Foreign financing: The basics

Please understand that private savings finance not only the public deficit, but they also increase the current account surplus (read details). Understand the basics of the carry trade.

The balance of payments (BoP) has two major components: the current account and the financial (or capital) account. The United States has low savings and a negative current account. Therefore, they are obliged to achieve surpluses in the financial account, i.e. inflows of foreign capital (inflows of foreign current account surpluses).

Foreign inflows, e.g. from a surplus country Germany to the US, can happen via:

- The purchase of US treasuries (the US has the big advantage that it has the “world reserve currency”). Emerging markets’ central banks often buy treasuries with their surpluses. By design of the euro system, surpluses are first invested, via target liabilities inside the euro zone. Only if the whole euro zone has a BoP surplus, then the ECB obtains a surplus and could buy treasuries.

- Foreign direct investments (e.g. the German exporter that opens a plant in the US).

- Portfolio investments (e.g. a German investors buy US stocks or bonds, according to the Global Wealth Report, German rich investors only hold 8% North American stocks.)

- Bank loans (e.g. a German bank gives a loan to a US company). But German banks might prefer to repair their balance sheets instead giving loans.

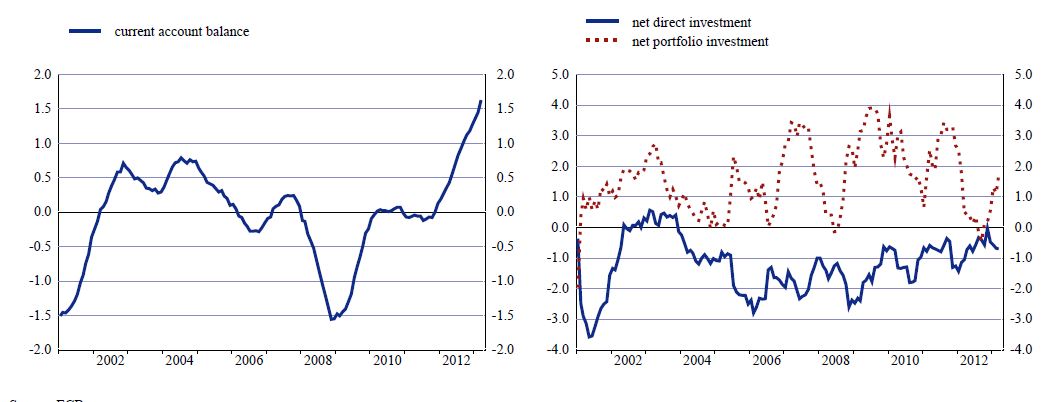

The balance of payments delivered by the ECB shows what was happening recently:

- The Euro current account is positive and rising.

- Euro direct investments are negative: European firms invest in the U.S.

- Euro portfolio investments are positive: US investors buy Euro money market funds again. In 2012 they left them out of simple fear.

The long USD, short EUR carry trade during the dot com bubble

Unfortunately investments in the US cannot offer the yields that emerging markets delivered in the last decade.

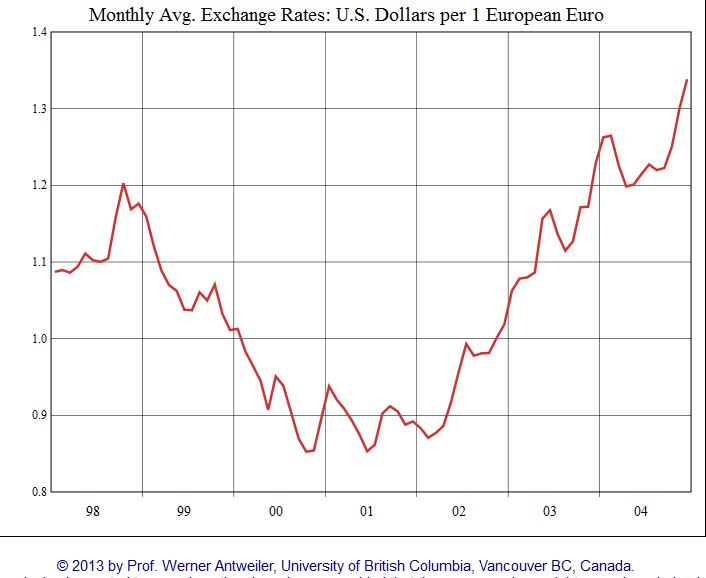

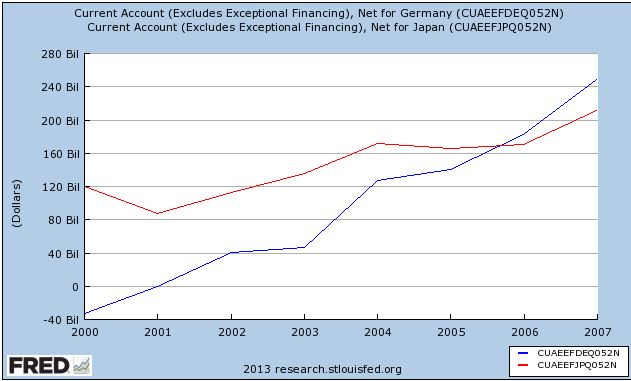

During the dot com bubble things were different: High German spending after the re-unification let the German current account balance become negative. High US treasury and investment yields made the dollar more attractive and let the EUR/USD fall to 85 US cents. With the end of this bubble, this carry trade finished and finally the European periphery investment bubble started.

The long EUR, short JPY carry trade during the sub prime and euro periphery bubble

German exporters started their success story and year for year they increased the German current account surplus. German banks invested in the periphery bubble and the euro continued to rise.

The Japanese current account, however, helped to finance the US sub prime bubble. This weakened the yen and let the USD/JPY and even more the EUR/JPY rise.

How can the dollar become stronger?

Looking at the balance of payments, there are four main possibilities:

- The Fed hikes rates: Portfolio investments will return to the US. However, doing this, the Fed could break the housing market.

- The Fed exits or announces the exit from QE. This actually happened in June 2013.

- The ECB reduces rates, the rate differential will reduce from the current 0.25%. Portfolio investments will return to the US. By August 2013, the probability of a ECB rate has diminished and consequently the euro has risen again.

- The US improves the current account deficit, this is long-term growth.

Long-term US growth and global imbalances

Long-term US growth can be achieved only with an increase in the US savings rate.

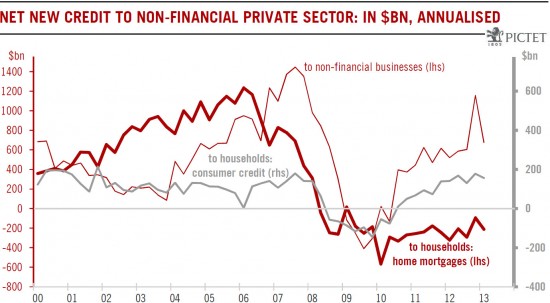

Rapid US growth cannot take place without a sharp recovery in fixed investment – which in turn must be financed by savings. If US domestic savings remain depressed, then either US fixed investment will remain low, which implies a slow US upturn, or the US must finance a new higher level of investment from abroad – i.e. there must be a new widening of the US balance of payments deficit.

Second, one of the major theories of the international financial crisis, outlined most influentially by Martin Wolf, chief economics commentator of the Financial Times, was that it would lead to an overcoming of “global imbalances“, that is the balance of payments deficit of the US and the surplus of China and other states, through an increase in US saving.

As the US balance of payments deficit, by accounting identity, is equal to the US shortfall of domestic savings compared to domestic investment, the US balance of payments deficit could decrease through either, or both, an increase in savings or a decline in investment. But, as shown above, US savings have stalled, and partially reversed, as a percentage of GDP at a historically low level. The improvement in the US balance of payments since the beginning of the international financial crisis is primarily due to a fall in fixed investment, not to a rise in savings. An analysis that international financial imbalances would be corrected via a rise in US savings has not been been factually confirmed.

These two issues are evidently interrelated. A major rise in US savings, which would permit an increase in US fixed investment simultaneously with a narrowing of the US balance of payments deficit, would provide the basis for relatively rapid US economic growth. The current factual trend, that of a continuing low level of US savings, does not permit rapid US growth except in conditions of worsening of the US balance of payments deficit.

The current trend of US savings therefore continues to point to relatively slow US growth unless the US is prepared to permit a significant deterioration of its balance of payments position – i.e. a new, and in the long term, unsustainable worsening of global imbalances. Short term fluctuations in US growth must therefore be judged against this strategic background. (source)

Short-term US growth

Due to years of low investment since the financial crisis, companies have accumulated cash.

Companies aren’t making the capital investments because they don’t see the growth to make the investment,” said Jim Paulsen, chief market strategist at Wells Capital Management in Minneapolis. “They’re not making long-term investments without a feel for sales growth. That’s what’s got to come.”

“It’s going to take on more significance for investors. They’re going to get more and more upset about sitting on hoards of cash. You may be hearing more activist investor calls,” Paulsen said.

“People are getting less concerned about financial risks and more concerned about growth,” he added. “If you’re not going to grow, at least pay it back in returns. It’s going to go from a badge of honor (for accumulating cash) to representation of poor management.”

US investors have assets. Many were invested in emerging markets, some in gold and silver. With the upcoming stronger growth in the US, these investors sold their foreign positions, visible in the recent breakdown of the carry trade (depreciation of AUD, BRL or NZD) and of gold and silver prices. Australia and New Zealand have current account deficits, they need foreign investments.

Some of these funds are loaned out via banks.

As opposed to Europeans, Japanese banks do not have a balance sheet issue, they have far more ease to loan out Japanese funds to the US.

See more for