Tag Archive: ECB

Nasty Number Five, Not Hawk Hiking CBs

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide.

Read More »

Read More »

The End Game Approaches

The pendulum of market sentiment swings dramatically. It has swung from nearly everyone and their sister complaining that the Federal Reserve was lagging behind the surge in prices to fear

of a recession.

Read More »

Read More »

Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%.

Read More »

Read More »

Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting.

Read More »

Read More »

Over to the ECB

Overview: Equity markets in Asia Pacific and Europe are weaker. The main exception in Asia Pacific was India, where the market rose by about 0.75%.

Read More »

Read More »

The Greenback Bounces Back

Overview: After modest US equity gains yesterday, the weaker yen and Beijing’s approval of 60 new video games helped lift most of the large markets in the Asia Pacific region.

Read More »

Read More »

Reserve Bank of Australia Surprises, but Aussie Struggles

Overview: The jump in US interest rates helped lift the greenback to new 20-year highs against the Japanese yen and pushed the euro back below $1.07. US equities saw initially strong gains pared and this set the tone for today’s activity.

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

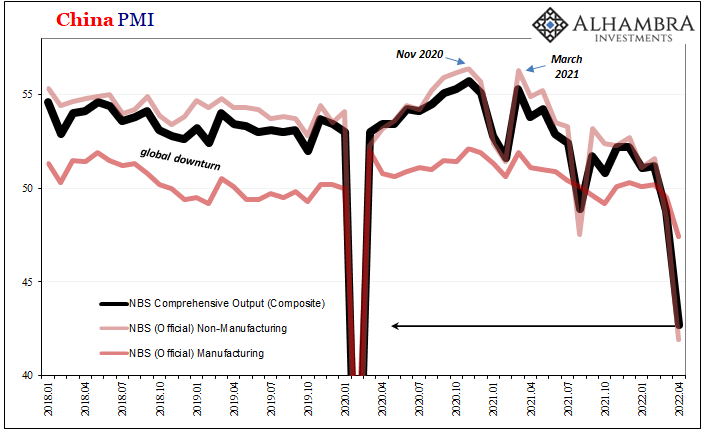

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

Dollar Gains Pared

Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop.

Read More »

Read More »

Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed.

Read More »

Read More »

Dollar and Yen Surge

Overview: Global equities are bleeding lower. Several large markets in the Asia Pacific region, including Hong Kong, Taiwan, and India are off more than 2%. Japan and Australian bourses fell by more than 1.5%.

Read More »

Read More »

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

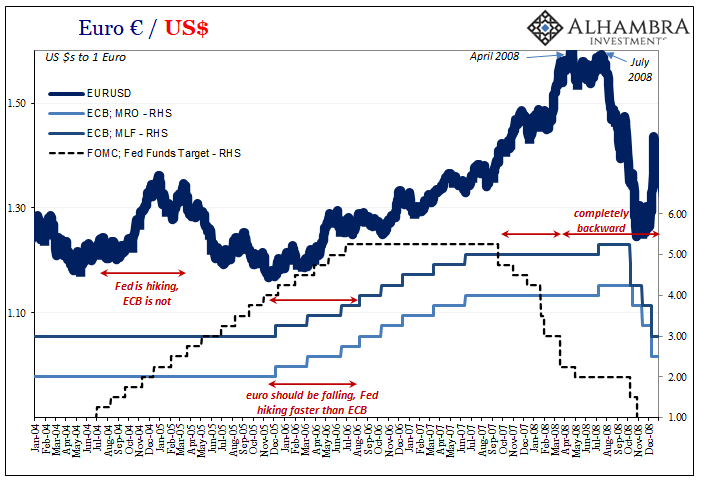

What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials.

Read More »

Read More »

The Euro Continues to Stuggle to Sustain Even Modest Upticks, but Specs Still Long in the Futures

Overview: The US dollar begins the new week on a firm note ahead of the mid-week conclusion of the FOMC meeting. Many centers are closed for the May Day holiday, making for thinner market conditions. Equities are mostly lower in the markets that traded today. This includes Japan, South Korea, Australia, and India in the Asia Pacific.

Read More »

Read More »

Good Friday

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares.

Read More »

Read More »

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an "expeditious" campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower.

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools.

Read More »

Read More »

ECB Meeting and US and China’s CPI are the Macro Highlights in the Week Ahead

One of the most significant market responses to Russia's attack on Ukraine is in the expectations for the trajectory of monetary policy in many of the high-income countries, including the US, eurozone, UK and Canada. The market has abandoned speculation of a 50 bp hike in mid-March by the FOMC and the Bank of England. It has also scaled back the ECB's move to 20 bp this year from 50 bp.

Read More »

Read More »