Tag Archive: Czech

Serenity Now

Overview: The markets are calmer after yesterday's post-US election drama. A consolidative tone has emerged in the foreign exchange market, and the dollar is softer against all the G10 currencies, led the 1% gain in the Norwegian krone, after the central bank left rates on hold. Sweden's Riksbank delivered the expected half-point cut and the krona is up 0.5%. Japanese officials warned against excessive moves, and the PBOC set the dollar's...

Read More »

Read More »

US Polls Spur Position Adjusting Ahead of Tomorrow’s Election

Overview: Weekend polls in the US made it seem that the Trump victory, which many large pools of capital, had discounted, was not so inevitable after all. The most dramatic market response was taking US yields and the dollar lower. The US 10-year yield is off about nine basis points to straddle 4.30% and the two-year yield down four basis points to around 4.16%. The greenback is also against all the G10 currencies. Most emerging market currencies...

Read More »

Read More »

The Greenback Consolidates while Sustaining Break against the Yen

Overview: The dollar is sporting a softer

profile today against all the G10 currencies but the Swedish krona. The

Riksbank sounded more dovish than previously, signaling the possibility of a

cut in each of the last three meetings of the year. The dollar has sustained its

push above JPY160 against the Japanese yen. Most emerging market currencies are

also firmer, with the notable exception of Türkiye and South Africa. Türkiye is

expected to keep its...

Read More »

Read More »

Macro: Tell Us Something We Don’t Already Know

As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings.

Read More »

Read More »

FX Daily, October 11: Rate Expectation Adjustment Continues

Overview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3 earnings season.

Read More »

Read More »

What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%.

Read More »

Read More »

FX Daily, June 22: Turn Around Tuesday or Dollar Rally Resumes?

Firming long-term US yields have lent the dollar support after trading heavily yesterday. The greenback is around 0.15%-0.50% higher against the major currencies. The Japanese yen and Canadian dollar are among the more resilient, and the Australian dollar and sterling among the heaviest.

Read More »

Read More »

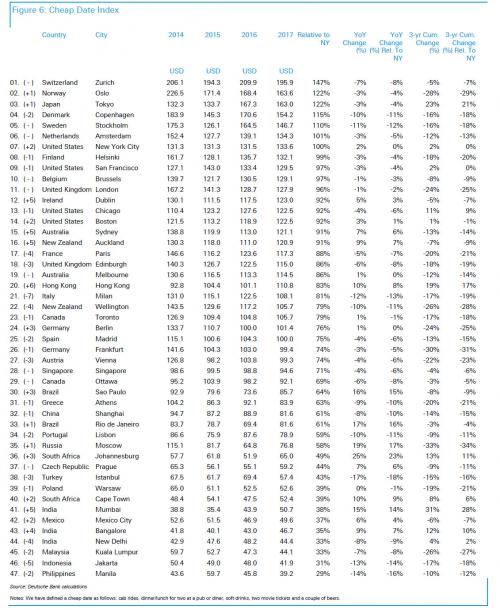

These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of & cheap dates in the world's top cities.

Read More »

Read More »

End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side.

POLICY OUTLOOK

Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6% y/y. If so,...

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

Europe Debates The Burkini: “We Will Colonize You With Your Democratic Laws”

"We will colonize you with your democratic laws." — Yusuf al-Qaradawi, Egyptian Islamic cleric and chairman of the International Union of Muslim Scholars. "Beaches, like any public space, must be protected from religious claims. The burkini is an anti-social political project aimed in particular at subjugating women.

Read More »

Read More »

(5.2) FX Rates, the Balance of Payments Model and Central Bank Interventions

We will apply the balance of payments model for determining FX rate movements and FX interventions by central banks.

Read More »

Read More »