Tag Archive: Economics

Corporate Profits: A Reading Without Rose-Tinted Glasses

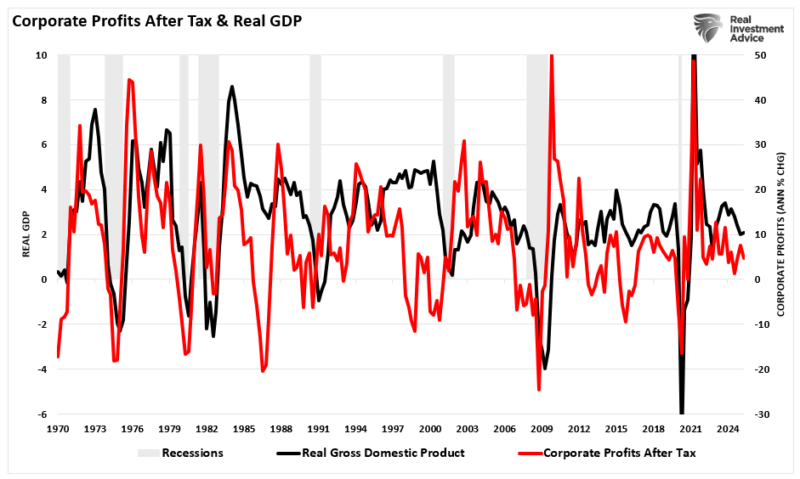

If you want to understand where we are in the cycle, skip the noise and follow profits. Corporate profits are the lifeblood of investment, hiring, and market returns. Crucially, linkage to the real economy is very tight. In the national accounts (NIPA), the BEA’s “profits from current production” (with inventory valuation and capital consumption adjustments) …

Read More »

Read More »

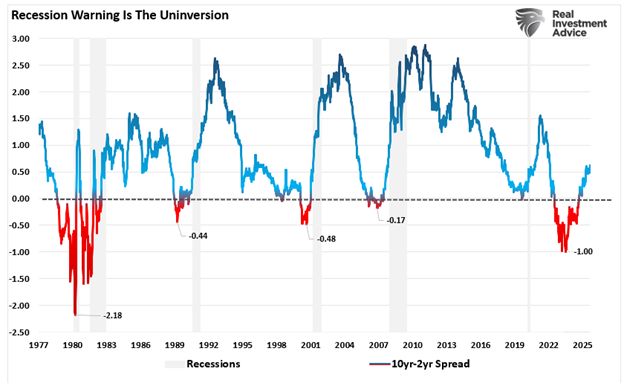

Promised Recession…So Where Is It?

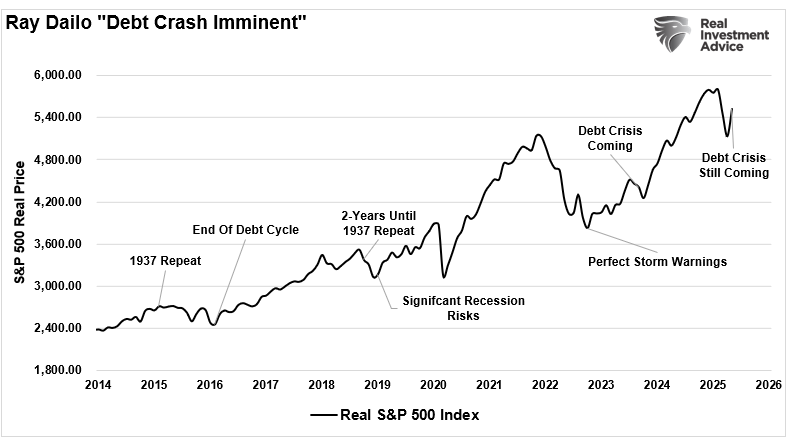

Over the past three years, the economic conversation has been a "promised recession." If you read the headlines, tracked economist surveys, or even listened to Wall Street strategists, you would have assumed a downturn was imminent. Many investors, bloggers, and YouTubers have had a "parade of horribles" promising a recession is just on the horizon.The logic was …

Read More »

Read More »

Slowdown Signals: Are Leading Indicators Flashing Red?

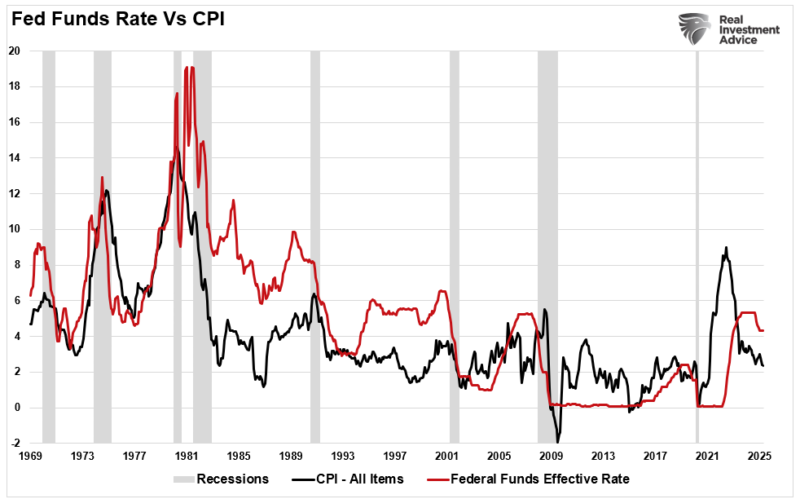

Lately, there’s been a growing sense of confidence among investors that the U.S. economy has dodged the proverbial bullet. Despite a historic rate-hiking cycle by the Federal Reserve, two years of stubborn inflation, and signs of strain in global trade, the dominant Wall Street narrative is now a curious mix of “soft landing,” “no landing,” …

Read More »

Read More »

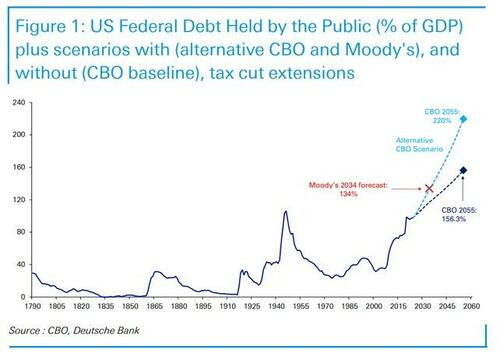

Data Centers And The Power Grid: A Path To Debt Relief?

Could data centers and the power grid be America's next "renaissance?" With the U.S. national debt exceeding $37 trillion and interest payments surpassing defense spending, many articles have been written about the "debt doomsday" event coming. Such was a point we made in "The Debt and Deficit Problem." "In recent months, much debate has been …

Read More »

Read More »

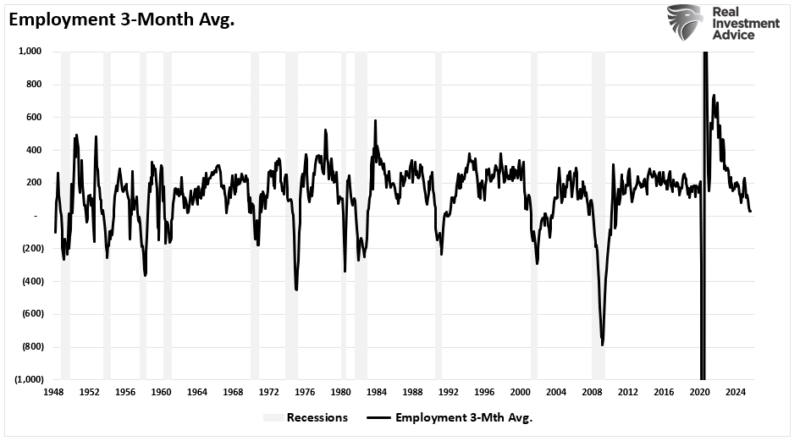

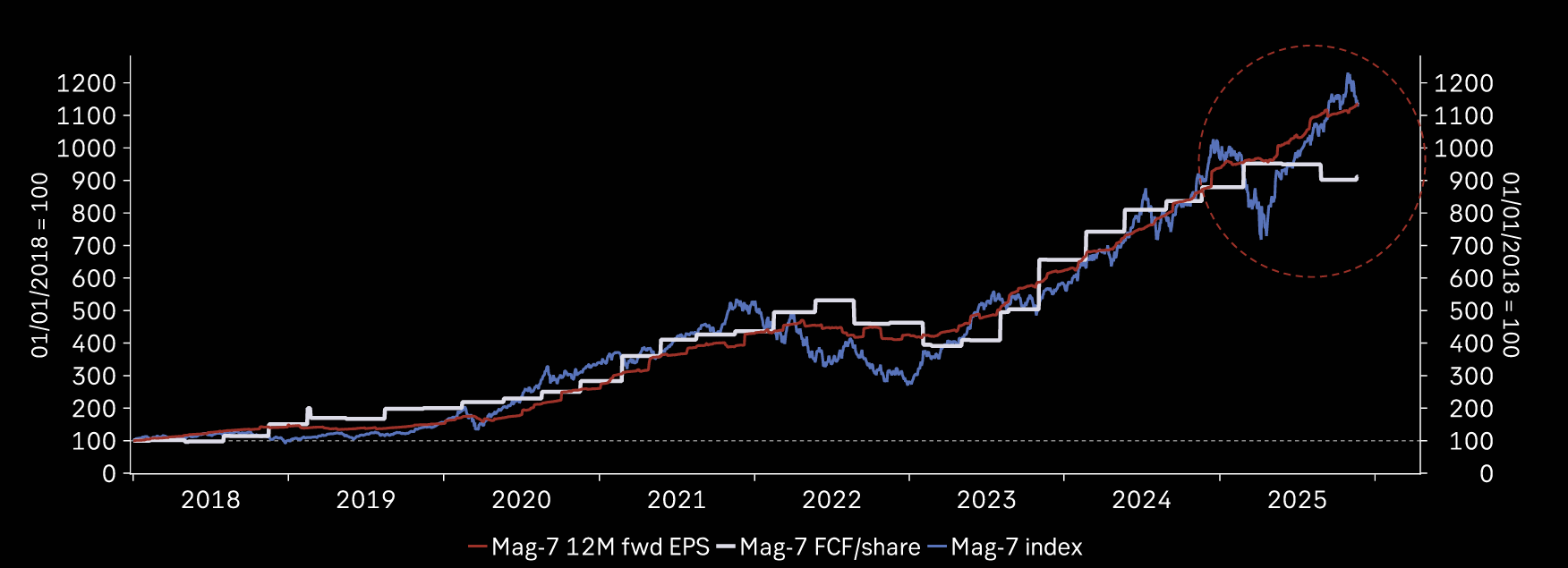

Corporate Earnings Slowdown Signaled By Employment Data

The latest employment data strongly warned of a potential corporate earnings slowdown ahead. This is the first time we have warned about the employment data and its impact on corporate earnings. In May, we penned "Employment Data Confirms Economy Is Slowing." wherein we stated: "Given the importance of consumption in the economy and that employment (production) must come …

Read More »

Read More »

Why Keynes’ Economic Theories Failed In Reality

A recent post from Daniel Lacalle, “How Keynesians Got The US Economy Wrong Again,” exposed the widening gap between John Maynard Keynes' economic theory and reality. Despite the confident forecasts of leading Keynesian economists, the U.S. economy in 2025 continues to defy expectations. The Federal Reserve’s tightening cycle failed to trigger the widely predicted “hard …

Read More »

Read More »

Investing in times of policy volatility

At the end of last month, a shock announcement came from the US Customs and Border Protection (CBP), declaring that one-kilogram and 100-ounce gold bars imported from Switzerland would be subject to a hefty 39% tariff, under the country’s “reciprocal tariffs” policy, which had already applied broadly to Swiss goods. This CBP decision came in response to a Swiss refiner’s request for clarity and guidance on whether gold would be part of the wider US...

Read More »

Read More »

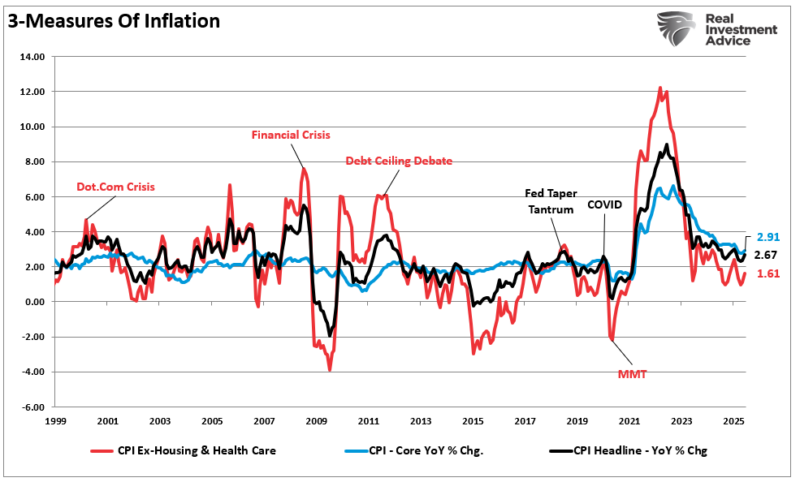

Energy Price As An Economic Indicator

What are energy prices telling us about the economy? A recent article on Bloomberg noted that: "Hedge funds slashed their bullish position on crude to the lowest in about 17 years as risks of additional sanctions on Russian crude oil waned, bringing concerns about a global supply glut back to the fore. Money managers’ net-long position on …

Read More »

Read More »

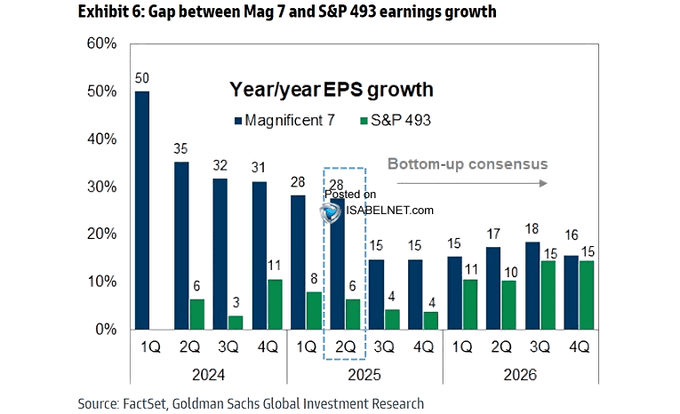

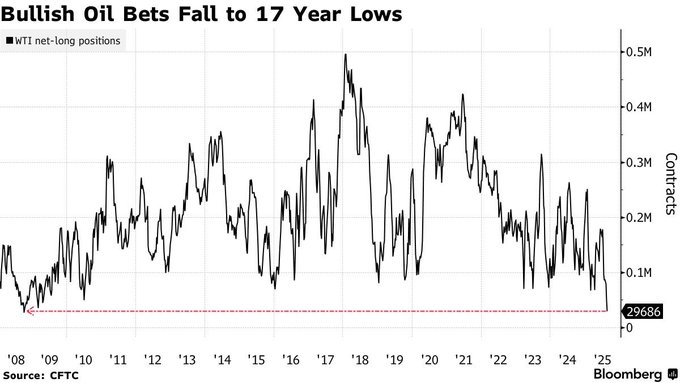

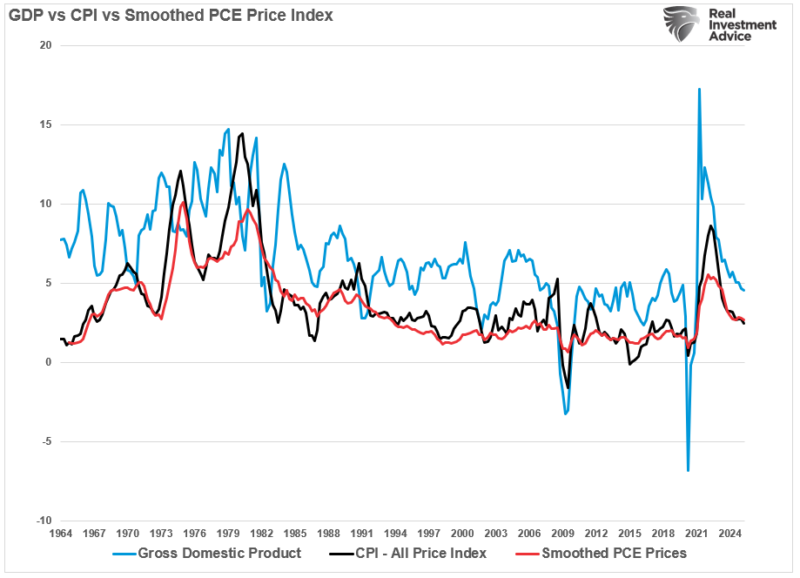

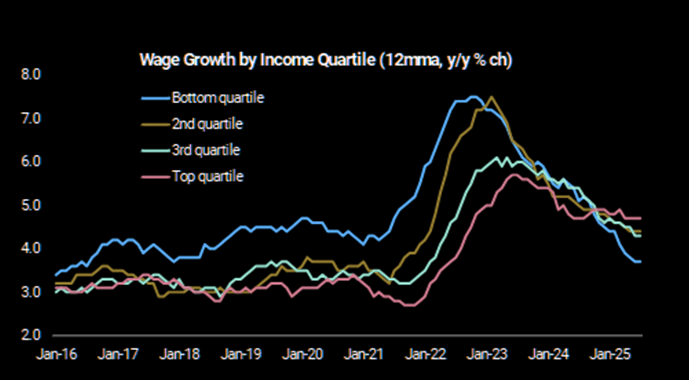

US Economy: Recent Data Suggests Risk To Earnings

The latest economic data suggests the US economy is decelerating. That means growth is slowing, jobs are shrinking, and households are spending less. As we showed in a recent #BullBearReport, economic growth, inflation, and personal consumption are trending lower. Unsurprisingly, with job growth weakening, consumer sentiment also took a hit in the latest report, with …

Read More »

Read More »

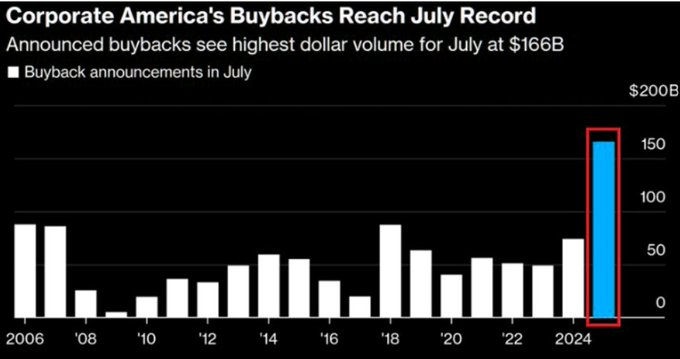

Insider Selling Reveals Fallacy Of Buyback Theory

Mainstream commentary repeats a simple refrain: “Buybacks return capital to shareholders.” The logic sounds convincing. A company reduces its outstanding shares, giving each shareholder a larger slice of the earnings pie. But as I’ve discussed in past work like “Stock Buybacks Aren't Bad, Just Misused,” the reality is more complex. If corporate buybacks were an …

Read More »

Read More »

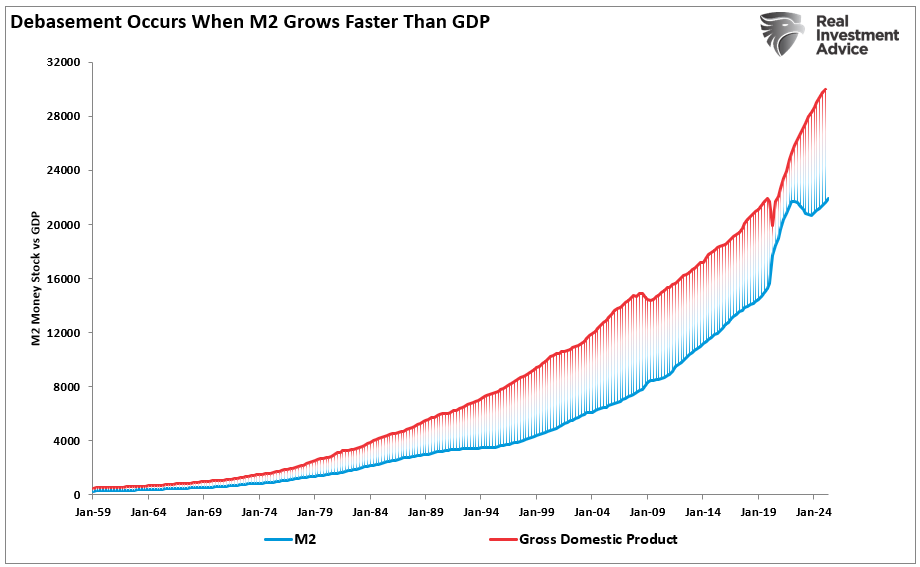

The Debt And Deficit Problem Isn’t What You Think

In recent months, much debate has been about rising debt and increasing deficit levels in the U.S. For example, here is a recent headline from CNBC: The article's author suggests that U.S. federal deficits are ballooning, with spending surging due to the combined impact of tax cuts, expansive stimulus, and entitlement expenditures. Of course, with …

Read More »

Read More »

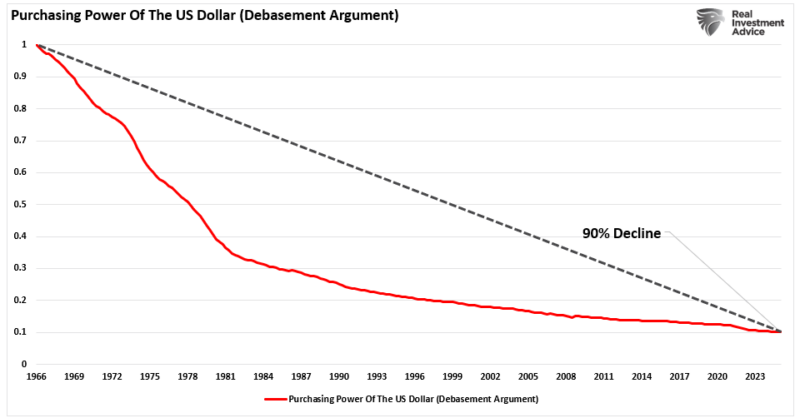

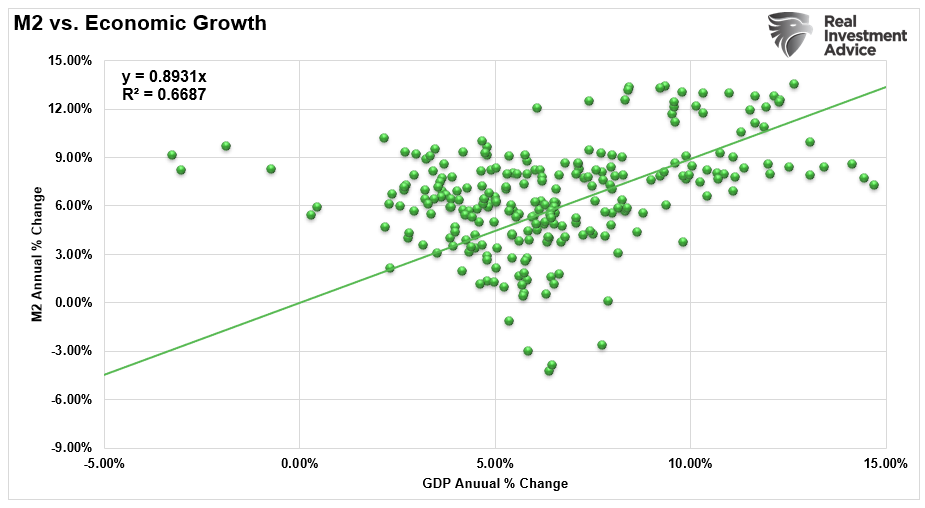

Debasement: What It Is And Isn’t.

Over the past year, financial headlines continue to flood investors with doomsday predictions about the U.S. dollar. Whether it's social media influencers waving "dollar collapse" charts or YouTube personalities warning about debasement, the noise has become deafening. The narrative is seductive: inflation is out of control, the government is printing money, and the dollar is on its last legs.

Read More »

Read More »

Storing gold in the right place and in the right way

By now, I’m pretty sure that all of my clients and regular readers fully understand why allocating a part of their wealth to physical precious metals is not just the smart move, but an increasingly essential one. Owing real, tangible gold and silver is the only way to protect yourself from both monetary and fiscal excesses and from government overreach. However, it is equally important to know what to do with it once you bought it. Preparing for...

Read More »

Read More »

Is Private Equity A Wolf In Sheep’s Clothing?

In July 2007, just before the financial crisis erupted, Citigroup CEO Chuck Prince summed up Wall Street's dangerous exuberance: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing.” Eighteen years later, Wall Street is …

Read More »

Read More »

China’s Economic Demise And Its Impact On The U.S.

Few are as candid and historically accurate as hedge fund manager Kyle Bass when identifying structural breaks in the global economy. In a recent interview, Bass painted a grim but telling picture of China's economic condition, warning: “We are witnessing the largest macroeconomic imbalances the world has ever seen, and they are all coming to …

Read More »

Read More »

Geopolitical theater and implications for investors (or lack thereof)

The last month has been truly remarkable for modern human history – at least if one was paying attention to mainstream news headlines and TV anchors. Apparently, we came extremely close to World War III and we very likely had a very tight escape from an all-out nuclear holocaust that could have forever changed the our species’ trajectory and annihilated millions.

It all started with Israel’s surprise bombardment of Iran (which wasn’t really a...

Read More »

Read More »

The Fed’s “Transitory” Mistake Is Affecting Its Outlook

In 2023 and 2024, the Fed was under intense public and media scrutiny for calling the post-pandemic surge in inflation “transitory.” Critics argued that the Fed's failure to anticipate the persistence and severity of rising prices undermined its credibility. Yet, with the benefit of hindsight and historical context, the Fed's position wasn't entirely misguided. Inflation …

Read More »

Read More »

The Dollar’s Death Is Greatly Exaggerated

The narrative surrounding the "dollar's death" as the world's reserve currency has been on the rise recently. However, this happens whenever the dollar declines relative to other currencies. We previously wrote about the false claims of the "dollar's death" in 2023 (see here, here, and here). The recent decline in the dollar relative to other currencies is well within historical norms.

Read More »

Read More »

The Deficit Narrative May Find Its Cure In Artificial Intelligence

Lately, the "deficit narrative" has dominated much of the financial media, particularly those channels that are continual "purveyors of doom." In this post, we will discuss the "deficit narrative," the likely outcomes, and why the cure for the deficit may be found in Artificial Intelligence. The "deficit narrative" has dominated the media lately as President …

Read More »

Read More »

A Politically Incorrect “Where Are We Now?”

A few days ago, I had the great pleasure to sit down again with my good friend James Patrick in person, in Monte Brè. It was a truly spontaneous and unfiltered conversation about the current state of the world, the bizarre geopolitical situation and the tragicomical moment in history that we find ourselves in. We talked about the extreme, and likely unprecedented, risks we face in the global economic and financial system and I’m very glad we...

Read More »

Read More »