Tag Archive: Claudio Grass

Private property rights under siege – Part II

An astonishing acceleration Even though the downhill trajectory we saw over the last decades in terms of property rights was bad enough, nothing could have ever prepared us for what the covid crisis would bring.

Read More »

Read More »

Unheeded warnings: Václav Klaus at the Marmara Forum

This not the first time that Václav Klaus’ astute observations and experience-based predictions turn out to be shockingly accurate years later, and I’m pretty confident it will not be the last. Even before the examples that follow and that he clearly laid out in his address at the Marmara Forum, the former President of the Czech Republic has repeatedly proven to be quite prophetic in his assessment of the future.

Read More »

Read More »

A crack-up boom in the making

The great Ludwig von Mises first described the concept of a crack-up boom as part of the Austrian business cycle theory, based on real life events that to an unsuspecting bystander might have appeared unconnected, or perhaps even quite bizarre and counterintuitive. Indeed, such a bystander might think the same of today’s economy and would likely have trouble making sense of the picture painted by stock markets, by our monetary and fiscal policies...

Read More »

Read More »

Inflation outlook – A battle lost before it started

After months of consumer price increases and after countless working households found themselves in dire financial straits struggling to make ends meet, in the late May, President Biden finally revealed his grand plan to fight inflation in an op-ed for the Wall Street Journal. The much-anticipated response to the cost of living crisis that has been ravaging the nation sadly did not contain the silver bullet that so many Americans were hoping for....

Read More »

Read More »

“Gold is an insurance policy against the stupidity of governments”

Interview with Bob Moriarty

As I mentioned many times before, trying to accurately forecast economic events or to “time the market” is a fool’s errand. To the chagrin of all central planners, mainstream analysts and all kinds of “experts”, the economy is a vastly complex, living organism, with too many parameters and too many moving parts to make it predictable or tamable.

That being said, understanding monetary and geopolitical history...

Read More »

Read More »

“Real innovation and progress happen beyond Big Tech” – Part II

Interview with Bernd Rodler – Part II of II

Claudio Grass (CG): A lot people still consider it safer to go with a huge, established corporation, thinking these solutions would be more reliable and robust, especially for business applications. What is your take on this view?

Bernd Rodler (BR): This is a perfectly understandable view, at least from the standpoint of a manager applying the „cover your a…“ strategy. Who can blame him if the SAP...

Read More »

Read More »

“Real innovation and progress happen beyond Big Tech”

Interview with Bernd Rodler – Part I of II

Those who know me and who have read my writings before will be very well aware of how important the topic of decentralization is to me and to my way of looking at the world, at our societies and our economies. I truly believe that there is no future to be had, at least not one that respects human dignity, should we continue down this same path of top-down control, mindless conformity and blind obedience...

Read More »

Read More »

Gold: A use case for the modern era

Part II of II

The big picture here is clear and it is essential to understand that it represents a very significant paradigm shift. Whether it is online or offline, whether it is through a mobile app, an exchange or even through physical contracts, ownership titles to gold holdings keep changing hands. And thus, no matter the vehicle that is used to facilitate these transactions, the fact of the matter is that it acts as a gold-backed...

Read More »

Read More »

Gold: A use case for the modern era

Part I of II

For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or...

Read More »

Read More »

Ukraine conflict: A dispassionate analysis

I realize that I shouldn’t be surprised at the way the crisis in Ukraine has divided our societies or at the blind fanaticism the conversations around it have provoked. After all, virtually every other development of consequence has tuned out exactly the same. From covid to the economy and from freedom of speech to science itself, rational, respectful and productive debates are nowhere to be found.

Read More »

Read More »

Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that...

Read More »

Read More »

The forgotten art of Debate

One quick glance at different news headlines or just 5’ switching between TV networks suffice to convince even the most naive news consumer that there is something seriously wrong with the way public discourse was (d)evolved in our societies over the last years. Of course, journalism was never entirely devoid of bias, not even in its “golden age”.

Read More »

Read More »

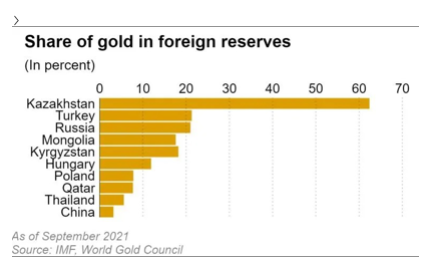

Central Banks’ record gold stockpiling

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly...

Read More »

Read More »

Lessons from 2021: The rational way out

As we are all preparing to bid farewell to 2021, there is a general feeling that this year, much like its predecessor, will not be missed. To my mind, however, it is clear that even though the past 12 months didn’t really teach us anything new, they did help cement the lessons of 2020 and spread important ideas to people who might otherwise have never come to question anything about the status quo.

Read More »

Read More »

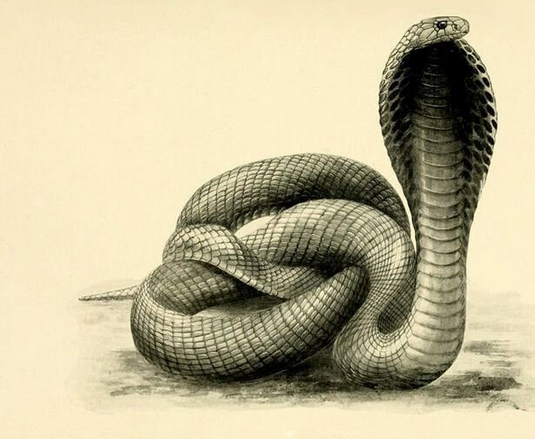

Government interventions and the Cobra effect – Part II

Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime.

Read More »

Read More »

Government interventions and the Cobra effect – Part I

Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for.

Read More »

Read More »

The battle for control over the future of money

It’s no secret that governments and central planners of all stripes have long detested the rise of private money and independent digital currencies. They have tried to stifle the burgeoning crypto industry from the moment it attracted mainstream attention. For years, they have continued to add regulatory hurdles and threaten crypto holders and investors, as well as companies in this space, with unreasonable tax burdens and unrealistic disclosure...

Read More »

Read More »

Inflation risk takes center stage – Part II of II

A lot of people might be aware of historical cases of hyperinflation, like that of Hungary and the Weimar Republic, or even contemporary ones, like that of Venezuela. And yet, these are taught or reported like extreme cases, very far removed from the daily experience of most modern Western citizens.

Read More »

Read More »