Tag Archive: Canada Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, May 18: EUR/CHF Continues the Collapse

The US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765.

Read More »

Read More »

FX Daily, April 20: The Greenback is Alive

The US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just below 300 bp. It is the fourth consecutive advancing session for the Dollar Index, which is near a two-week high.

Read More »

Read More »

FX Daily, September 22: Markets Limp into the Weekend

The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships.

Read More »

Read More »

FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week's gain in half. The Dow Jones Stoxx did not completely escape the US carnage yesterday, but losses are accelerating today, with a nearly 1% decline following a 0.6% decline yesterday.

Read More »

Read More »

FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

The euro has depreciated by 0.13 to 1.1043 CHF. ECB President Draghi did not argue forcefully enough at yesterday's press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year's high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near.

Read More »

Read More »

FX Daily, June 23: Dollar Pares Gains Ahead of the Weekend

The US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone.

Read More »

Read More »

FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors' reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

Read More »

Read More »

FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

The US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump's economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation.

Read More »

Read More »

FX Daily, February 24: Anxiety? What Anxiety?

The US dollar is finishing the week on a mixed note in choppy activity in narrow ranges. It is an apt way to finish this week, which has been largely directionless as investors wait for fresh incentives, and are especially looking toward Trump's speech to a joint session of Congress next week.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

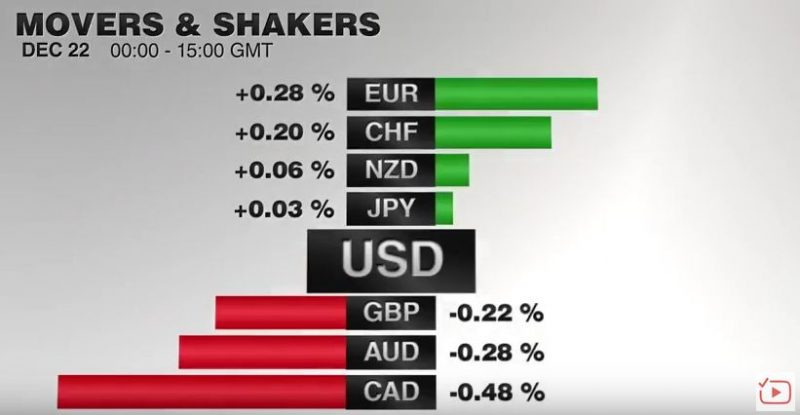

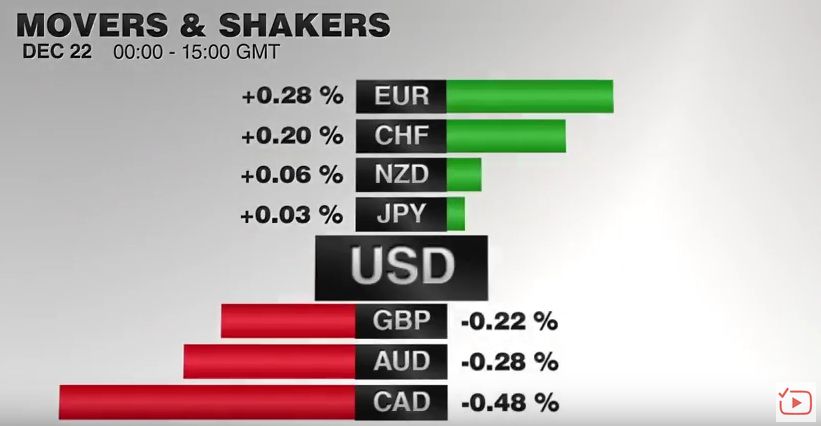

FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF.

Read More »

Read More »

