The Indian central banker Rajan recently accused his Western colleagues of lax policy before 2007. Furthermore he argued that FX intervention using so-called “quantitative easing or exchange rate intervention” (QEE) helped to dry up the needed money supply in India. We will look at his statement from the money supply angle: in some countries, the money multiplier is falling, due to QE or QEE, in some others it is increasing, mostly due to central bank tightening. Does this data justify speaking of a secular stagnation?

If you are not familiar with the terms please first read the definition of money supply and the aggregates base money MB or M0 and broad money M1 to M4. A short movie will start this post. Please enable flash to understand parts of our reasoning.

The money multiplier sets money at central banks (MB) in relation to broad money (M1-M4).

![]() The money multiplier, also defined by 1/r, one divided by the percentage of required bank reserves, describes the relationship between money at the central bank (the monetary base) and broad money (M1 to M4).

The money multiplier, also defined by 1/r, one divided by the percentage of required bank reserves, describes the relationship between money at the central bank (the monetary base) and broad money (M1 to M4).

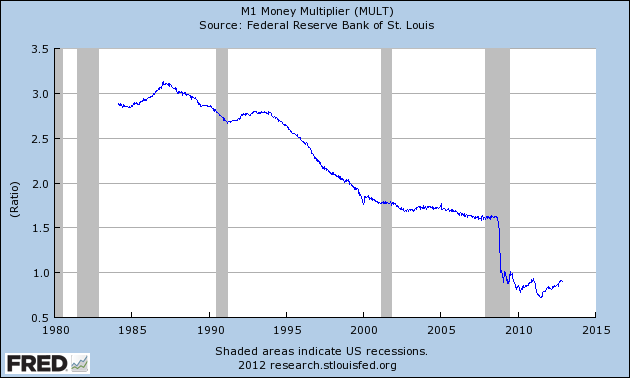

The M1 money multiplier in the US and Europe is typically bigger than 2 during periods of high growth and higher interest rates. It is low (smaller than 2) during phases of slow growth. Most recently the M1 money multiplier in the United States has been even lower than 1, which means that one dollar provided by the central bank leads to less than one dollar in the real economy. This phenomena is a symptom to the failing monetary transmission of central banks like the ECB or the Fed and quantitative easing by the Fed, the BoJ or the BoE.

This failing monetary transmission concerned only certain countries like the U.S., the U.K. and most parts of the Euro zone, areas that still produce 40% of global GDP.

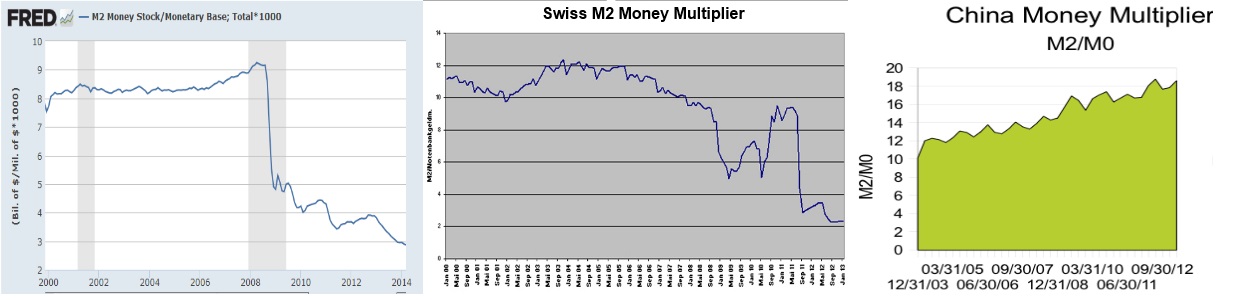

We think that globally we have to distinguish three categories for the M2 money multiplier:

- “QE” countries (Quantitative Easing): These are the ones where the M2 multiplier has fallen since 2008; economies have slowed because economic actors are reducing debt; wages are near to stagnant in nominal terms or sometimes even falling. The central banks are using QE to push up asset prices. Since asset purchases are not limited at country borders they push up asset prices of category 2 countries and until 2010 the ones of category 3 upwards.

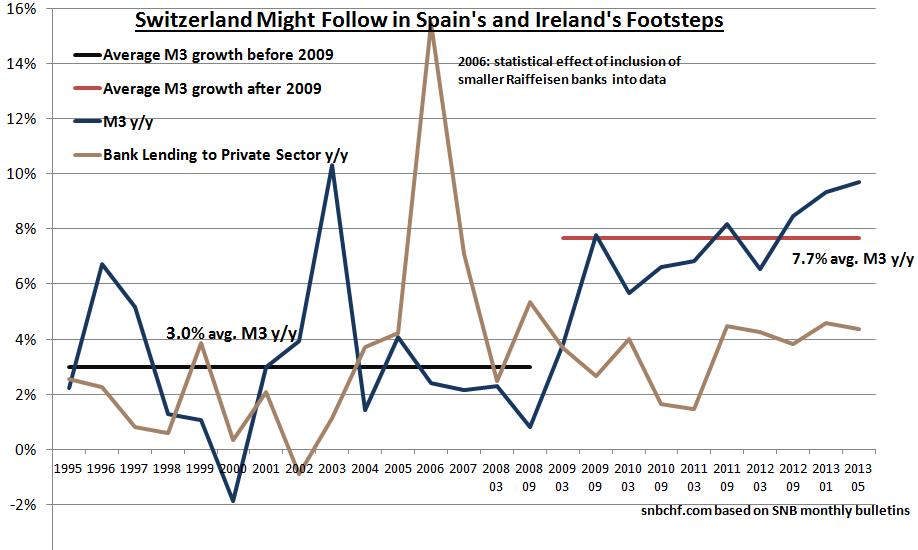

- “QEE” countries (“Quantitative easing or exchange intervention”): The money multiplier has fallen since 2008. But the economy, wages and credit are expanding normally, real wages are rising. The weaker money multiplier mostly stems from currency interventions: central banks have extended the MB strongly while broad money aggregates expand at normal levels. Concerned nations are e.g. Switzerland, the Czech Republic, South Korea, Singapore, Hong Kong and Taiwan. See the piece on QEE countries by the chairman of India’s central bank Rajan. But as FT Alphaville and implicitly Hans-Werner Sinn explain, Germany is also at the QEE forefront via artificial credit easing from German savers to the periphery executed by the ECB and Target2.

- Countries with weak asset price manipulation: Countries where the M2 multiplier is increasing like in China, Brazil, Indonesia or India. Central banks are tightening because wage growth, investment and inflation was excessive. Due to high wage growth, company margins are shrinking, stock prices cannot rise any more, while home prices still move with money inflows and perceived inflation. Interest rates are high, hence higher level monetary aggregates are quite big. Often money and credit are insufficient, at least compared to the wishes of the economic actors to invest. The central banks are able to steer broad money with the monetary base, just as described in our old textbooks. When QE finishes, it should have a negative “dry-up” effect for countries like Brazil, Indonesia or India and partially for China.

Since 2008, both Swiss broad money supply and credit has risen far more quickly than in the euro zone. QEE countries like Switzerland might face high inflation, once the U.S. and the Euro zone (ex Germany) leave their “secular stagnation”.

Anybody speaking of “secular stagnation” has lost the global picture: Some countries slowed due to excessive spending and lax central bank policy before 2008. With excessive spending, wages rose too much, so it is perceived today as a competitiveness issue, in particular in Southern Europe and partially in the United States.

Unfortunately the QE countries make up (still) a big part of global GDP and determine the myopic views of English-speaking and IMF economists. Since 2009 the world as a whole has expanded quite well, just far less than during the debt-financed bubble years before 2007, but similar to in the 1980s. In the 1980s there was also lackluster growth after strong U.S. monetary expansion in the 1970s that spilled over into rising growth and debt in Southern America and Europe. This is the same picture we saw in the Emerging Markets in 2010/2011 and that caused a boom-bust cycle.

We think that only one single QE operation was needed and that was QE1: the remaining ones including QEE were unnecessary and caused a boom-bust cycle in the category 3 countries and will cause them in the category 2, in the QEE, countries.

Five years after a crisis that was mostly isolated to category 1 countries, we think that it is time to finish all sectarian economic approaches like MMT or New Arthurian Economics that want to use fiscal expansion to fight missing competitiveness. Still we agree with them that fiscal policy would have been more effective during their crisis years because the spill-over effects of monetary policy are avoided. The desire to pay down debt comes from human nature and is healthy, but does not need to be enforced by fiscal policy like New Arthurians advocate.

Both Southern Europe and the U.S. are achieving competitiveness thanks to stagnating wages compared to rising salaries in category 2 and 3 countries. Improved current accounts and low bond yields in the European periphery are one sign of this rising competitiveness. We reckon that the U.S. will follow them in the future and reduce the trade deficit.

Reference:

See more for