Carry Trade

(the basis for this page is the inflation and interest rates page)

The carry trade was once described in Robin Hood terms as “borrowing from the rich to lend to the poor.” A carry trade is a strategy in which the trader invests in a high yielding instrument financed by borrowing in a low yielding instrument.

Popular carry trades include investments in low grade bonds financed by borrowings in high grade bonds, investments in long maturity bonds financed by borrowings in short maturity bonds and options strategies in which the investor is long theta (receiving time premium). (via George Bijak)

In our days, the carry trade in the area of currencies it being long the currencies of emerging markets, AUD or NZD with high interest rates and short JPY, USD or CHF.

If a country sees high inflation and/or high wage increases (historically the main driver of inflation) thanks to an improving economy, then the central bank is obliged to raise the key interest rates. If the country has a good rating, then the currency typically appreciates.

The logic is identical to that behind any investment. The investor seeks the highest returns possible provided that the investment seems to be sufficiently secure. Countries that offer the highest return on investment through high interest rates, economic growth and growth in domestic financial markets tend to attract the most foreign capital.

As you can see, it is not just the rate itself that is important. The direction of the interest rate can act as a good proxy for demand for the currency. The direction of the interest rate is obtained through the central bank’s language in the statement that accompanied their target rate decision. The accompanying statement is analyzed word-for-word for any signs of what the central bank may do at the next meeting. The interest rate decision itself tends to be less important than the expectations for future interest rate moves.

High and increasing rates at the beginning of an economic expansion can generate growth and value in a currency. On the other hand, low and lowering rates may represent a country experiencing difficult economic conditions, which is reflected in a reduction of the currency’s value.

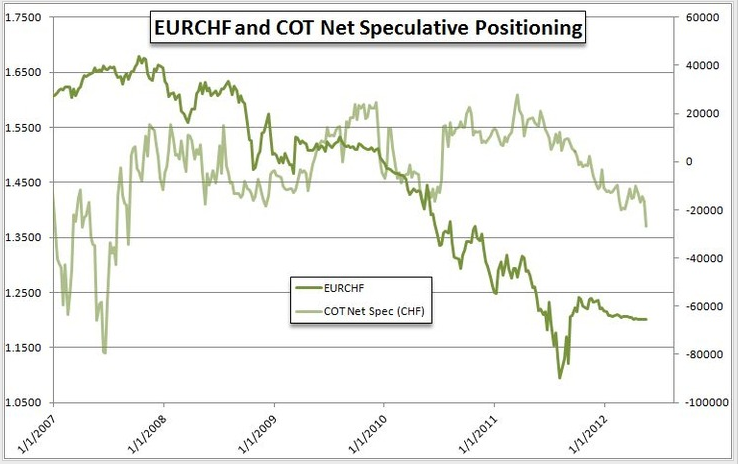

The following graph shows the carry trade between euro and Swiss franc, visible in the COT Net Speculative Positioning. Till summer 2007 speculators were strongly short the franc in order to invest in high-yielding currencies, one of them was the euro. Still in 2007, speculators were short CHF with up 80000 contracts with 100K CHF contract size each. This carry trade unwinded until end 2009, when the speculators were long the franc with 10000 contracts (see the explanation for the unwind furtherbelow).

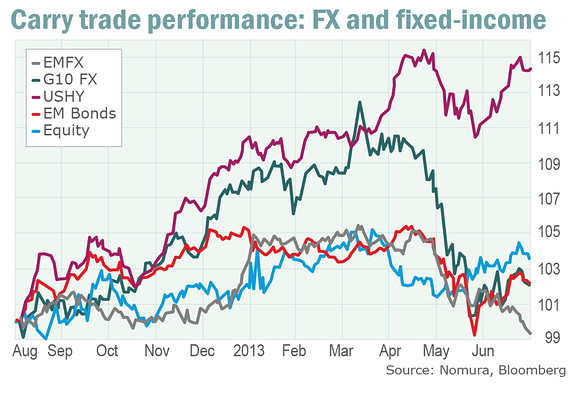

They can be done between currencies or different types of instruments like high yielding bonds, Emerging Markets bonds or equities. In 2013, FX carry trades were not performing, but there was a gap between the performance of carry trades with emerging-market currencies (gray line) and U.S. high-yield bonds (magenta line), based on indexes constructed by the firm. The high-yield trade (USHY) involves buying high-yield debt and shorting investment-grade debt:

This page discusses two closely related concepts: the carry trade and the reverse carry trade. - Click to enlarge

Reason for the carry trade were large interest rate differentials.

The Interest Rate Differential

For years, there were rather big interest rate differentials between G10 economies. For years Japan offered nearly zero percent, while other countries hiked rates to fight a housing boom and economic overheating, the period of the “global carry trade”.

In early 2009, a new carry trade started: The worldwide economy was bottoming out as the United States’ credit freeze began to thaw. The Fed kept U.S. interest rates at all-time lows while the Reserve Bank of Australia began their process of increasing their target benchmark rate thanks to a boom in China.

Since this was at the beginning of an economic expansion, foreign investors into Australian companies needed Australian Dollars to make their investment. Additionally, FX traders began buying the AUDUSD currency pair in anticipation of this demand for the Australian Dollar.

Until 2012, unconventional monetary policy and Quantitative Easing weakened the US dollar. Investors flew into Emerging Markets and “commodity countries” like Australia, New Zealand, Norway and Canada.

The End of the Carry Trade

With the US recovery and the Chinese slowing in 2013, however, everything seems to have changed. Investments in Australia and Emerging Markets (EM) are reduced.

US Investors seem to prefer the American housing market to global investments. Global interest rates gravitate to zero, even in the countries like Australia, New Zealand and Norway, central banks speak about weak inflation, cutting rates and overvalued currencies. EM central banks needed to intervene to sustain their currencies. Increasingly central banks speak about macro-prudential measures – e.g. more equity capital for banks- to fight excesses in the housing market instead of hiking rates.

The Reverse Carry Trade

Another Forex rule states that a state with a current account deficit needs to re-compensate this lack of safety via higher interest rates. With low debt, a positive current account and a positive net international investment position (NIIP), the country typically obtains a good credit rating. All these factors help to reassure investors that their money is safe.

If a state experiences the opposite, quickly rising wages and therefore weaker company margins and consequently a negative current account balance, this drives money out of the country and weakens the currency. Consequently it causes inflation to rise. The central bank then often hikes interest rates that attracts capital again and slows inflationary effects. But on the other side it reduces economic growth.

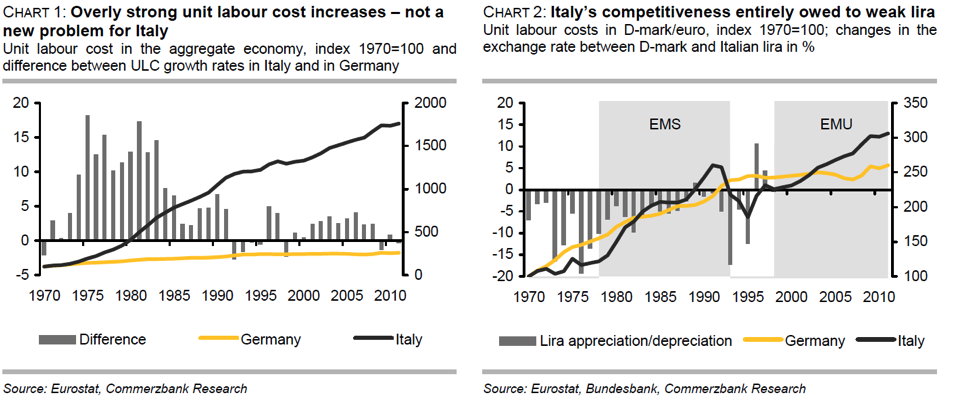

Till the 1990s the Bank of Italy followed this principle and was regularly constrained to hike rates against the Lira’s depreciation with the effect that Italy had to pay higher interest on its bonds. This drove Italian public debt/GDP to far over 100%, but kept the country competitive.

The appreciation of the Swiss franc since the financial crisis is the manifestation of the reverse carry trade or the unwinding of the carry trade.

read on the next page more about the EUR/CHF carry trade

2 comments

TolerantLiberty

2014-10-28 at 12:09 (UTC 2) Link to this comment

Three reasons for a carry trade:

1) Country has lower labor costs than the financing providing country. Borrowers want to profit with direct or portfolio investments.

Dobb-Douglas

2) Households in the country reduce their savings rate,

a) e.g. caused by a housing boom (US, Spain, Ireland) and the feeling to be richer.

b) caused by lower borrowing rates (Eurozone, US) than previously

Results –> companies profit on more spending, country becomes

The carry trades collapse when

A) labor costs in the destination country rise too much compared to the other –> loss of competiteness

B) or foreign financing costs rise too much. (often caused by rising labor costs in financing country).

TolerantLiberty

2014-10-28 at 15:18 (UTC 2) Link to this comment

GNI = Local income + Foreign Income

Net S = GNI – C- Inv

Net S = GNI – C – Local Inv – Foreign Inv

Need of Finance country: Net S < 0

Financing Country: Net S > 0

Depletion Country: Net S < 0 and C >>I

Investment Country: Net S < 0 and Inv relatively high

compared to C