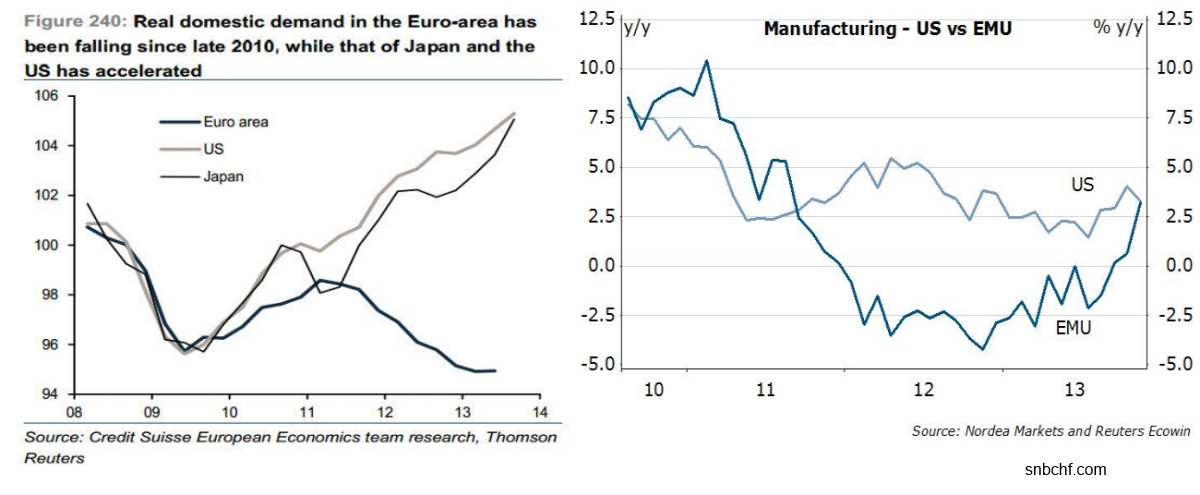

The concerted actions in Summer 2012 by the two biggest central banks in the world reflected two fundamental economic principles:

- The Fed opted for Keynes’ law, “demand creates its own supply,” i.e. sustain U.S. housing with QE3, foster U.S. consumer spending and decrease their savings.

- The ECB opted for Say’s law, “supply creates its own demand,”. The conditionality implied an increase in the savings rate, higher investments, lower prices, higher exports and improved competitiveness for the European periphery, so-called “supply-side reforms“.

While the European leaders considered it important to increase savings and stop excessive imbalances in Europe, somebody in the world needed to continue spending and keep the global economy afloat. Since the US dollar was the reserve currency and it was not expected that US borrowing costs would rise significantly, the Americans took the burden of spending and risked their long-term competitiveness.

Fostering demand is often easier than doing supply-side reforms and increasing supply. While in the 19th century Say’s Law was mainstream economics, the picture changed with the interpretation of the American Great Depression. Today, nearly the whole english-speaking press and leading economists like Paul Krugman are advocates of Keynes’ law.

This principle, however, led to two fateful experiences:

- The Great Inflation in the 1970s. In the early Eighties Reagan’s supply side reforms and Volcker’s tight montary policy could finish that period.

- The expropriation of the American middle- and lower class via excessive spending since the year 2000. Winners of this expropriation were the former war opponents China, Germany and Russia that managed to massively increase their net international investment position. And certainly the upper class profited because they could globalize their companies and investments.

Tyler Cowen: The Great Stagnation: How America Ate All the Low-Hanging Fruit of Modern History, Got Sick, and....

Just recently the IMF warned against deflation, but exactly dis- and deflation were Say’s ingredients that helped to improve competiveness and let to an impressive rise of Greek, Italian or Spanish stocks.

Markets would rather follow Say’s law and are not impressed by what Keynesian economists say. Deflation is for us an issue, only when the whole of Europe were in deflation. This is and will not be the case. The same interpretation gave Draghi when said during the last ECB press conference

A few Euro countries have deflation. Deflation might be a needed adjustment for them. We do not expect deflation for the euro area as a whole.

November 2013: ECB’s Application of Say’s Law Was Apparently Successful

By November 2013, the ECB seems to have had success. For three years demand has been rising in the U.S. and in Japan. Europeans are creating the necessary supply despite continued low European spending. Manufacturing is improving quickly. Spanish and Portuguese production rose by 3% y/y.

European leaders managed to halve peripheral bond yields using the following methods:

- They eliminated the current account deficits of the weak member states.

- They helped to increase supply in the export market. Exports of the weak members continue to rise (e.g. Italy to the right).

- They successfully reduced labor costs, prices and inflation in the weak member states, which helps to make their companies competitive.

- Finally, investments also seemed to improve. Capital goods production in the euro zone is up 4.7% against last year.

- They reduced the fear factor among Germans. Hence they helped to increase German spending. In 2013 the German export surplus decreased for the first time; spending and investments have started to accelerate in Q3/2013.

- One measure to reduce the fear factor was disinflation. Germans were fearing that their savings would be eroded by expansionary monetary policy and inflation. Germans are now finally reducing their savings rate. Investments in inflation-hedges like (German) real-estate are increasing only modestly, while they rose by 11% in 2011.

- Low inflation (e.g. Spanish food prices +1.2% in 2013) helps to compete against increasing German prices (e.g. German food prices +4.4% in 2013). This finally reverses a trend that came with the euro introduction and the common market. As an example, German competition helped to wipe out a big part of the Italian dairy industry. As opposed to 15 years ago, most dairy products in Italian supermarkets are today German or Austrian.

Say’s Law seemed to help the euro zone recover. Still, some time is needed; countries like France and Italy are still struggling. Italian food inflation is 3% and Italian wage increases of 1.5% are still too high, but despite that Italy has already managed to reduce the producer price index (PPI) by 2.3% y/y.

Read more: