Tag Archive: Bank of Canada

The Yen and Yuan Continue to Weaken

While the US dollar appears to be consolidating its recent gains, the Japanese yen and Chinese yuan remain under pressure. Officials seem more concerned about the pace of the move than the level it has reached. New and large fiscal initiatives that the new UK government has floated has failed to change sentiment toward sterling, which is the second weakest major currency today after the Japanese yen.

Read More »

Read More »

RBA, BOC, and ECB Meetings and more in the Week Ahead

All

three major central banks that meet in the coming days will hike rates. The question is by how much. The Reserve Bank of Australia makes its

announcement early Tuesday, September 6. One of the challenges for policymakers and investors is

that Australia reports inflation quarterly. The Q2 estimate was released on July

27. It showed prices accelerating to 6.1% year-over-year from 5.1% in Q1. The

trimmed mean rose to 4.9% from 3.7%, and the...

Read More »

Read More »

Market Prices in More Aggressive Fed AND is more Confident of Rate Cuts by the End 2023

Overview: The higher-than-expected US CPI and the strong expectation of a 100 bp hike by the Fed in two weeks is propelling the dollar higher.

Read More »

Read More »

Euro Parity Holds ahead of US CPI

Overview: The US dollar is consolidating with a slight downside bias ahead of the June CPI report. The euro held above $1.00 but is still pinned in the trough. The rate hike by the Reserve Bank of New Zealand failed to have much impact.

Read More »

Read More »

Dollar Gains Pared

Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop.

Read More »

Read More »

Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed.

Read More »

Read More »

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

European Currencies Continue to Bear the Brunt

Overview: Russia's invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next.

Read More »

Read More »

FX Daily, January 26: Federal Reserve and Bank of Canada Meet as Risk Appetites Stabilize

After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe's Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the S&P 500 popping more than 1% and NASDAQ by 2%.

Read More »

Read More »

FX Daily, January 17: PBOC Eases, but the Yuan Firms

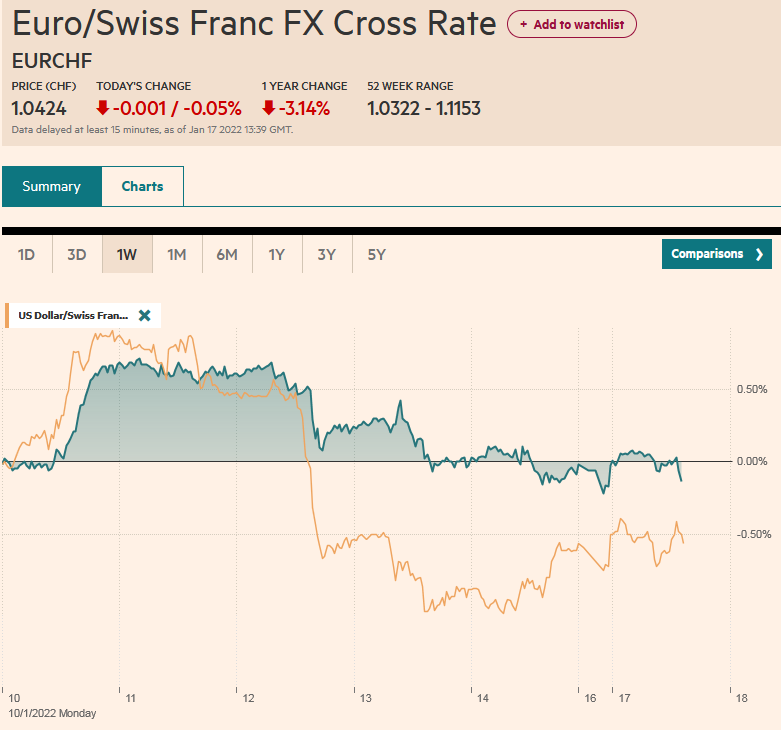

Overview: Russia is thought to be behind the cyber-attack on Ukraine at the end of last week, but a military attack over the weekend may be underpinning risk appetites today. The dollar's pre-weekend gains are being pared slightly. Led by the Canadian dollar and Norwegian krone, the greenback is lower against most major currencies, with the yen being the notable exception, which is off about 0.2%.

Read More »

Read More »

Yuan Rises Despite China’s Move and the Fed’s Course is Set Regardless of Today’s CPI

Overview: After US equity indices posted their first loss of the week, Asia Pacific and European equities fell. While the MSCI Asia Pacific Index fell for the first time since Monday, Europe's Stoxx 600 is posting its third consecutive decline. US futures are trading slightly firmer. The US 10-year Treasury yield is up about 1.5 bp to 1.51%, which is about eight basis points higher than it settled last week when the sharp drop in equities saw...

Read More »

Read More »

Markets Calmer, Awaiting Fresh Incentives

Overview: The capital markets are calmer today, and the fear that was evident at the end of last week remains mostly scar tissue. Led by gains in Japan, China, Australia, New Zealand, and India, the MSCI Asia Pacific Index extended yesterday's gains. Europe's Stoxx and US futures are firm. The US 10-year yield is softer, around 1.43%, while European yields are mostly 1-2 bp lower. The Norwegian krone and euro lead major currencies higher...

Read More »

Read More »

Eyes Turn to the ECB and the First Look at Q3 US GDP

Overview: The market awaits the ECB meeting and the first look at the US Q3 GDP. The pullback in US shares yesterday was a drag on the Asia Pacific equities. It is the first back-to-back loss of the MSCI Asia Pacific in a few weeks. Europe's Stoxx 600 is recovering from early weakness and US future indices are firm. The US 10-year yield is flat, around 1.55%, after falling around 15 bp over the past four sessions. European bonds are paring...

Read More »

Read More »

Strong Earnings and Easing of (Some) Political Tensions Bolster Sentiment

Overview: Helped by new record highs in the S&P 500 and Dow Industrials, constructive earnings, and an easing of political tensions, risk appetites are robust today. The MSCI Asia Pacific Index recouped yesterday's losses plus more as the large equity markets in the region, but China and Hong Kong rose, led by a more than 1% gain in Tokyo. European shares are rallying, and the Stoxx 600 is posting gains for the ninth session in the last 11...

Read More »

Read More »

Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached...

Read More »

Read More »

Week Ahead: The First Look at US and EMU Q3 GDP and more Tapering by the Bank of Canada

The macro highlights for the week ahead fall into three categories. First are the preliminary estimates for Q3 GDP by the US and the EMU. Second, are the inflation reports by the same two. The US sees the September PCE deflator, which the Fed targets, while the eurozone releases the first estimate for October CPI. Third are the meetings of three G7 central banks, the BOJ, the ECB, and the Bank of Canada. The broad backdrop includes softening...

Read More »

Read More »

The Greenback Continues to Claw Back Recent Losses

Overview: The US dollar continues to pare its recent losses and is firm against most major currencies in what has the feel of a risk-off day. The other funding currencies, yen and Swiss franc, are steady, while the euro is heavy but holding up better than the Scandis and dollar-bloc currencies. Emerging market currencies are also lower, and the JP Morgan EM FX index is off for the third consecutive session.

Read More »

Read More »

FX Daily, July 14: RBNZ Moves Ahead of the Queue, Will the Bank of Canada Maintain its Place?

The Reserve Bank of New Zealand jumped to the front of the queue of central banks adjusting monetary policy by announcing the end of its long-term asset purchases. New Zealand's s 10-year benchmark yield jumped seven basis points, and the Kiwi is up almost 1%, to lead the move against the greenback today.

Read More »

Read More »

FX Daily, July 12: Markets Adrift ahead of Key Events

The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc's resilience seen last week is carrying over.

Read More »

Read More »

Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week's economic events, which include June US CPI, retail sales, and industrial production, along with China's Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan.

Read More »

Read More »