Tag Archive: economy

Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

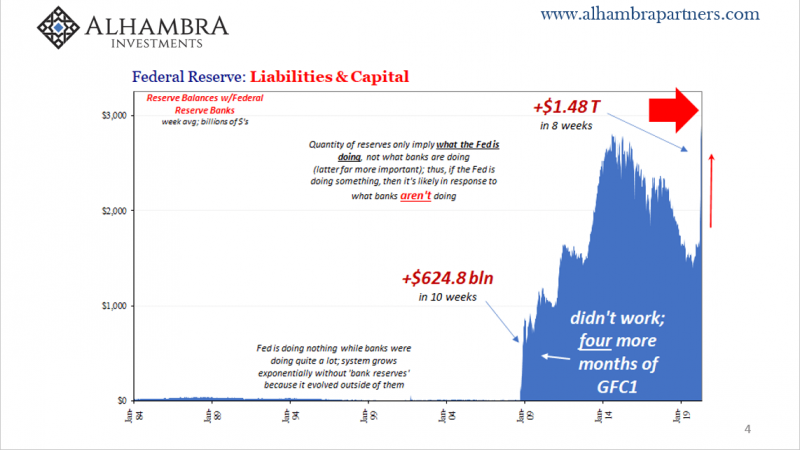

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t).

Read More »

Read More »

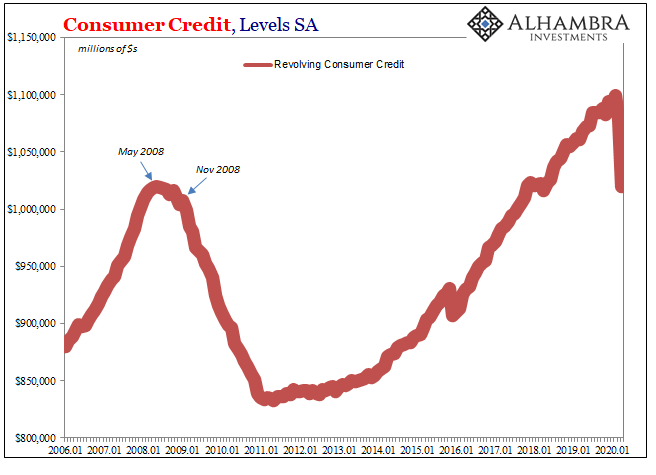

A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail.

Read More »

Read More »

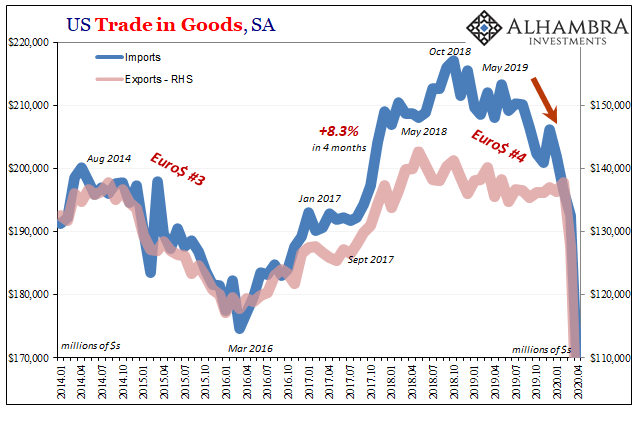

Someone’s Giving Us The (Trade) Business

The NBER has made its formal declaration. Surprising no one, as usual this group of mainstream academic Economists wishes to tell us what we already know. At least this time their determination of recession is noticeably closer to the beginning of the actual event. The Great “Recession”, you might recall, wasn’t even classified as an “official” contraction until December 2008 – a full year after the NBER figured the thing had begun.

Read More »

Read More »

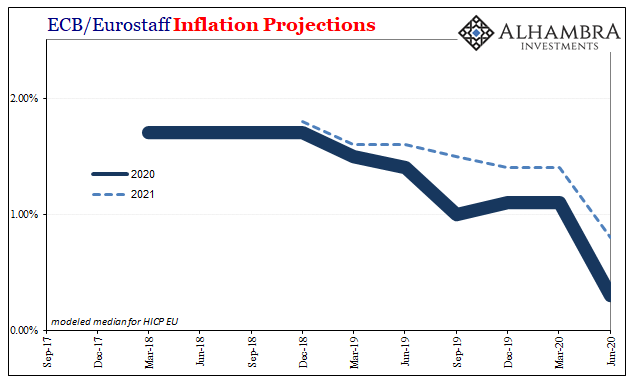

ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press.

