In summer 2011, the rate differential between the euro zone and Switzerland arrived at 1.5%, but despite this widening interest rate differential, the EUR/CHF depreciated to parity. The reason was the high importance of risk averseness in the form of the reverse or inverse carry trade.

The Carry Trade Era between 2003 and 2007: undervalued franc

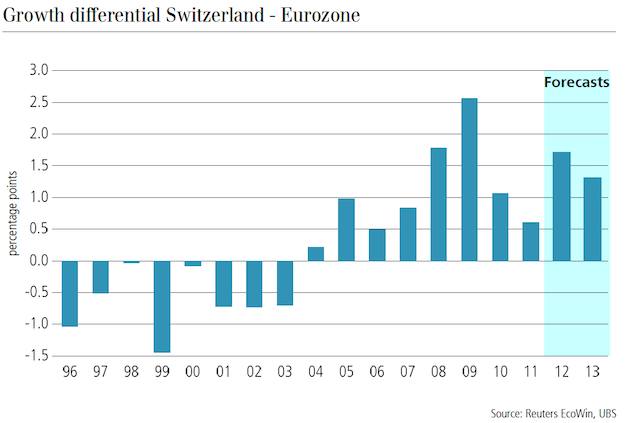

During the carry trade period between 2003 and 2007, the euro strongly increased against the Swiss franc to 1.68. But from 2004 to 2007 the Swiss GDP growth was on average 0.5% stronger than the one in the Eurozone.

The EU-Swiss bilateral agreements helped to increase the number of foreign workers by 23% between 2005 and 2011, whereas the number rose only by 10% between 1992 and 2005. As opposed to former migrations into Switzerland this time foreign employees are mostly highly qualified. Since German wages were relatively low (see previously) German personnel like engineers and computer scientists found it attractive to work in Switzerland and were quickly integrated thanks to the common language. The increasing migration caused rents to go up by more than 2% per year between 2006 and 2009 even during the global financial crisis. Wages increased similarly.

Swiss inflation was low and considerably lower than in the euro zone. The reasons were:

- Lower inflation in all industrialized countries than previously thanks to an aging population and cheap imports from developing nations like China

- Slow growth and slow wage increase in both Germany and Switzerland between 1997 and 2004 (see 3.1.)

- Moderate increases in Swiss housing prices compared to most other countries thanks to more rigid bank requirements after the bad experience of the Swiss housing bust in the 1990s.

- Lower dependency of Swiss companies on the rising oil prices thanks to increased use of water and atomic energy and resulting lower commodity price inflation than the one of the euro zone.

- Further opening of the Swiss market to foreign companies and imported products reduced prices (examples: German low-cost retailers Aldi and Lidl came to Switzerland)

The global carry trade favored high-yielding currencies against low yielders like the yen and the franc. The Swiss CPI was consistently under the SNB price stability target of 2%. Therefore the SNB did see any need to raise interest rates till inflation had become a bit stronger in 2006 and the ECB first started to hike rates. Even if the US housing market started to tumble in 2007, Swiss real estate continued its rise.

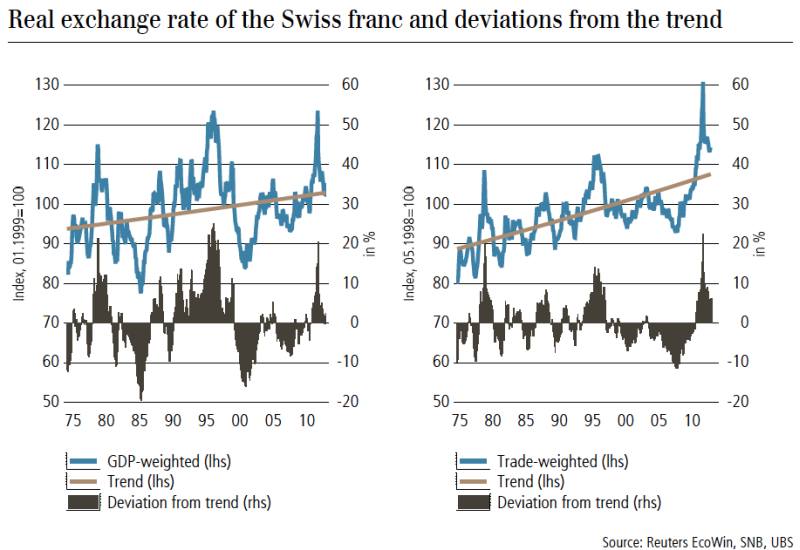

The SNB ignored the stronger growth in Switzerland than in the Euro zone : Swiss rates remained steadily between 0.75% and 1.25% under the ECB rates . This gap together with a high risk appetite caused an undervaluation of the Swissie between 2004 and 2010 in terms of the real effective exchange rate and purchasing power parity.

Real Effective Exchange Rate UBS GDP Trade

Inflation, Reverse Carry Trade and the Influence on the EUR/CHF Exchange Rate

The SNB cap on the franc does the same as the Bank of Italy did (see page 1): it protects the Swiss current account surplus. We will see that similarly to what the Bank of Italy did, this cap on the franc can only end in higher public debt, in this case via SNB losses. Therefore, we think that the euro zone will need to offer at least 1.5% to 2% higher interest rates than Switzerland so that the SNB is able to sell (a big part of) their currency reserves.

Peripheral wages must fall in comparison to German or Swiss salaries in order to make the periphery competitive again. For this reason inflation pressures and interest rates in the euro zone will be subdued. Similarly, as previously in Greece or Ireland, Spanish or Italian inflation might fall to levels between 1% and 2%. Spanish companies did not reduce salaries, but due to inflexible labor laws, they fired especially younger personnel.

Even if some inflation pressures in Germany, Finland and Austria exist, we do not think that the ECB will opt for big interest rate hikes in the next 3-5 years. The main chance to sell reserves for the SNB would be a return to the carry trade period, but given the persisting risk differentials this is extremely unlikely.

Must a carry trade always end in a currency crash?

The following paper from the NBER shows that a carry trade may often end in a currency crash.

[gview file=”https://snbchf.com/wp-content/uploads/2013/01/CarryTrades-CurrencyCrashes.pdf”]

Here the direct access to Carry Trades and Currency Crashes

See more for

2 comments

TolerantLiberty

2014-10-28 at 12:09 (UTC 2) Link to this comment

Three reasons for a carry trade:

1) Country has lower labor costs than the financing providing country. Borrowers want to profit with direct or portfolio investments.

Dobb-Douglas

2) Households in the country reduce their savings rate,

a) e.g. caused by a housing boom (US, Spain, Ireland) and the feeling to be richer.

b) caused by lower borrowing rates (Eurozone, US) than previously

Results –> companies profit on more spending, country becomes

The carry trades collapse when

A) labor costs in the destination country rise too much compared to the other –> loss of competiteness

B) or foreign financing costs rise too much. (often caused by rising labor costs in financing country).

TolerantLiberty

2014-10-28 at 15:18 (UTC 2) Link to this comment

GNI = Local income + Foreign Income

Net S = GNI – C- Inv

Net S = GNI – C – Local Inv – Foreign Inv

Need of Finance country: Net S < 0

Financing Country: Net S > 0

Depletion Country: Net S < 0 and C >>I

Investment Country: Net S < 0 and Inv relatively high

compared to C