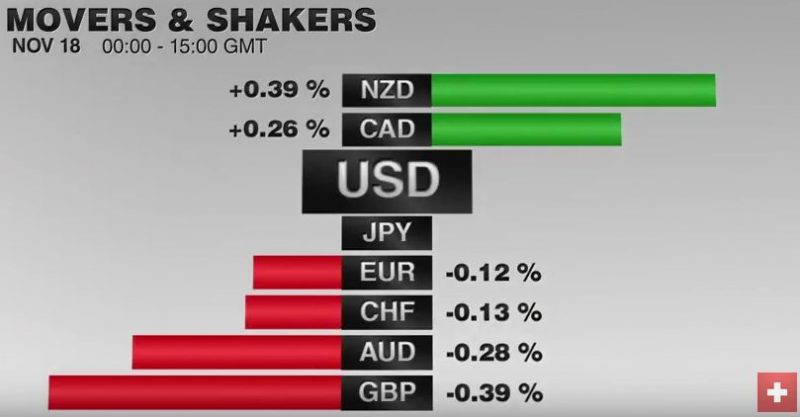

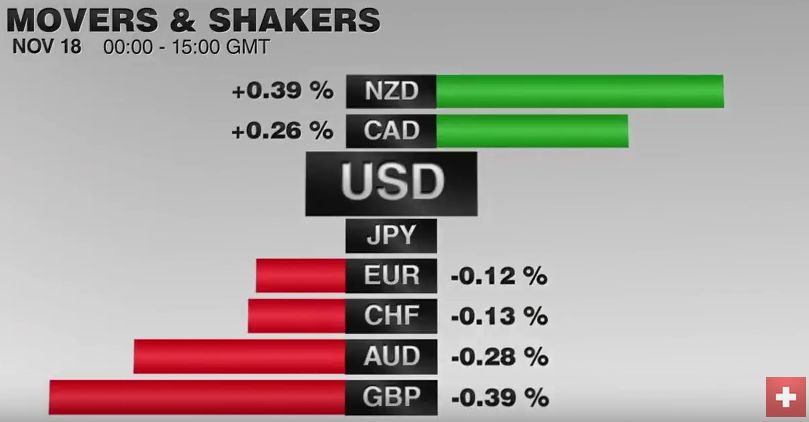

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

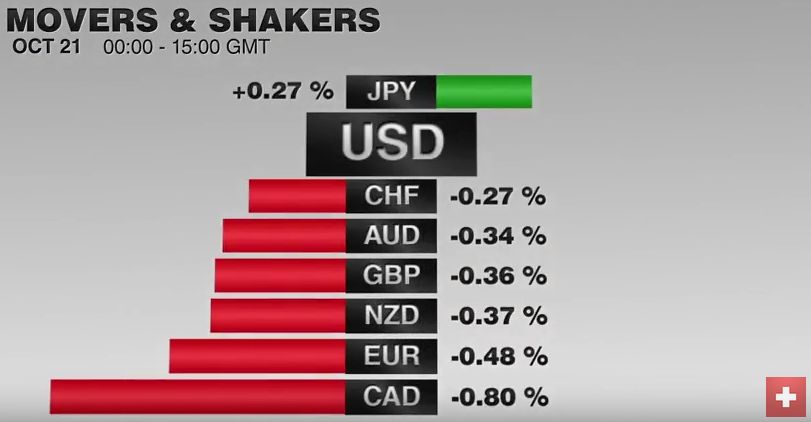

FX Daily, October 21: Greenback Ending Week on Firm Note

The US dollar is firm especially against the European complex and emerging market currencies. The yen continues to be resilient, and exporters are thought be capping the dollar above JPY104. The dollar is lower against the yen for the fourth consecutive session and set to snap a three-week advancing streak.

Read More »

Read More »

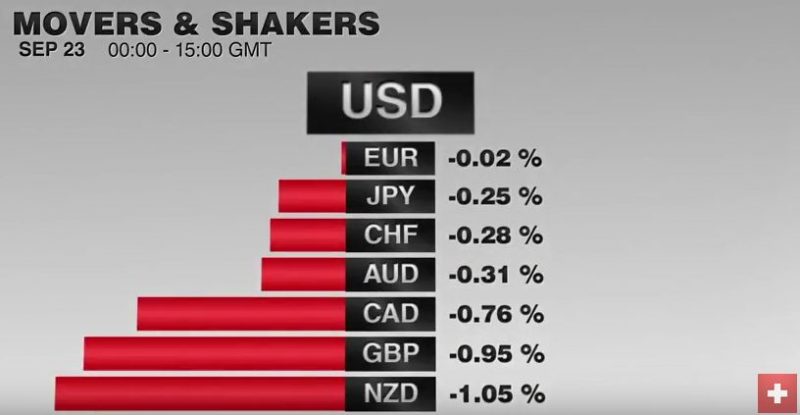

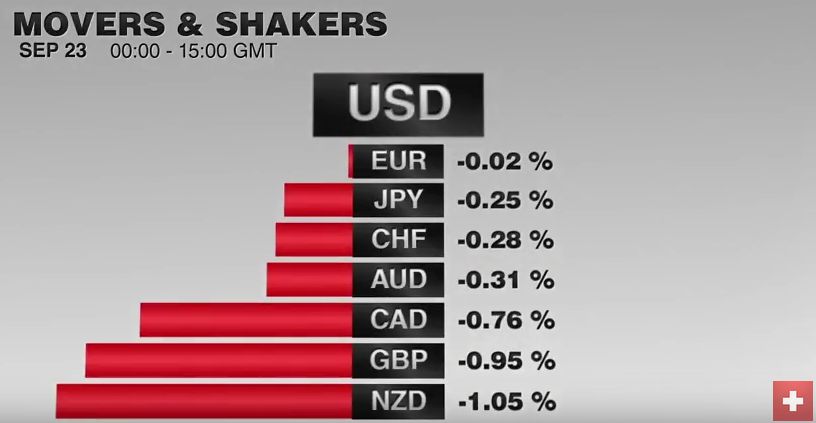

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

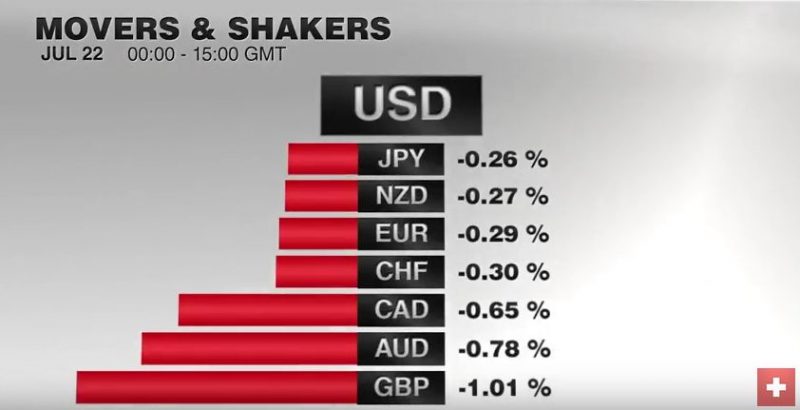

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »