As you may have expected, last week the market moved more into wind-down mode as the week progressed and dosed to a near-sleep on Friday’s half-day with the S&P500’s volume down 53%. This is the usual script at this time of year, so that the market ignored the WTI crude oil price, which it had recently been closely correlated to, when it moved from last week’s close $34.73 per barrel to this week’s price of $38.10, an increase of 3.38%.

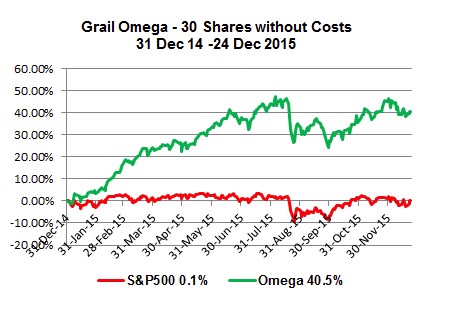

The market still languishes in its ‘under pressure’ stasis, although the S&P 500 pushed up through its 500-moving average, but only just, and is resting on its 200-day moving average. Looking back down the year, the S&P 500 needle has only moved finitely to end the week barely in plus at 0.1% year-to-date! The index had peaked as far back as on 21 May, when it reached 2130.81, or +3.49% from year’s begin! Since then is has slid from peak to trough losing 3.28% to-date from its May highest high! Also given that the prices of 5,529 of the market’s 8,288 stocks, or 66.7%, are at zero or less for the year, Grail portfolios on the other hand have the propensity of generating more than 30% returns per annum, as this portfolio shows.

Russ Koesterich on the 2016 profit recession

Russ Koesterich of Blackrock believes that the market is experiencing a profit recession. To watch the video press Ctrl + Click. If so, equity markets will experience more of the same pain next year. The global economy will be even worse off as it moves through its recessionary cycle. However, in contrast, Grail portfolios will continue to show very attractive earnings growth, since their average earnings surprise over 5 quarters is $0.06

In 2016, the majority of banks and finance companies are likely to suffer from Koesterich’s predicted profit recession, because of the mediocre to poor returns generated this year, and which will continue to proliferate in client portfolios next year. Thus those entities, which are unable to embrace the challenges of the Post-QE3 era, are therefore likely to experience further profit contraction. On the other hand, those that are able to adapt to the changing market forces by offering proactive high-Alpha portfolios and management can expect to achieve a sustainable competitive advantage by attracting a genre of investors who seek the low risk and high returns that is the hallmark of all GRAIL portfolios.

Click on the video for a full view.

See more for