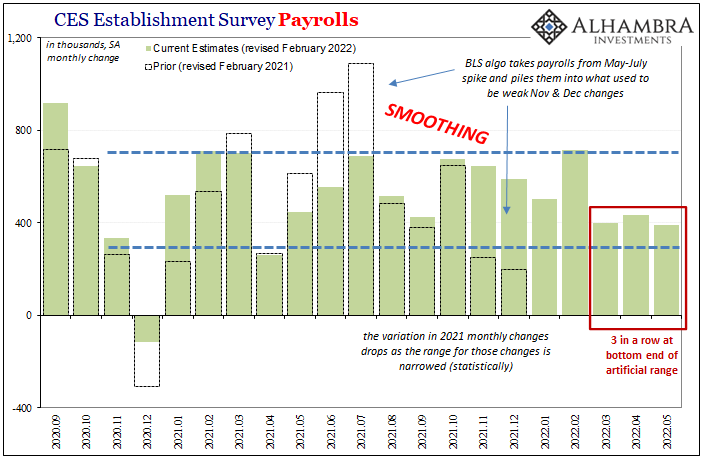

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

May Payrolls (and more) Confirm Slowdown (and more)

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market.

Read More »

Read More »

ADP Front-Runs BLS and President Phillips

It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part.

Read More »

Read More »

President Phillips Emerges To Reassure On Growing Slowdown

Just the other day, President Biden took to the pages of the Wall Street Journal to reassure Americans the government is doing something about the greatest economic challenge they face. Biden says this is inflation when that’s neither the actual affliction nor our greatest threat.

Read More »

Read More »

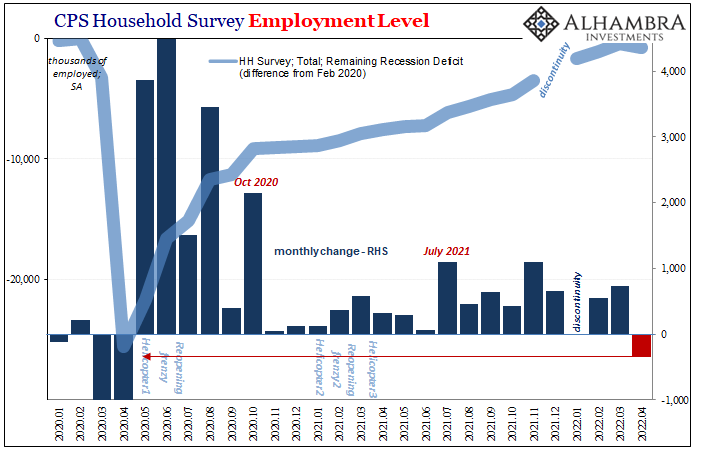

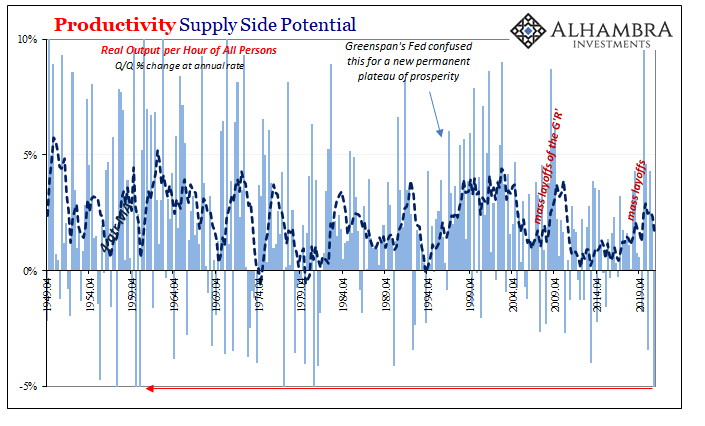

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

A Global JOLT(s) In July

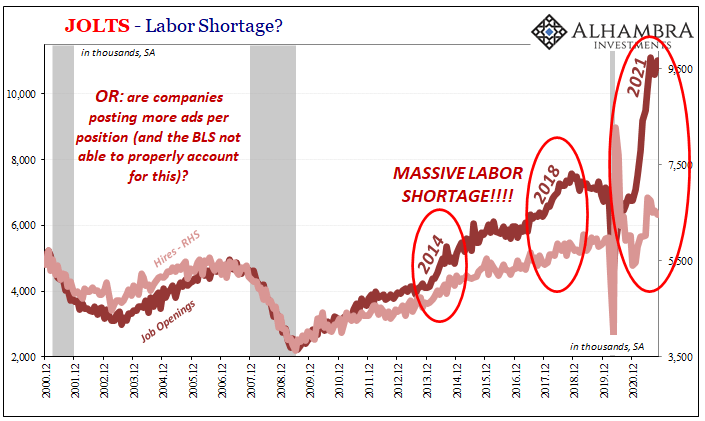

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million.