Read More »

Read More »

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

Personal Income and Spending: The Other Side

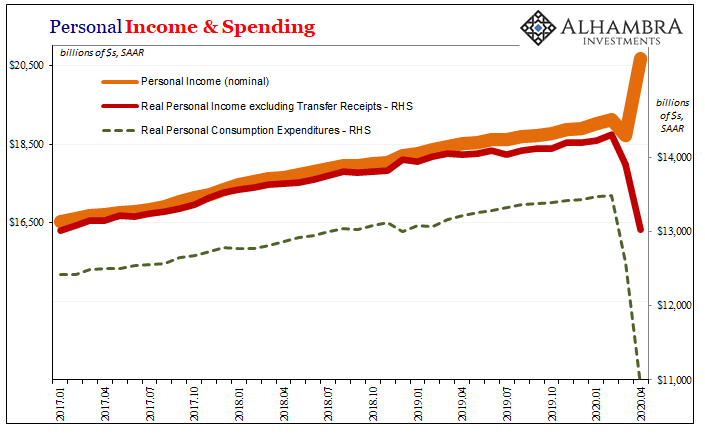

The missing piece so far is consumers. We’ve gotten a glimpse at how businesses are taking in the shock, both shocks, actually, in that corporations are battening down the liquidity hatches at all possible speed and excess. Not a good sign, especially as it provides some insight into why jobless claims (as the only employment data we have for beyond March) have kept up at a 2mm pace.These are second order effects.

Read More »

Read More »

Getting A Sense of the Economy’s Current Hole and How the Government’s Measures To Fill It (Don’t) Add Up

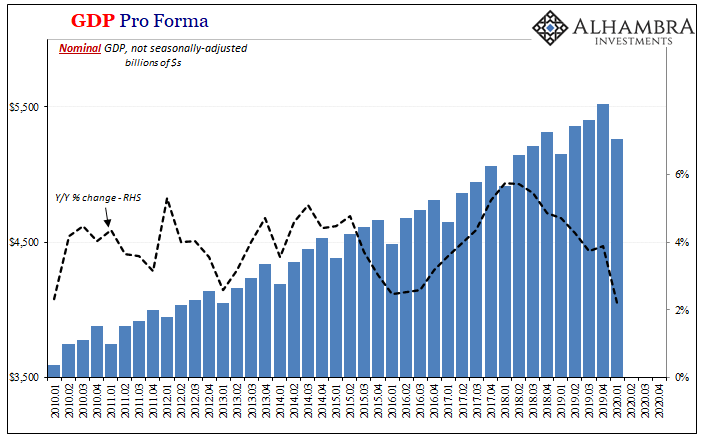

The numbers just don’t add up. Even if you treat this stuff on the most charitable of terms, dollar for dollar, way too much of the hole almost certainly remains unfilled. That’s the thing about “stimulus” talk; for one thing, people seem to be viewing it as some kind of addition without thinking it all the way through first.You have to begin by sizing up the gross economic deficit it is being haphazardly poured into – with an additional emphasis...

Read More »

Read More »

