The rise of the emerging markets was strongly facilitated by the housing, credit and spending boom in the United States between 2002 and 2007. After 2008, cheap Fed interest rates further facilitated the emerging markets boom, even if the U.S. consumer slowed spending.

The period can be subdivided into

2002-2007: Emerging Markets and Commodities Boom based on US and Southern European Trade Deficits

2008-2009: The short-lived so-called “Great Recession”

2009-2011: Emerging Markets Boom Continued, transforming in a Bubble thanks to Fed Easy Money

Thanks to cheap money from the Federal Reserve and heavy fiscal spending in China, the boom in the emerging markets continued, while spending in the U.S. and in Southern Europe significantly slowed.

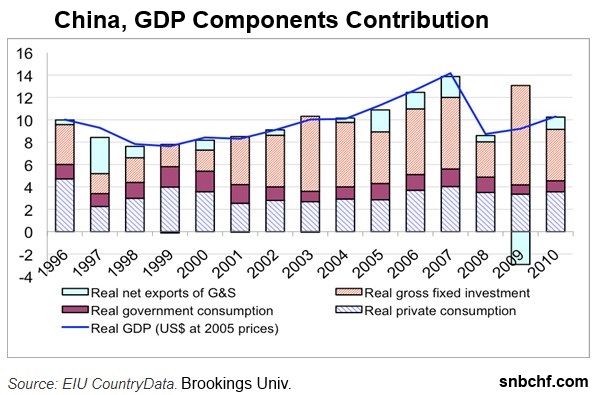

Source Brookings click to expand

As opposed to the 1970s, rising demand was accompanied with increasing global supply and easier ways of communication and transportation. This was visible in the trade surpluses of emerging market economies. Cheap Chinese products helped to slow inflation in developed countries and to boost expansion – the BIS speaks of 1% additional GDP growth. While China grew thanks to gross fixed investments and net exports, the United States and Southern Europe concentrated their growth on consumption and real estate investments.

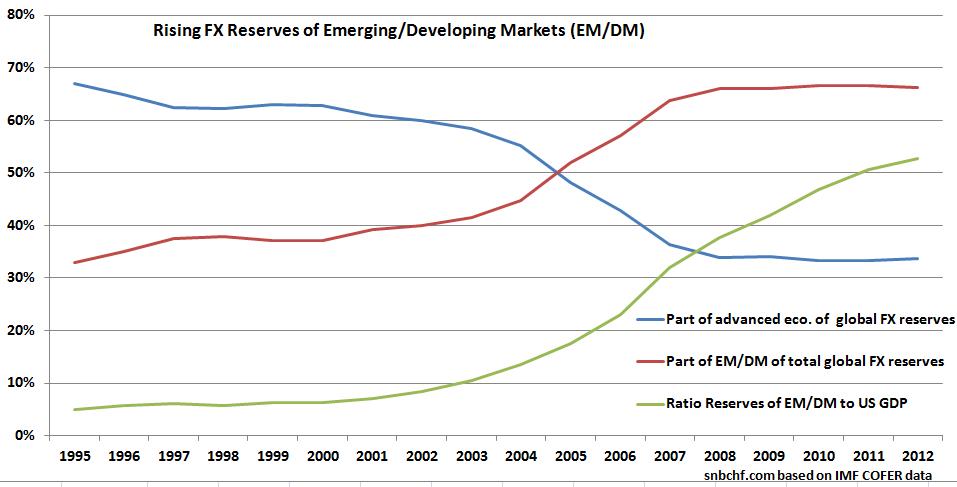

From 2001, emerging markets were progressing and increasing their wealth, FX reserves of emerging and developing nations rose from 5% to 50% of US GDP. The success of emerging markets drove commodity demand and prices up. Due to the American reliance on imported oil – the dollar fell constantly.

From 2001, emerging markets were progressing and increasing their wealth, FX reserves of emerging and developing nations rose from 5% to 50% of US GDP. The success of emerging markets drove commodity demand and prices up. Due to the American reliance on imported oil – the dollar fell constantly.

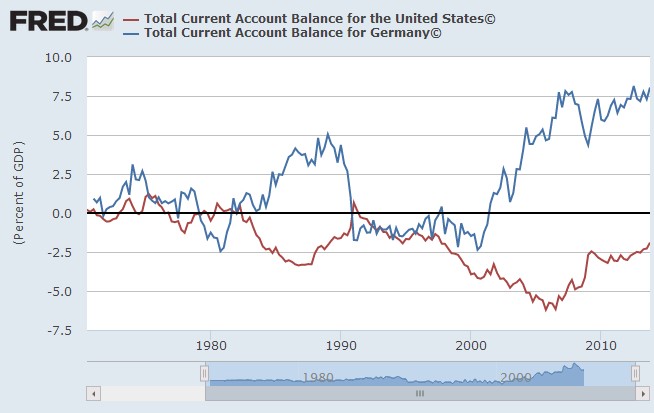

A decade of weak German spending, private debt reduction and huge current account surpluses followed. Germany, who was weak in the previous financial cycle, managed to become strong thanks to stagnating salaries. Finally, the global imbalances between strongly spending countries and nations with heavy trade surpluses led to the financial crisis of 2008.

A decade of weak German spending, private debt reduction and huge current account surpluses followed. Germany, who was weak in the previous financial cycle, managed to become strong thanks to stagnating salaries. Finally, the global imbalances between strongly spending countries and nations with heavy trade surpluses led to the financial crisis of 2008.

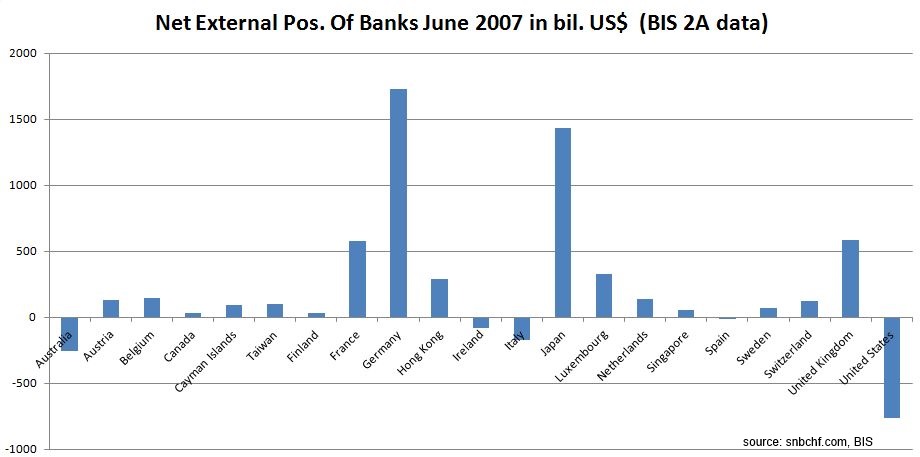

This was visible in the massive improvement of the German net external balance. Between 2000 and 2007 the Germans overtook Japan: Many creditor countries are located in the Emerging Markets and not visible in the graph. The increase of FX reserves at their central banks was partially neutralized by rising foreign debt.

FX Markets:

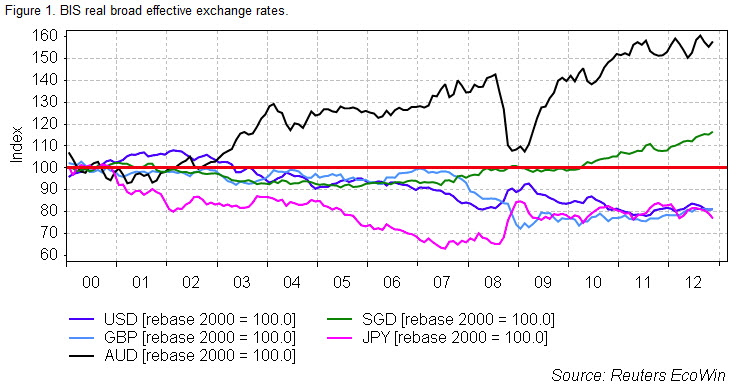

Between the years 2000 and 2007/2008 the Australian dollar, British pound, the euro and even the US dollar – but only between 2005 and 2006- appreciated, especially against the Japanese yen and the Swiss franc. The so-called global carry trade was on vogue.

Between the years 2000 and 2007/2008 the Australian dollar, British pound, the euro and even the US dollar – but only between 2005 and 2006- appreciated, especially against the Japanese yen and the Swiss franc. The so-called global carry trade was on vogue.

<– Back to Financial Cycles Overview

See more for