Tag Archive: China

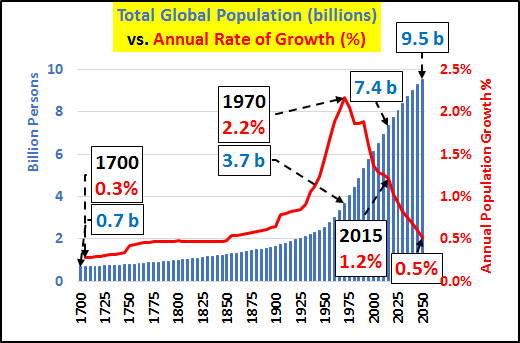

Destroying The “Wind & Solar Will Save Us” Delusion

Submitted by Gail Tverberg via Our Finite World blog, The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short … Continue reading »

Read More »

Read More »

Policy Makers – Like Generals – Are Busy Fighting The Last War

The Maginot Line formed France's main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success...as the Germans never seriously attempted to attack it's interconnected series of underground fortresses. But the days of static warfare...

Read More »

Read More »

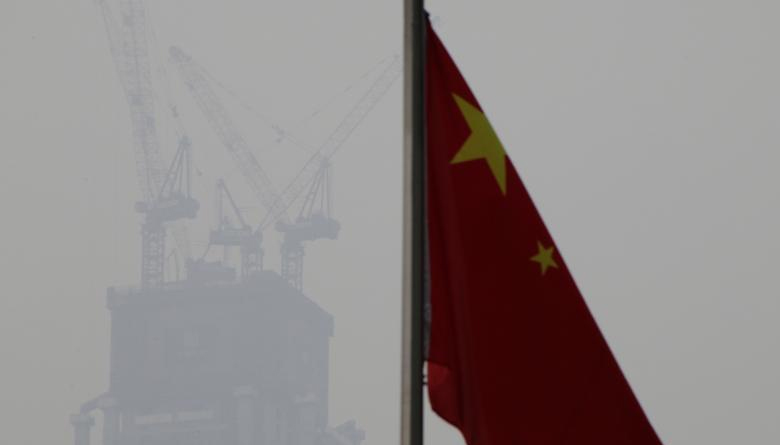

China Says It Is Ready To Assume “World Leadership”, Slams Western Democracy As “Flawed”

Over the weekend China used the Trump inauguration to warn about the perils of democracy, touting the relative stability of the Communist system as President Xi Jinping heads toward a twice-a-decade reshuffle of senior leadership posts.

Read More »

Read More »

These Are The 3 Main Issues For Europe In 2017

What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake.

Read More »

Read More »

Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum.

Read More »

Read More »

Davos: In Defense Of Populism

DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism, Pepper Spray Davos”

Read More »

Read More »

China Capital Flight: When $4 trillion is Too Much and $3 trillion is not Enough

All of China's capital outflows are not capital flight fleeing. Capital controls limiting outflows can be tightened. Paying down dollar loans, a major source of capital outflows, is not an infinite process.

Read More »

Read More »

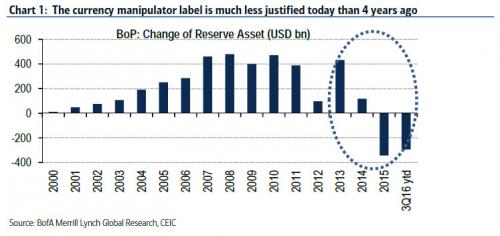

Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump's violating the "One China" policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office.

Read More »

Read More »

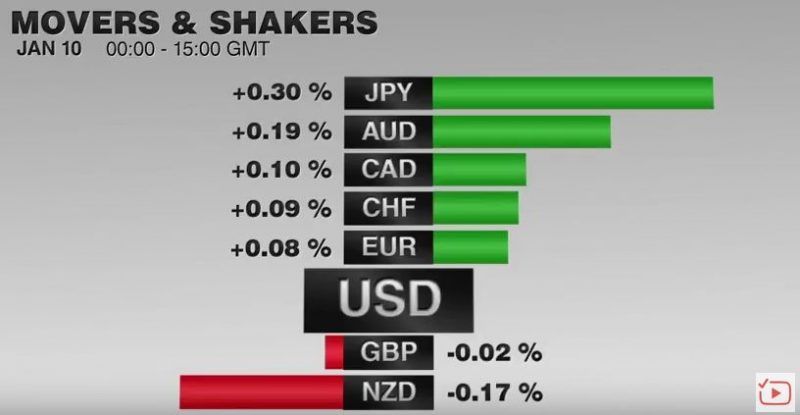

FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

After strong moves to start the year, the capital markets continue to consolidate. Many observers are suggesting a fundamental narrative behind the loss of momentum, but in discussions with clients and other market participants, it seems as if the main source of caution is coming from an understanding of market positioning rather than a reevaluation of the macro drivers.

Read More »

Read More »

FX Weekly Preview: Macro Forces Underpin Dollar, Equities and Yields

Odds of a March Fed hike edged up last week, and Q4 GDP figures were revised higher. Many continue to expect the new US Administration to pursue pro-growth tax reform, deregulation and infrastructure spending. Although many other high income countries are growing, near trend divergence of monetary policy continues.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

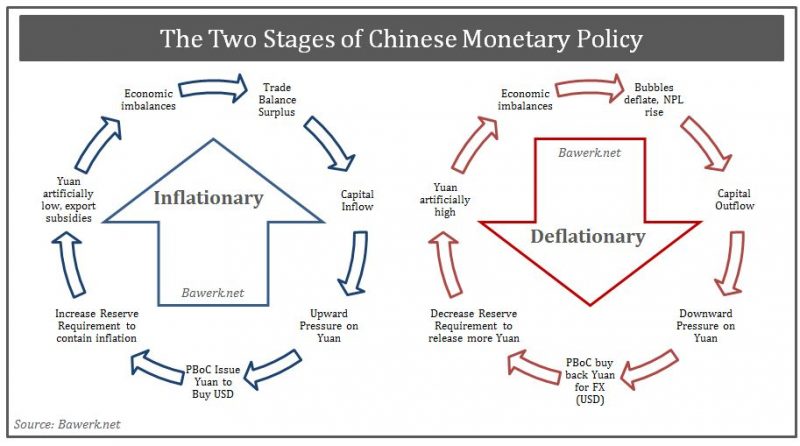

Chinese Philosopher Kings, Losing their Yuan FX Religion?

It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching up to reality.

Read More »

Read More »

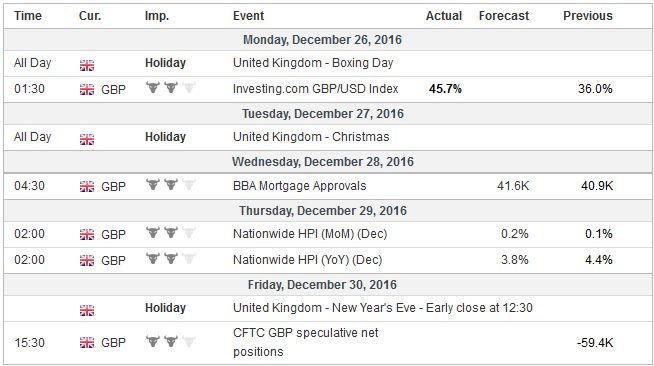

FX Daily, December 30: Dollar Slips into Year End

In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions.

Read More »

Read More »

FX Outlook 2017: Politics to Eclipse Economics

Investors are familiar with a broad set of macroeconomic variables that often drive asset prices. Many are familiar with corporate balance sheets, price-earning ratios, free cash flow, Q-ratio, and the like.

Read More »

Read More »