The chapter contains the following sections:

- The Fed’s FOMC Composition: Who is Hawk, Who is Dove?

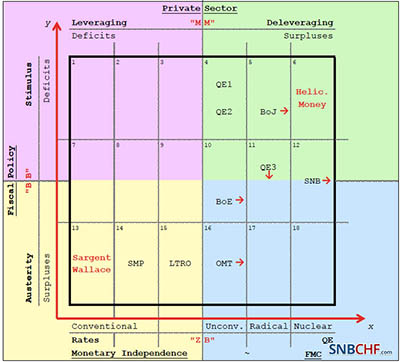

- Quantitative Easing, its Indicators and the Swiss Franc

- The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

- A Monetarist Approach: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

- What Drives the Economy: Consumer Spending or Saving/Investment?

- How European Leaders Are Successfully Implementing Say’s Law

- Introducing the “reverse Volcker moment”

- Helicopter Money against Animal Spirits and our Critique

- Which Primary Surpluses are needed for EU Members?

- The Natural Rate of Interest/Taylor Rate

- Definitions of money supply in the context of the SNB

- ECB’s Monetary Transmission

- Bank of Japan Balance Sheet

- History of Bank of Japan Interventions

- The ECB interventions in the year 2000

- Why negative interest rates are contractionary, the base money confusion

- What Drives the Economy: Consumer Spending or Saving/Investment?

- Why negative interest rates are contractionary, the base money confusion

See more for