Read More »

Read More »

The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

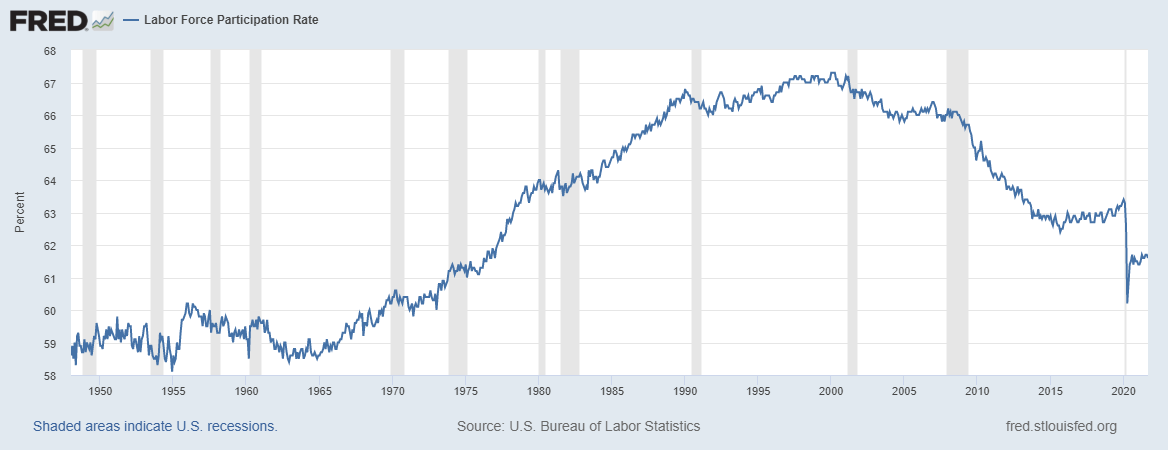

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market.

Read More »

Read More »

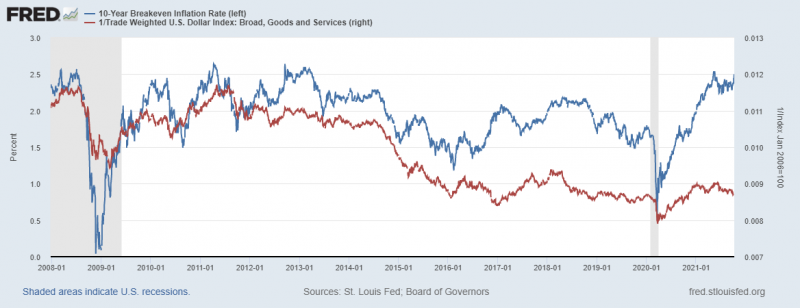

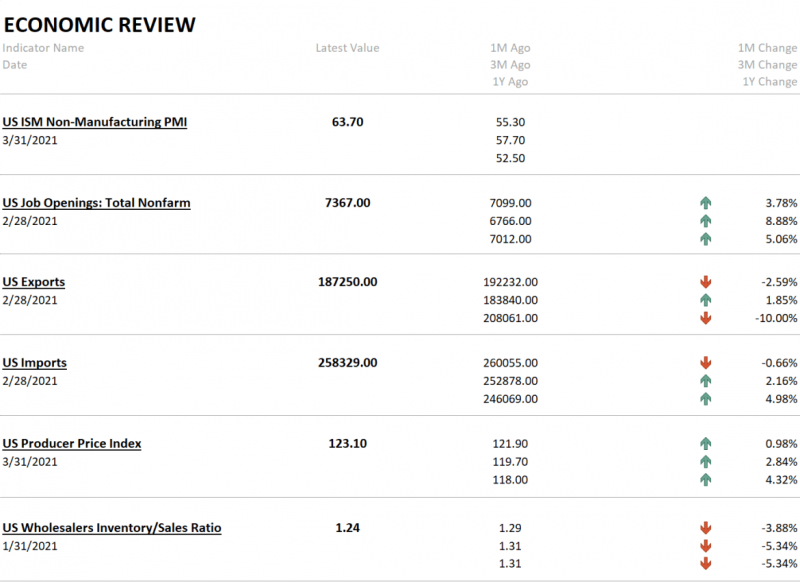

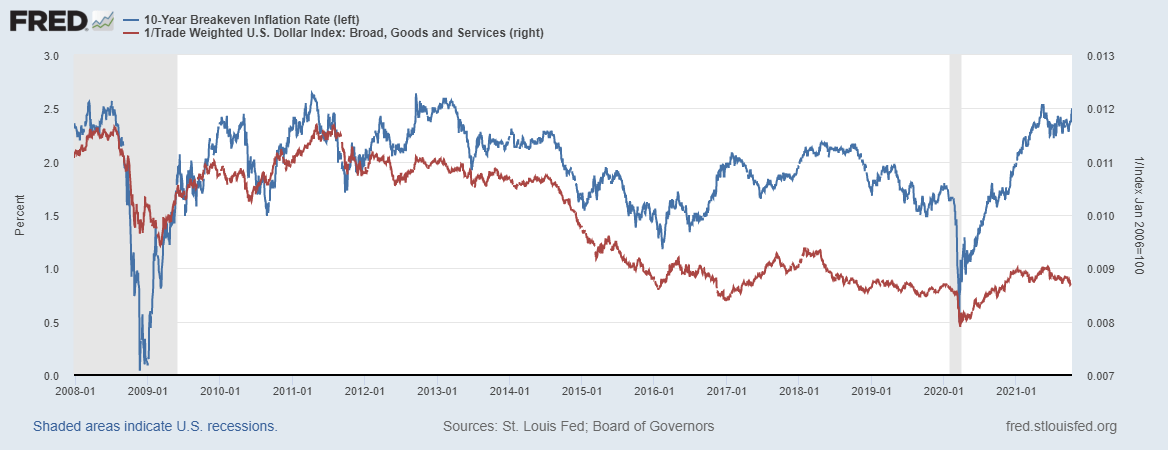

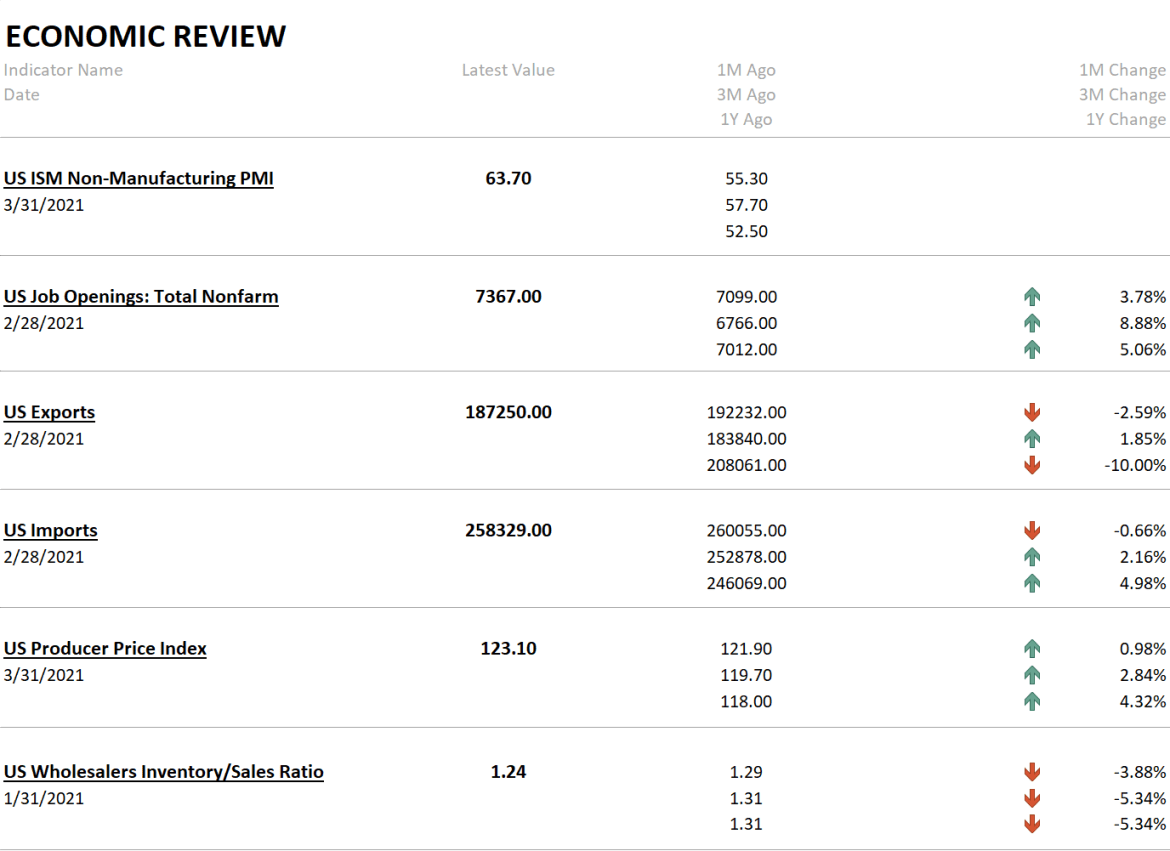

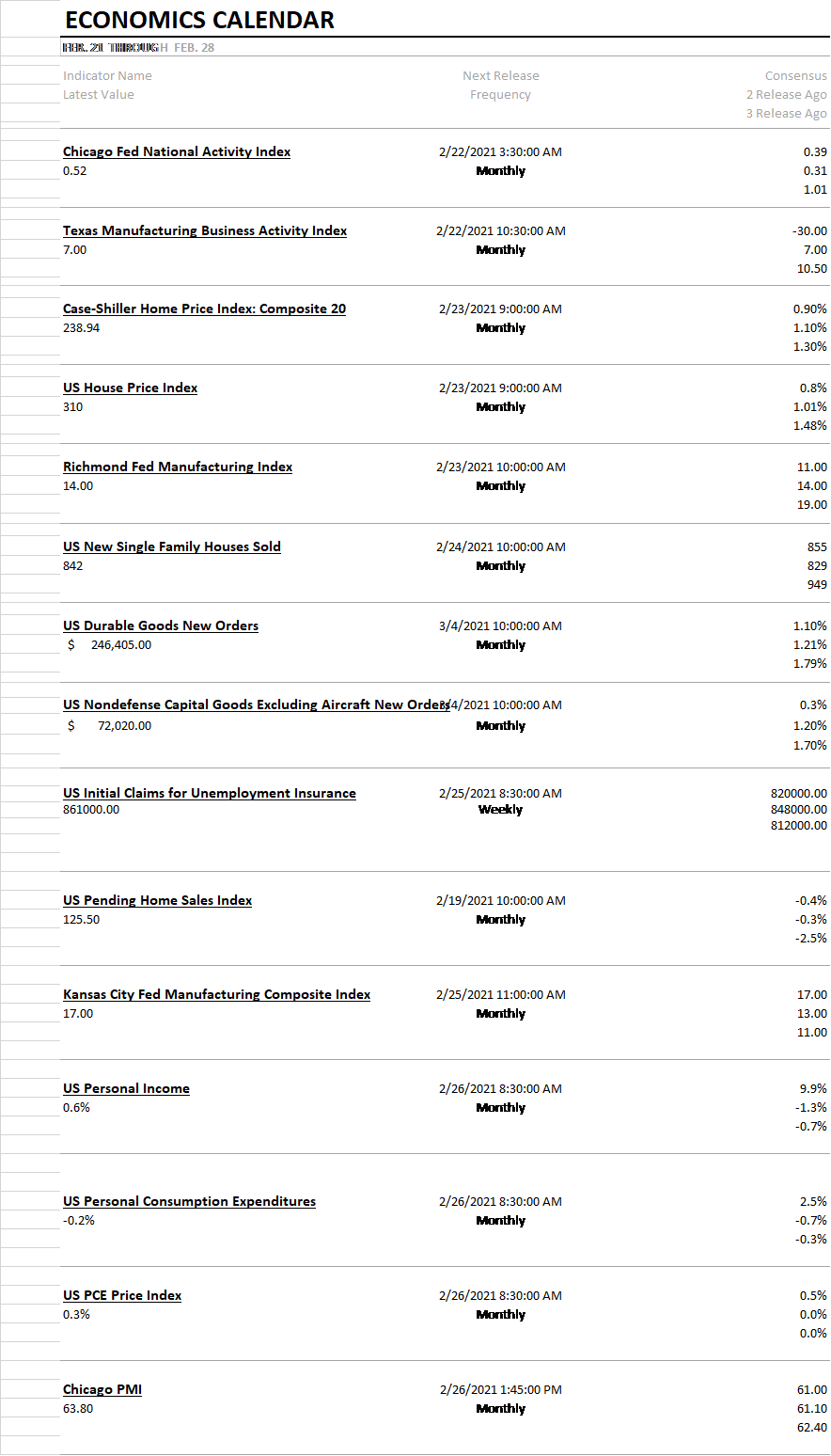

Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »

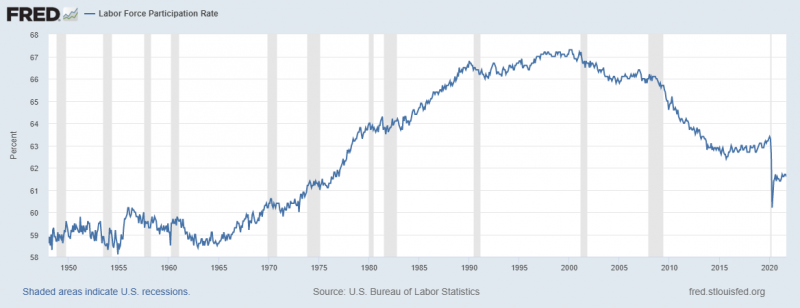

For The Love Of Unemployment Rates

Here we are again. The labor force. The numbers from the BLS are simply staggering. During September 2021, the government believes it shrank for another month, down by 183,000 when compared to August. This means that the Labor Force Participation rate declined slightly to 61.6%, practically the same level in this key metric going back to June.

Read More »

Read More »

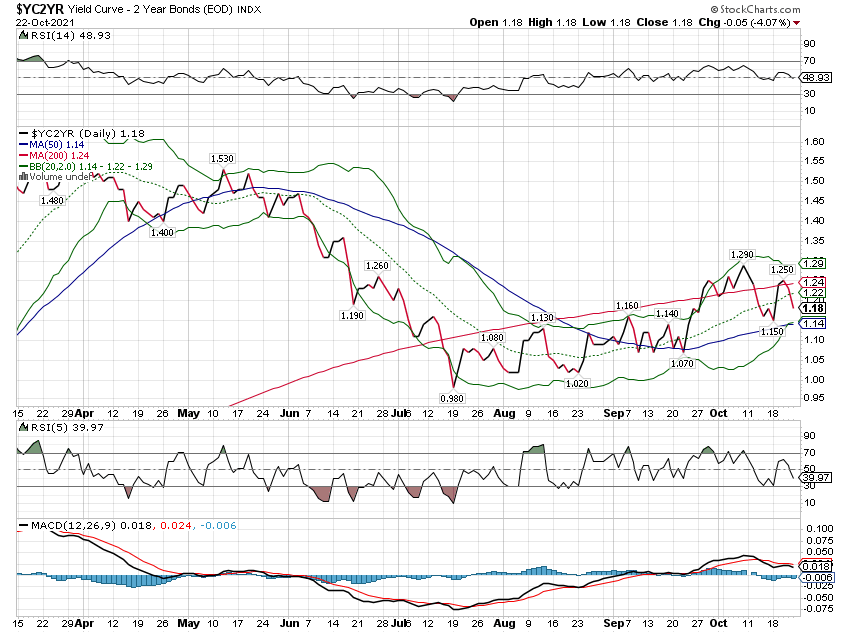

Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it.

Read More »

Read More »

Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time.

Read More »

Read More »

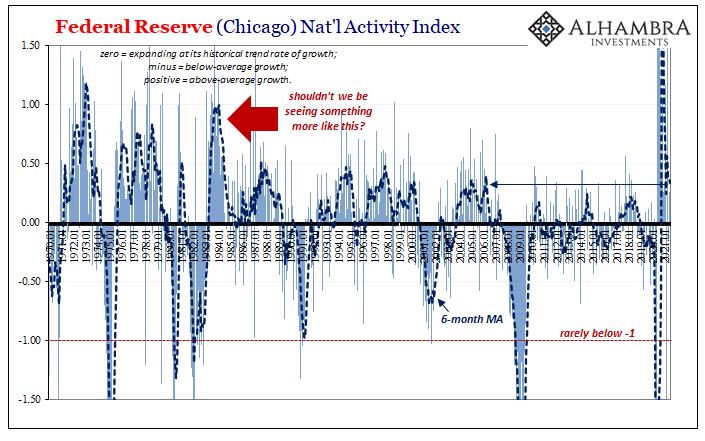

Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »

Read More »

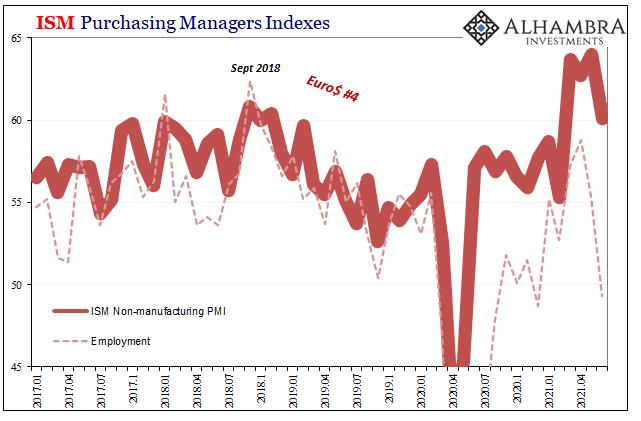

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things.

Read More »

Read More »

Weekly Market Pulse – Real Rates Finally Make A Move

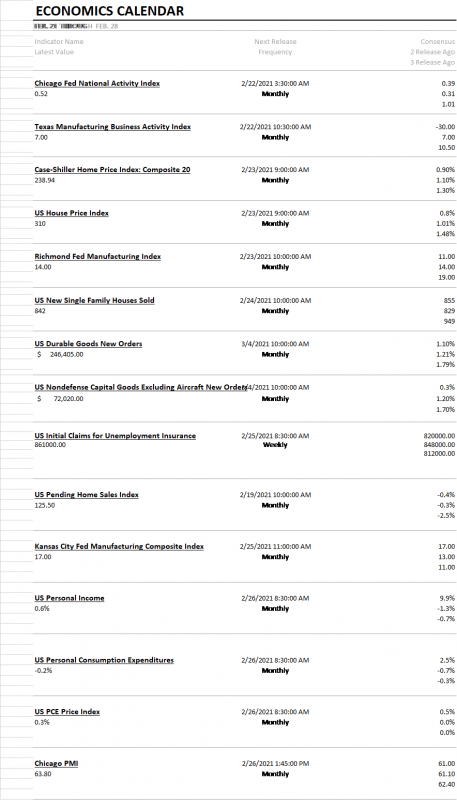

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

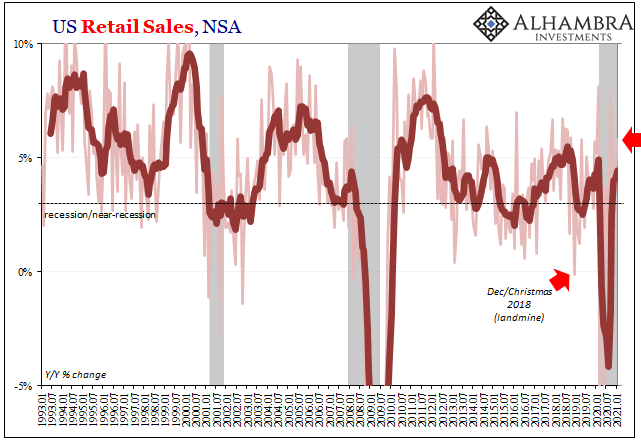

Uncle Sam Was Back Having Consumers’ Backs

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

Read More »

Read More »