In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

The Strong Dollar, Difference between the 1980s, 1998-2002 and Today Part 2

(originally written in July 2013)

In the first part we examined the relationship between strong dollar phases and austerity in other parts of the world. Between 1983 and 1985, reasons were the high real interest rates in the U.S. after the defeat of the Great Inflation period, the enforced austerity in South America and cheap commodity prices caused by generally low global growth.

Between 1997 and 2002 the dollar was strong, because Germany had to finally digest the high costs of the reunification. Eastern Germany was still missing competitiveness and unemployment was high. Whole Europe implemented austerity to get ready for the euro, France and Italy even achieved trade surpluses. European surpluses flooded into the United States to benefit from the dot com bubble, higher Fed rates and strengthened the dollar.

Today European austerity depresses spending and weakens Chinese exports and growth.

See also the third part from September 2014: A weak global economy, tight monetary policy in China and Emerging Markets, European austerity, the ECB and falling oil prices have effectively strengthened the dollar and the ISM Manufacturing Index.

The Dollar, the ISM, Buy American and Irrational Exuberance

Former central bankers, fund managers and traders bet on stronger dollar

From Track, FX Concepts

In March 2013, Track hosted its March Idea Dinner, which brought together an assortment of analysts, former central bankers, traders, and fund managers.As mentioned in the discussion above, the United States is seen as the beneficiary of a number of special circumstances keeping it afloat. The USD would appreciate on the weakness of a number of other world currencies (especially in the case of a currency war), and intimations of an earlier end to easing also serve to strengthen the dollar. Using the dollar index (DXY), 84.10 was seen as a good target….

Short EUR. This trade is predicated on continuing weakness and turmoil in the Eurozone, as well as poor technical in the Euro. 1.23 was set as a target for June, and a 1.24.-1.20 put spread was advised.

We already mentioned that Pictet has become “secular” dollar bulls.

JP Morgan’s FX Pulse

warned about the risk linked to a valuation increase of a currency used for more than a decade for funding purposest (see The Underestimated USD Shortage , June 7, 2012). Then, [they] estimated that the size of the global private sector USD short position was USD 2.0 – 2.5 trn.

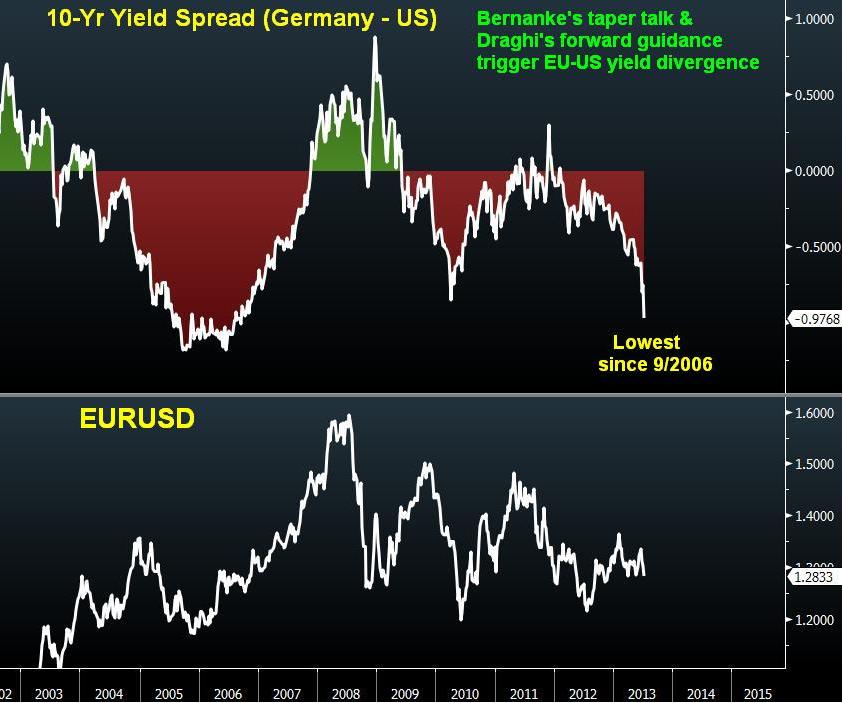

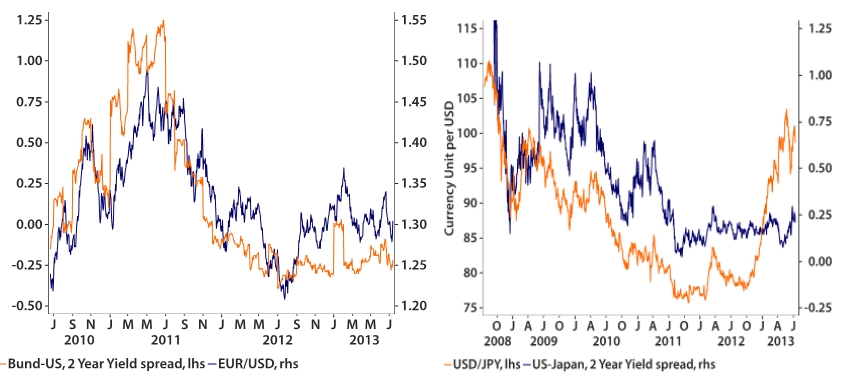

Ashraf Laidi claims that the difference between U.S. and German 10 year yields would lead to further longer-term euro weakness, when foreigners buy U.S. bonds. Reasons for the red and green phases in the picture below were often rate or inflation differentials.

In summary, nearly the whole “smart money establishment” thinks that the dollar and the U.S. economy will be strong in the coming year(s) or even “secular”, i.e. for a century.

Till now, this euro weakness has not happened. On the contrary, the euro is far stronger than one year ago.

The Strong Dollar in the Early 1980s

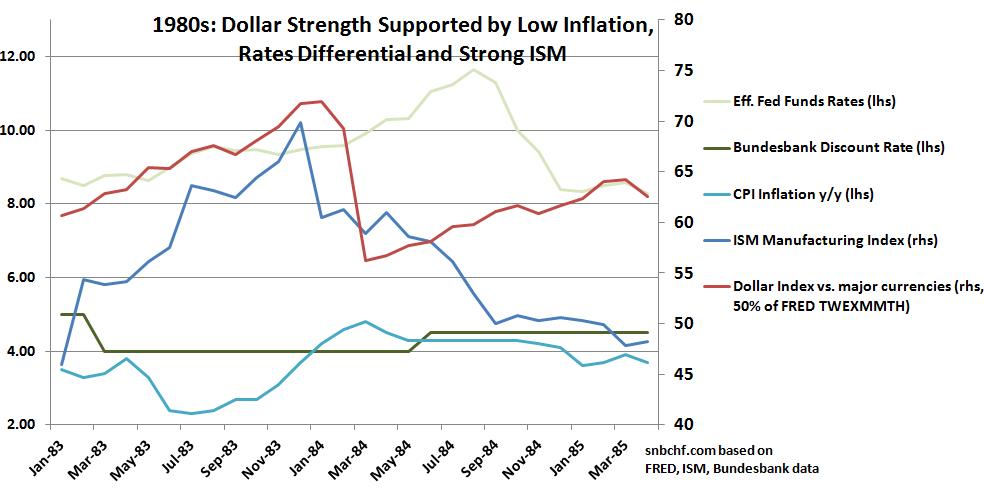

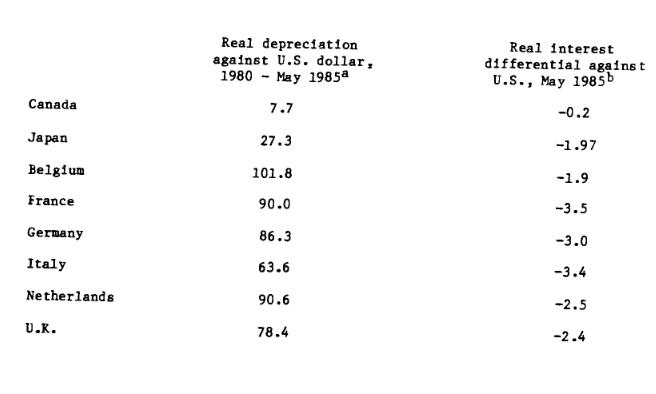

During the early 1980s the U.S. paid far higher interest rates than its major peers, e.g. Germany here. The difference between the U.S. central bank and money market rates were 5% to 7% (see lhs below).

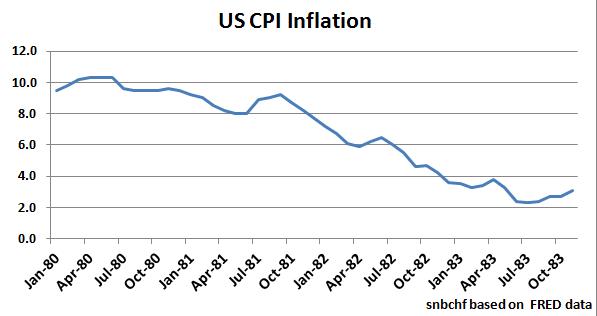

Strong U.S. manufacturing with levels up to 71 was achieved thanks to Volcker’s high interest rates, these high rates ended the Great Inflation period, but slowed growth in South America that was dependent on U.S. funds. Europe slowed similarly and thanks to lower inflation globally (most importantly the US), the Bundesbank was able to cut rates in 1983. The strong dollar period intensified.

However already in 1984, strong U.S. manufacturing ended, but thanks to a big interest rate differential the dollar remained strong.

With the rate cuts at the end of 1984, and definitely with the Plaza Accord in September 1985, the strong dollar period finished. The dollar index topped at 143 in February 1985.

The period between 1998 and 2002

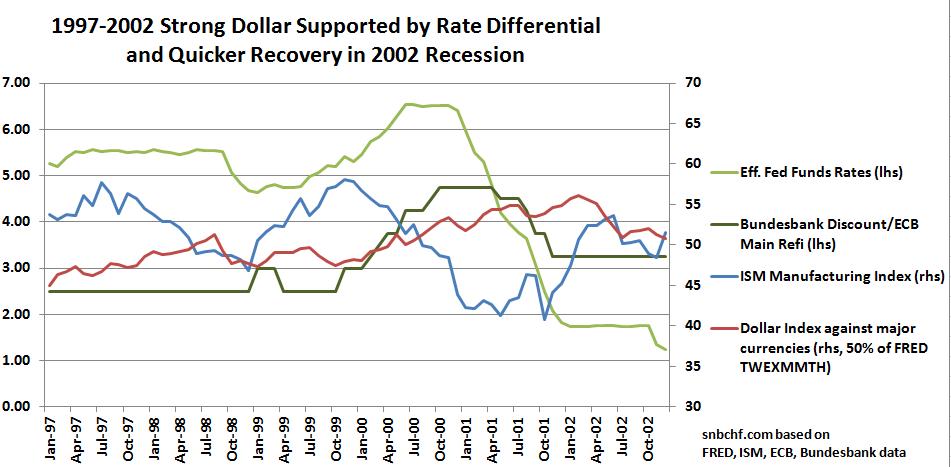

In the first part we spoke already about two major reasons for the strong dollar during that period: European austerity and the U.S. dot com bubble. Again the strong dollar was sustained by rate differentials. Thanks to big Fed rate cuts from 6% to under 2%, the American economy exited the 2002 recession more quickly, visible in the strong ISM.

From September 2002 on, from a level of 110, the dollar started its descent because the European and Asian economies recovered. Be aware that the dollar index top of 110 is already far lower than the 143 in 1985. Already in 2002 the U.S. had structurally high inflation due to long distance/expensive fuel and old infrastructure compared to other nations.

2013: Is a longer strong dollar period possible?

Similarly as above we look at the ISM Manufacturing, interest rates, the Fed and current accounts.

1) ISM Manufacturing index

The ISM is declining and not rising like during the strong dollar periods. This is despite the recent increase in U.S. unemployment figures that were more concentrated on the services sectors, e.g. part-time jobs in hospitality. The weak ISM manufacturing index, however, indicates that there is no replacement of foreign goods by American ones. Foreign goods must be paid for in foreign currency, which weakens the dollar.

