Tag Archive: economy

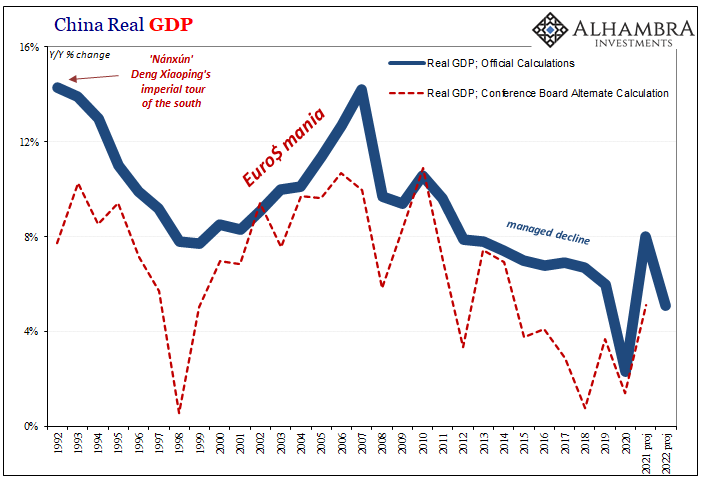

Taper Rejection: Mao Back On China’s Front Page

Chinese run media, the Global Times, blatantly tweeted an homage to China’s late leader Mao Zedong commemorating his 128th birthday. Fully understanding the storm of controversy this would create, with the Communist government’s full approval, such a provocation has been taken in the West as if just one more chess piece played in its geopolitical game against the United States in particular.No. The Communists really mean it. Mao’s their guy again....

Read More »

Read More »

White-Hot Cycles of Silence

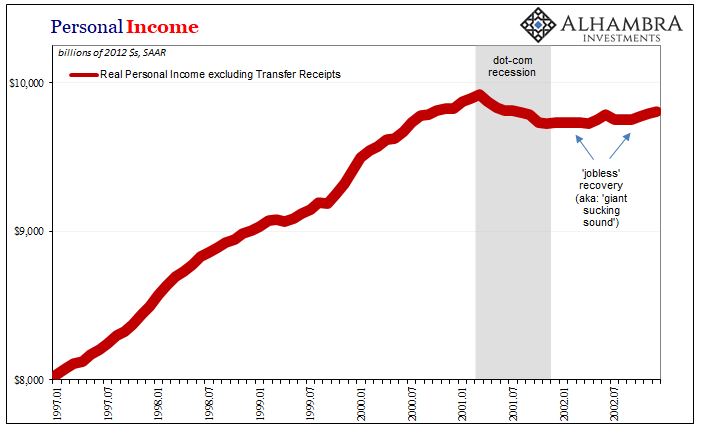

We’re only ever given the two options: the economy is either in recession, or it isn’t. And if “not”, then we’re led to believe it must be in recovery if not outright booming already. These are what Economics says is the business cycle. A full absence of unit roots. No gray areas to explore the sudden arrival of only deeply unsatisfactory “booms.”

Read More »

Read More »

The Historical Monetary Chinese Checklist You Didn’t Know You Needed For Christmas (or the Chinese New Year)

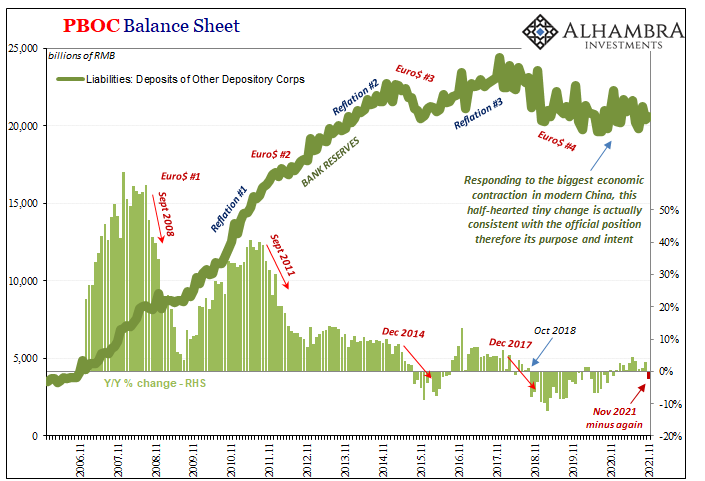

If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source.

Read More »

Read More »

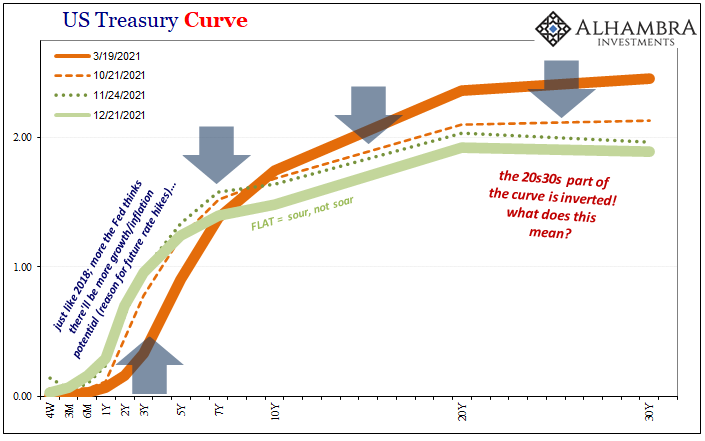

Start Long With The (long ago) End of Inflation

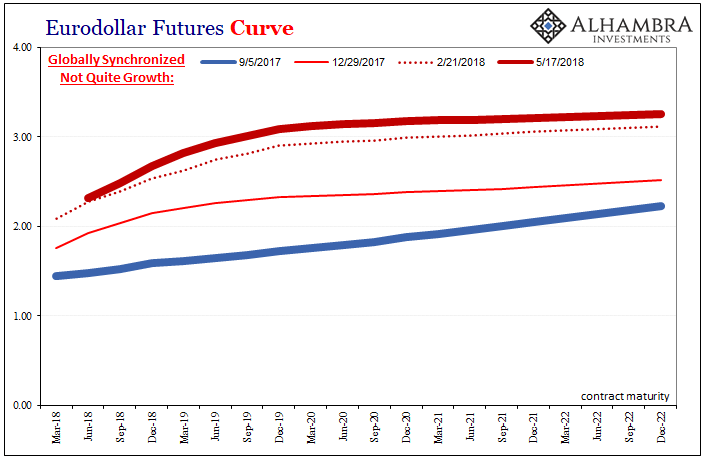

With the eurodollar futures curve slightly inverted, the implications of it are somewhat specific to the features of that particular market. And there’s more than enough reason to reasonably suspect this development is more specifically deflationary money than more general economic concerns.

Read More »

Read More »

TIC October: The Deflationary ‘Dollars’ Behind The Flat, Inverting Curves

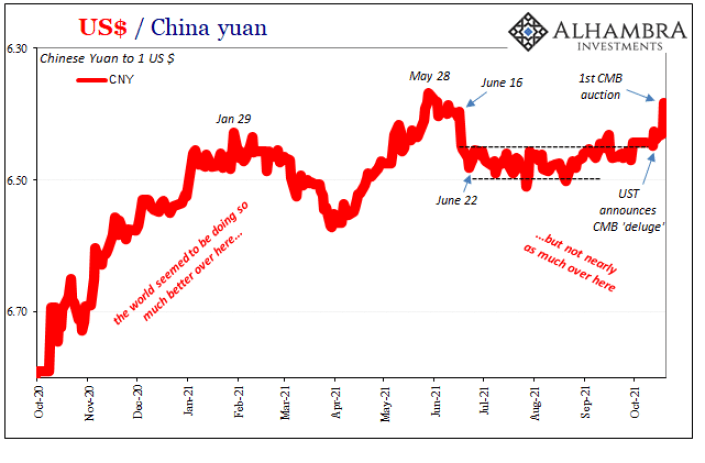

Seems like ancient history given all that’s happened since, but on October 13 Treasury Secretary Janet Yellen announced a planned deluge of cash management bills in the wake of the debt ceiling resolution (the first one). The next day, China’s currency, CNY, broke free from its previous and suspiciously narrow range.

Read More »

Read More »

One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

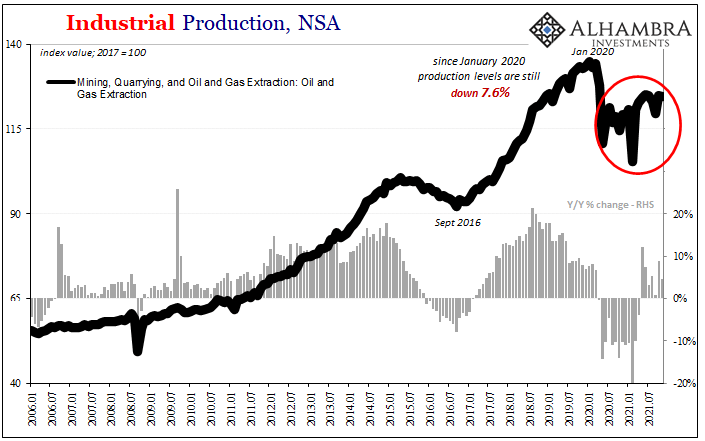

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts.

Read More »

Read More »

Playing Dominoes

That was fast. Just yesterday I said watch out for when the oil curve flips from backwardation to contango. When it does, that’s not a good sign. Generally speaking, it means something has changed with regard to future expectations, at least one of demand, supply, or also money/liquidity.

Read More »

Read More »

Testing The Supply Chain Inflation Hypothesis The Real Money Way

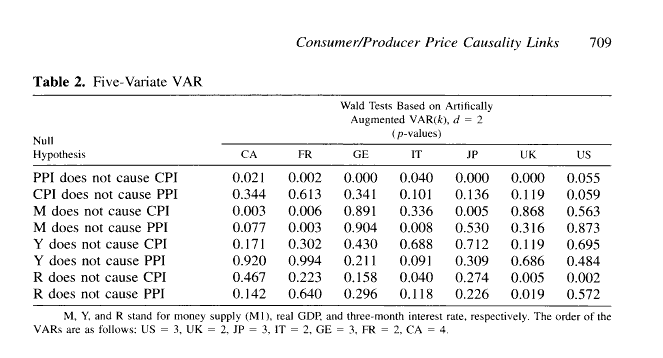

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

The FOMC Chases The US Unemployment Rate Regardless of China’s Huge Mess

In certain quarters, “scientific” quarters, the Chinese haven’t just done a fantastic job managing their own outbreak of COVID-19, the Communist government has produced a pandemic response model for the entire world to envy.

Read More »

Read More »

Trying To Project The Goods Trade Cycle

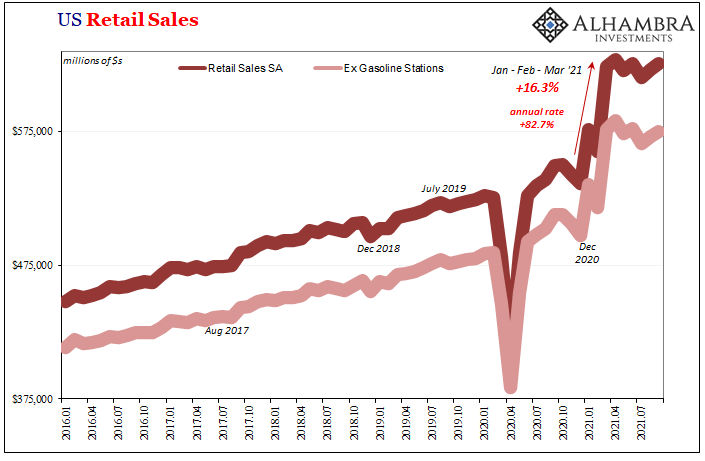

One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure.

Read More »

Read More »

Weekly Market Pulse: Has Inflation Peaked?

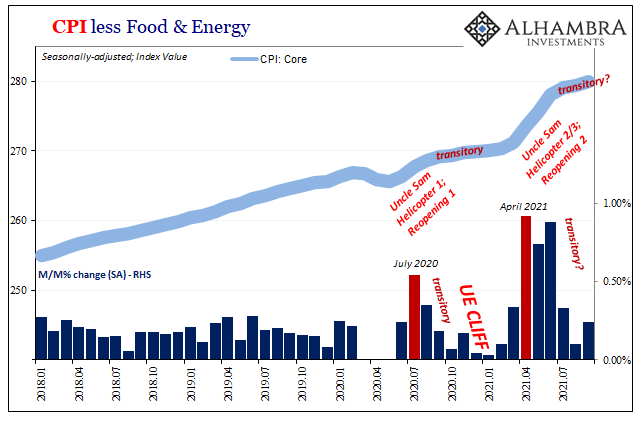

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

A Global JOLT(s) In July

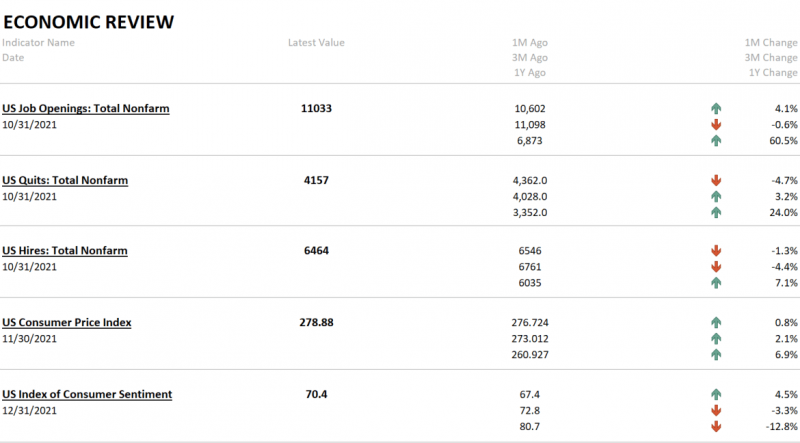

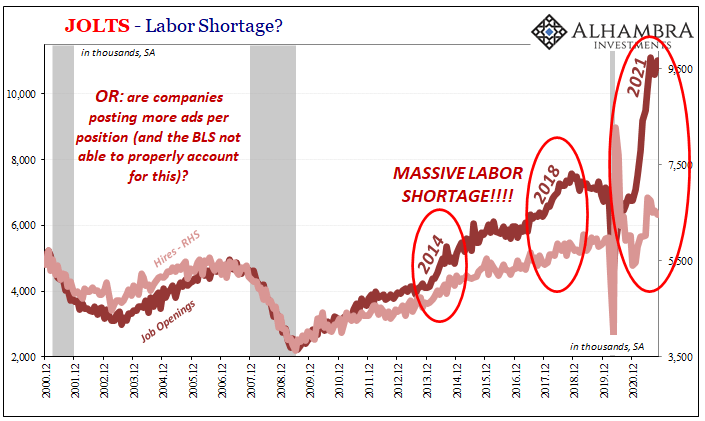

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million.

Read More »

Read More »

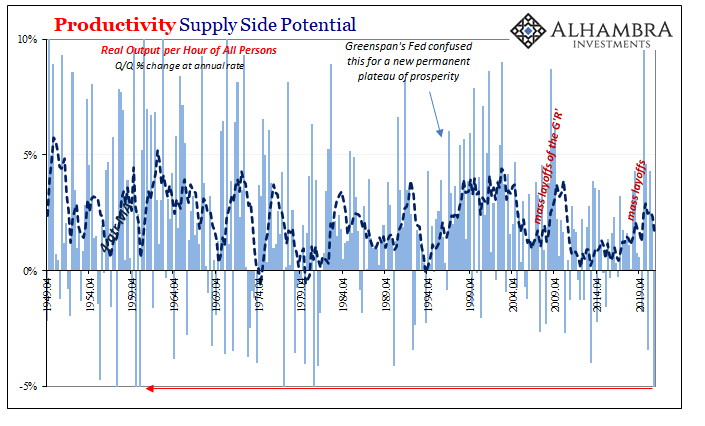

The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

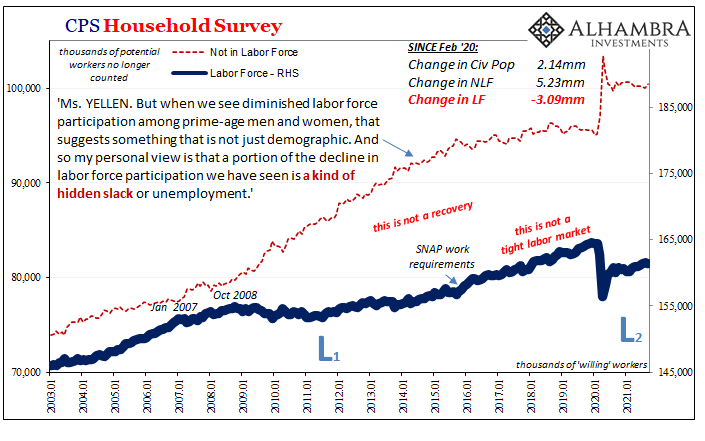

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market.

Read More »

Read More »

Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs.

Read More »

Read More »

This Is A Big One (no, it’s not clickbait)

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two.

Read More »

Read More »

The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID.

Read More »

Read More »

#RestartVienna at an unforgettable 10th Austrian Economics Conference – 1st Day

On November 4-5, the 10th Austrian Economics Conference took place at the Austrian Central Bank (Österreichische Nationalbank). The event was organized in collaboration with the Fundación Bases and the Hayek Institut and received more than 150 academics, researchers, think-tankers, entrepreneurs, and student advocates of the ideas of freedom from all over the world.

Read More »

Read More »

The Wile E. Powell Inflation: Are We Really Just Going To Ignore The Cliff?

Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed.

Read More »

Read More »

What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace.

Read More »

Read More »

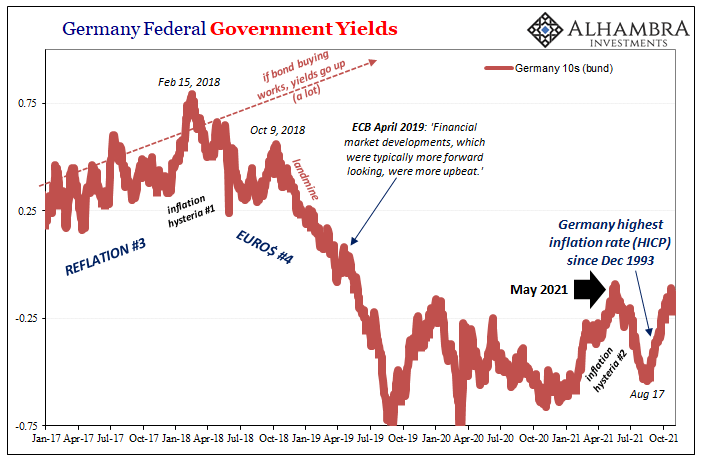

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »