Tag Archive: Barclays Bank

UBS Among 10 Banks Exploring G7-Backed Stablecoin

UBS is among ten major banks exploring the issuance of a stablecoin, highlighting traditional finance’s growing interest in digital assets.

The consortium also includes Bank of America, Deutsche Bank, Goldman Sachs, Citi, MUFG, Barclays, TD Bank, Santander and BNP Paribas.

The banks said they will work together to investigate creating blockchain-based assets pegged to G7 currencies, Reuters reported.

The project, still in its early stages, will...

Read More »

Read More »

Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX).

Read More »

Read More »

Six Banks Join UBS’s “Utility Coin” Blockchain Project

Here’s a piece of news that the remaining human members of Wall Street’s FX sales and trading desks probably don’t want to hear. According to the Financial Times, six of the world’s largest banks have decided to join a blockchain project called “utility coin” that will allow banks to settle trades in securities denominated in different currencies without a money transfer.

Read More »

Read More »

The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken our economy, our society and latterly our politics.

Read More »

Read More »

How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich's nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at Citigroup, kicking government...

Read More »

Read More »

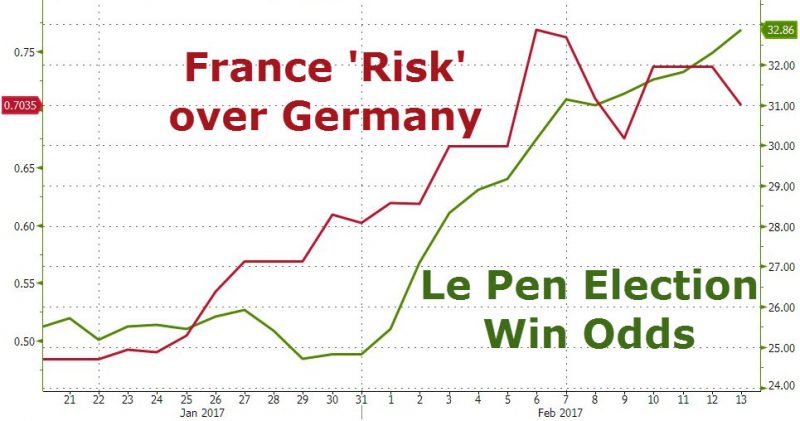

Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen's strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would "amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012, threatening chaos to the world...

Read More »

Read More »

Credit Suisse Settles With DOJ For $5.3 Billion; Will Pay $2.5 Billion Civil Penalty

Shortly after last night's news that Deutsche Bank had settled with the DOJ for $7.2 billion, of which it would pay $3.1 billion in a civil penalty, far lower than the $14 billion number initially speculated (the stock popped as much as 4% before settling just over 2% higher currently), Credit Suisse likewise closed the books on its pre-crisis RMBS fraud when the largest Swiss bank agreed to pay $5.28 billion to resolve a U.S.

Read More »

Read More »

Two More Banks Start Charging Select Clients For Holding Cash

Bank of Ireland, which is 14% owned by the State, has informed its large corporate and institutional customers that it plans to charge them a negative rate of -0.1% for deposits of €10 million or more starting in October.

Read More »

Read More »

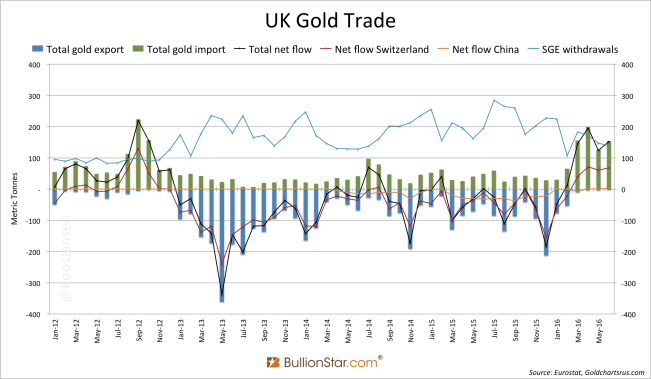

UK Imported Net 152 Tonnes of Gold in June, 68 from Switzerland

On a firmly rising gold price the UK is one of the largest net importers of gold in 2016. The gold price went up 25 % from $1,061.5 dollars per troy ounce on January 1 to $1,325.8 on June 31. Over this period the UK net imported 583 tonnes and GLD inventory mushroomed by 308 tonnes.

Read More »

Read More »

As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders

Anyone wondering why gaps and volatility in FX, and especially cable is reaching on the absured today, with 100 pips swings in minutes the norm, the reason is that there is virtually no liquidity.

Read More »

Read More »

Spain Sells 3x Oversubscribed 50-Year Bond

Following a scramble by European nations to issue ultra long-dated government paper, which saw France and Belgium sell 50-year bonds last month, while Ireland and Belgium went all the way and issued century bonds, with even Switzerland locking in 42-...

Read More »

Read More »

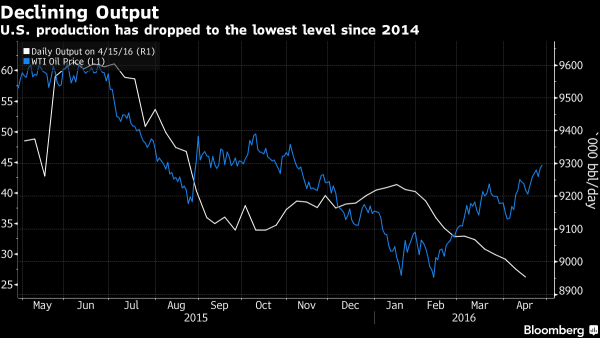

Futures Ignore Apple Plunge; Oil Rises Above $45 As Yellen Looms

For those who thought that the world's biggest company losing over $40 billion in market cap in an instant on disappointing Apple earnings, would have been sufficient to put a dent in US equity futures, we have some disappointing news: with just over...

Read More »

Read More »

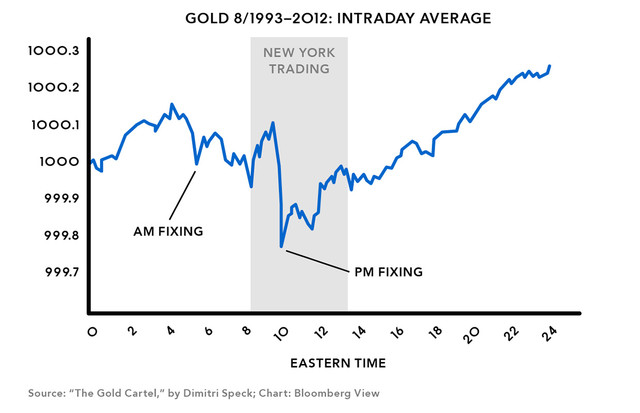

FINMA Fines UBS, All Markets are Manipulated?

Gold and Silver Are Manipulated

Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices.

In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “...

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

12 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Bitcoin: Ich kaufe JETZT!

-

Was kocht man einem Multimillionär?

-

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell

-

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch!

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch! -

2-2-26 Bears Are an Endangered Species

2-2-26 Bears Are an Endangered Species -

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen!

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen! -

UN 20% DE LOS INMIGRANTES NO TRABAJA

UN 20% DE LOS INMIGRANTES NO TRABAJA -

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!!

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!! -

Swiss bank Julius Bär posts lower profits

Swiss bank Julius Bär posts lower profits -

Michael Burry warnt, das ist passiert

Michael Burry warnt, das ist passiert

More from this category

- UBS Among 10 Banks Exploring G7-Backed Stablecoin

13 Oct 2025

Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks22 Apr 2018

Six Banks Join UBS’s “Utility Coin” Blockchain Project

3 Sep 2017

How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

How The US Government Let A Giant Bank Pin A Scandal On A Former Employee12 May 2017

Here Are The Best Hedges Against A Le Pen Victory

Here Are The Best Hedges Against A Le Pen Victory13 Feb 2017

Credit Suisse Settles With DOJ For $5.3 Billion; Will Pay $2.5 Billion Civil Penalty

Credit Suisse Settles With DOJ For $5.3 Billion; Will Pay $2.5 Billion Civil Penalty25 Dec 2016

Two More Banks Start Charging Select Clients For Holding Cash

Two More Banks Start Charging Select Clients For Holding Cash19 Aug 2016

UK Imported Net 152 Tonnes of Gold in June, 68 from Switzerland

UK Imported Net 152 Tonnes of Gold in June, 68 from Switzerland16 Aug 2016

As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders

As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders23 Jun 2016

Spain Sells 3x Oversubscribed 50-Year Bond

Spain Sells 3x Oversubscribed 50-Year Bond11 May 2016

Futures Ignore Apple Plunge; Oil Rises Above $45 As Yellen Looms

Futures Ignore Apple Plunge; Oil Rises Above $45 As Yellen Looms27 Apr 2016

FINMA Fines UBS, All Markets are Manipulated?

FINMA Fines UBS, All Markets are Manipulated?14 Apr 2016