Tag Archive: currencies

As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens.

Read More »

Read More »

How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses.

Read More »

Read More »

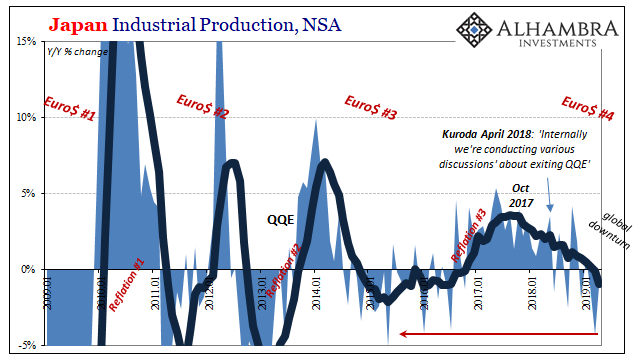

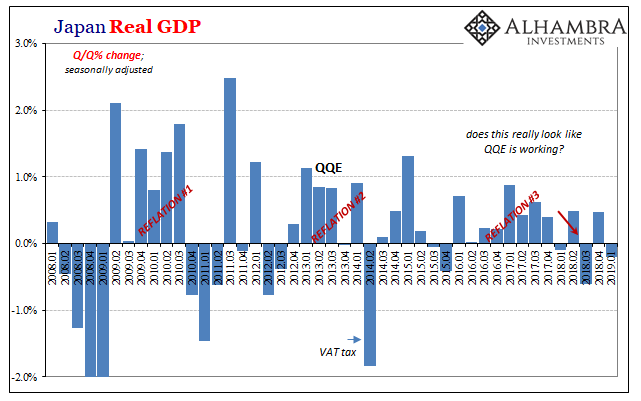

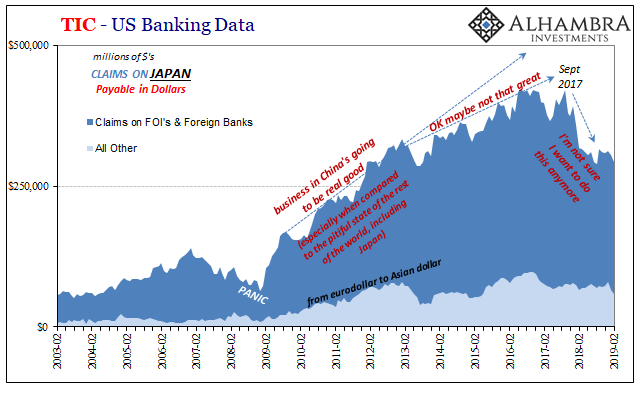

Japan’s Bellwether On Nasty #4

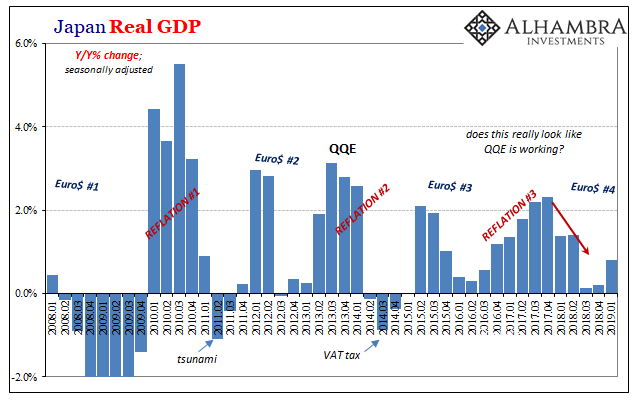

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best.

Read More »

Read More »

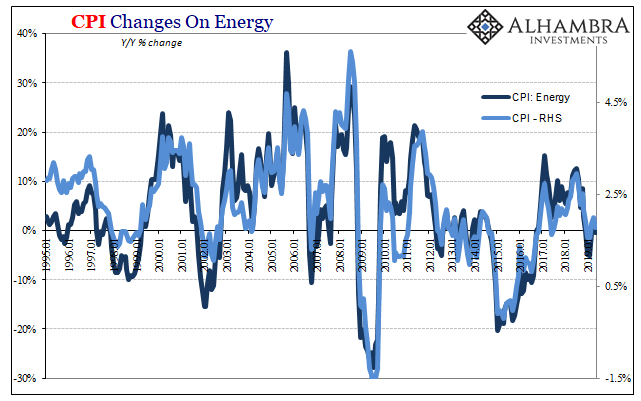

When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

Read More »

Read More »

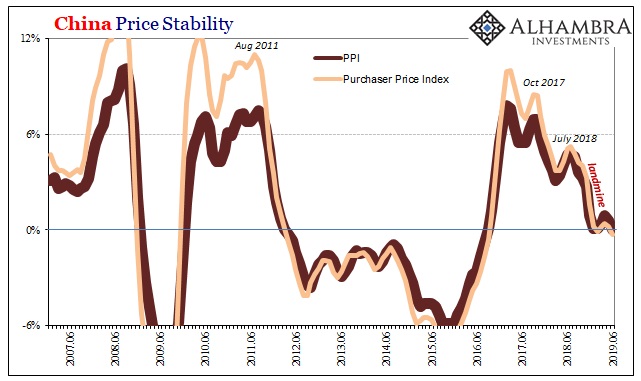

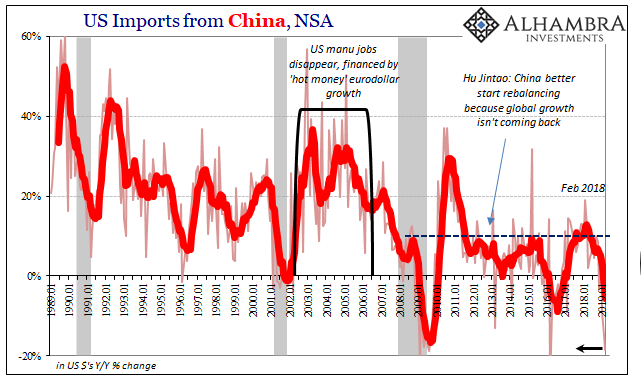

Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016.

Read More »

Read More »

All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

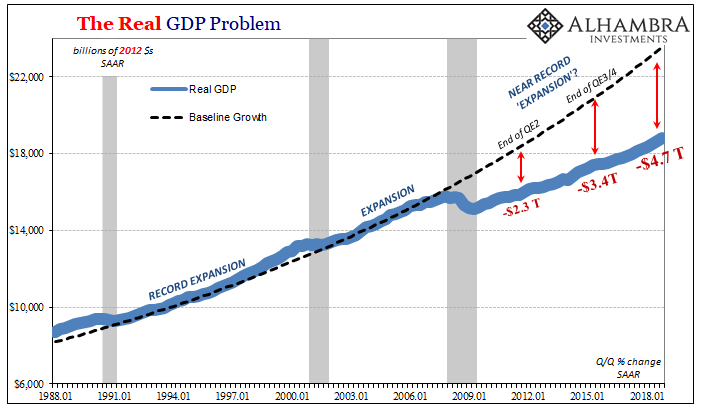

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied.

Read More »

Read More »

Janus Powell

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.”

Read More »

Read More »

What Kind Of Risks/Mess Are We Looking At?

The fact that the mainstream isn’t taking this all very seriously isn’t anything new. But how serious are things really? That’s pretty much the only question anyone should be asking. What are the curves telling us about what’s now just over the horizon?

Read More »

Read More »

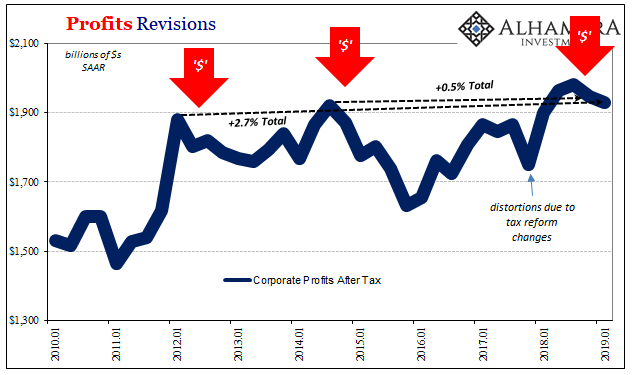

More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message.

Read More »

Read More »

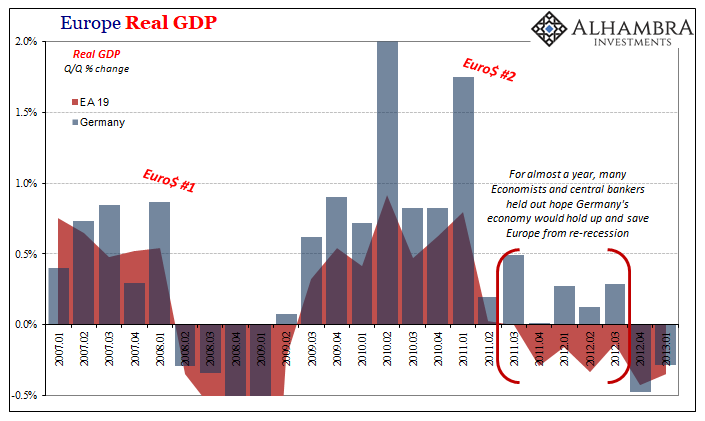

Europe Comes Apart, And That’s Before #4

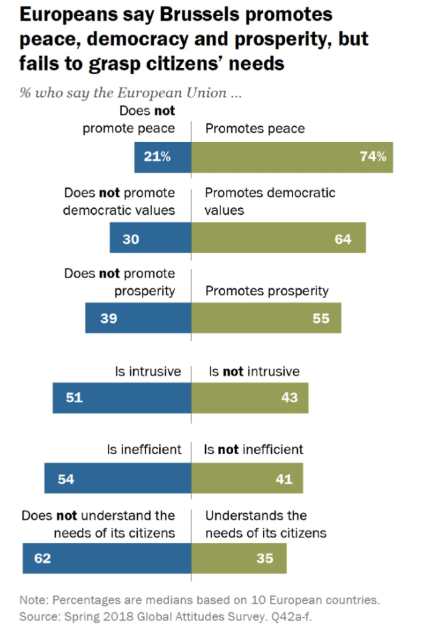

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey.

Read More »

Read More »

The Transitory Story, I Repeat, The Transitory Story

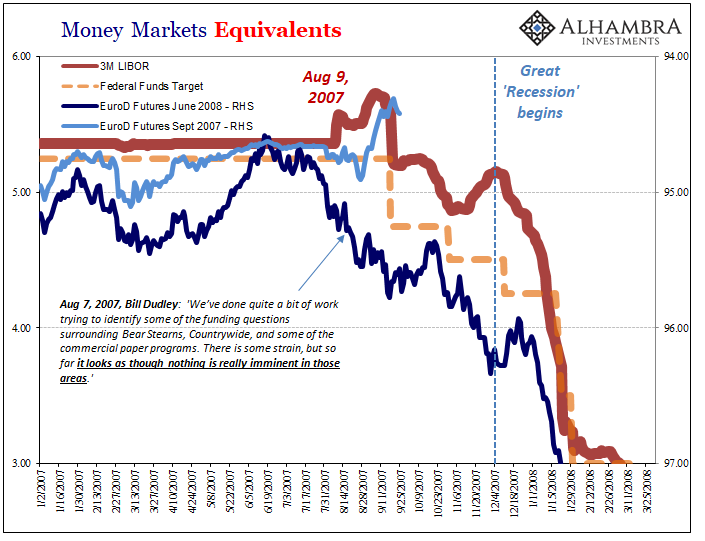

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand.

Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to discuss their lying eyes....

Read More »

Read More »

Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

Read More »

Read More »

Japan’s Surprise Positive Is A Huge Minus

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five.

Read More »

Read More »

Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

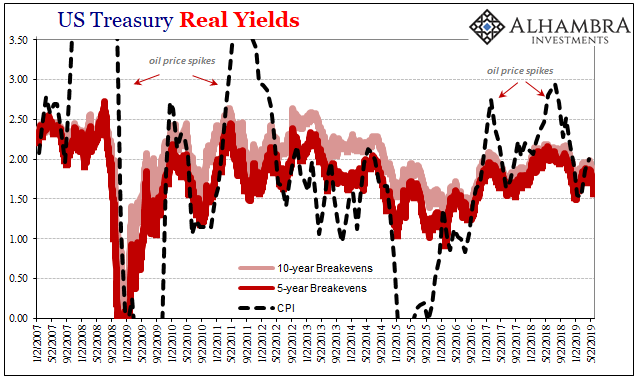

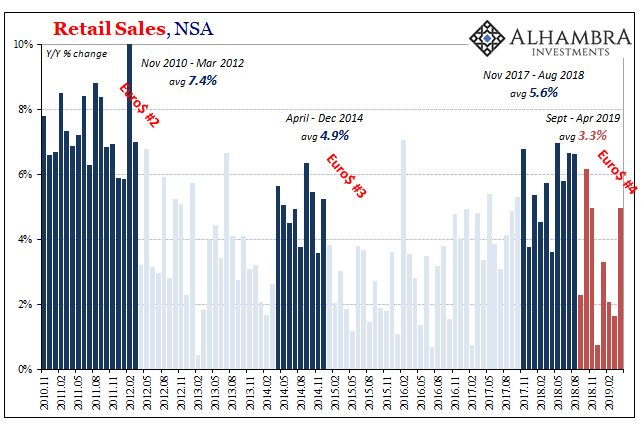

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough.

Read More »

Read More »

Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so straightforward.

Read More »

Read More »

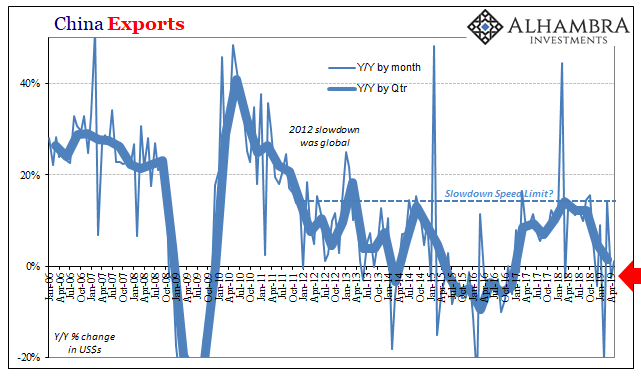

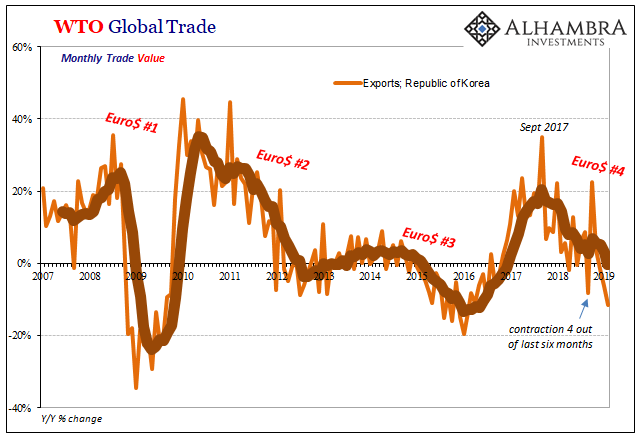

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

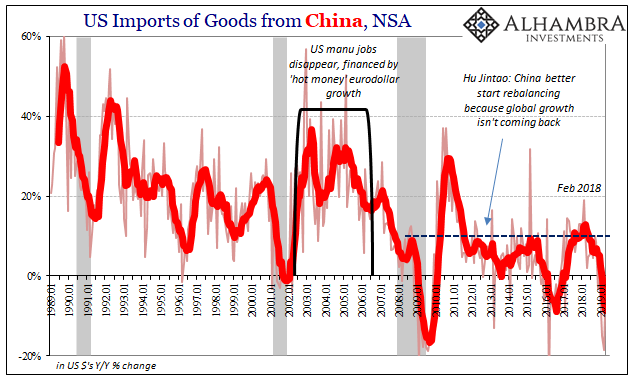

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

What’s Germany’s GDP Without Factories

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of crisis and economic weakness...

Read More »

Read More »

What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective.

Read More »

Read More »

Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death.

Read More »

Read More »