Tag Archive: Bonds

Investor Dilemma: Pavlov Rings The Bell – Draft

Classical conditioning teaches us a valuable lesson regarding the current investor dilemma. Pavlov's research discovered a basic psychological rule: when a neutral stimulus is repeatedly paired with a reward‑stimulus, eventually it will trigger the same response even when the reward is absent. The famed experiment by Ivan Pavlov illustrated that dogs would salivate at the …

Read More »

Read More »

Weekly Market Pulse: An Energetic Market

Quite the turnaround from February–March. Back then, tariff chaos sank the dollar 10% in March, volatility spiked, correlations went quickly toward +1, markets cracked, and only currency havens like the euro, yen, and gold found love.

Read More »

Read More »

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

Weekly Market Pulse: Big Rate Cuts? Not Right Now

“I think we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September”. “If you look at any model” it suggests that “we should probably be 150, 175 basis points lower.”

Treasury Secretary Scott Bessent in a Bloomberg interview, 8/13/25

President Trump and others in his administration have been pushing for lower interest rates for months – one wonders what they’re worried about – and are doing and saying...

Read More »

Read More »

Weekly Market Pulse: The Turkey Leg

Note: I wrote most of this commentary prior to the US strike on Iran and I decided to go ahead with it anyway. I don’t know any more than you do about what is going on in the Middle East and trying to predict what will happen in the coming days and weeks is a fool’s errand. We have a strategic allocation to commodities in our portfolios exactly because we can’t predict things like this.

Read More »

Read More »

Weekly Market Pulse: No Free Lunches

Moody’s Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable New York, May 16, 2025 — Moody’s Ratings (Moody’s) has downgraded the Government of United States of America’s (US) long-term issuer and senior unsecured ratings to Aa1 from Aaa and changed the outlook to stable from negative.

Read More »

Read More »

Weekly Market Pulse: On The Road Again

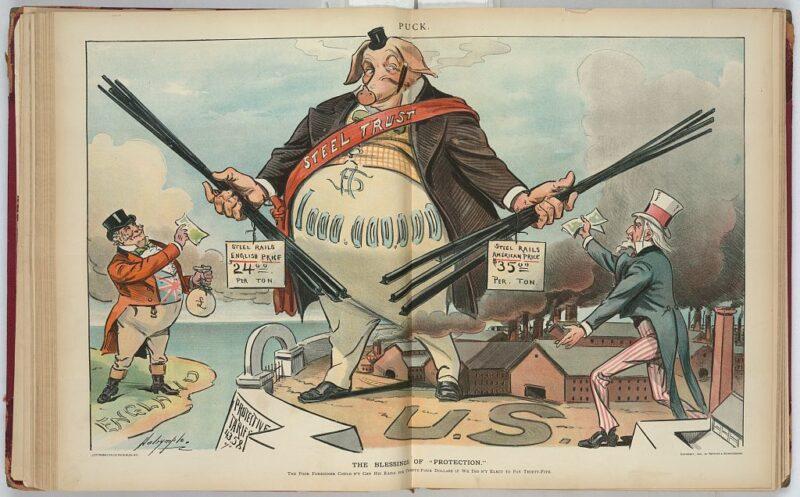

“Our freedom of choice in a competitive society rests on the fact that, if one person refuses to satisfy our wishes, we can turn to another. But if we face a monopolist we are at his absolute mercy.

Read More »

Read More »

Weekly Market Pulse: Peak America?

