Tag Archive: Bank of Japan

Central Banks Roil Markets

The Bank of Japan defied expectations and its economic assessment to leave policy unchanged. The inaction spurred a 3% rally in the yen and an even larger slump in stocks. The financial sector took its the hardest and dropped almost 6%. The...

Read More »

Read More »

What is the BOJ Going to Do?

Under Kuroda's leadership the BOJ has surprised the market a number of times, most recently with the move to negative rates at the end of January.

It is not that such a move, which has been tried by several European central banks, was without...

Read More »

Read More »

The Week Ahead: FOMC, BOJ and More

The last week of April is eventful. The Reserve Bank of New Zealand, the Federal Reserve and the Bank of Japan hold policy meetings. The UK, eurozone, and the US provide the first estimates of Q1 GDP. Japan, the eurozone, and Australia report consumer prices, while the US updates the Fed’s preferred (targeted) inflation measure, the …

Read More »

Read More »

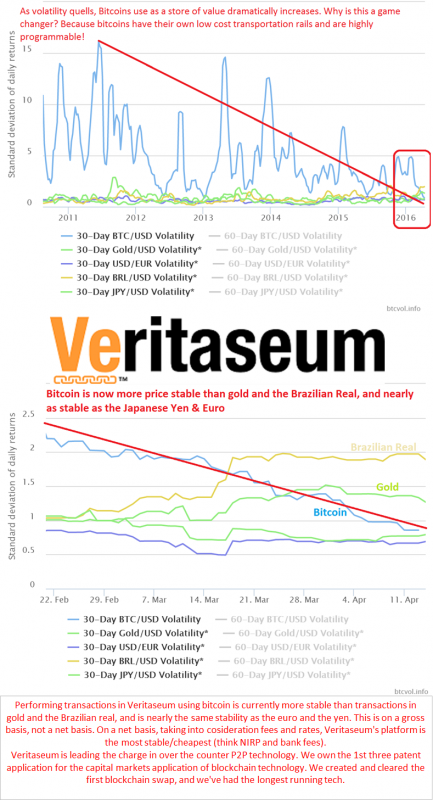

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »

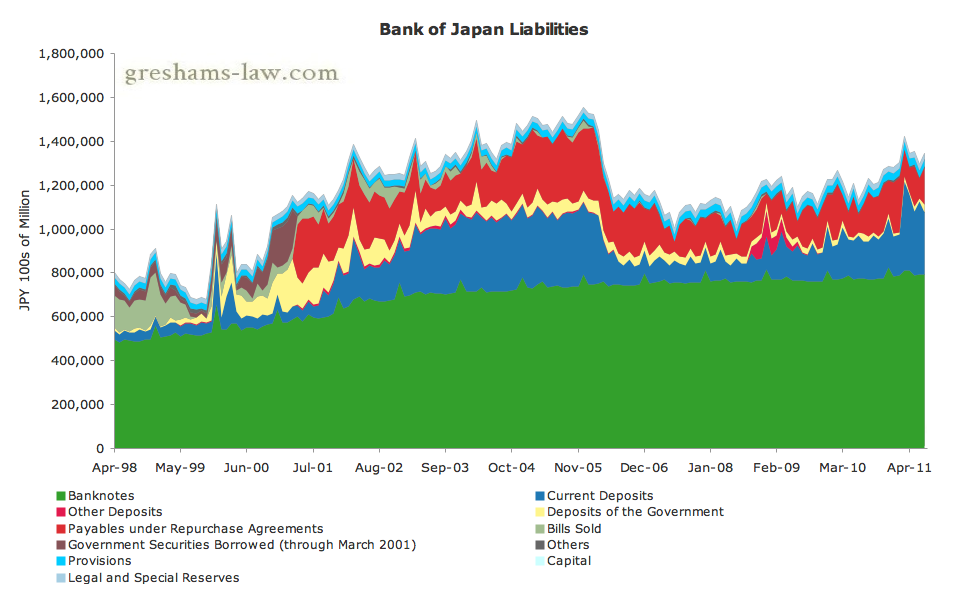

History of Bank of Japan Interventions

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.

As opposed to the Swiss National Bank, the Japanese only talk, they do not fight.