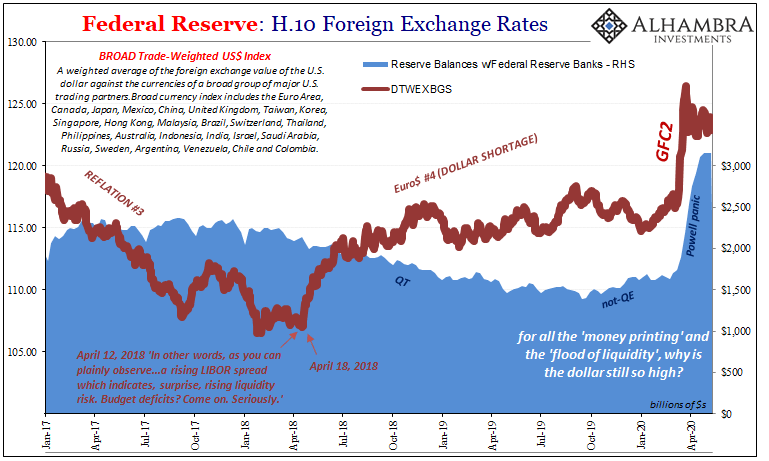

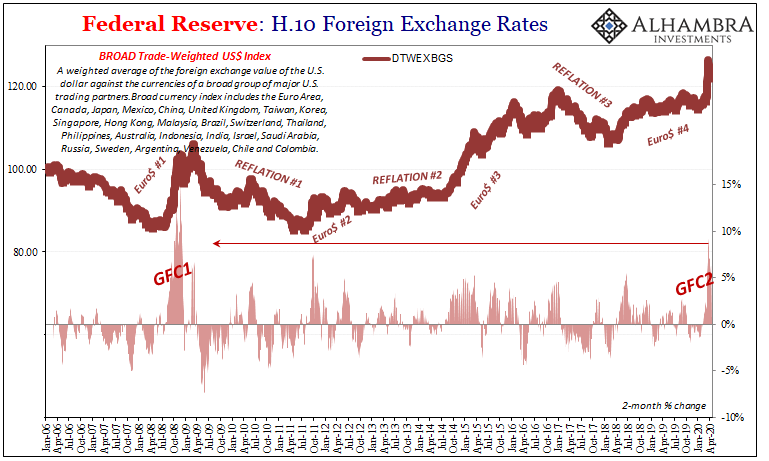

So Much Dollar Bull

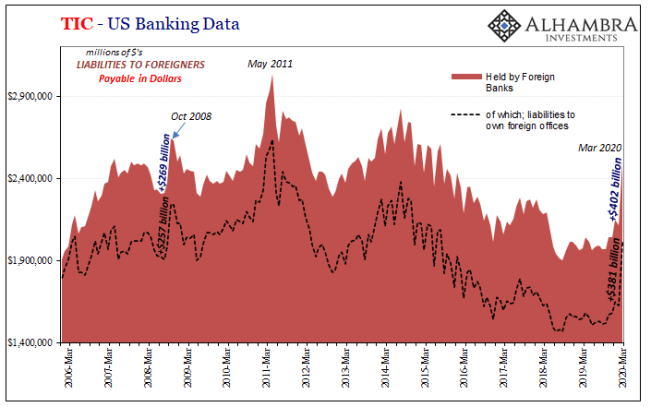

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered.In second place (now third)...

Read More »

Read More »

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

There Was Never A Need To Translate ‘Weimar’ Into Japanese

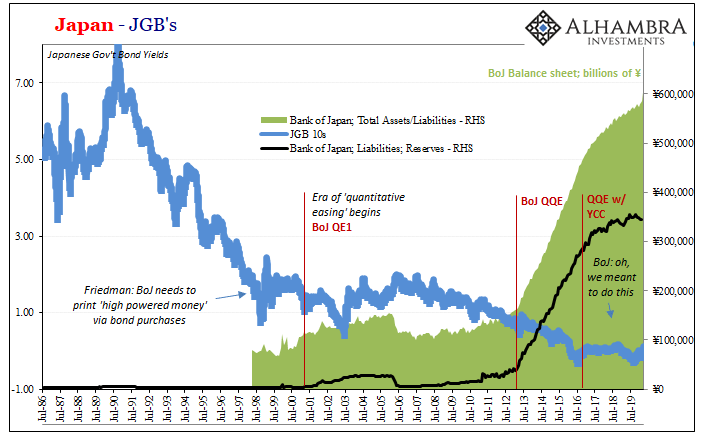

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

A Big One For The Big “D”

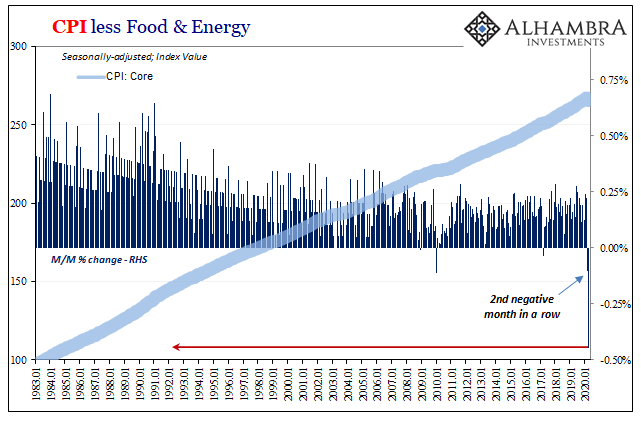

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy.

Read More »

Read More »

Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary?The answer: the Federal Reserve is not a central bank, not really.

Read More »

Read More »

We All Know Who’s On First, But What’s On Second?

It wasn’t entirely unexpected, though when it was announced it was still quite a lot to take in. On September 1, 2005, the Bureau of Economic Analysis (BEA) reported that the nation’s personal savings rate had turned negative during the month of July. The press release announcing the number, in trying to explain the result was reduced instead to a tautology, “The negative personal saving reflects personal outlays that exceed disposable personal...

Read More »

Read More »

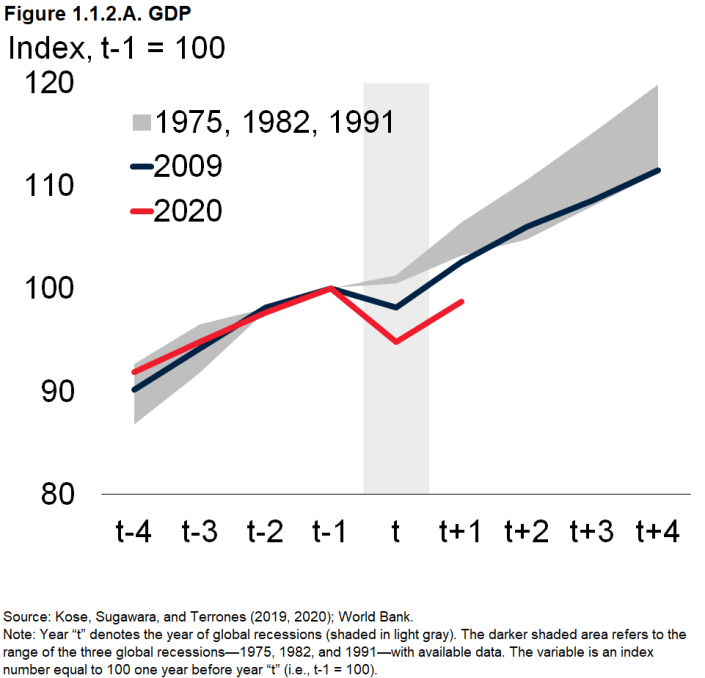

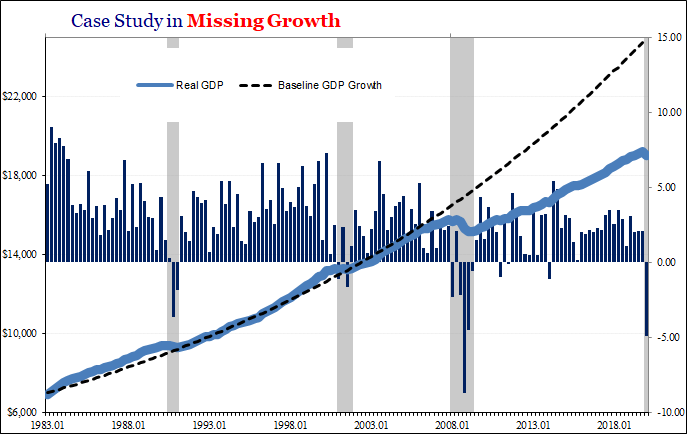

GDP + GFC = Fragile

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

The Puppet Show Is Powerful

I never said it wasn’t powerful. What I continue to show is that it doesn’t work. Ben Bernanke kept his job because despite the carnage, in times of turmoil people are willing to give anyone a second chance. And if the turmoil never ends, so much the luckier – for him.

Read More »

Read More »

The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »