Some extracts from BIS Working Papers No 419 Caveat creditor:

The Bank for International Settlement stresses the importance of getting “overlending” under control.

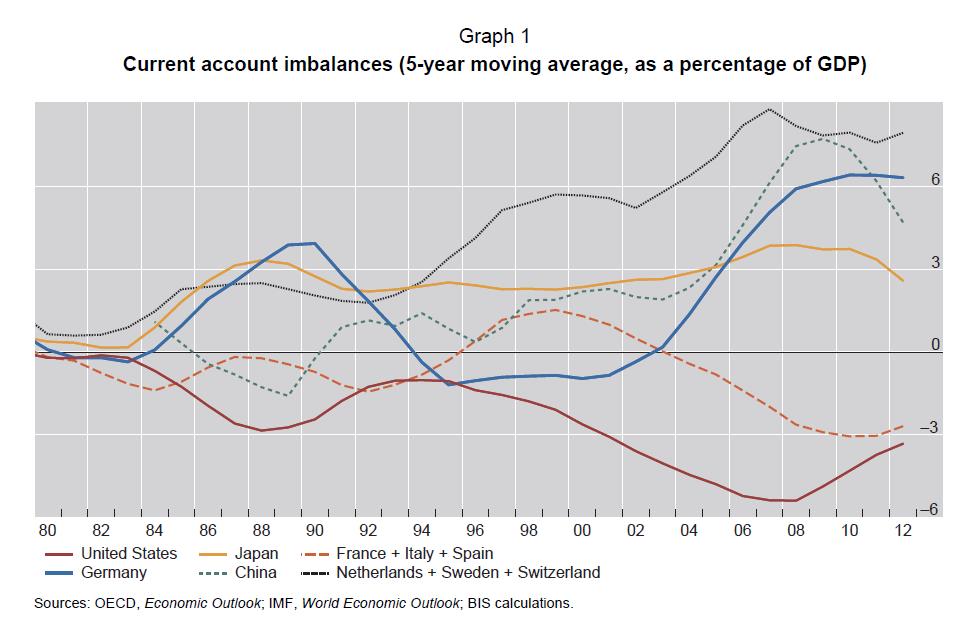

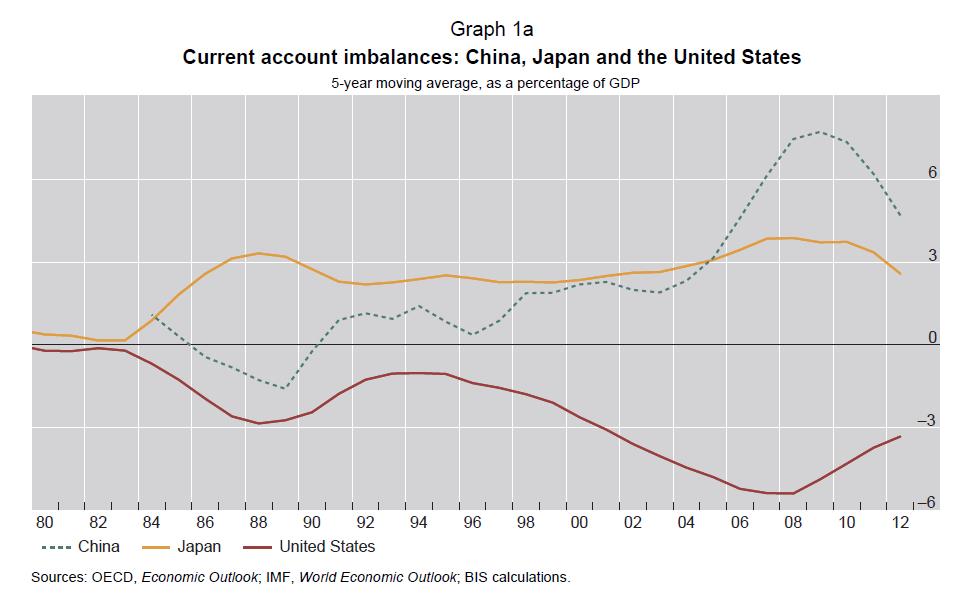

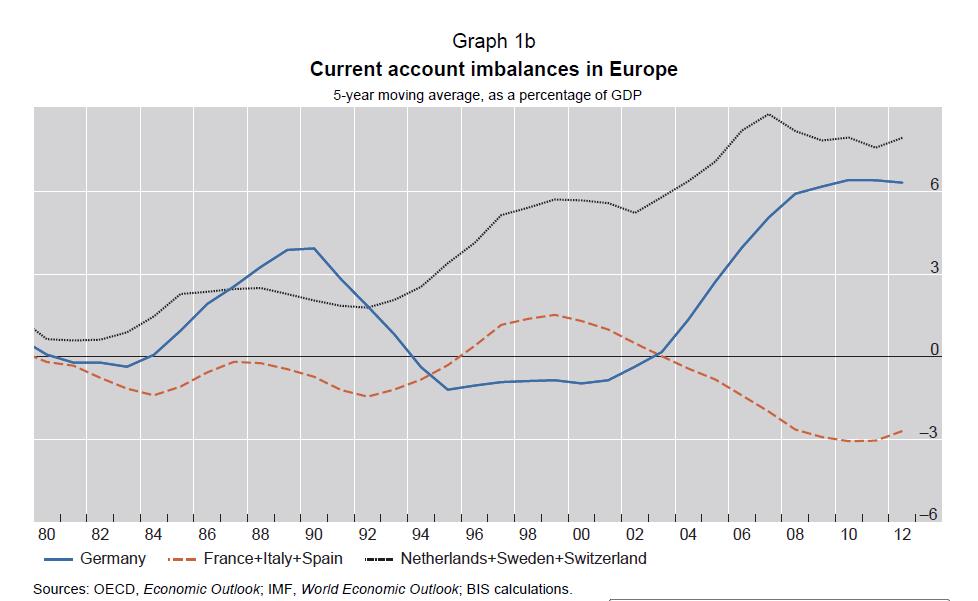

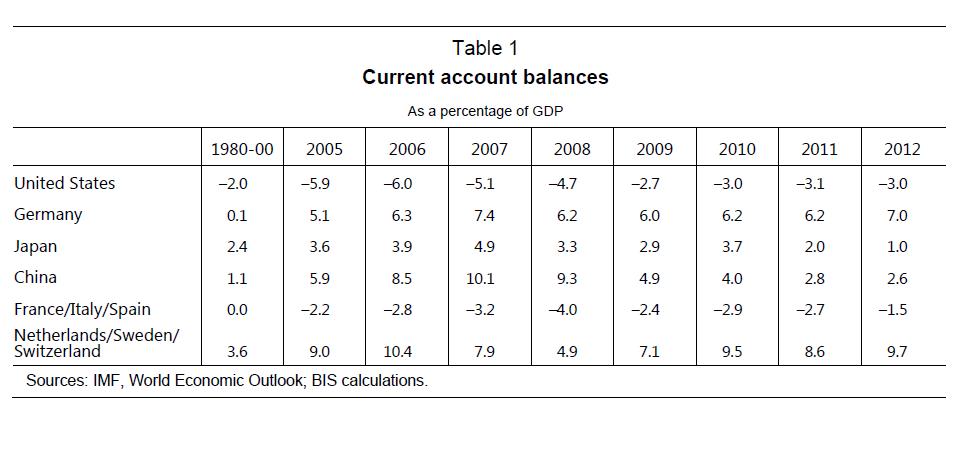

On macroeconomic grounds, the persistence of imbalances is surprising. Simple macroeconomic models suggest that imbalances should be self-stabilising and contain the seeds of their own correction. Monetarist models assume that current account surpluses expand the money supply and thus stimulate demand: this was clearly true under the Gold Standard. Keynesian models (with fixed exchange rates) view a current account surplus as an injection of aggregate demand, which ultimately stimulates imports and so leads towards a correction.

In both models, real exchange rate appreciation in surplus countries (depreciation in deficit countries) should contribute to international rebalancing. Moreover, flexibility in the nominal exchange rate can reinforce or accelerate these re-equilibrating mechanisms. Many economists, drawing on one or other of these models (often counting in addition on flexible exchange rates), have therefore dismissed worries about imbalances

