The Rube Goldman machines

We normally like to keep things simple and do things the easy way, but we’re completely fascinated by Rube Goldberg machines. They require a level of skill and patience we doubt we’ll ever posses and they’re the ultimate expression of doing something just because you can.

Keep It Simple, Stupid or kiss goodbye to your money

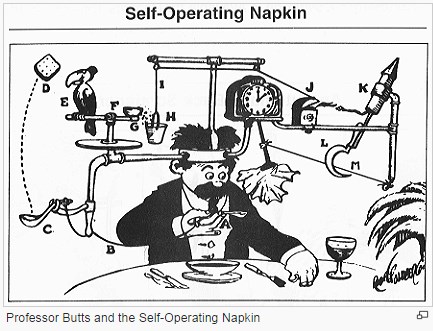

Investors sometimes are tempted to build convoluted Rube Goldberg-type contraptions to tell them when to buy and sell a stock. Goldberg was a newspaper cartoonist whose work was syndicated in the 1920s and ’30s. His trademark was sketching unnecessarily complicated machines to do something simple, like using a 13-step device to wipe your mouth with a napkin.

To help you with your investment decisions the following effective investment guidelines are offered because of their elegant simplicity:

- As a bull, ensure that you are in an up-trending market

- Find a stock with elite fundamentals

- Wait for a support base to form after a prior uptrend

- Buy the stock when it breaks out of the support base in strong volume

- Cut your losses quickly if the stock fails

Granted, mastering these simple steps takes time, study and practice. You have to learn what constitutes an elite stock, a proper base and a healthy market. Perhaps the greatest challenge is to gain the self-discipline needed to follow these rules.

Every rule counts

Murphy’s Law tells you that the most painful loss is when you ignore any of these key rules. Maybe you thought that buying during a market uptrend could be ignored because you had identified an exceptional stock. Or maybe you thought a breakout was worth buying even though it lacked convincingly strong volume. Or lastly, maybe you thought on July 13, 2011 that you could ignore the 8-10% sell rule “just this one time” only to realize that by September 29 your favourite stock Netflix would fall by 62%!

The key word in all these instances is “discipline”. Rules are formed from experience and are designed to keep the easily seduced investor on the straight and narrow path to profit. Yet, no rule can work if it isn’t followed. So if you decide to make an exception to a rule, the sacrificing of your beloved money on the “alter of heavy losses” is no solace either for your self-esteem or your diminished bank balance.

Many investors however do sacrifice their funds because of their lack of appreciation of the system these rules engender. If you are new to this style of equity investing, you probably shouldn’t risk too much money while you are learning to master these skills, because otherwise the mistakes you could make can be rather bloody.

Avoid unnecessary complexity

Another violation involves the Rube Goldberg-type of investors. They are those who can’t resist adding as many indicators as possible to help them ‘see’ the market’s hidden signals. This is naïve because often several indicators do the very opposite of what is intended by clouding judgment with divergent signals, instead of giving the confirmation that is sought. It is therefore advisable to limit yourself to not more than two well-tried indicators that measure price and volume action reliably. This is because these components tell the whole story better than any other tool in use.

If that sounds too simple, think of it this way: A sport scout’s main impression of a prospective player invariably comes from watching him or her in action and not from just how fast, strong or motivated the candidate is.

Grail Securities (Switzerland) follows this way. It offers you a simple way to high returns avoiding high risk and complications.

Read more