Michael Pettis gave Matthew Klein the arguments for the following sharp analysis on the Financial Times. For me, it remains the best essay on the end of the EUR/CHF peg. Matt asks two questions:

Question 1: Is the Swiss Franc really so expensive?

Question 2: Is the Franc so strong because the Swiss do not consume enough?

We will add more information inside the post or outside of it, that questions if the Swiss savings are really so high (e.g. in comparison to China), where these high savings come from and which sector of the economy possesses the savings, firms, households or the state.

We will see later that one does not even know what the Swiss economy is, given that more than half of income and costs for Swiss firms and multi-nationals are not generated in Switzerland and therefore in foreign currency.

What we know, however, and this is the crux, is that the stocks are denominated in Swiss francs and that movements in stocks are the main driver of the balance of payments and therefore of FX rates.

One of the most predictable consequences of the Swiss National Bank’s decision to stop suppressing the exchange rate between the franc and the euro was the whinging of Swiss exporters. That doesn’t mean the policy change was an error. If anything, it may help rebalance the Swiss economy away from its excessive dependence on exports towards greater levels of domestic consumption.

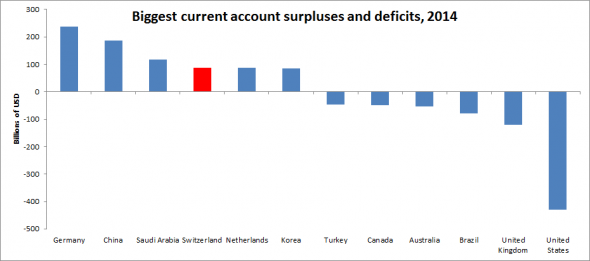

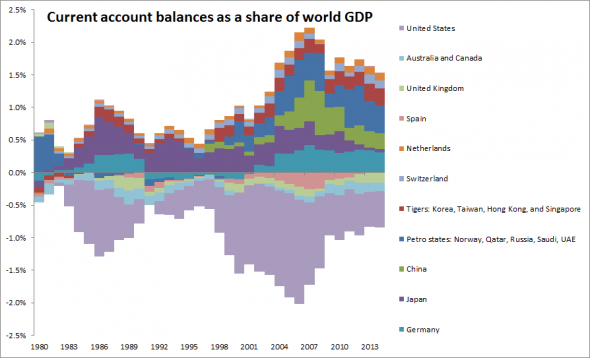

The clue is Switzerland’s ridiculously large current account balance. The chart below shows the countries with the six biggest current account surpluses and six biggest current account deficits:

(Source: International Monetary Fund World Economic Outlook database)

For context, remember that Switzerland is a country of only 8 million people — by far the smallest of any on that chart — and doesn’t have any oil revenues it needs to reinvest with a sovereign wealth fund. Clearly something odd is going on.

The current account balance tells you how much a country’s residents save relative to how much they spend. Surpluses mean that residents are sending more capital abroad than they import from the rest of the world, while deficits are a sign that domestic savings are insufficient to finance consumption and investment. (In theory, you should be able to add up all the current accounts of every country and get exactly zero, but problems with data collection prevent the math from working out.)

Essentially, countries with current account surpluses export economic weakness to places that can absorb it by increasing their borrowing. That can work for a while but it’s always dangerous because there are limits to how much people can borrow without endangering the health of their own economy.

Normally, there isn’t anything inherently wrong with having a current account deficit or a current account surplus. Rates of return aren’t the same everywhere in the world, so savers in places with few worthwhile investment opportunities ought to fund higher-yielding projects abroad.

But in a world awash in excess debt, surplus countries are effectively leeching off the demand generated elsewhere without making the necessary sacrifices to maintain global economic growth. Often this is due to policies that boost domestic employment by distorting capital flows — tax and regulatory policies that limit consumption, financial repression, and currency manipulation.

(We strongly recommend you read Michael Pettis’s The Great Rebalancing for a detailed explanation of how all this works.)

Until yesterday, Switzerland was clearly engaged in currency manipulation by setting an arbitrary limit on the value of the franc relative to the euro and enforcing that limit with unlimited purchases of euro-denominated assets.

The SNB always denied that mercantilism was driving its policy. They argued that Switzerland was a victim of inflows from panicked residents of the euro area worried about the collapse of the single currency, bank failures, and sovereign defaults. Like emerging markets responding to Fed bond-buying with capital controls, the SNB was just trying to shield itself from outside forces it couldn’t control. When the crisis abated, the peg would no longer be necessary.

We’re sceptical. Even if the franc’s appreciation was primarily driven by inflows associated with the euro crisis, the fact is that Switzerland could use a much stronger currency to correct the country’s imbalances. We struggle to understand the SNB’s argument that the massive surplus is “determined by structural factors that behave independently of the exchange rate.” There is always some exchange rate that balances the flows of money in and out, it just might be a lot different than what Swiss exporters feel comfortable with.

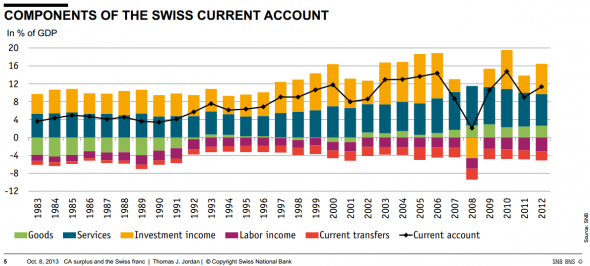

Besides, Switzerland’s current account surplus is composed of large surpluses in tradable goods, services, and investment income — any one of those might be “structural” but it strains credulity to think that they all are:

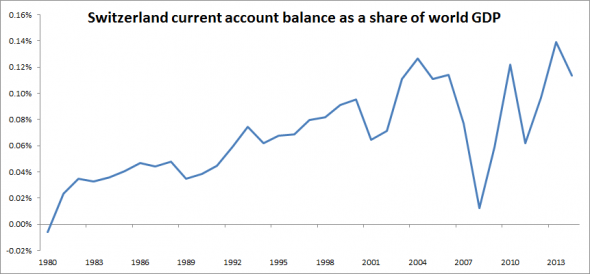

Also, note that the surplus shrank somewhat in 2011 — the year when the franc soared in value against the euro so much that the SNB established the ceiling. Otherwise, though, the history is clear that the Swiss current account surplus has steadily soared relative to world GDP:

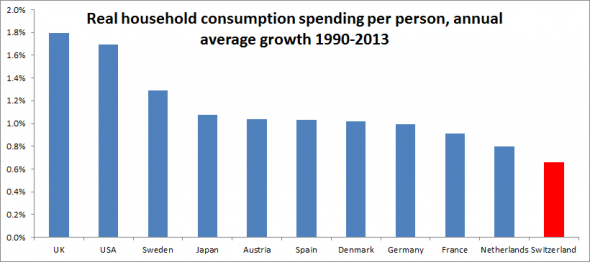

The flip side of these massive net outflows in capital is that Swiss households have enjoyed the least growth in their living standards in the rich world, at least as measured by real consumption per person:

(Sources: Eurostat, World Bank, author’s calculations)

A stronger franc could be the ideal solution to this problem. Swiss consumers won’t need to save as much because their currency is no longer so undervalued. Most of their extra spending will probably be at home, but imports should nevertheless rise, which would be a boost to neighboring economies that need the help. Exporters will be forced to become more competitive now that the subsidy of an artificially cheap currency has been taken away.

If this sounds like the what people have suggested for Chinese economic reform, there’s a reason for that. Switzerland, in certain ways, resembles the stereotype of China more than China itself does. (And, for that matter, the stereotype of Japan.) Here’s a chart of the biggest contributors to global imbalances over time:

Notice how Japan’s current account surplus ballooned and then shrank. China’s did so too, although it did so at a faster pace and under somewhat different circumstances. The surpluses of the petro states will probably soon vanish thanks to the decline in the oil price, which, happily enough, also ought to boost real incomes and spending in the rest of the world. That leaves Germany, the Netherlands, and Switzerland as the major villains sapping global demand.

Germany and the Netherlands are limited in what they can do because of their membership in the single currency, although tax cuts and higher levels of government spending would help. (We would also point out that the growth of enormous surpluses in Germany and the Netherlands started around the time that the euro was established.)

Switzerland, however, has monetary sovereignty. Until yesterday, it used that power for ill. The recent move by the SNB could be the first step in Switzerland’s long-awaited transition towards less savings and more consumption. Swiss households should be pleased.

Related reading from FT Alphaville:

Paul Krugman and the Swiss Movement — Dean Baker

When will the SNB end FX intervention and start raising rates? — FT Alphaville