Tag Archive: Claudio Grass

Predictions vs. Convictions

Share this article

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can...

Read More »

Read More »

Swissgrams: the natural progression of the Krugerrand in the digital age

Having worked in the precious metals industry for decades, I have had countless opportunities to have very honest and very enlightening conversations with numerous investors and partners alike. For many years, I’ve been discussing the challenges, the hurdles and the problems they’ve encountered. The details of each story I’ve heard might be as unique as the person who shared it with me, however, most of these accounts have a common denominator....

Read More »

Read More »

Swissgrams: the natural progression of the Krugerrand in the digital age

Share this article

Having worked in the precious metals industry for decades, I have had countless opportunities to have very honest and very enlightening conversations with numerous investors and partners alike. For many years, I’ve been discussing the challenges, the hurdles and the problems they’ve encountered. The details of each story I’ve heard might be as unique as the person who shared it with me, however, most of these accounts have a...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

Share this article

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war fronts and the images...

Read More »

Read More »

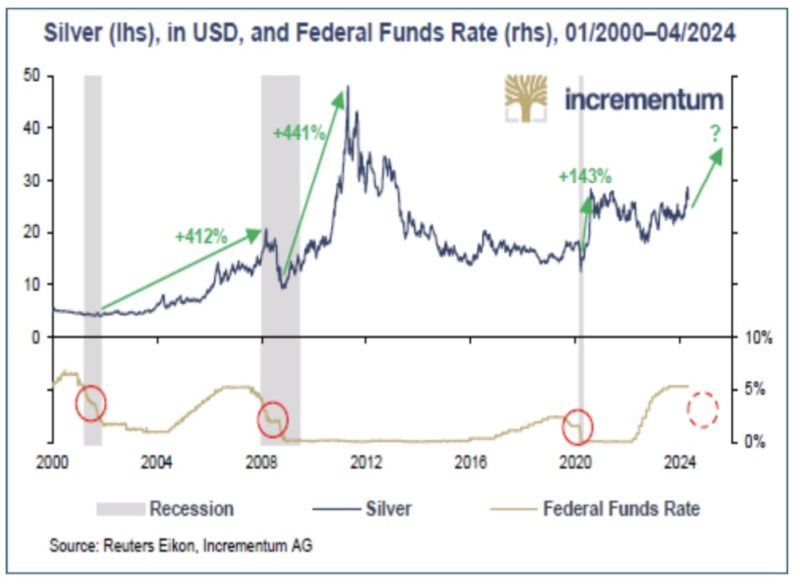

“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS

Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be healed. Is all...

Read More »

Read More »

“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Share this article

DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS

Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be...

Read More »

Read More »

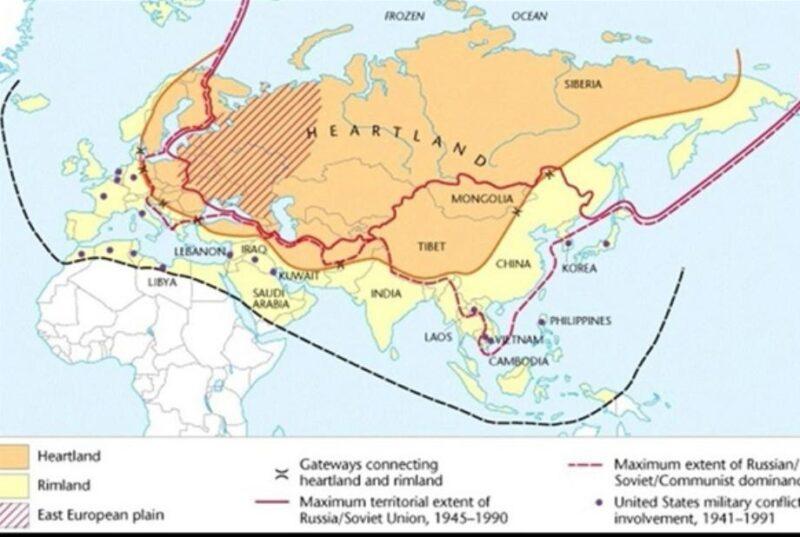

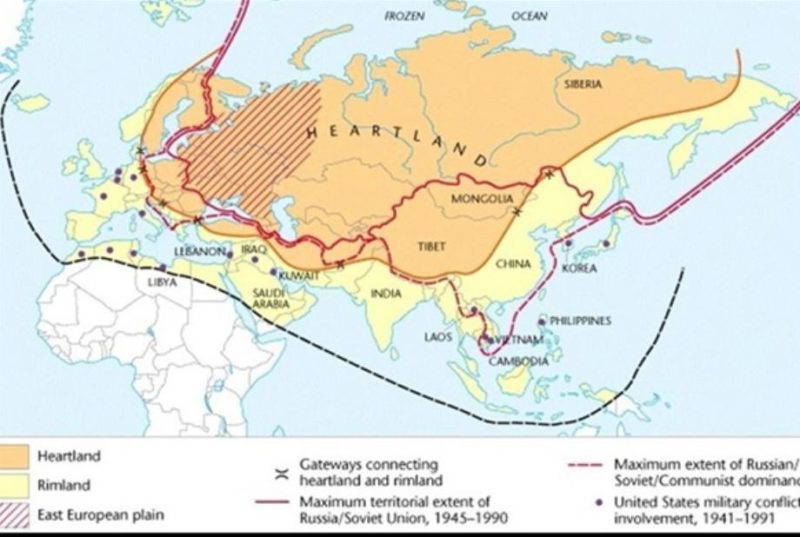

The Heartland theory: More relevant than ever?

Sir Halford Mackinder’s famous Heartland Theory was first formulated in the early 20th century, but it holds renewed relevance and importance today, especially when analyzed though a critical lens of the current geopolitical system, one that emphasizes individual freedom, limited government intervention, and skepticism of centralized power. Mackinder’s theory posits that control over the “Heartland” — roughly the region of Eastern Europe and...

Read More »

Read More »

The Heartland theory: More relevant than ever?

Share this article

Sir Halford Mackinder’s famous Heartland Theory was first formulated in the early 20th century, but it holds renewed relevance and importance today, especially when analyzed though a critical lens of the current geopolitical system, one that emphasizes individual freedom, limited government intervention, and skepticism of centralized power. Mackinder’s theory posits that control over the “Heartland” — roughly the region of...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Share this article

Part II of II

Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before.

And it’s not only because the central bankers have overused these “weapons” and have by now...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Part II of II

Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before.

And it’s not only because the central bankers have overused these “weapons” and have by now exhausted all their...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Share this article

Part I of II

There is no question that gold owners have been finally and spectacularly vindicated over the last months: the “barbarous relic”, the “worthless shiny rock”, as many have called the yellow metal, once again proved its value as a true safe haven. In the face of inflation, intense geopolitical turmoil and widespread uncertainty, investors fled to safety “en masse”, as they consistently, repeatedly and predictably...

Read More »

Read More »

The permacrisis strategy: the mortal dangers of our “new normal”

Share this article

Over the last years, we have encountered an abundance of alarmist and hysterical “warnings” and admonitions, foretelling the impending doom of the world as we know it. Market corrections have served as an excuse for scaremongers to cultivate panic over a total systemic collapse. Surprising political shifts, like unexpected electoral results, have been coopted to support extreme scenarios, predicting the fall of the current world...

Read More »

Read More »

The illusion of choice: Democracy as the greatest show on earth

Share this article

As individual citizens, as voters and taxpayers we have been so deeply, so consistently, so relentlessly indoctrinated, so blindly radicalized, and so thoroughly and easily subjugated and ideologically manipulated that, by now, it has become terribly challenging for any of us to even entertain any viewpoint or any opinion that is opposed to our own. It is next to impossible for a single individual to find the strength of...

Read More »

Read More »

Vortrag: Es gibt nichts Neues unter der Sonne

Die Verwirrung ist gross, was bringt die Zukunft? Der Versuch einer Einordnung aus Sicht eines freien und eigenständig denkenden Schweizers.

Read More »

Read More »

The road to Serfdom: are we on the final stretch?

Share this article

An attempt at an analysis from the perspective of a free Swiss individual

What you’re about to read is the abridged and condensed English translation of a speech I gave in Munich in November 2023. You can find the full speech, in German with English subtitles, here.

It tackles the very difficult, but also very crucial, subject of individual freedom, or what is left of it these days, and it seeks to offer a constructive...

Read More »

Read More »

Economic freedom: Politics, of course, by its nature is always the pursuit of the Left

Share this article

Article II of II, by Claudio Grass

Collectivism is extremely versatile and very easy for political animals to “sell” to the public and to weaponize. Politics, of course, by its nature is always the pursuit of the Left, if we are to follow strict definitions. It seeks to influence and coerce others and it abhors individual liberties and self-determination. What we know as far-right is national socialism and the rest is...

Read More »

Read More »

Economic Freedom: The Cornerstone of Western Civilization

Share this article

Part I of II, by Claudio Grass

Western civilization – with all its scientific and technological progress, artistic prowess, philosophical and sociopolitical evolution, moral values, ethical principles and rich culture – took millennia to reach its famed “Enlightenment” point. It has been a rollercoaster, violently swinging from highs to lows and from darkness to light, from autocracy, tyranny and despotism to humanism and...

Read More »

Read More »

Social justice and other evils

Share this article

The post-covid years have brought about an unquestionable acceleration and intensification in the attacks against the Western value system, against basic Enlightenment ideas and principles and against the pillars of the very civilization that gave us all the liberties, the rule of law and the justice system that we enjoy today (or used to enjoy until fairly recently at least).

All-important and self-evident ideas like the...

Read More »

Read More »