Some Selected Headlines from 2013

Update for the week ending July 19, 2013:

UBS: “We have been net sellers of CHF for 5 weeks in a row now – a pattern we have not seen since shortly after the SNB put in the floor.”

July 22, 2013

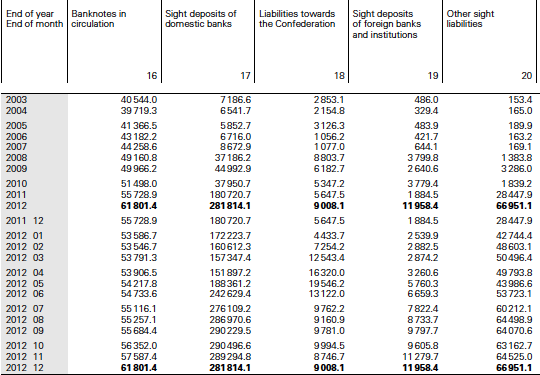

Despite UBS private clients selling CHF, there was no substantial change in SNB sight deposits. They are 1.5 bln. CHF under the record-high of 371.6 bln. CHF See full history below.

Update for the week ending July 5:

Total sight deposits down by 700 million CHF. Where is the money flowing?

Two possibilities:

- Out of the franc or

- Do Swiss banks increase lending and simply remove the funds from the central bank, because they have more profitable use for it?

Update for the week ending June 28: 25 million CHF will reclassified from “other” to “local sight deposits”.

Since PostFinance Ltd was granted a banking licence on 26 June 20 13, its sight deposit account is reported under the sight deposits of domestic banks item and no longer under the other deposits on sight in Swiss francs item. (source SNB)

Update for the week ending March29, 2013 Slight decrease of 300 million francs, driven by “other deposits” (companies, foreign banks) that showed 1 bln. CHF that moved out of the franc, while Swiss banks moved in franc investments. The weak ISM PMI of 51.2 on April 1, is an early warning of the typically harder times for the SNB from May on.

Update for the week ending March22: Despite the Cyprus crisis, only slight increase of 370 million francs. This time more local banks moved in the franc, but others (companies, Swiss state and foreign banks) are down.

Update February 22: Adding bank notes to the sight deposits, total SNB liabilities rise to a new record level.

Total sight deposits increased slowly to 370.9 billion francs, which is just 2.8 bln. under the record level of September. The ones of local banks, however, are higher by 3 billion francs and even 7 billion since the beginning of February. Bank notes, another type of central bank liabilities reached a high record high: The latest balance sheet shows that they are 6 billion francs or 10% higher than in September.

Update January 17: Since last week the SNB is buying reserves again, and increasing its liabilities in francs. In the first week of January we suspect a sterilization of 4 billion CHF from sight deposits to local banks into other deposits, possibly into liabilities to the Swiss confederation; a method used previously. Since the Swiss CPI was weaker than expected (-0.2% MoM on Friday, the SNB should get the data earlier), the SNB did not continue to sterilize last week.

Draghi’s talking up of the euro, the weak CPI and rumors about negative interest rates at ZKB, let the EUR/CHF rise to 1.24 via bullish FX traders. These FX traders may close their positions, take profit and the pair will fall again.

Still ZKB just changed general conditions to be ready for negative rates. Other banks are able to introduce them without changing conditions.

2013

Week ending on December 27, 363 606 million (of which 45 087 “other deposits”)

Week ending on November 29, 367’785 million (of which 47’961 “other deposits”)

Week ending on November 8, 368’634 million (of which 50’876m “other deposits”)

Week ending on November 1, 369’044million (of which 51’478m “other deposits”)

Week ending on October 25, 369’657 million (of which 50’409m “other deposits”)

Week ending on September 13, 369’482 million francs (of which 51’382m “other deposits”).

Week ending on August 30, 370’131 million francs (of which 49’266m. “other deposits”).

Week ending on August 9, 369’900 million francs (of which 49’498m. “other deposits”).

Week ending on July 19, 370’142million francs (of which 47’707m. “other deposits”).

Week ending on July 5, 370’043 million francs (of which 49’083 m. “other deposits”). –> Other deposits: Postfinance becomes a bank. See remark on page 1.

Week ending on June 28, 370’785 million francs (of which 73’923 m. “other deposits”).

Week ending on June 21, 371’052 million francs (of which 93 601 m. “other deposits”).

Week ending on June 07, 370’484 million francs (of which 95 080 m. “other deposits”).

Week ending on April 26, 371’624 million francs (of which 87 402 m. “other deposits”).

Week ending on April 19, 371’327 million francs (of which 87 001 m. “other deposits”).

Week ending on March 29, 370’831 million francs (of which 87 032 m. “other deposits”).

Week ending on March 22, 371’128 million francs (of which 88 149 m. “other deposits”).

Week ending on March 15, 370’755 million francs (of which 88 591 m. “other deposits”).

Week ending on March 8, 370 523 million francs (of which 87 496 m. “other deposits”).

Week ending on March 1, 370 905 million francs (of which 84 761 m. “other deposits”).

Week ending on February 22, 370 970 million francs (of which 82’922 m. “other deposits”).

Week ending on February 15 : 370’267 million francs (of which 85’242 m. “other deposits”).

Week ending on February 8: 370’065 million francs (of which 89’839 m. “other deposits”).

Week ending on February 1: 370’420 million francs (of which 88’486 m. “other deposits”).

Week ending on January 25: 371’282 million francs (of which 87’764 m. “other deposits”).

Week ending on January 18: 371’124 million francs (of which 86’794 “other deposits”).

Week ending on January 11: 369’839 million francs (of which 86’156 “other deposits”)

Week ending on January 04: 368’833 million francs (of which 86’194 “other deposits”):

2012

Week ending on December 28: 369’642 million francs (of which 81’115 “other deposits”)

Week ending on November 30: 373’346 million francs (of which 80’242 “other deposits”)

Week ending on November 23: 373’909 million francs (of which 79’350 “other deposits”)

Week ending on November 16: 373’044 million francs (of which 80’344 “other deposits”)

Week ending on November 9: 372’503 million francs (of which 80’981 “other deposits”)

Week ending on November 2: 372’538 million francs (of which 81’859 “other deposits”)

Week ending on October 26: 373’291 million francs (of which 79’981 “other deposits”)

Week ending on October 19: 373’360 million francs (of which 81’917 “other deposits”)

Week ending on October 12: 372’956 million francs (of which 79’814 “other deposits”)

Week ending on October 5: 372’734 million francs (of which 81’673 “other deposits”)

Week ending on September 28: 373’416 million francs (of which 82’171 “other deposits”)

Week ending on September 21: 373’731 million francs (of which 81’425 “other deposits”) —> RECORD HIGH

Week ending on September 14: 373’297 million francs

Week ending on September 7: 370’673 million francs

Week ending on August 31: 365’976 million francs (of which 77’017 m. “other deposits”)

Week ending on August 24: 362’112 million francs

Week ending on August 17: 356’676 million francs

Week ending on August 10: 353’304 million francs

Week ending on August 03: 352’055 million francs -> plus 42 bn. in 1 month

Week ending on July 27: 341’543 million francs (of which 70’620 mil. “other deposits”)

Week ending on July 20: 331’167 million francs (of which 69’769 mil. “other deposits”)

Week ending on July 13: 320’783 million francs (of which 71’502mil. “other deposits”)

Week ending on July 6: 316’901 million francs (of which 71’740 mil. “other deposits”)

Week ending on June 29: 310 970 million francs (of which 73’134 mil. “other deposits”) -> plus 58 bn. in 1 month

Week ending on June 22: 300 894 million francs (of which 72 938 mil. “other deposits”)