Authored by Steven Englander of Citibank:

It is hard to find a policymaker who hasn’t actively tried to talk his currency down. The few who don’t talk, act as if they were intent on driving their currency lower. Citi’s Steven Englander argues below that the ‘currency wars’ impact is collective monetary/liquidity easing. Collective easing is not neutral for currencies, the USD and JPY tend to fall when risk appetite grows while other currencies appreciate.

Moreover, despite the rhetoric on intervention, we think that direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are not issues. In other countries, intervention can boost domestic asset prices and borrowing and create more medium-term economic and asset price risk than conventional currency overvaluation would. So the MoF/BoJ may be credible in their intervention, but countries whose economies and asset markets are performing more favorably have much more to lose from losing control of asset markets. So JPY and, eventually CHF, are likely to fall, but if the RBA or BoC were to engage in active intervention they may find themselves quickly facing unfavorable domestic asset market dynamics.

Consider some conventional wisdom on currencies:

1) A weak currency buys you happiness

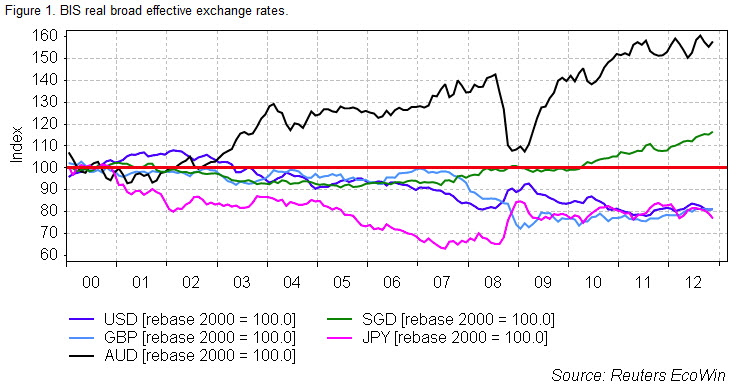

Figure 1 shows real broad effective exchange rates as calculated by the BIS since the beginning of 2000 for selected currencies. If currency weakness were all that it takes to achieve happiness, then the US, UK wand Japan would be very happy places and, Singapore and Australia pretty miserable. This is very basic analysis but it is meant to show that currencies are not all that matters, much as currency strategists would like that to be the case. JPY has depreciated in effective terms, even before the recent bout because major Asian trading partners currency appreciation and Japan low inflation have combined to yield real depreciation.

When looking at the correlation of currencies and outcomes, it is important to consider the possibility that the dominant causality is the reverse of conventional wisdom. Economies with weak fundamentals rely on a weak currency to bail themselves out. Economies with strong fundamentals do not need the crutch of a weak currency. So currency weakness may be more a symptom of underlying issues than a cure all for policy mistakes and structural rigidities.

AUD is obviously a different kettle of fish. Being lucky, like being born rich, is always the best outcome. AUD, positioned offshore from China and sitting on a pile of commodities, does very well. Being lucky is not a policy option, however. Although one hears frequent complaints about AUD over-valuation, it is hard to argue that the AUD over-valuation makes Australia a less attractive location than the US or Japan. It is also pretty clear that the eurozone is a happier place with the EUR at 1.30 than when it was pushing 1.20, and was even happier when EUR was at 1.40 in early 2011. The reason is that weak currencies do not happen in isolation, and often the accompanying effects in other asset markets and economic activity far outweigh any feeling of well-being that accompanies a weaker currency.

2) A weaker currency improves the trade balance

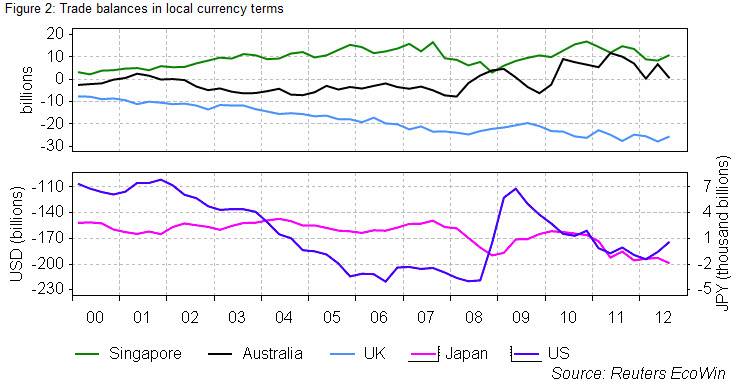

The correlation of currencies and trade performance is also less evident than casual discussion would suggest. The long-term depreciations of USD, GBP and JPY have not done much to improve the trade balance and the Australian and Singapore balances are higher than earlier in the decade. The US improvement is somewhat illusory as much is due to the reduction in income and demand for imports because the US economy has been chronically weak since the crisis began in 2008.

