We recently explained that China will overtake the United States not only for GDP but also for wealth. In this post we explain what is still missing to become a world reserve currency and how quickly this could happen.

——————————————————————–

In our recent analysis “How Long Will the Dollar Be the Major World Reserve Currency? A Look at Wealth” we showed that in about ten years the Chinese will overtake the United States not only for GDP but also for wealth. In the post “Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?” we discussed what happens if the U.S. would not have big trade deficits any more.

Since China is as much addicted to imported oil as the U.S. we could imagine that in twenty years time the Chinese will be richer than the U.S. but that a Chinese (oil) trade deficit forces the Renminbi (sometimes also called “Yuan”) into a reserve currency status.

Still, in our discussion we did not look at other factors like the followings:

- Nearly all commodities are priced and settled in dollars. Much international trade is invoiced in U.S. dollars, even when the United States is not the source or destination of the goods or services involved in the transaction.

- The United States has the largest, most liquid and most transparent financial markets in the world.

- Many countries, including several with significant international reserves, rely on the U.S. for military protection.

- Finally, since a high proportion of the external liabilities of many countries are U.S. dollar-denominated, holding reserves as dollars is a form of asset-liability matching.

John Mauldin gives insights how far the Chinese Renminbi could become also a reserve currency as for financial transactions.

Extracts from The Renminbi: Soon to Be a Reserve Currency?

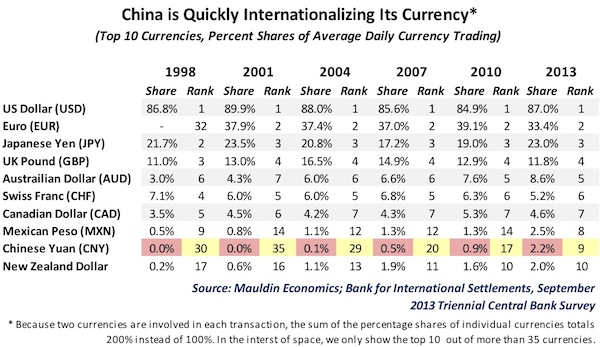

I think the answer to those very important questions will increasingly be the RMB. What you have witnessed in the past two to three years is China making a very apparent play to internationalize its currency. In just two years, China has gone from settling 0% of its exports in RMB to settling 18% of its exports in RMB. Two years ago, the RMB was a non-currency [in international trade/finance]. Nobody owned it. Nobody traded it. Today, the renminbi is already – in just two years – in the top ten traded currencies in the world…. [See the table my research staff found, below. –John]

I think this shift is taking place because China has a massive comparative advantage that most people never think of. If I asked, “What’s China’s comparative advantage?” 99 out of 100 people would say “cheap labor,” but that’s not true. Labor is not that cheap in China anymore. China’s comparative advantage is that China – alone amongst emerging-market nations – has a deep and credible financial center. It takes 50 years to build a financial center – to, you know, have auditors, lawyers, accountants, judges. And China is very lucky, because in 1997 the Brits – who are quite good at building financial centers – basically built one in Hong Kong and told China, “Here it is. Try not to mess it up.”For twelve years, China did nothing with Hong Kong. It was kind of a deal of “You don’t bother us, we won’t bother you. We’ve got other fish to fry.” And that worked well until all of a sudden, in the past two to three years, China has been internationalizing its currency through Hong Kong, and it is taking off like wildfire. We always talk about what you see and what you don’t. Everybody talks about the China slowdown. Everybody talks about the impact this is going to have on commodities, on countries like Canada, on countries like Australia. Nobody talks about what you don’t see. And what you don’t see is that China is slowly but surely internationalizing its currency. It’s slowly freeing capital controls. It’s creating deep and liquid capital markets, and this is going to change the way that companies and individuals finance themselves among emerging markets. It’s going to make for more stable emerging markets and hopef ully for higher growth.

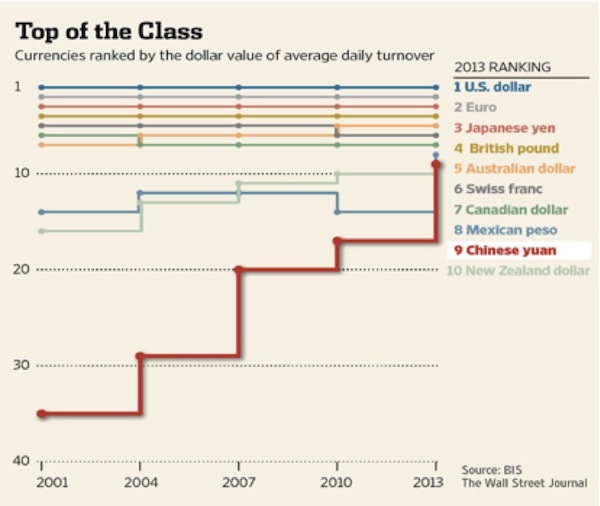

Just as Louis Gave predicted years ago, the Chinese RMB has continued to quickly climb the ranks from an internationally non-existent currency to number nine on the list!

This process is happening at lightning speed by historical standards, but we can still expect it to progress over the next 5-10 years. The renminbi is still only involved in 2.2% of foreign currency transactions, but this number can take a big jump when the RMB floats freely, though there is a big difference between the RMB and the true reserve currencies (USD, EUR, JPY, GBP) today. (Note that the renminbi is also called the yuan, abbreviated as CNY in the chart below.) As Louis mentioned, China stands alone among the emerging markets as having the only mature and credible financial center with deep and liquid capital markets, in Hong Kong. The building of a true global financial center typically takes about 50 years, so China is taking advantage of its lucky break to fast-track its currency to reserve status.

What may speed the process up is increasing cooperation between Chinese officials and the UK government to support RMB internationalization through London’s FX markets. Gregory Clark, Financial Secretary to the UK Treasury, was in Hong Kong this past week and wrote an op-ed in the South China Morning Post. Let’s look at a few telling sentences:

Over 50 percent of UK investment in Asia is in or flows through Hong Kong. That is a tremendous vote of confidence in Hong Kong by UK companies….

Bilaterial trade in goods between Hong Kong and the UK rose by 13.5% between 2009 and 2012, to a total value of £12.1 billion in 2012. This makes Hong Kong the UK’s second biggest export market for goods in Asia Pacific….

According to the Society for Worldwide Interbank Financial Telecommunications (SWIFT), London now accounts for 28 per cent of offshore RMB settled transactions.

In London, the volume of Renminbi-denominated import and export financing has increased 100 per cent since 2011. This is delivering real benefits and savings for business. It is estimated that firms can reduce their transaction costs with China by up to 7 per cent by denominating their trade in Renminbi.

The Renminbi’s rise is being enabled not just in Hong Kong and London. Chinese banks have established clearing banks and accounts in more than 80 other countries in the last four years. But the story runs even deeper. It appears to me that China is getting ready to create another Hong Kong in the traditional financial center of China, Shanghai. My good friend and decades-long China expert Simon Hunt notes:

The proposed development of the Free Trade Zone (FTZ) in Shanghai, covering 28sq km, will have huge consequences for China’s financial markets and that of the world. It will be a tax-free zone; the RMB will be fully convertible; the FTZ will have its own rules and regulations that cannot be trumped by central government; it will be legally outside the Chinese Customs, in fact a separate territory inside China; it has the effect of abolishing control over capital account investment, so allowing freedom to set up all kinds of companies and moving capital in and out of the FTZ, meaning in and out of China; it will become an international settlement centre for international trade and it will allow banks within the FTZ greater flexibility in conducting business. In short, the implications of the development of the FTZ, if the pilot scheme goes smoothly, will be humungous not just for China but for the global economy.< /p>

One near-term consequence will be that interest rate arbitrage can be more effectively conducted in the zone and will take business away from Hong Kong and Singapore. Chinese companies won’t have to set up offshore companies in Hong Kong or Singapore to conduct this business. Already, Chinese and foreign companies are either renting space, putting up buildings or buying office space in the FTZ, just waiting for the final details to be publicised.

This move makes sense for China, as it is a large step toward eventually floating the currency, which is yet another requirement for a true reserve currency. I’ve written in the past that I think the initial move when the Chinese eventually float their currency will be for the RMB to go down against the dollar (although longer-term it should become quite strong), because there is a lot of money in China that would like to diversify. Setting up a free-trade zone, as they propose in Shanghai, is a way to slowly let the air out of the balloon and perhaps even avoid the dramatic dislocations that might occur if they were to float the currency all at once.

Even so, internationalizing the RMB carries a lot of risk, so why does China really want to globalize its currency? Summarizing from a recent report from DBS Bank (based in Singapore), we can piece the picture together:

- “China has experienced 35 years of relatively stable 10% GDP growth. It’s 28 times bigger today than it was in 1978. Why risk this kind of success for a globalized RMB and an open capital account?

- The structure of the global economy has changed radically since 1978 while the financial architecture has changed barely at all.

- Between now and 2020, China’s two-way trade will grow by $4 trillion. That’s nearly the size of the entire of offshore eurodollar market.

- China doesn’t just want a globalized RMB; it needs one. The Middle Kingdom’s growth since the 1970s can largely be explained by mobilizing two key factors of production: land and labor. Now that economic growth is slowing in China as a whole (although there are still regional booms in some areas), Chinese policymakers hope they can regain momentum by mobilizing the last factor: capital.

For China to become a powerhouse exporter of its own products, it is eventually going to need to be able to offer financing to its ultimate customers in Indonesia, Vietnam, and the rest of Asia. If you are competing with Caterpillar and Komatsu, you not only need to have a less expensive product, you need to be able to offer financing. The same goes if you’re selling telecom gear, power-generation equipment, automobiles, or bullet trains.

In order for a currency to achieve reserve status, there has to be something for the country receiving the currency to invest in. If a country receives US dollars, they can invest in our bonds and stock markets. Just a few years ago, China created the dim sum bond market in Hong Kong, which is beginning to provide a real investment alternative for emerging markets – particularly in Greater China and Southeast Asia, where trade is largely intraregional. With China’s having the largest trading flows in the world (it just passed the US, by roughly $1 billion, in 2012), a free-floating RMB could quickly reach reserve status and, oddly enough, take FX market share from the USD, which could become be too strong and too scarce to work well in global trade.

China is on its way to becoming a reserve currency not because of weakness in the US dollar but precisely because the US dollar is going to get stronger and become less readily available. Countries are going to need to be able to trade in something besides dollars. It simply makes sense that if 20% of an emerging-market country’s trade is with China, it should do the trades in RMB rather than in relatively scarcer dollars. Of course, this means that China needs to have a relatively stable monetary policy so that its trading partners will have confidence in the long-term RMB, but China realizes that. And of course the RMB will have to meet all the other requirements for being a reserve currency.

Note that there is a difference between a reserve currency and a safe-haven currency. A safe-haven currency must be immune from government confiscation, currency controls, taxation, rapid exchange-rate depreciation.

As I mentioned, the RMB will probably depreciate rather than appreciate when the currency floats freely. There is a lot of capital trapped behind China’s capital-control wall that wants out, and party leaders know the trick is to make the transition to floating very gradually and without precipitating a crisis.

John Mauldin

Thanks to John Mauldin, for the points on the Renminbi, we were still missing. Still we doubt that capital is behind the Chinese wall.

From Forexlive:

I’ve been spending a lot of time reading about offshore tax evasion methods in the past couple weeks and it’s truly a staggering and game-changing phenomenon. In any multinational or jurisdiction where it isn’t yet present, it will be soon.

Exhibit A: New York real estate is the new Swiss bank account

30% of all apartments between 49th and 70th Streets and between Fifth and Park Avenues are vacant at least 10 months of the year. And since 2008, around 30% of condo sales in large-scale Manhattan developments have been by buyers with overseas addresses or through secretive LLCs.

Via Bloomberg: Secret Path Revealed for Chinese Billions Overseas

For years, wealthy Chinese have been transferring billions worth of their money overseas, snapping up pricey real estate in markets including New York, Sydney and Vancouver despite their country’s currency restrictions.

Nowadays, capital always finds it way, and it will find it before the official start of the free-floating Renminbi.

See more for