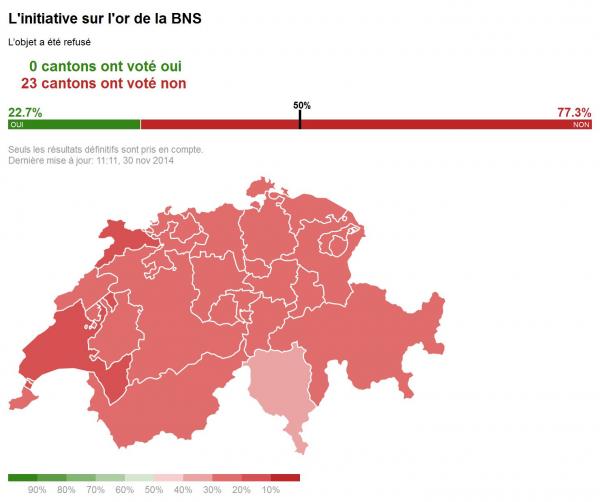

One year ago (and just two months before the shocking announcement the Swiss Franc’s peg to the Euro would end, dramatically revaluing the currency, and leading to massive FX losses around the globe and for the Swiss National Bank) the Swiss held a referendum whether to demand that their central bank should convert 20% of its reserves into gold, up from 7% currently. After the early polls showed the Yes vote taking a surprising lead, the Diebold machines kicked in and the result was a sweeping victory for the No vote, without a single canton voting for sound money.

Ironically, this unexpected nonchallance about the Swiss central bank’s balance sheet by one of Europe’s more responsible nations took place just before the same bank announced CHF30 billions in losses on its long EUR positions following the revaluation of the CHF. It also took place when not just Germany, but the Netherlands and Austria announced they would repatriate a major portion of their gold in a move which, all spin aside, signals rising concerns about the existing monetary system.

We wonder if the Swiss have changed their mind about just how prudent it is to have their central bank operate as one of the world’s largest – and worst – after its CHF 30 billion loss in Q1 FX traders, and hedge funds with $94 billion in stock holdings, since then.

We may soon have the answer, because in what is shaping up to be another historic referendum on the treatment of money, earlier today the Swiss Federal Government confirmed that it had received enough signatures and would hold a referendum as part of the so-called “Vollgeld”, or Full Money Initiative, also known as the Campaign for Monetary Reform, which seeks to ban commercial banks from creating money, and which calls for the central bank to be given sole power to create the money in the financial system.

In other words, an initiative to ban fractional reserve banking, and revert to a 100% reserve.

As Finanzen.ch reports, after 111,763 signatures urging a referendum were submitted, of which 110,955 valid, the Federal Chancellery announced on Thursday that the popular vote would take place. Under Switzerland’s direct democracy, a referendum can be held if a motion gains 100,000 signatures within 18 months of launching.

“Banks won’t be able to create money for themselves any more, they’ll only be able to lend money that they have from savers or other banks,” said the campaign group.

Ever since the SNB was established in 1891, it has had exclusive power to mint coins and issue Swiss banknotes. However, as with every other fractional reserve banking system, over 90% of the money in circulation in Switzerland, as in every other country, now exists in the form “electronic” cash created by private banks, rather than the central bank.

It is this threat of uncontrolled money creation and the risks to systemic stability that the Vollgeld campaign is seeking to stem.

“Due to the emergence of electronic payment transactions, banks have regained the opportunity to create their own money,” said the Swiss Sovereign Money campaign. “The decision taken by the people in 1891 has fallen into oblivion.”

So with the referendum now docketed, will this vote too be mysteriously “lost” in the final minutes of voting? According to the Telegraph, unlike the gold vote – which was seen as a precursor to re-introducing the Gold Standard in Switzerland – economists have been more supportive of the idea of “sovereign money” as a way to stabilize the economy and prevent excess credit growth.

A date for the Swiss referendum has not been set.

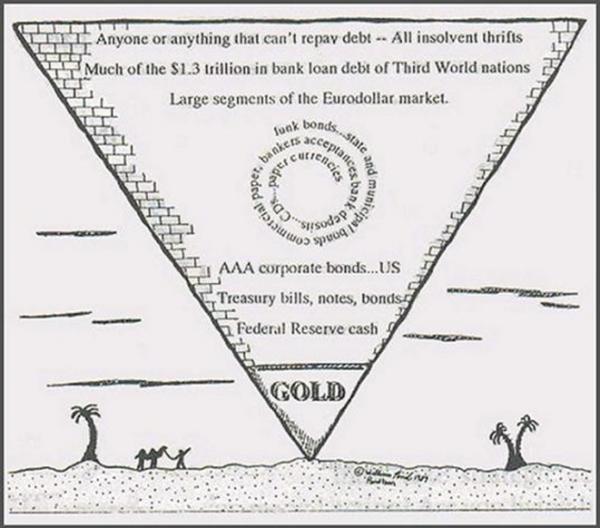

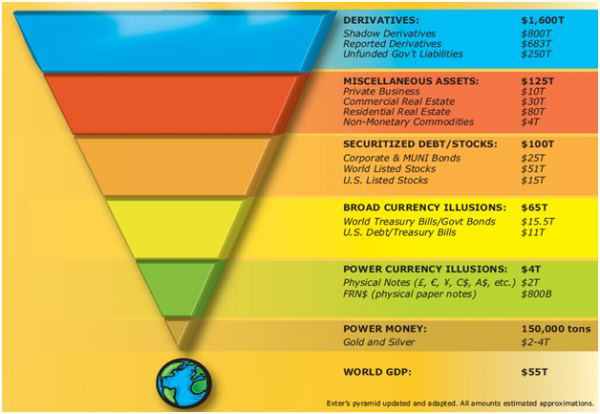

If the vote passes, and if Swiss banks are barred from creating deposits (by way of loans), it would shake to the core the entire modern financial system, which these days is exclusively reliant on runaway fractionalization of sound money, as more and more layers are added to the top of the Exter’s Pyramid, as the only possible “growth” left in a world that has never seen so much debt, is to find new and creative ways to borrow from the future, with banks getting all the benefits and stuffing taxpayers when the inevitable collapse happens.

Below is a pdf provided by the Vollgeld Initiative, responding to popular criticisms against its “100% reserve” crusade.

See more for