Tag Archive: Bank of Japan

The Day They Killed the Dollar

LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered!

Read More »

Read More »

Bank of Japan: Destination Mars

Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical.

Read More »

Read More »

FX Daily, July 14: Will BOE Ease on May Day?

After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new government are particularly relevant. First, May demonstrates strategic prowess by putting those like Johnson and Davis, who campaigned for Brexit, to lead the negotiations with the EU, while putting Tories who favored remaining in the EU in the internal ministries.

Read More »

Read More »

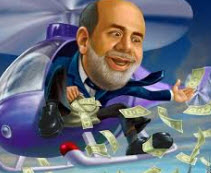

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces "Krugman Era" economics and deeper into the new "Bernanke Era" economics of helicopter money. As a result Japan's citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives.

Read More »

Read More »

Kuroda and the BOJ

Following today's FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow.

The SNB will keep its powder dry to be able to respond to the results of the UK

referendum if needed. The Bank of England is als...

Read More »

Read More »

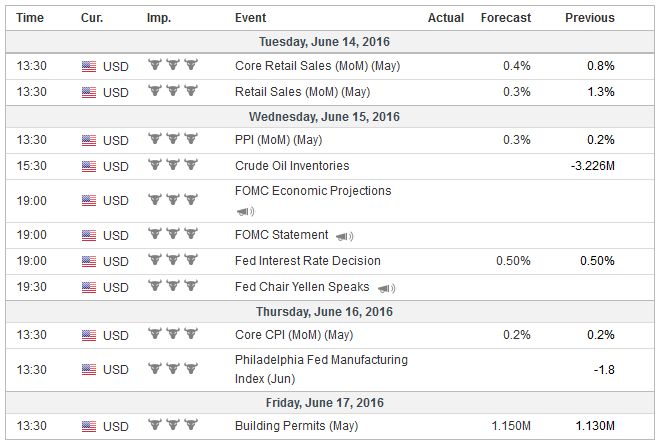

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »

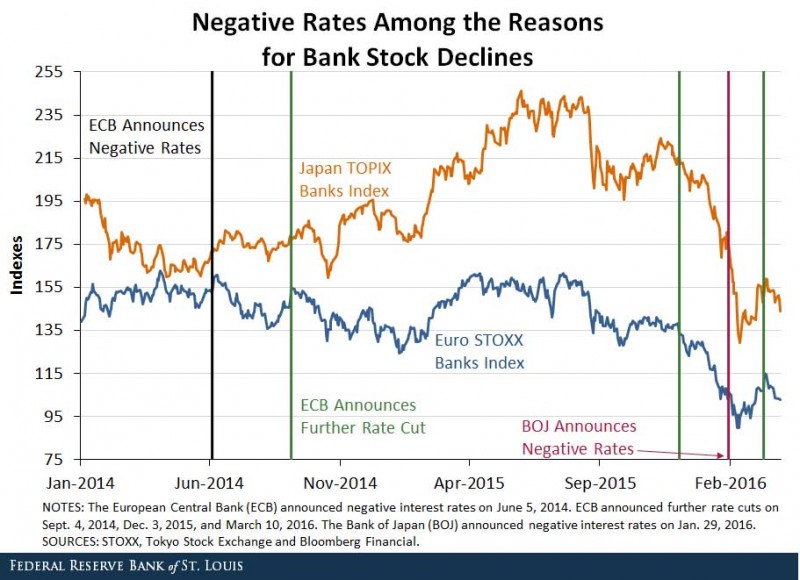

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »

FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning.

Read More »

Read More »

The Japanese Popsicle Affair

Policy-Induced Contrition in Japan As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly,...

Read More »

Read More »

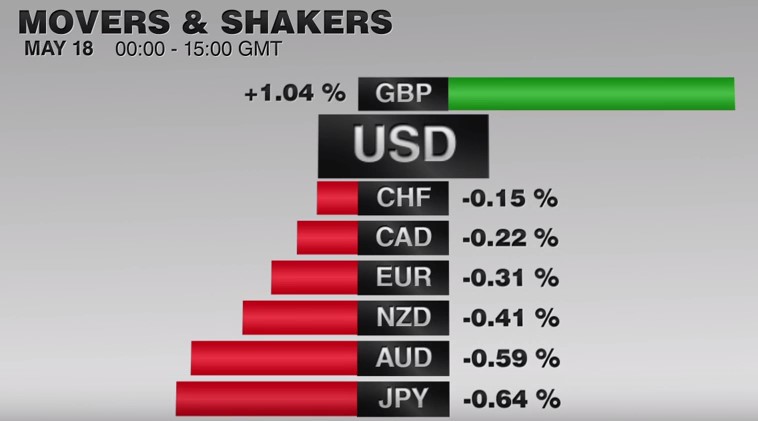

FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

Apart from GBP, the US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable …

Read More »

Read More »

FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This …

Read More »

Read More »

Kuroda-San in the Mouth of Madness

Deluded Central Planners Zerohedge recently reported on an interview given by Lithuanian ECB council member Vitas Vasiliauskas, which demonstrates how utterly deluded the central planners in the so-called “capitalist” economies of the West have bec...

Read More »

Read More »

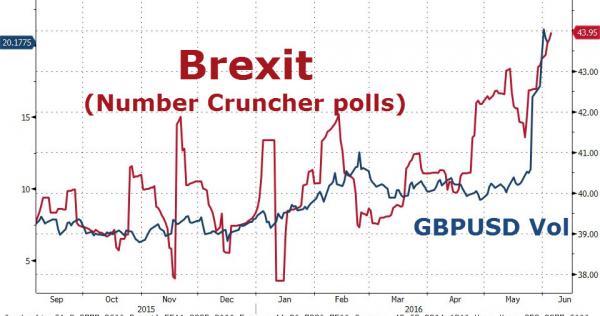

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking wor...

Read More »

Read More »

Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and ...

Read More »

Read More »

Podcast Discussing Dollar, Fed, BOJ on Futures Radio Show

I had the privilege of being interviewed by Anthony Crudele, who is trader at the CME, for the Futures Radio Show.

There was much to discuss. The FOMC met yesterday. The market, judging from the Fed funds futures see little chance of a Ju...

Read More »

Read More »