2) Interest rates

Higher U.S. rates would drive money market funds to the United States and strengthen the dollar. The graph shows that the differential for two year bond yields is at 25 bps in favor of the US. This is not enough to support the dollar against the euro. The yen, however, is weaker, because Abenomics and the negative Japanese trade balance weakened the yen far more than the small yield difference.

On the contrary, higher Fed rates would increase treasury yields even more than recently. This, however, could cause an explosion of US public debt.

3) Short dollar positions and Federal Reserve

The Fed has made clear that its policy will continue to be supportive, even if some tapering might occur. This implies, that the majority of the 2.0 – 2.5 Trillion USD short positions will be closed only in case of clearly higher rates (point 2) or a significant improvement of the US economy in comparison to foreign ones (see point 1).

None the less, many emerging economies and the Australian dollar have already suffered from slower global growth and the closing of some dollar short positions. Thanks to high current account surpluses, most European economies do not depend on U.S. funding and are not concerned by short dollar positions.

With expected Fed tapering, investors, especially hedge funds, sold off U.S. bonds, because the Fed might not buy them any more, but less because there is a sustained improvement in the U.S. economy. Ashraf Laidi suggests that foreigners will buy U.S. bonds instead and, as a consequence, sustain the dollar. The question is if rather risk-averse foreign long-term investors would accept currency risk now.

4) European current account surpluses

A stronger US economy would also mean that the huge European current account surpluses (see part 1 and the basics of the carry trade) could be invested in the United States. Till now Europeans, especially German risk-averse investors, preferred to keep the funds in their country, because they did not believe in a strong U.S. economy. The German DAX and German Bunds are very expensive. In consequence, euros gained on trade surpluses remained in euro and strengthened the single currency. As mentioned above, the yen has depreciated not only due to Abenomics but possibly more due to the negative Japanese trade balance.

In summary, we judge that only “real economic improvements” like clearly higher U.S. GDP and strong manufacturing can strengthen the dollar. Moreover, higher short-term rates are needed. Greater 10 year bond yields only reflect higher inflation expectations, rising house prices do not necessarily translate into GDP growth, more (part-time) jobs in hospitality and other services are not sufficient.

On the contrary, these small improvements have translated so far into higher crude oil prices (108$ instead 88 in December), 2.5% higher producer prices and a 1.8% higher CPI. Despite so-called “US energy independence“, higher prices should imply a weaker US trade balance and a GDP growth rate at nearly stall speed.

The final issue is that, as soon as real improvements arrive, the weak US trade balance might foster foreign economies and their currencies. We do not live in the 1960s, 70s or 80s any more when foreign trade made up only a small portion of the US economy. This is where all these professionals possibly get wrong. There won’t be a repetition of a long-lasting strong dollar phase.

At the end, the dollar will remain just a safe-haven but not a risk-on currency. We think that EUR/USD (FXE) will remain mostly above 1.25 , gold (GLD) above 1100 in the coming years, as usual euro and gold higher during the summer driving season and lower in winter. As Ray Dalio stated one year ago, Europeans have started the reforms that the U.S. still must do, some speculation on US house price is not sufficient to boost the economy.

Interesting literature:

Krugman, Paul R. “Is the Strong Dollar Sustainable?” NBER 1986

This paper presents evidence strongly suggesting that the current strength of the dollar reflects myopic behavior by international investors; that is, that part of the dollar’s strength can be viewed as a speculative bubble. At some point this bubble will burst, leading to a sharp fall in the dollar’s value.The essential argument is that given the modest real interest differentials between the U.S. and its trading partners, the dollar’s strength amounts to an implicit forecast on the part of the market that with high probability the dollar will remain very strong for an extended period. The paper shows that such sustained dollar strength would lead the U.S. to Latin American levels of debt relative to GNP, which is presumably not feasible. Allowing for the possibility that something will be done to bring the dollar down before this happens actually reinforces the argument that the current value of the dollar is unreasonable.

See more for