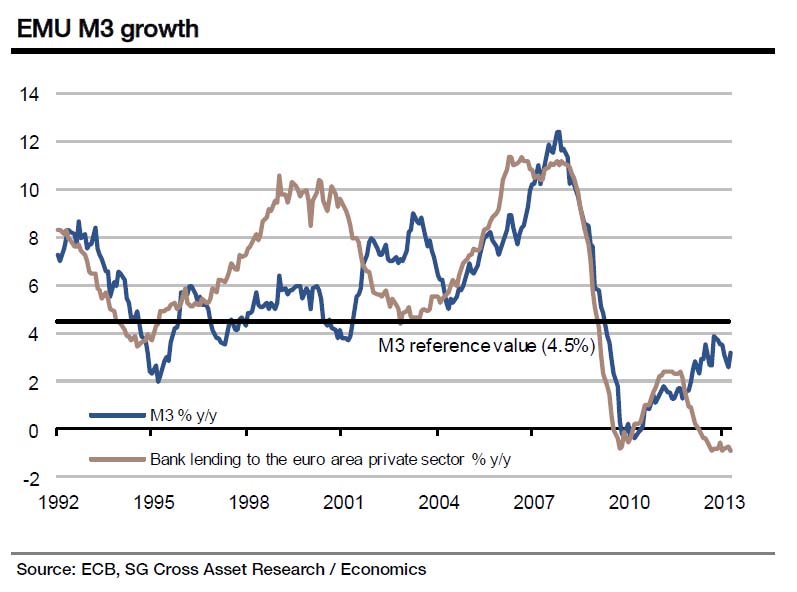

ECB’s monetary transmission seems to be broken still in 2013:

See more for

Transmission mechanism of monetary policy

This is the process through which monetary policy decisions affect the economy in general and the price level in particular. The transmission mechanism is characterised by long, variable and uncertain time lags. Thus it is difficult to predict the precise effect of monetary policy actions on the economy and price level.

The chart below provides a schematic illustration of the main transmission channels of monetary policy decisions.

Change in official interest rates

The central bank provides funds to the banking system and charges interest. Given its monopoly power over the issuing of money, the central bank can fully determine this interest rate.

Affects banks and money-market interest rates

The change in the official interest rates affects directly money-market interest rates and, indirectly, lending and deposit rates, which are set by banks to their customers.

Affects expectations

Expectations of future official interest-rate changes affect medium and long-term interest rates. In particular, longer-term interest rates depend in part on market expectations about the future course of short-term rates.

Monetary policy can also guide economic agents’ expectations of future inflation and thus influence price developments. A central bank with a high degree of credibility firmly anchors expectations of price stability. In this case, economic agents do not have to increase their prices for fear of higher inflation or reduce them for fear of deflation.

Affects asset prices

The impact on financing conditions in the economy and on market expectations triggered by monetary policy actions may lead to adjustments in asset prices (e.g. stock market prices) and the exchange rate. Changes in the exchange rate can affect inflation directly, insofar as imported goods are directly used in consumption, but they may also work through other channels.

Affects saving and investment decisions

Changes in interest rates affect saving and investment decisions of households and firms. For example, everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment.

In addition, consumption and investment are also affected by movements in asset prices via wealth effects and effects on the value of collateral. For example, as equity prices rise, share-owning households become wealthier and may choose to increase their consumption. Conversely, when equity prices fall, households may reduce consumption.

Asset prices can also have impact on aggregate demand via the value of collateral that allows borrowers to get more loans and/or to reduce the risk premia demanded by lenders/banks.

Affects the supply of credit

For example, higher interest rates increase the risk of borrowers being unable to pay back their loans. Banks may cut back on the amount of funds they lend to households and firms. This may also reduce the consumption and investment by households and firms respectively.

Leads to changes in aggregate demand and prices

Changes in consumption and investment will change the level of domestic demand for goods and services relative to domestic supply. When demand exceeds supply, upward price pressure is likely to occur. In addition, changes in aggregate demand may translate into tighter or looser conditions in labour and intermediate product markets. This in turn can affect price and wage-setting in the respective market.

Affects the supply of bank loans

Changes in policy rates can affect banks’ marginal cost for obtaining external finance banks differently, depending on the level of a bank’s own resources, or bank capital. This channel is particularly relevant in bad times such as a financial crisis, when capital is scarcer and banks find it more difficult to raise capital.

In addition to the traditional bank lending channel, which focuses on the quantity of loans supplied, a risk-taking channel may exist when banks’ incentive to bear risk related to the provision of loans is affected. The risk-taking channel is thought to operate mainly via two mechanisms. First, low interest rates boost asset and collateral values. This, in conjunction with the belief that the increase in asset values is sustainable, leads both borrowers and banks to accept higher risks. Second, low interest rates make riskier assets more attractive, as agents search for higher yields. In the case of banks, these two effects usually translate into a softening of credit standards, which can lead to an excessive increase in loan supply. (source ECB)