Tag Archive: Currency Movement

US Dollar Slumps and China Surprises with Twice the Expected Trade Surplus

Overview: The market took US short-term rates and

the dollar lower after the CPI data, which was largely in line with

expectations. On the one hand, the odds of a quarter-point hike next month

increased slightly (73.6% vs. 71.6%) to 5.25%, but it reinforced that sense

that it is last hike and that the Fed will unwind this hike and more before the

end of the year. The year-end implied policy rate fell by about six basis points to

4.33%. The dollar...

Read More »

Read More »

US CPI is Unlikely to Tell Us Anything We Don’t Already Know

Overview: Today's highlight is the March US

CPI, and while everyone is talking about it, it is unlikely to tell us anything

we do not already know. Headline price pressures are easing but the core rate

is sticky, and despite comments from the Chicago Fed president about the need

for patience, the odds of a hike next month have crept up. Understanding the

Fed's reaction function, it seems clear that for most officials, inflation is

remains too high...

Read More »

Read More »

Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites

have returned. Equities and yields are mostly higher. The dollar is seeing

yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese

stocks, with the Nikkei advancing 1%. Several other markets in the region also

gained more than 1%, including Australia and South Korea. China's CSI was an

exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6%

through the European...

Read More »

Read More »

The Extended Holiday Makes for Subdued Price Action

Overview: The holiday continues. In the Asia Pacific

region, Hong Kong, Australia, and New Zealand, and the Philippines markets were

closed. The regional bourses advanced but China. European markets remain

closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is

off nearly three basis points to about 3.36%. The dollar is trading quietly

mostly within ranges seen before the weekend. It is slightly softer against

most of the...

Read More »

Read More »

Good Friday

Overview: Activity throughout the capital markets remains

light as most financial centers in Europe are closed for the Easter celebration.

Hong Kong, Australia, New Zealand, and Indian markets were closed as well. Still,

most of the equity markets in Asia Pacific advanced, led by South Korea's

Kospi's nearly 1.3% advance. The market responded favorably to news that

Samsung would cut its production of memory chips and shrugged off its smaller

than...

Read More »

Read More »

Fragile Calm Casts a Pall over the Capital Markets

Overview: There is a fragile calm in the capital

markets today ahead of the long holiday weekend for many. The poor US economic

data yesterday and third consecutive decline in the KBW bank index weighed on

risk sentiment. Most of the large bourses in the Asia Pacific region fell, with

Hong Kong and India notable exceptions. In Japan, the Topix bank index fell

1.1% after a 1.9% decline yesterday and is now lower on the week. Europe's

Stoxx 600 is...

Read More »

Read More »

Pressure Returns to Bank Shares and seems to Help Propel Gold Higher

Overview: There are three themes today. First, the

sharp decline in US rates seen yesterday (-14 bp on the two-year yield) on the

back disappointing economic data seemed a bit exaggerated and the two-year

yield has bounced back to almost 3.90% from around 3.81%. This appears to be

helping the dollar consolidate today. Second, bank shares are coming under

renewed pressure. The US KBW bank index fell almost 2% yesterday after a 0.5%

decline on...

Read More »

Read More »

RBA Holds Fire, Sterling Reaches Best Level since last June, and the Dollar Struggles to Find Much Traction

Overview: The jump in oil prices is the newest shock and the May

WTI contract is holding above $80 a barrel as it consolidates yesterday's

surge. A week ago, it settled near $73.20. Australian and New Zealand bond

yields moved lower, partly in catch-up and partly after the RBA stood pat. South

Korean bonds also rallied on the back of softer inflation (4.2% vs. 4.8%). But

European and US benchmark yields is 2-4 bp higher. The large equity markets...

Read More »

Read More »

OPEC+ Surprises while Manufacturing Remains Challenged

Overview: News of OPEC+ unexpected output cuts saw May WTI gap

sharply higher and helped lift bond yields. May WTI settled near three-week

highs before the weekend near $75.65 and opened today near $80. It reached

almost $81.70 before stabilizing and is straddling the $80 area before the

North American session. The high for the year was set in the second half of

January around $83. Benchmark 10-year yields are up 2-5 bp points. The 10-year

US...

Read More »

Read More »

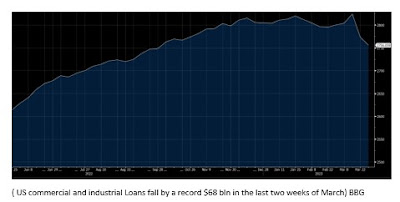

March: Going Out like A Lamb after Wrestling with a Lion

Overview: The banking stress that roiled the markets

this month has eased. However, the emergency lending by the Federal Reserve,

vias the discount window and new Bank Term Funding Program hardly slowed in the

past week ($152.6 bln vs. $163.9 bln). Money markets took in more funds. Almost

$305 bln has flowed to them over the past three weeks. The US KBW bank index is

up 3.75% this week coming into day (after pulling back 1.2% yesterday). Europe's...

Read More »

Read More »

Dollar Soft but Stretched

Overview: While bank stress seems to continue

to ease, the dollar languishes against most of the major currencies. The

Japanese yen is the notable exception. It is off about 1.5% this week. The

Dollar Index has given back the gains scored at the end of last week but

remains inside the range set last Thursday and Friday (~101.90-102.35). Perhaps

the participants are waiting for Friday. In addition to month-, quarter, and

fiscal-year ends, it is...

Read More »

Read More »

Financial Stress Continues to Recede

Overview: Financial stress continues to recede. The

Topix bank index is up for the second consecutive session and the Stoxx 600

bank index is recovering for the third session. The AT1 ETF is trying to snap a

four-day decline. The KBW US bank index rose for the third consecutive session

yesterday. More broadly equity markets are rallying. The advance in the Asia

Pacific was led by tech companies following Alibaba's re-organization

announcement. The...

Read More »

Read More »

Firmer Rates and Higher Bank Stocks Give the Greenback Little Help

Overview: Financial strains eased yesterday, and

short-term yields jumped. The two-year US yield jumped 25 bp to pierce 4%. Yet,

the dollar fell against most of the major currencies yesterday and is mostly

softer today. Banking stress is ebbing. The Topix bank index snapped a

three-day decline and jumped nearly 2% today to recoup the lion's share of its

three-day decline. The Stoxx 600 index of EMU banks is extending yesterday's

1,7% advance. The...

Read More »

Read More »

Calmer Markets to Start the New Week

Overview: There did not appear to be any negative

surprises over the weekend, and this is helping calm investors' nerves at the

start of the new week. Deutsche Bank shares have recovered most of the

pre-weekend loss in the German market, and Stoxx bank index is posting a gain

for the first time in four sessions. The AT1 ETF is slightly softer. In Japan,

the Topix bank index slipped around 0.5%, its fourth decline in the past five

sessions. Asia...

Read More »

Read More »

The Dollar Jumps Back

Overview: The pendulum of market expectations has

swung dramatically and now looks for 100 bp cut in the Fed funds target this

year. That seems extreme. At the same time, the dollar's downside momentum has

stalled, suggesting that the dollar may recover some of the ground lost

recently as the interest rate leg was knocked out from beneath it. The euro

twice in the past two days pushed through $1.09 only to be turned away.

Similarly, sterling pushed...

Read More »

Read More »

Market Hears Dovish Fed Hike and Sells Dollars

Overview: The dollar remains under pressure

following the Federal Reserve's rate hike. The market thinks it heard that the

Fed was done hiking, even though Fed Chair Powell held out the possibility that

"some additional firming may be necessary." The Norwegian krone

is the strongest of the G10 currencies today, up more than 1%, spurred by a 25

bp hike and a commitment to do more. The Dollar Index briefly traded below

102.00 for the...

Read More »

Read More »

Tough Fed Decisions

Overview: The market has concluded that the Fed will

hike rates today. The US two-year yield has risen from about 3.63% at Monday's

lows almost 4.20% yesterday. It needs to rise to 4.35% to recover half of its

decline since March 8 but has come back softer today. Meanwhile, the banking

crisis continues to ease, and Europe's Stoxx 600 bank index is up 1.5%, its

third consecutive advance. The US KBW bank index rallied almost 5% yesterday. Still,...

Read More »

Read More »

Banking Stress Eases

Overview: The banking crisis is ebbing. The Bank of

England and European Central Bank assured investors that the AT1 bonds are

senior to equity claims, and Switzerland is a unique case. Bank share indices

in the Europe and the US rose yesterday, even though the shares of First

Republic Bank fell by 47% yesterday. The $123-stock at the end of last month

reached almost $11 yesterday. It is trading around $14.75 pre-market. Global equities are...

Read More »

Read More »

Terms of UBS Acquisition Wipes out Additional Tier 1 Capital and Spurs Fresh Concerns

Overview: UBS takeover of Credit Suisse, the sale of

Signature bank assets, and the daily dollar swaps could have helped stabilize

the budding banking crisis. However, the wipeout of the additional tier 1

capital cushion (16 bln Swiss francs) at Credit Suisse has raised concern about

the vulnerability of other such assets, which post-GFC is a $275 bln market in

Europe. Asia Pacific equities was a sea of red, led by a 2.65% drop in the Hang

Seng...

Read More »

Read More »

Fragile Calm to End the Volatile Week even with the Quadruple Expirations

Overview: The support for First Republic Bank shown

by a consortium of US banks by shifting $30 bln of deposits is helping break

the financial anxiety that has gripped the market for more than a week. The

liquidity provisions for Credit Suisse by the Swiss National Bank also are

contributing to improved sentiment. The Fed's balance sheet expanded sharply

last week as the bridge banks were extended credit to help the unwind of SVB

and Signature...

Read More »

Read More »