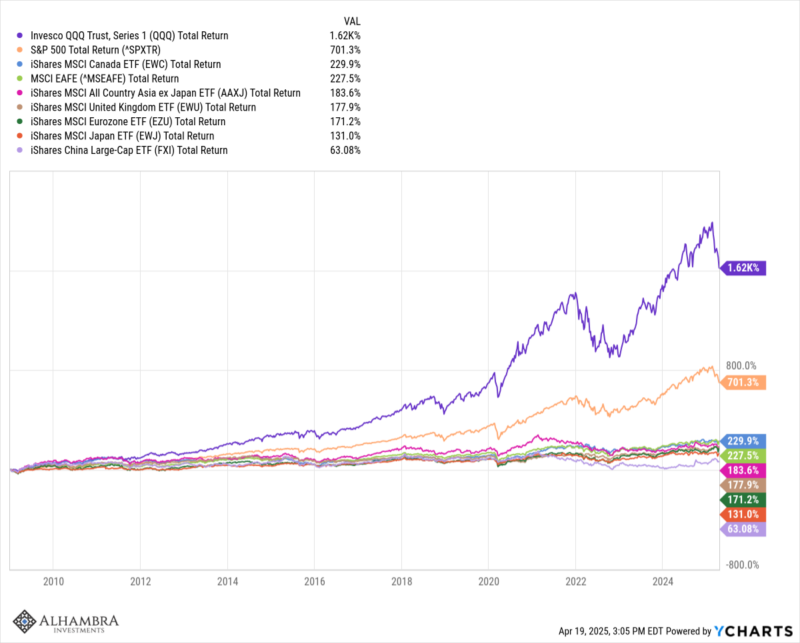

The US economy has been the envy of the world for a long time, especially after the 2008 financial crisis and the COVID pandemic. Our economy has grown faster than just about any other in the developed world thanks in large part to the extraordinary performance of our technology sector. Our markets for debt and equity are the largest and most liquid on the planet. The US economy represents roughly 25% of global GDP but our stocks make up over 50%...

Read More »

Read More »

Weekly Market Pulse: Tune Out The Noise

Okay, I confess. It was my fault. I decided to take a couple of days off. I took my eye off the ball and the stock market fell a quick 2% while I was relaxing, eating too much, and seeing some great art in the Holy City, Charleston, SC. I promise it won’t happen again, at least until my wife tells me where we’re going next.

It is a running joke within Alhambra that every time I go away for a few days the market takes a hit. Of course, that isn’t...

Read More »

Read More »

Weekly Market Pulse: Questions

As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual.

Read More »

Read More »

Weekly Market Pulse: Did The Fed Just Make A Mistake?

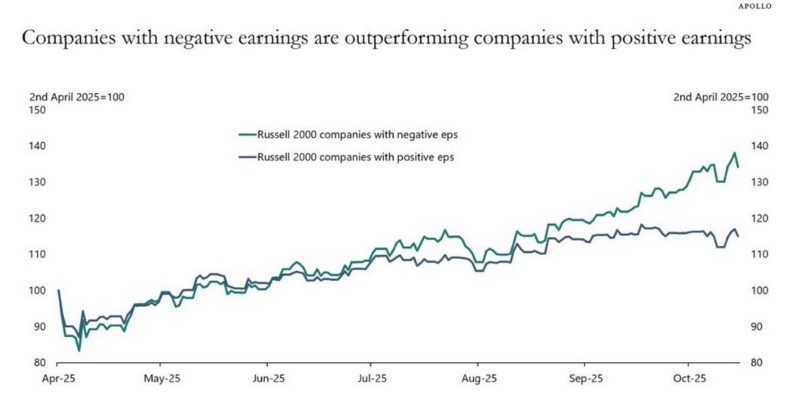

Well, they did it. The Fed cut the Fed Funds rate by 50 basis points last week and indicated that there is likely more to come. Stock investors liked it, bidding up small cap stocks (S&P 600) by 2.25%, large caps (S&P 500) by 1.4% and the NASDAQ by 1.5%.

Read More »

Read More »

S&P 500 – A Bullish And Bearish Analysis

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

Risks Facing Bullish Investors As September Begins

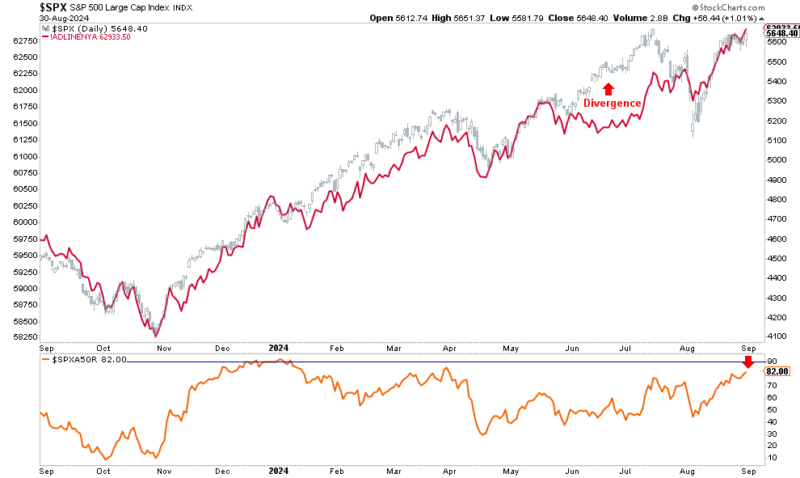

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

Weekly Market Pulse: It’s An Uncertain World

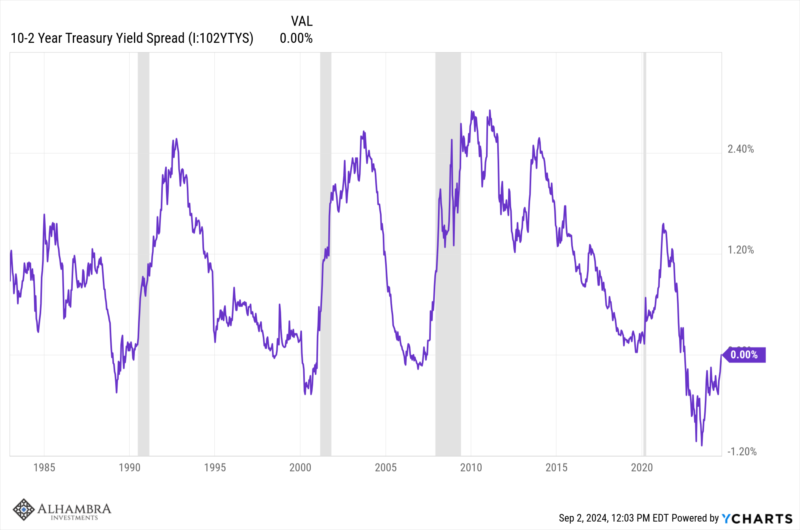

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year.

Read More »

Read More »