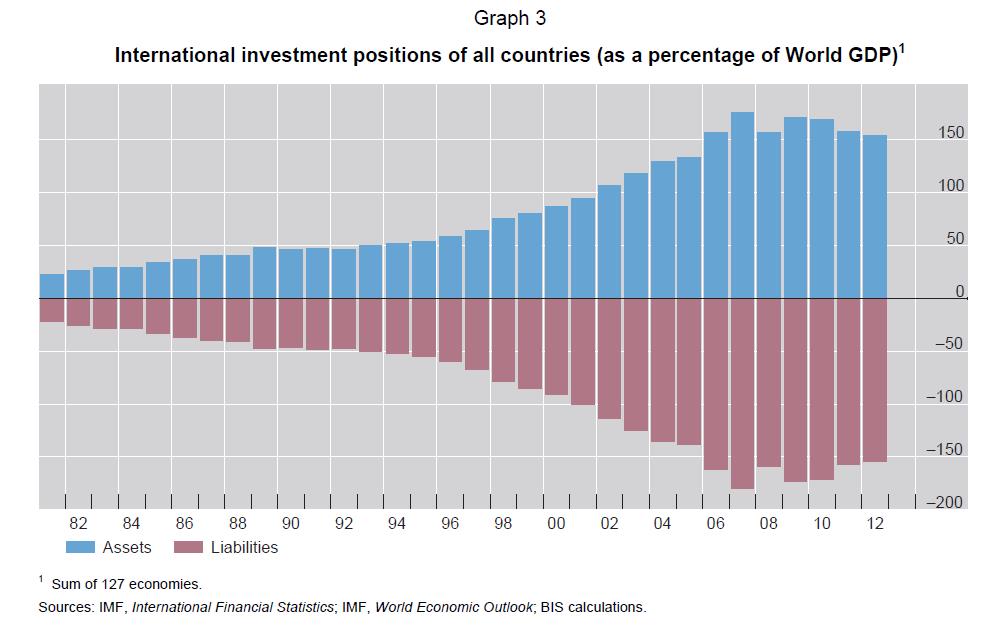

Yet the reality is very different from these simple theories. Why? The answer is finance: the nature of the external financing of imbalances creates its own dynamics. Imbalances are often corrected not because macroeconomic adjustments run their course, but because of a sudden stop in financing.1 At some point, creditors become worried that they may not be paid back. So they begin to refuse to finance debtors, and often do so in unison (“herding”). How easily the often-indiscriminate optimism in global financial markets which stimulates cross-border investment can turn to near-universal pessimism! As lenders face the prospect of capital losses, there is a “flight to quality”. Equally important is the “flight home” effect: home bias in financial portfolio allocation tends to reappear, sometimes abruptly, during periods of financial stress.

The conclusion from this history and from the recent crisis is the same: “overlending” was as responsible for the ensuing crises as was “overborrowing”. Foreign investors, who had sought higher yields in riskier capital markets, often pulled back sharply when a crisis threatened. Lending banks suffered losses and stopped lending. Such sudden reversals badly hurt borrowers, who would have been better served by more moderate lending restraint applied earlier.

Conclusion

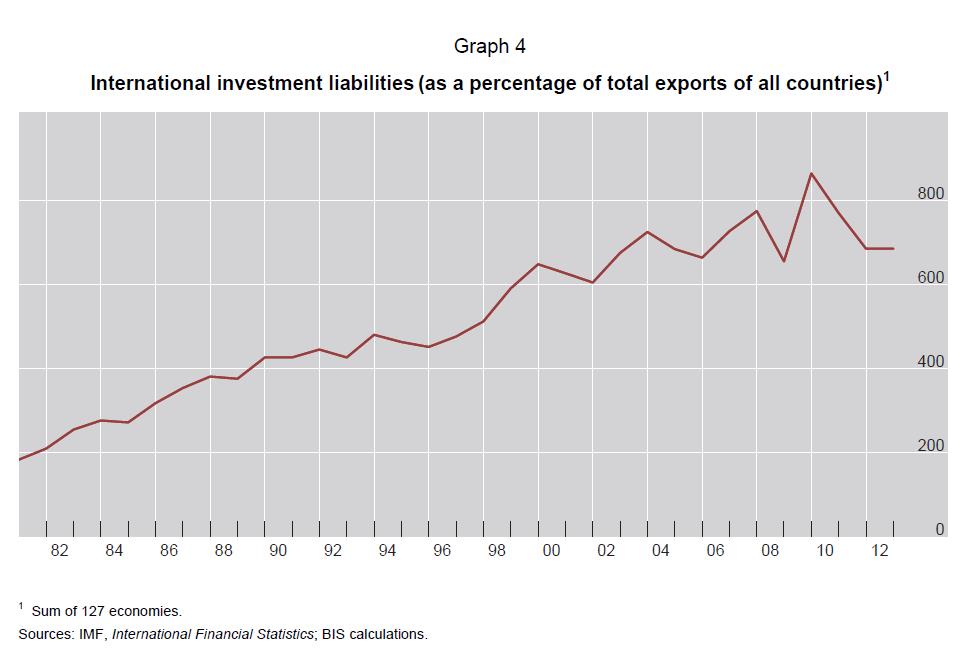

The financing of large and persistent external deficits often takes dangerous forms. Capital flow reversals, always difficult to predict, can have devastating consequences for debtors. The stock dimensions of external imbalances – net external positions, leverage in national balance sheets, currency/maturity mismatches, the structure of2 The contributions of Mateos y Lago (and other IMF economists), Truman, Reddy and Aglietta all put emphasis on this in their contributions to the Palais Royal Initiative. It has been on the agenda for international monetary reform since the Committee of Twenty in 1974. It is now on the agenda of the G20. It remains an important but unresolved issue of international monetary reform.

- Many cross-country studies have shown that higher current account deficits increase the risk of financial crisis. See Bush et al (2011). Gros (2013) has shown that there is a strong non-linear correlation between cumulative current account deficits in the euro area and the spread of government bond yields over German government bonds. [↩]

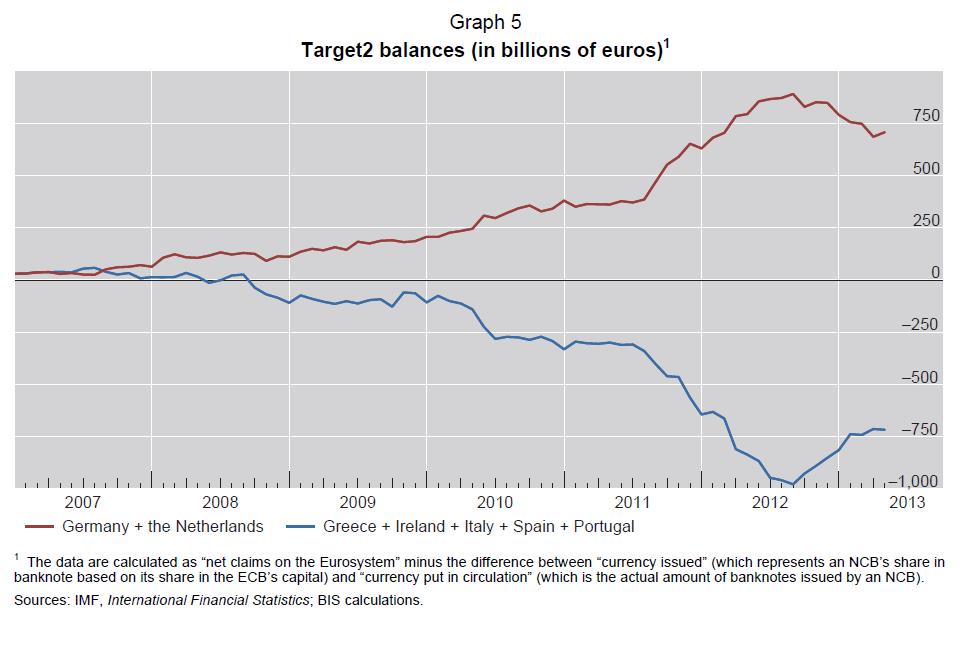

- As Allen and Moessner (2012) explain, euro area banks with surplus funds began to place them on deposit in the Eurosystem, and banks which were short of funds borrowed from the Eurosystem.

For these reasons, creditor countries have a responsibility both for avoiding “overlending” and for devising cooperative solutions to excessive or prolonged imbalances. The need for some symmetry in adjustment between creditors and debtors is hardly novel. It was central to Keynes’s proposals for international monetary arrangements in the post-war world. It is within the IMF’s mandate (although creditor countries, which do not need IMF money, are less susceptible to their influence).((The Articles of Agreement on the IMF did incorporate a scarce currency clause which permits tariffs and export restrictions on countries with persistent current account surpluses. But this clause, which was the only one referring to the responsibilities of surplus countries, has never been invoked. [↩]