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

FX Daily 03/14: Five Central Banks Meet as Monetary Policy is Downgraded

Fixed exchange rates limit the degrees of freedom for policymakers. The breakdown of Bretton Woods in 1971 removed this constraint on official action, and the results were larger budget deficit and higher inflation. The zero bound on interest rates also posed a constraint on behavior. Until this year, despite the long struggle against deflation, the Bank …

Read More »

Read More »

Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog,

Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative ...

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

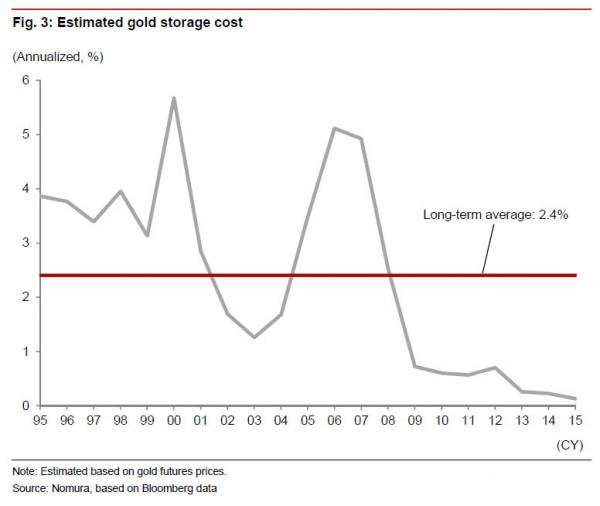

How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Pan...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »

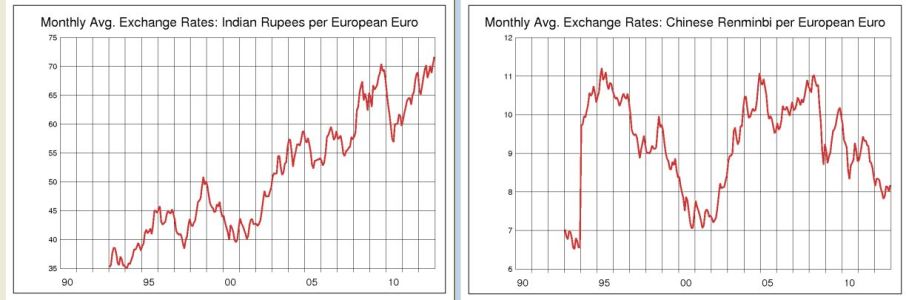

(1.2) Explaining price movements in FX rates

We indicate the main factors that influence FX rates in the longer term. We explain the movements of currencies based on these factors.

Read More »

Read More »

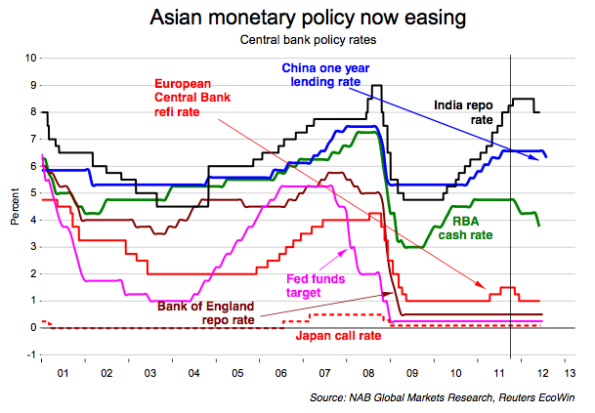

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

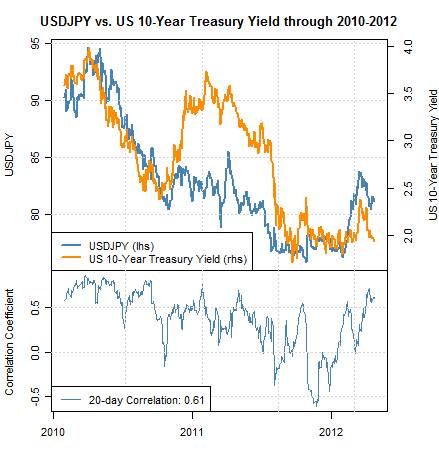

(7) FX Theory: The Asset Market Model

The Asset Market Model implies that a currency will be in higher demand and should appreciate in value, if the flow of funds into financial market of the country such as equity and bonds markets increase.

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »