Tag Archive: ECB

FX Weekly Preview: Yellen Pushes Divergence Front and Center

The summer dynamics of the capital markets has changed by the enhanced prospects of a Fed hike. Equity markets and other risk assets look particularly vulnerable. Sterling may do better against the euro than the dollar.

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »

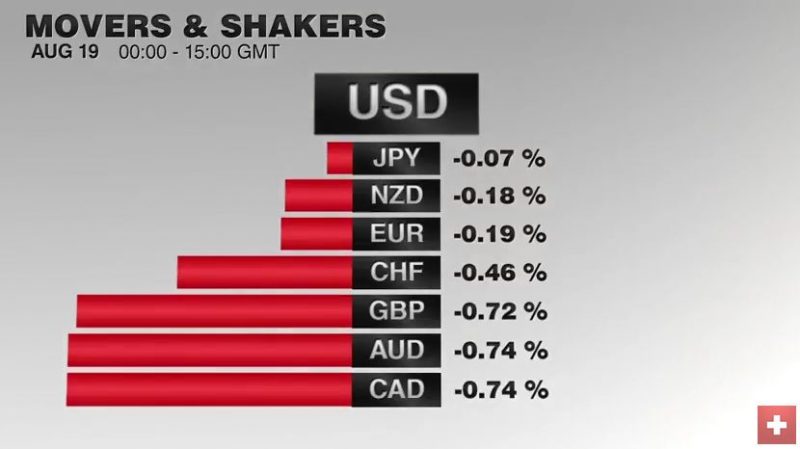

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

FX Weekly Preview: Thoughts on the Significance of Ten Developments

The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view.

Dudley's press conference may be more important than FOMC minutes.

Two German state elections that will be held next month comes as Merkel's popularity has waned.

Read More »

Read More »

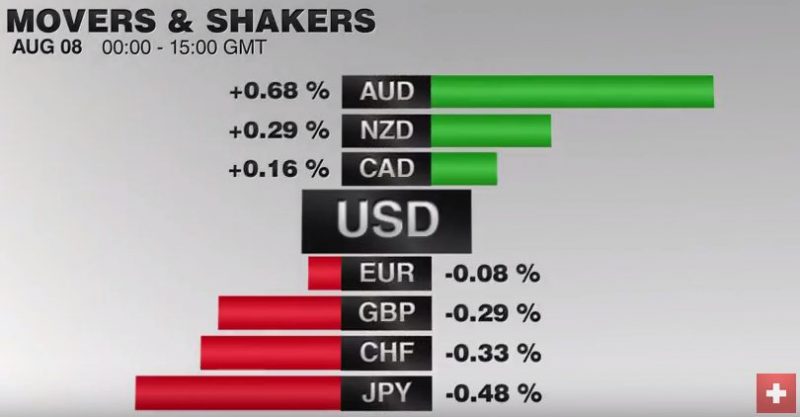

FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia.

Read More »

Read More »

FX Weekly Preview: Light Economic Calendar Week Allows New Thinking on Macro

Policy outlook is clear: ECB and BOJ review next month, FOMC still looking for opportunity. Inventory cycle making quarterly US GDP forecasting difficult, but it looks like re-acceleration still the more likely scenario than recessions.

Why didn't European bank stress tests results have more impact?

Read More »

Read More »

Jailing Banksters Will Not Resolve the Economic Crisis

Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months).

Read More »

Read More »

Draghi Does not Surprise and Euro Edges Away from $1.10

Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken.

Read More »

Read More »

How Germany Could Upset Europe before UK Referendum

The assassination of the Jo Cox has broken the powerful momentum in the markets. Investors recognize that the tragedy potentially injects a new element into consideration for the outcome of next week’s referendum. The campaigns will be resume over the weekend, and new polls will be available. Investors will place more weight on polls conducted …

Read More »

Read More »

FAQ: ECB’s Corporate Bond Buying Program Starts

In March, the ECB decided to increase its asset purchases from 60 to 80 bln euros a month and to include corporate bonds. The corporate bond buying program begins this week. We use an FAQ format to discuss the key issues. What is the ECB doing? The ECB will buy euro-denominated, investment grade bonds … Continue reading...

Read More »

Read More »

Notes from ECB Press Conference

ECB press conference June 2 2016 Q; Risk to inflation balanced? April meeting, no conclusive evidence of second round effects, are they now? A; Additional stimulus beyond CSPP and TLTRO2 not necessary as we expect higher inflation. We do not see evid...

Read More »

Read More »

FX Weekly Preview

The US dollar bottomed against nearly all the major currencies on May 3. The hawkish April FOMC minutes that began swaying opinion about the prospects for a summer rate hike were not published until two weeks later, and the confirmation by NY Fed President Dudley was not until May 19. Nevertheless, the shift in expectations for …

Read More »

Read More »

Two Decisions from Europe

It might not be on investors' calendars, but European officials will take steps toward addressing two issues tomorrow. First, the EC will make a preliminary recommendation of visa-free travel in the Schengen area for Turkish passport holders. S...

Read More »

Read More »

FX Daily, April 21: ECB Takes Center Stage

The ECB meeting is the session's highlight. In recognition of the risk that ECB President Draghi expresses displeasure with the premature tightening of financial conditions through the exchange rate channel is encouraged a modest bout of euro s...

Read More »

Read More »

Four Keys to The Week Ahead

There are four events that will shape market psychology in the week ahead. They are Yellen's speech to the NY Economic Club, US jobs data, eurozone March CPI and PMI, and Japan's Tankan Survey. The broad backdrop is characterized by the rebuilding of risk appetites since the middle of February, though the MSCI emerging market … Continue reading...

Read More »

Read More »

ECB, Corporate Bonds, and Credibility

The euro's rallied shortly after the ECB announced numerous monetary measures that in their totality were more than expected. Many saw this as proof that monetary policy had lost its effectiveness, and central banks have lost credibility.

R...

Read More »

Read More »

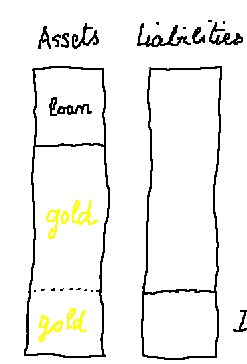

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

What Drives the Economy: Consumer Spending or Saving/Investment?

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »

When FX wars become negative interest wars

Beat Siegenthaler, FX strategist at UBS, has been wondering about what the Swiss National Bank may do if the ECB’s measures to weaken the euro begin to test its 1.20 EURCHF floor. He notes, for example, that there has already been a marked divergence...

Read More »

Read More »