Tag Archive: Austrian economics

The permacrisis strategy: the mortal dangers of our “new normal”

Share this article

Over the last years, we have encountered an abundance of alarmist and hysterical “warnings” and admonitions, foretelling the impending doom of the world as we know it. Market corrections have served as an excuse for scaremongers to cultivate panic over a total systemic collapse. Surprising political shifts, like unexpected electoral results, have been coopted to support extreme scenarios, predicting the fall of the current world...

Read More »

Read More »

#RestartVienna at an unforgettable 10th Austrian Economics Conference – 1st Day

On November 4-5, the 10th Austrian Economics Conference took place at the Austrian Central Bank (Österreichische Nationalbank). The event was organized in collaboration with the Fundación Bases and the Hayek Institut and received more than 150 academics, researchers, think-tankers, entrepreneurs, and student advocates of the ideas of freedom from all over the world.

Read More »

Read More »

Unless the US stops printing money, the dollar will collapse

Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about?

Read More »

Read More »

“Unless the US stops printing money, the dollar will collapse.”

We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

Toward A New World Order, part III

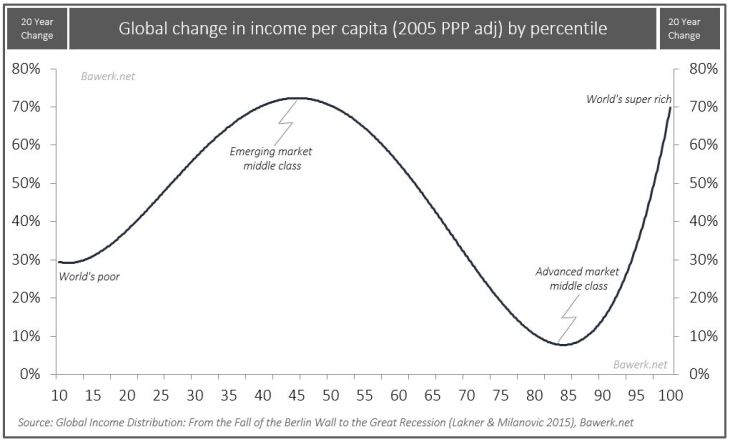

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

The Road to Fascism in Just Two Charts

Laws of politics have been turned upside down. The Intellectuals Yet Idiots can make no sense of it. The underdog who ‘tell it how it is’ appeal to people while established reasoning does not.

Read More »

Read More »

The FOMC Butterfly that Will Ruin the World

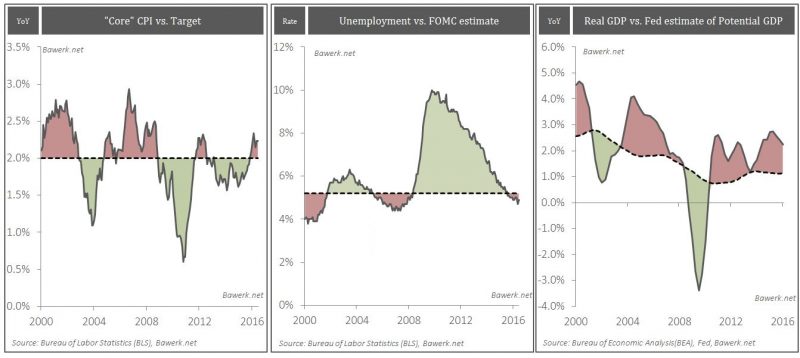

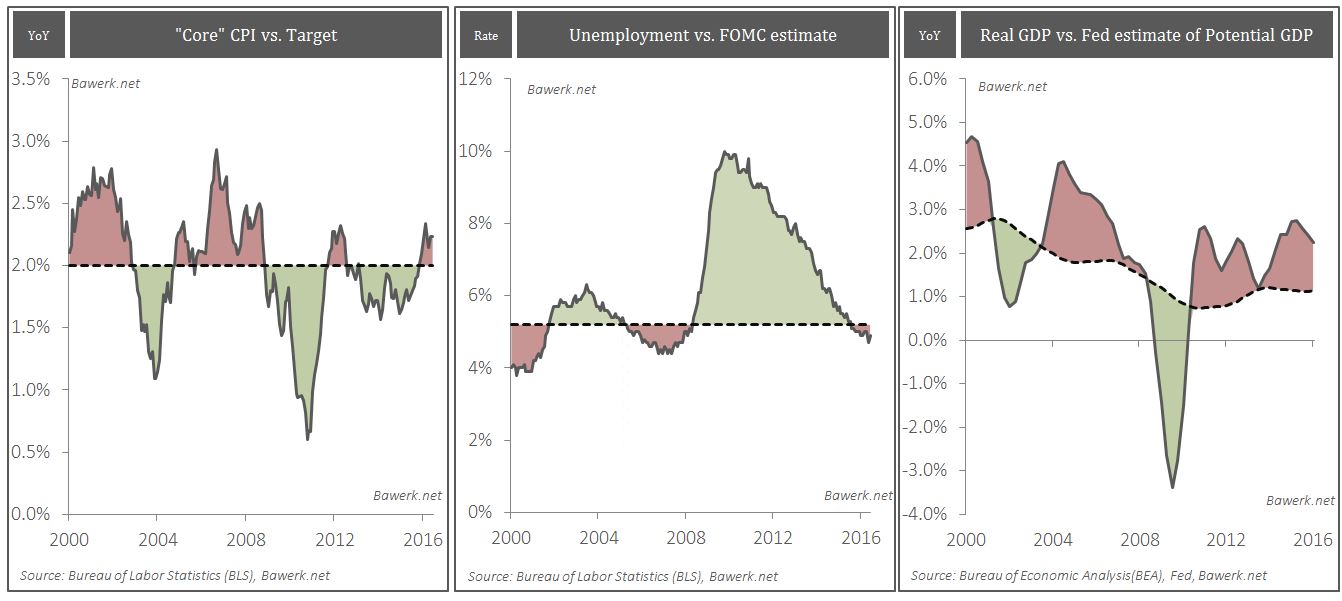

Given the fact that the core CPI is currently over the arbitrarily set 2 per cent target unemployment below what the FOMC regards as full employment and GDP running at a rate far above the Federal Reserve’s own estimates of so-called potential; you would say the Federal Funds rate would be in the vicinity of five per cent.

Read More »

Read More »

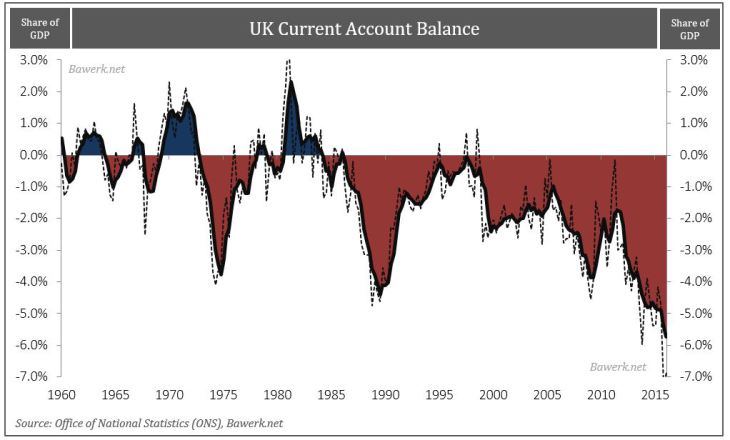

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »

Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

The Greatest Keynesian monetary experiment is not sustainable. It will not continue ad infinitum. Our money masters are just postponing the inevitable bust that will eventually correct these imbalances through worldwide capital re-allocation. Bawerk shows 3 graphs how investment growth gets slower and slower since the End of Bretton, how debt is increasing and how cheap dollar fuel debt-driven growth.

Read More »

Read More »

Circulus in probando

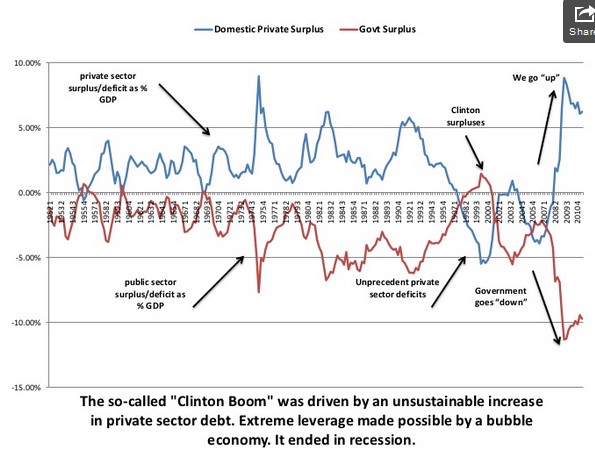

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because ...

Read More »

Read More »

Greenspan, the Sheepherder

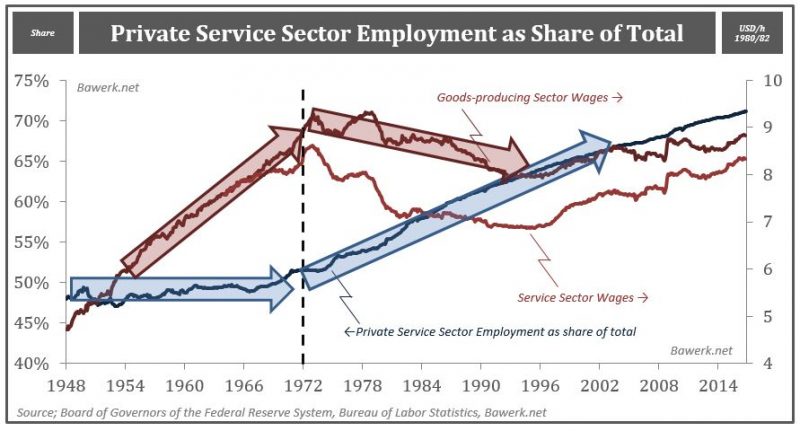

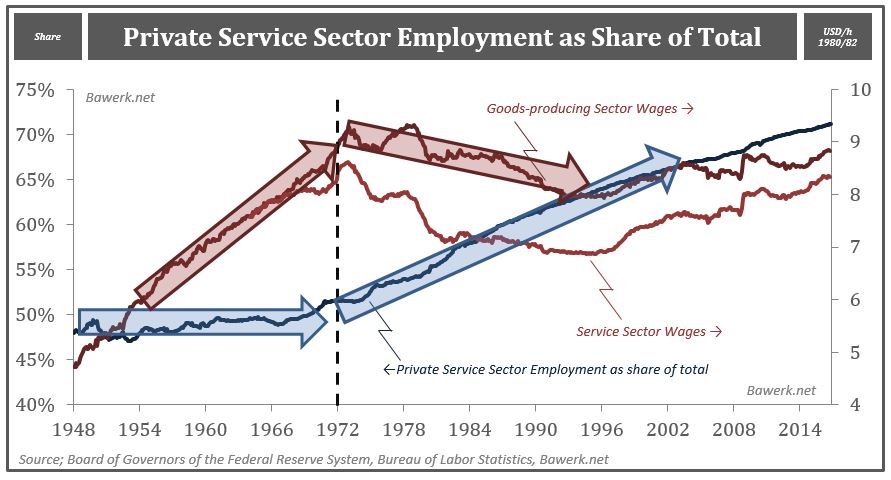

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated,...

Read More »

Read More »

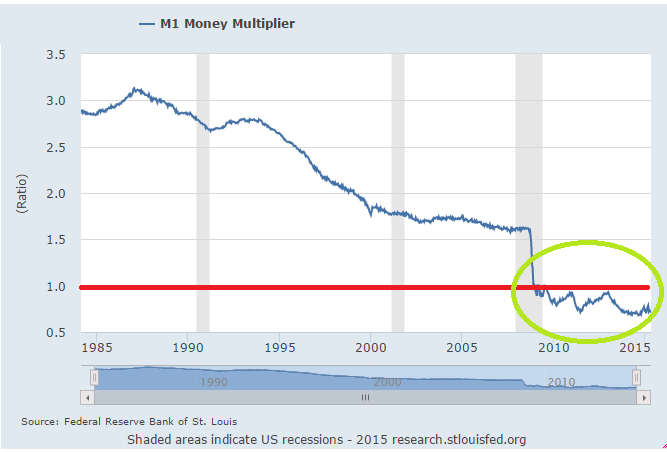

The Credit Multiplier – Revisited

In last week’s article, we explained how the yield curve could cause GDP to contract in The Yield Curve and GDP – a causal relationship. Some of our readers suggested the analysis was wrong on back of an outdated view of modern money creation. The cr...

Read More »

Read More »

Why was the gold price so low in 1999/2000?

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US and weakened it in other countries. Real interest rates were positive. Markets...

Read More »

Read More »

Peter Schiff’s Message to Switzerland: Preserve Your Wealth, Gold is Better than Pegging to the Euro

Peter Schiff, an Austrian economist who predicted the financial crisis urges the Swiss to preserve their wealth. Therefore, they should vote yes in the gold referendum. He thinks that buying gold is better than pegging to the euro. The Swiss will be better off if they possess a strong currency. Pegging to the euro implies that the Swiss Franc will become a new Italian Lira, Peseta or French Franc.

Read More »

Read More »

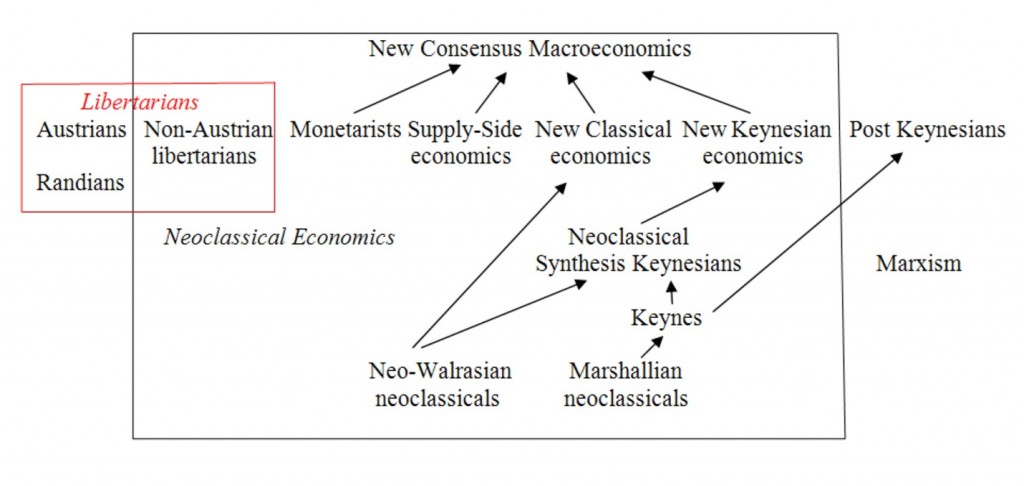

Libertarian and Austrian economic theory

Libertarian economic theories comprises Austrian economists and Free Market economists like Nozick, Narveson, Gathier, Caplan, Bryan Caplan, David Friedman and the Randian philosophy.

Read More »

Read More »

Did Austrian Economists Get the Recovery Wrong?

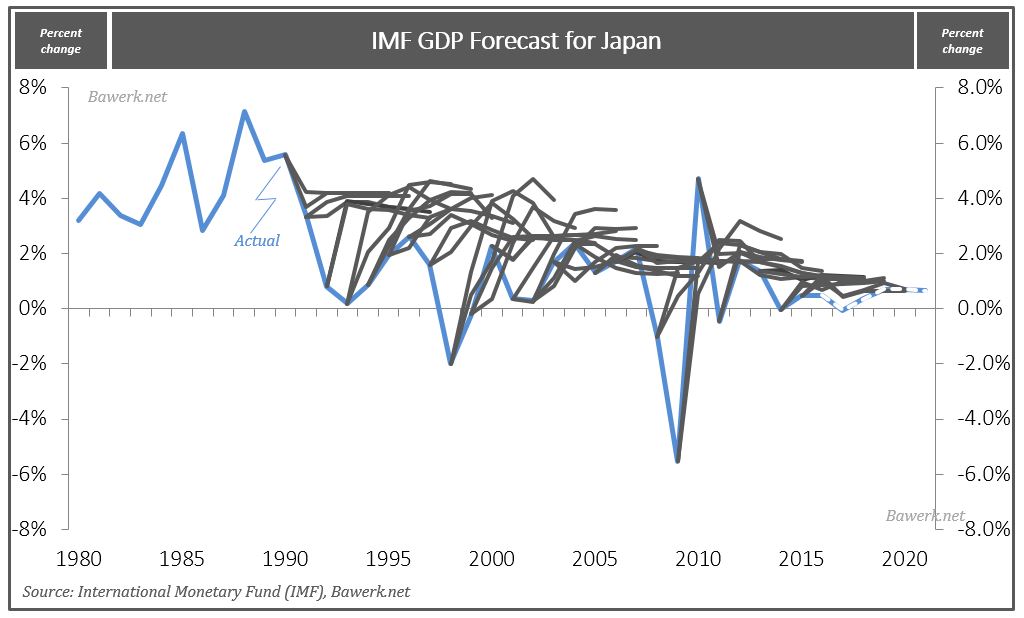

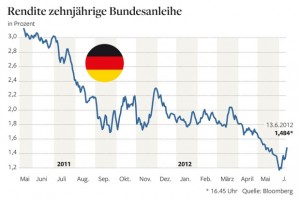

Austrians got the recovery after the financial crisis wrong. Monetary expansion did not lead to hyperinflation and a collapse of central banks. Their mistake was that the Austrian principle of "too cheap money leads to wrong investments", is currently not valid. Due to high risk aversion after the financial crisis, firms do only only best projects. Austrian economists were right before the crisis, but after the crisis Keynesians and Germans with...

Read More »

Read More »

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »