The German Bundesbank decided to opt for full transparency of their gold reserves and their whereabouts since the second world war. Our details:

Extracts from a comment of the FT:

Most report, on a monthly basis, their gold reserves to the International Monetary Fund. But these data fall a long way short of full transparency. They tell us nothing about derivative positions in the gold market – for example gold loans, agreements for future sales or options transactions.They are open to the whims of whether individual countries decide to classify a chunk of gold as belonging to their “international reserves” or being held by some other state entity (such a as sovereign wealth fund).

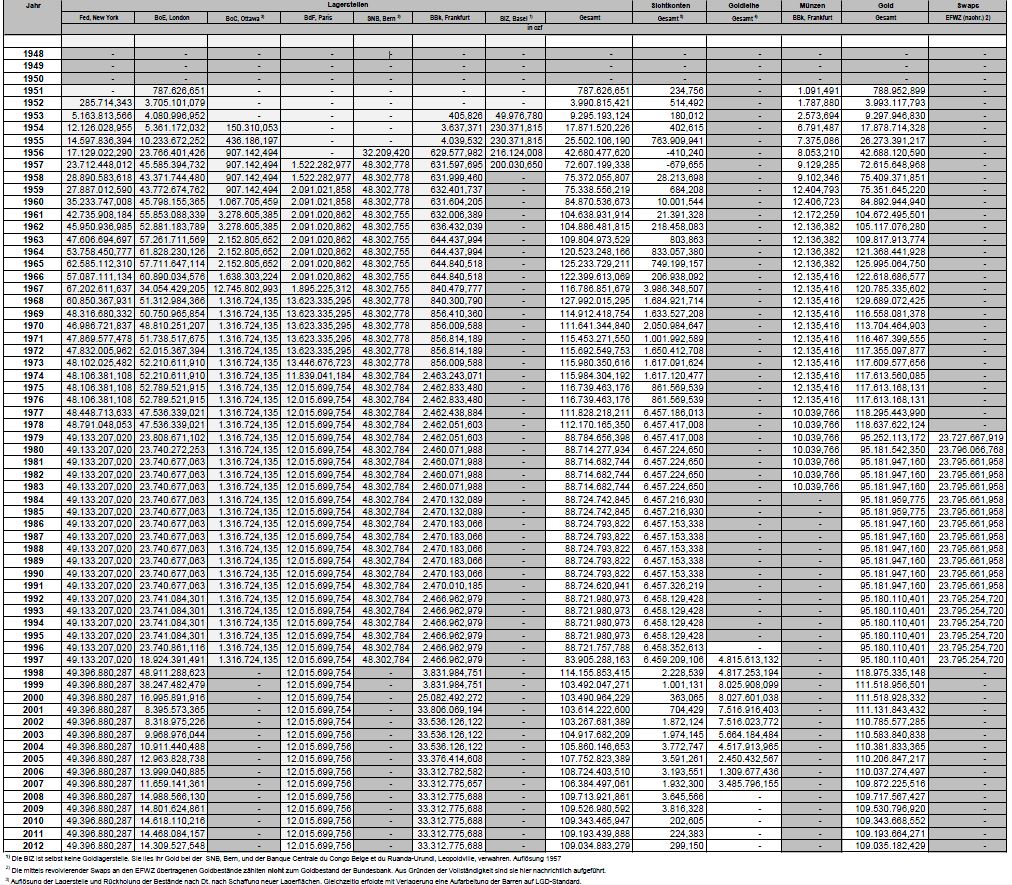

In one document published on its website this month, the Bundesbank lists, for example, each one of its gold transactions since 1951.

In another, it details how much gold it has held in each of New York, London, Ottawa, Paris, Bern, Frankfurt and Basel since 1951, and how much it was lending to the market at any one time.

. It also shows that the German central bank halted all gold lending activity in 2008 when the financial crisis began – presumably because of concerns about the credit risk of the banks it was lending to.The historical lack of transparency among central banks is somewhat understandable. With 29,500 tonnes between them (a decade of global mine supply), they have the ability to disrupt the market significantly if their trades are too public. See, for example, the reaction to the UK’s announcement that it would sell a large part of its reserves in 1999.

But there is a difference between revealing your trading strategies to the world and disclosing simple facts about your reserves – such as their quantity, where they are held, whether they have been lent or swapped, and so forth – with a delay if need be.

That the Bundesbank has been nudged into this new-found transparency must be chalked up as a victory for the groups of investors – most prominent among them, the Gold Anti-Trust Action Committee, or Gata – that have for years been asking central banks to reveal their activities.

If central banks wish to refute suggestions from such groups that their gold does not exist, or that they are scheming to manipulate prices, they could do worse than to follow the Bundesbank’s lead. (Source FT)

Click for next years

Year Change in 1000 ounces Biggest contributors to German Surplus Year end German Gold Position Remarks

1951 +788 BoE 789

1952 3203 European Payment Union (EPU) 3993

1953 5304 Fed (3700), BIS 9288

1954 8581 Fed (6400) EPU, BoE, BIS 17879

1955 8394 BoE, EPU, BIS 26273

1956 16464 EPU (13283), Fed 42688

1957 29922 EPU (31280) 72616 Excessive gold increase required revaluation of DEM

1958 2794 BIS (3482) 75409

1959 66 75432

1960 9542 BIS (6420) 84893

1961 19819 BoE(11137), 4003 (BIS), IMF(2571) 104672 Dollar devalued from 4.20 to 4 DEM

1962 443 105117

1963 4707 2248 (BoE), 1240 (Fed) 109818

1964 11528 2491 (BoE), 6414 (Fed), 6683 (BoE res. at IMF) 121368

1965 4591 BIS(3511), IMF(3911 Europ. state) 125995

1966 -3378 -2300 (Fed, BoE) 122619

1967 -1834 -3564 (Fed,BoE) 120785

1968 8842 10729 (BdFrance) 129689

1969 -13131 -14286 (Fed) 116558 US Dollar is devalued from 4 DEM to 3.66 DEM. Consequence: Losses in German BoP.

1970 -2854 -2798 (Fed, BoE) 113704

1971 2786 diverse 116487 Gold purchases in first months of 1971. DEM allowed to free float. May: US Dollar falls from 3.66 DEM to 3.32. Currency revaluations replace gold purchases.

1972 888 117355 Gold rises to 50 $ (inflation-adjusted 208$)

1973-1978 2000 Nearly any transactions

1979 -23386 -23386, IMF gold mechanism dissolved, remained gold returned to Fed 95282 goldprice 508$ (inflation-adjusted: 1697$)

1980 0 95282 gold price 573$ (inflation-adjusted: 2566$)

1981-1997 0 No transactions 95282

1998 +23723 23723 EFCF dissolved 118975

1999 -7456 -7456 for introduction of ECB and euro system 111519

2000-2012 -2500 for German gold coins -2500 for German gold coins 109035 yearly between 150 and 387 for gold coins

The full extract movements among gold depositaries is here (click to expand):

See more for