Arguing that competitiveness never matters is foolish. However, the view that competitiveness is all that matters seems to be accepted very uncritically, whereas in fact trade patterns respond with long and variable lags to currency moves, and in the mean-time issues such as productivity gains, savings, investment productivity growth, human capital investment, industrial structure, unionization, taxation, competitiveness and regulation seem to matter a lot more for a lot longer. To be clear, if conventionally measured competitiveness was all that mattered, the link between trade and real effective exchange rates would jump out at you. That we are not all driving Rovers made in the UK means that something other than a weak currency matters a lot.

3) The exchange rate reduces imbalances by changing relative prices in international trade…

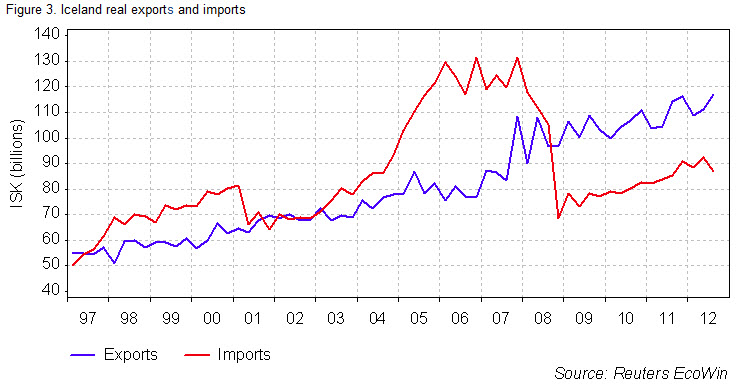

…so it is all very painless. In fact, import and export elasticities with respect to price are low, but import elasticities with respect to income are high. If you are trying to reduce imbalances by depreciating you have to crush domestic purchasing power, as the Icelanders found out (Figure 3). ISK’s massive 2007 depreciation gave exports a modest boost but eliminated the trade deficit by reducing purchasing power in foreign currency terms so much that imports were too expensive to buy. If there is a real imbalance this is a bullet you have to bite, but becoming poor is the best way of getting rid of a trade deficit and the only way to do it in a hurry, as peripheral Europe is discovering.

Although policymakers often make it seem that big, exogenous swings in exchange rates are key drivers of economic outcomes, the opposite is actually true. The reason exchange rates move so much is that they have so little immediate impact on activity, so if a capital outflow creates an imbalance between supply and demand for a currency then the currency has to move a long way to get the trade balance to cover the gap. Conversely, if the currency is being used to stabilize activity, it typically will have to move a long way to generate the desired outcome, assuming nothing else changes.

4) Why do policymakers individually like a weaker currency?

Complaining about other countries’ currencies distracts from domestic policy issues that they prefer to avoid confronting. Foreign investors and foreign policymakers don’t vote, and talking about unfair competition is a lot easier than trying to stimulate domestic activity through innovation and structural policies.

On the margin, the weaker currency does provide benefit to sectors that are very price sensitive (although we repeat that those effects are much more muted than thought). However, consider that most businesses and individuals go out of their way to avoid being in businesses that are highly price sensitive – in those lines you are likely to be competing against some of the poorest people in the world, and it is hard to undercut them unless you are extremely fortunate. It is far easier to sell high-end, differentiated products, whose buyers are willing to pay a premium – and that is what we aim for, but it means much less price sensitivity in demand for what we produce.

5) Why do policymakers collectively like weaker currencies?

Of course all currencies cannot weaken at the same time, but if the fear of being beggared by thy neighbor is rampant, it provides cover for either direct currency market intervention or easy money overall, and is stimulatory.

In effect, the Fed has won the currency wars because EM and G10 policymakers globally have used currency war as a cover to intervene, ease policy and augment liquidity. So when everyone fights the currency war we end up with a collective easing of monetary policy, and in some cases, even of fiscal policy. This is the global stimulus US policymakers have been advocating for a long time. The downside is that the biggest winner is the economy with: 1) the most sensitivity to monetary stimulus; 2) the greatest indifference to inflation; and 3) the least CPI sensitivity to a run-up in commodity and other liquidity-sensitive economies. In this respect advanced economies that are services heavy, financially developed and that are well-treated by capital markets may see more upside to a global liquidity run-up.

6) Should policymakers engage in currency wars?

It used to be thought that the tradeoff was between currency strength and inflation. A weaker currency gave you more growth and higher inflation, and policymakers would choose the combination that did them the most good. The financial crisis has made clear that the trade-off is between a stronger currency and irrational exuberance in domestic asset markets. Now the policy choice is between a stronger than desired currency and excess stimulus to domestic asset markets. So when policymakers from Canada to Norway to Australia keep policy rates low out of concern over excess appreciation, they have to beg domestic households not to bid up housing prices or borrow too much.

This is an important choice. The policy dilemma is whether to keep rates low and risk a balance sheet recession/depression down the road because domestic households did not heed the central bank advice to be prudent in taking on debt and buying assets when real interest rates were low or negative, or take the consequences of tightening and watching your currency strengthen. We have found that balance sheet recessions are not readily solved by cutting interest rates. To their credit, BIS researchers has made the case to be watchful of asset market imbalances for at least a decade, but have yet to provide a working algorithm to define such a situation, essentially leaving policymakers to know it when they see it. Compounding their dilemma is that asset price bubbles are fun while they last, and it is hard to know when domestic asset markets are so far out of line with fundamentals that the risk of a crash is real.

7) Dutch disease

Everyone loves domestic manufacturing and there are high school kids who can explain why Dutch disease is terrible (although some probably think it is an STD). Essentially, Dutch Disease is a situation in which a temporary boom in one sector of the economy (i.e. commodities) leads to currency appreciation and the withering of exposed sectors that do not have a similar positive shock. RBA Governor Stevens has pointed out that arguments against shifting resources out of other tradable goods sectors into the resource sector weaken considerably, if there is no expectation that prices or production will collapse,. There may also be a case for fiscal consolidation or establishing a SWF to damp current demand and spread the benefits of the boom more evenly over a period of years, but artificially keeping domestic rates low so that there is a both an internally and externally driven boom is a questionable policy response.

From a policy perspective, the question is not which is the best policy under a reasonable baseline, but which policy mistake will be easier to fix if it turns out to go wrong. Despite the focus on the exchange rate, the risk that excess domestic asset price appreciation carries may be the harder to fix – an overvalued exchange can respond within a matter of days to changed circumstances, as we discovered in late 2008. If asset prices and are overvalued and households and businesses have taken out loans that they cannot pay back, it takes a lot longer to get prices and balance sheets back to equilibrium.

8) Why not intervene?

There is a Gresham’s Law with respect to intervention, It goes something like this – bad currencies will always end up in reserve portfolios. The reason a currency depreciates is that investors are unwilling to hold it. Absent intervention, it depreciates to the point that local assets become so cheap that investors see value or further limited downside. Typically when we are looking at depreciation of major currencies, that downside is so far below current values that when competitor countries see the depreciation, they intervene to support the weakening currency.

Whether intervention is needed in theory depends on whether the depreciation restores perceptions of value sooner than it causes panic among competitors. Empirically the competitiveness panic button is hit well before the valuation induces buying. (I am not mentioning trade adjustment because if that occurred sufficiently quickly, there would be no need for intervention.) So, when reserves are accumulated because of competitive pressure forces countries to buy the USD or EUR, by definition the country is accumulating the currency that no one else wanted.

Diversification is an illusion because when you buy a loser currency against your own on Monday, and turn around and try and sell it on Tuesday against a more attractive currency, the loser currency remains in excess supply, and that excess supply exerts downward pressure until we get the panic or (less likely) valuation buttons hit. At the end of the day, the weak currency has to find a price at which public or private investors are willing to hold it reserve manager buying+diversification selling doesn’t remove this excess supply. Almost all the reduction in the USD share in reserve manager portfolios has come because the USD has dropped in value, not because reserve managers have been able to discretely sell USD out of reserve portfolios into private hands.

9) What about verbal intervention?

In theory, sterilized intervention may work because it is a concrete indication of policymaker intentions. In current non-crisis conditions, verbal intervention and references to exchange rates in policy statements have temporary currency effects but these seem to fade quickly. The fear among traders is mainly that they trigger stops, rather than signal major risk. However, similar to QE, such verbal interventions have limited impact, but they also have essentially zero cost so they are likely to continue even if the impact fades.

10) Why can’t all CBs follow the SNB lead…

…and draw a credible line in the sand? The answers: 1) it helps a lot if you are facing a risk of deflation so unsterilized intervention does not have the usual inflation risk downside; 2) it helps a lot if the euro zone pulls back from the brink and you are able to unload the bulk of your euro reserves. Had the euro zone crisis intensified, the SNB would have been holding an increasing share of Swiss GDP in a currency that was at risk of falling apart, and the credibility of the intervention would have been in question. Being lucky continues to be important.

11) Why can’t all Finance Ministries follow the MoF lead…

…and push their currencies lower by threatening dire consequences to their central banks if they don’t cooperate? The answers: 1) Deeply embedded deflation again helps reduce the fears that the currency move and promised interventions will produce negative inflation consequences of intervention; 2) Unless you are a G4 country, the CB balance sheet expansion may be accompanied by damage to bond markets from inflation fears. 3) It also helps if your economy has been hollowed out by structural rigidities and demographics

Authored by Steven Englander of Citibank

Read also why the only central bank currency warriors are the Swiss and NOT the Japanese

See more for