Tag Archive: Editor’s Choice

New Swiss broadcasting fee starts next year

After a referendum in March 2018 threatened to axe Switzerland’s costly broadcasting fee, the government put forward a counter proposal, which was adopted when 71.6% of voters voted to keep the fee. On 1 January 2019, the lower fee contained in the government’s plan will come into force. Next year, instead of CHF 451, each household will need to cough up CHF 365.

Read More »

Read More »

Investigating suspected welfare cheats – where to draw the line

On 25 November 2018, Swiss will vote on whether to accept laws allowing detectives to uncover welfare fraud. Currently, there is nothing specific in Swiss law covering the practice. In the past, investigators have been used to gather evidence on disability and accident beneficiaries. Between 2009 and 2016, detectives were used on around 220 investigations a year, of which around two thirds were found guilty of fraud.

Read More »

Read More »

Swiss Divorce Rates Continue to Climb

By 2017, 40.5% of those married in 1987 were divorced, compared to 33.2% of those married in 1977 and 24.7% of those married in 1967. Divorce in Switzerland starts early. 9.4% of those married in 1987 were divorced after five years, as were 8.1% of those married in 1977 and 4.8% of those who tied the knot in 1967.

Read More »

Read More »

Swiss Health Insurance Costs to Rise Further in 2019

More bad news for Swiss household budgets was released today for residents of all but three Swiss cantons. Health insurance premiums in 2019 will be on average 1.2% higher than in 2018 across Switzerland as a whole. However, within this figure there are significant cantonal variations.

Read More »

Read More »

Swiss Housing – the hardest and easiest places to find a home

Recent government figures show a 13% rise in the number of vacant homes over the 12 months to June 2018. The number has more than doubled since 2009 when there were close to 35,000 vacant dwellings. By 1 June 2018, there were more than 72,000, a vacancy rate of 1.62%.

Read More »

Read More »

Vaud to cap health insurance premiums at 12 percent of income

Starting in September 2018, health insurance premiums in excess of 12% of income in the canton of Vaud will be covered by the government. From the beginning of 2019, this percentage will be reduced to 10%, increasing the number of people who qualify and the size of the subsidies, according to the newspaper Le Matin.

Read More »

Read More »

Costs of owning a home in Switzerland set to rise for some

Currently, home owners in Switzerland must pay tax on fictional rent, calculated based on a home’s size and location. At the same time home owners get to deduct mortgage interest and home maintenance costs from their taxable income.

Read More »

Read More »

Swiss study recommends 38 weeks of parental leave

This week, a government commission gave its verdict on the vote, recommending two weeks of paternity leave instead of the four set out in the referendum’s text. Their commission’s main concerns are centred on the impact on companies and the cost of funding it.

Read More »

Read More »

The secrets of the new 200 Swiss franc note

Switzerland began updating its notes starting with the 50 franc note in April 2016. It then issued the new 20 franc note in May 2017, and the new 10 in October 2017. The newest note to grace Swiss wallets, pockets and purses is the 200 franc note, which was launched on 22 August 2018.

Read More »

Read More »

Swiss Health Insurance Companies Aim to Make it Easier to Break Contracts

Swiss health insurance companies are aiming to change laws to make it easier for them to unilaterally end complementary insurance contracts, according to the newspaper Le Matin.

Read More »

Read More »

Geneva set to vote on maintaining public spending in the face of company tax reform

An initiative entitled: zero losses, was filed this week in Geneva. It aims to ring fence current public spending in the face of future company tax reform. The initiative gathered 9,147 signatures, more than the 7,840 required.

Read More »

Read More »

Majority favours later retirement for women, according to survey

In Switzerland, the official retirement age for women is 64, a year earlier than it is for men. A poll by gfs.bern shows that around two thirds are in favour of raising the retirement age of women to 65. Only 16% are against the idea, with a further 18% somewhat against it. Men (78%) are more in favour of the change than women (54%), according to the newspaper 20 Minutes.

Read More »

Read More »

TV Recording could be under threat in Switzerland

With TV recording there’s no need to miss programmes just because they’re on at the wrong time. And, when it’s time to watch them, it’s easy to fast forward through the adverts, something that can’t be done when watching live. In Switzerland, television recording is offered by big distributers, such as Swisscom, Sunrise and UPC. Broadcasters don’t provide it.

Read More »

Read More »

Swiss VAT might rise to fund lower company tax rates

Historically, Switzerland has offered certain foreign companies special preferential tax deals in order to attract them. In response to international pressure, the current system is to be phased out replacing preferential tax rates with lower universal ones in the hope that these companies will stay.

Read More »

Read More »

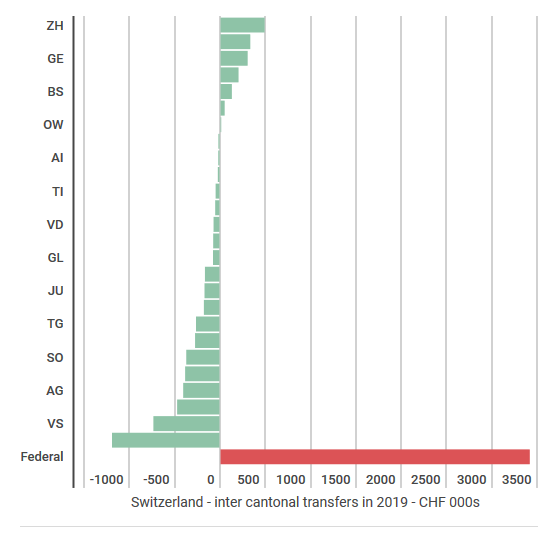

The price of solidarity – Switzerland’s inter-cantonal payments for 2019

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland.

Read More »

Read More »

Swiss Offshore Wealth Management Sector still World’s Largest by far

A report by The Boston Consulting Group highlights the size of Switzerland’s personal offshore wealth management sector. Total personal offshore wealth grew by 6% to reach US$8.2 trillion in 2017. US$2.3 trillion (28%) of this was managed in Switzerland. The top three offshore centres: Switzerland ($2.3 trillion), Hong Kong ($1.1 trillion) and Singapore ($0.9 trillion) made up more than half (52%) of the total.

Read More »

Read More »

Vaud Plans Tax Cuts

The residents of Vaud are among the highest taxed in Switzerland. In 2016, a single person in Lausanne earning CHF 100,000 paid CHF 16,050 in cantonal and communal tax on top of CHF 1,840 of federal tax. This was the fourth highest across all of Switzerland’s 26 cantonal capitals, and almost triple Zug, the lowest, where the figure was CHF 5,750 – see chart below.

Read More »

Read More »

Swiss pensions – lump sum withdrawal restrictions rejected by Council of States

Against the wishes of the Federal Council, Switzerland’s upper house, the Council of States, rejected a plan to prevent people from withdrawing lump sums from their 2nd Pillar pensions, according to the newspaper Tribune de Genève. Last week, the Council of States voted 25 to 15 to reject the plan.

Read More »

Read More »

No relief for Swiss renters

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 1 June 2017 when it fell to its lowest level since 2008.

Read More »

Read More »

House Prices Down in Verbier but Up in Some other Swiss resorts

A recent report published by UBS shows real estate price changes in european mountain resorts. Over the last year, Verbier (-3.2%) and Crans Montana (-3.0%) experienced the largest price declines, while Saas Fee (+14.3%) and St. Moritz (+7.4%) climbed the most.

Read More »

Read More »