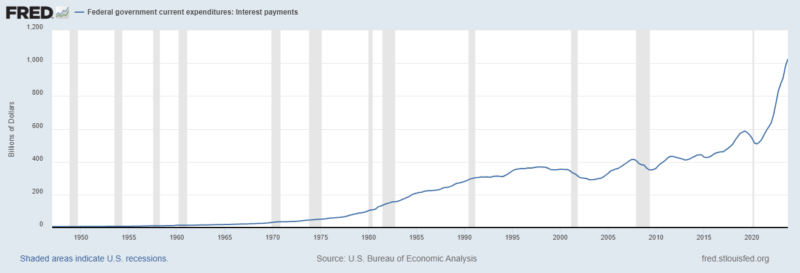

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

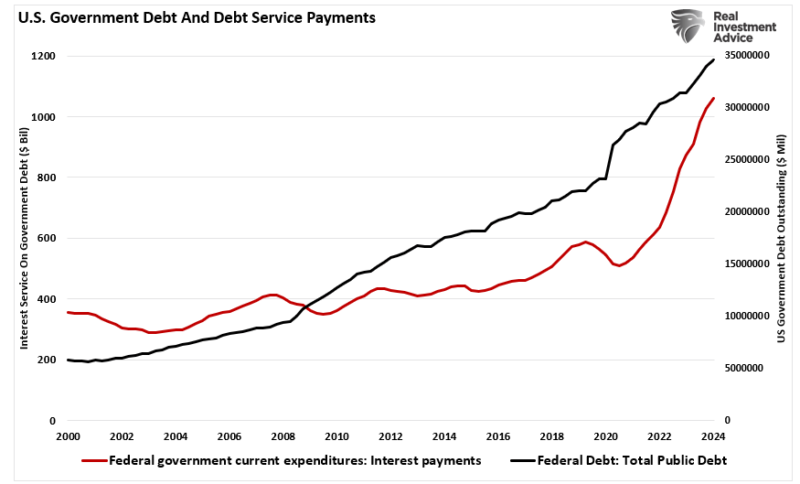

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

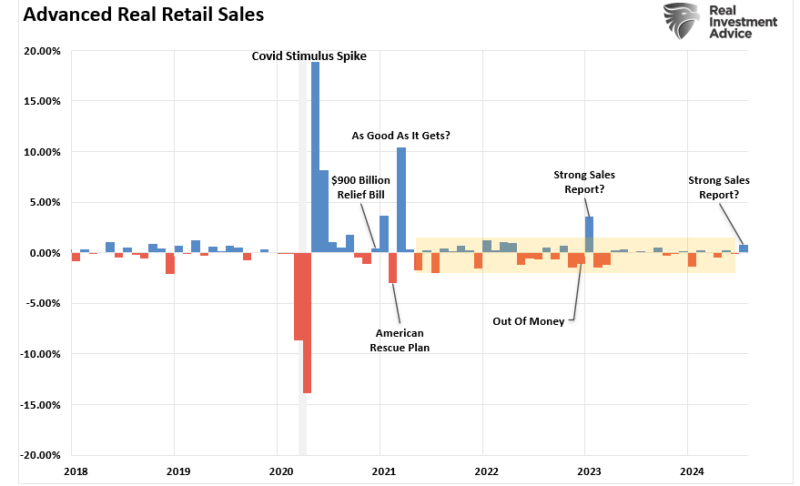

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market.

Read More »

Read More »

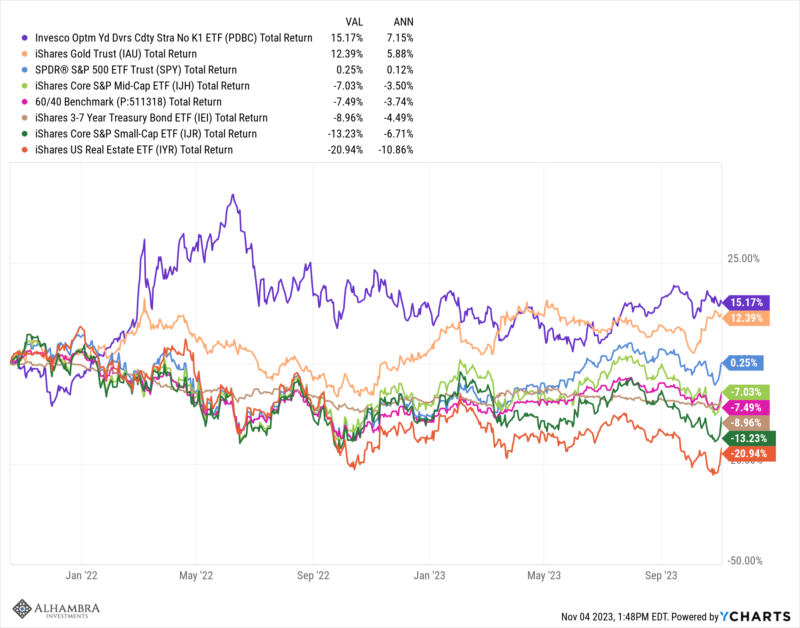

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »