Tag Archive: Economics

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Gold for the people

At the end of September, a very interesting story made the rounds in the media and caught my attention. Apparently, the US big box giant Costco added one rather surprising product to its range and it proved immensely popular. Next to humongous multipacks of cereal, buckets of peanut butter, mattresses and air fryers, customers were offered the opportunity to throw a gold bar in their carts as well.

Selling like hotcakes

According to a...

Read More »

Read More »

The slow, stealthy but steady spread of absolutism

Part II of II by Claudio Grass, Switzerland

Over the last couple of years, we saw countless examples of free speech suppression and of the steep price paid by those who chose to exercise that right. Divergent ideas and thoughts contradicting the government narrative were silenced and often punished in ways that would have been entirely unimaginable before the covid outbreak.

No matter what one thinks about the pandemic, about the policies...

Read More »

Read More »

The slow, stealthy but steady spread of absolutism

Part I of II by Claudio Grass, Switzerland

The struggle and rivalry between the “West and the rest” might be grabbing news headlines due to the Ukraine war these days, but in truth, it is anything but newsworthy. This antagonism, this battle for geopolitical, physical dominance, for moral supremacy, and this clash of ideas and fundamental values has been raging for much longer than that, perhaps longer than most of us can recall.

It sowed...

Read More »

Read More »

The Big Shift: The decline of Western politics

Part II of II

The big shift

Of course, this is the Left, but also the Right, of the good old days. The days of gentlemanly conduct and of real sportsmanship during a debate. These were the days when cultivated, curious and humble people argued passionately, but honourably. These were the days of decency, of common courtesy and civility.

But also these were the days of ideological integrity and consistency. For example, the arguments and...

Read More »

Read More »

The Big Shift: The decline of Western politics

Part I of II

Those of us who have read and studied political history, who have closely observed its evolution and especially those who have taken note of all the tactics and ploys used over the last couple of decades, will surely not be surprised by any of the findings and ideas I’ll outline in the following analysis. I would still encourage the reader to read on, though. Because for the majority of citizens, taxpayers, savers and investors,...

Read More »

Read More »

Freedom of speech and “de-banking”

Threats to freedom of speech and efforts to suppress dissenting views and voices have been on the rise over the past decades. They were exponentially intensified since the ascent of social media and as the political polarisation in the West truly took hold of our societies, the powers that be have been using any and all toolsat their disposal to “defend” the interests of the establishment against those who might try to publicly question its...

Read More »

Read More »

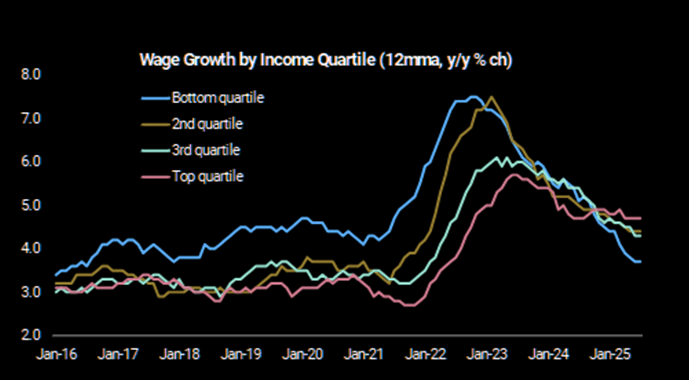

The real failure of “trickle down economics”

Part II of II

If this kind of theoretical reasoning seems too abstract, let us think about it more practically: Any public servant, any member of government, and even the leader of a nation, has very different motivations than any private sector decision-maker. Their financial compensation is a given and their time preference is dictated by their job description.

The company owner on the other hand has no such guarantees regarding their...

Read More »

Read More »

The real failure of “trickle down economics”

Part I of II

For decades already, one of the most popular and commonly employed attacks of Keynesians and other left-leaning economists was the one against the idea of “trickle down economics”. They ridiculed the notion that a rising tide lifts all boats or plainly put, the obvious fact that when job creators thrive, so do the people that hold those jobs and sustain themselves and their families thanks to them.

The main objection to this...

Read More »

Read More »

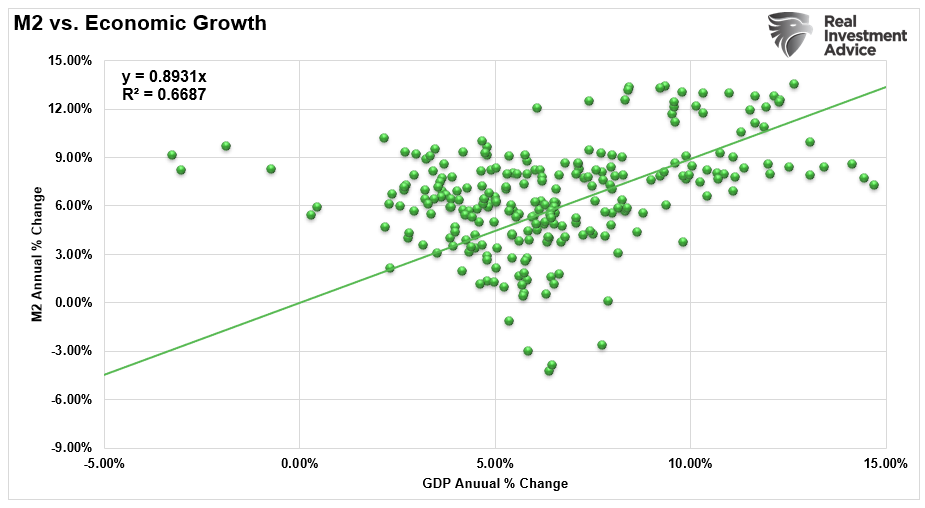

The demise of the dollar: What comes after that?

Part II of II

A good start

Whatever one might think about which currency is better suited to be used in trade or as a benchmark or as a central bank reserve, the fact remains that the USD’s days as the “only right answer” to that question are numbered. It might not happen tomorrow, but a credible challenger will eventually emerge.

As Patrick Barron also highlighted in his analysis: “Led by China and later by Russia, some nations of the...

Read More »

Read More »

The demise of the dollar: What comes after that?

Part I of II

Endless ink has been spilled by economists and financial analysts in their efforts to predict the impact of de-dollarization. As might be expected, most of those who embrace a US-centric view of the world and who defend the status quo paint a gloomy picture. They warn of the nightmarish consequences of a Russia- and China-dominated world order, of the threats to freedom and to human rights that this could pose and of a potential...

Read More »

Read More »

A conversation with Prince Michael of Liechtenstein

On November 15th, 2021, almost 20 months ago, I once again had the rare and delightful opportunity to have a conversation with Prince Michael. His insights, and especially his directness and unequivocal honesty, have frequently provided me with a lot of food for thought in the past. This interview was no different. His candid and unfiltered responses to a wide variety of questions and topics made this conversation as illuminating as it was...

Read More »

Read More »

Debt cancellation: the new panacea?

There is clearly a common denominator in the kind of “solutions” that the State comes up with to deal with the problems that it caused (and that’s most problems). Not only are these remedies worse than the disease, but they are always extremely simplistic, reductionist and they never, ever, take into account anything else apart from the political “optics” and the populistic value of each new measure or piece of legislation. There is no...

Read More »

Read More »

“Inflation it is not an act of God”

INTERVIEW WITH GODFREY BLOOM:

Over the last couple of years, the UK has been increasingly in the news – for all the wrong reasons. The cost of living crisis, in particular, has been monopolizing headlines at home and abroad. Of course, inflation is by no means unique to the country. To the contrary, it has been hovering at similar or higher levels in virtually all advanced economies for quite some time. What is unique to the UK though, is that...

Read More »

Read More »

“Bank walk”: The first domino to fall?

In early May, Reuters published a report that truly captured my attention. “European savers are pulling more of their money from banks, looking for a better deal as lenders resist paying up to hold on to deposits some feel they can currently live without,” the article reported. Over in the US, we see a very similar picture. As the FT also recently reported, “big US financial groups Charles Schwab, State Street and M&T suffered almost $60bn in...

Read More »

Read More »

France on strike

The roots of the injustice that brought over a million to the streets

It is the core of a long running joke that the French love to strike more than they like to work – and for good reason. Demonstrations, strikes and even riots, have been a common occurrence for decades. However, this latest round seems to be interestingly persistent, despite the fact that it’s receiving increasingly sparse media coverage.

The last time that the French...

Read More »

Read More »

A bank is a bank is a bank – Part II

Part II of II by Claudio Grass

A real systemic crisis

If there was one thing more telling than the bank failures themselves, it was the governments’ reaction to them. The sheer panic that shook US, Swiss and Eurozone officials was almost pitiable to behold. The way they all rushed to make statements denying that this would be a repeat of 2008 was alarming instead of reassuring. And their apparent, urgent desperation to be believed was perhaps...

Read More »

Read More »

A bank is a bank is a bank

Part I of II by Claudio Grass

It might sound like an old-fashioned notion, the sort of thing that one reads about in period novels and romantically sighs “oh, the good old days”. It might sound like old timely advice, perhaps of the kind that our grandparents would have given to our parents: “It doesn’t matter if you make mistakes, even if you lose everything, as long as you still have your honor”. Sure. But in our cynical, jaded and largely...

Read More »

Read More »

Banking crisis: The new bailout strategy

Part II of II

To be fair, it is true, this time is different. Indeed, this time the rescue plan for the bust banks is not comparable to what we saw in 2008. In the US, the guarantee for deposits up to $250.000 comes from funds that are maintained by participating banks and not from the taxpayer. The official answer to how they’re going to pay everyone back is also plausible and possible: Some, or even most, of the money can and will be recovered...

Read More »

Read More »

Gold Hits New All Time Highs

2023-11-02

by Dave Russell

2023-11-02

Read More »