Category Archive: 3.) Personal Finance

VAT now applied to most foreign online shopping from 1 January 2019

In 2016, Switzerland’s government decided to tighten the VAT exemption on imported purchases, a move that affects most online orders from foreign retailers. The new rules took effect on 1 January 2019 – they were originally planned for 1 January 2018 but systems and processes were not ready.

Read More »

Read More »

Switzerland’s electronic motorway vignette to be optional

This week, Switzerland’s Federal Council decided the planned electronic motorway vignette will be optional. Drivers will be able to choose. Anyone wanting to drive on Switzerland’s motorway network must first buy a vignette, a road tax sticker introduced in 1985, which must be displayed on the windscreen. It currently costs CHF 40.

Read More »

Read More »

New Swiss broadcasting fee starts next year

After a referendum in March 2018 threatened to axe Switzerland’s costly broadcasting fee, the government put forward a counter proposal, which was adopted when 71.6% of voters voted to keep the fee. On 1 January 2019, the lower fee contained in the government’s plan will come into force. Next year, instead of CHF 451, each household will need to cough up CHF 365.

Read More »

Read More »

Swiss Divorce Rates Continue to Climb

By 2017, 40.5% of those married in 1987 were divorced, compared to 33.2% of those married in 1977 and 24.7% of those married in 1967. Divorce in Switzerland starts early. 9.4% of those married in 1987 were divorced after five years, as were 8.1% of those married in 1977 and 4.8% of those who tied the knot in 1967.

Read More »

Read More »

Swiss Health Insurance Costs to Rise Further in 2019

More bad news for Swiss household budgets was released today for residents of all but three Swiss cantons. Health insurance premiums in 2019 will be on average 1.2% higher than in 2018 across Switzerland as a whole. However, within this figure there are significant cantonal variations.

Read More »

Read More »

Vaud to cap health insurance premiums at 12 percent of income

Starting in September 2018, health insurance premiums in excess of 12% of income in the canton of Vaud will be covered by the government. From the beginning of 2019, this percentage will be reduced to 10%, increasing the number of people who qualify and the size of the subsidies, according to the newspaper Le Matin.

Read More »

Read More »

Swiss Health Insurance Companies Aim to Make it Easier to Break Contracts

Swiss health insurance companies are aiming to change laws to make it easier for them to unilaterally end complementary insurance contracts, according to the newspaper Le Matin.

Read More »

Read More »

Geneva set to vote on maintaining public spending in the face of company tax reform

An initiative entitled: zero losses, was filed this week in Geneva. It aims to ring fence current public spending in the face of future company tax reform. The initiative gathered 9,147 signatures, more than the 7,840 required.

Read More »

Read More »

Majority favours later retirement for women, according to survey

In Switzerland, the official retirement age for women is 64, a year earlier than it is for men. A poll by gfs.bern shows that around two thirds are in favour of raising the retirement age of women to 65. Only 16% are against the idea, with a further 18% somewhat against it. Men (78%) are more in favour of the change than women (54%), according to the newspaper 20 Minutes.

Read More »

Read More »

Swiss VAT might rise to fund lower company tax rates

Historically, Switzerland has offered certain foreign companies special preferential tax deals in order to attract them. In response to international pressure, the current system is to be phased out replacing preferential tax rates with lower universal ones in the hope that these companies will stay.

Read More »

Read More »

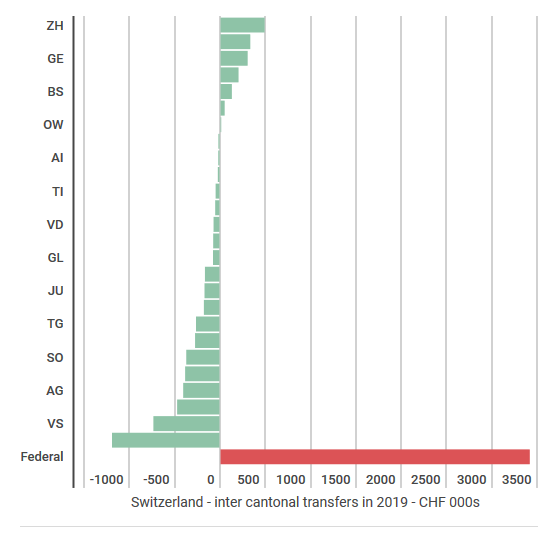

The price of solidarity – Switzerland’s inter-cantonal payments for 2019

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland.

Read More »

Read More »

Swiss pensions – lump sum withdrawal restrictions rejected by Council of States

Against the wishes of the Federal Council, Switzerland’s upper house, the Council of States, rejected a plan to prevent people from withdrawing lump sums from their 2nd Pillar pensions, according to the newspaper Tribune de Genève. Last week, the Council of States voted 25 to 15 to reject the plan.

Read More »

Read More »

No relief for Swiss renters

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 1 June 2017 when it fell to its lowest level since 2008.

Read More »

Read More »

Fribourg – moves to axe government pensions for life

Switzerland’s government is working hard to find ways to fix a looming state pension shortfall. Two politicians in the canton of Fribourg have decided to seek savings by attempting to cut lifetime government pensions granted after short stints in the job, according to the newspaper 20 Minutes.

Read More »

Read More »

Swiss Rail drops plan to put Wi-Fi in trains

Swiss Rail has dropped plans to install Wi-Fi in its trains, according to the newspaper Le Matin. After a survey revealed that customers would only use on-board Wi-Fi it was free, the company decided there was no justifiable way to cover the cost, according the the newspaper. Swiss Rail is not prepared to bear the costs the mobile operators would charge them for the service and cannot not justify adding the cost to ticket prices.

Read More »

Read More »

Disability welfare – fraud investigations expected to save 170 million

By January 2018, the number receiving disability welfare in Switzerland had dropped to 217,200, 40,300 fewer than in 2006 when the number reached a record 257,500. Switzerland’s Federal Social Insurance Office (FSIO) attributes the reduction to an occupational rehabilitation programme started in 2008, and disability welfare fraud investigations.

Read More »

Read More »

Child care tax deductions set to rise in Switzerland

Switzerland’s Federal Council, or cabinet, plans to increase the maximum annual deduction for child care costs to CHF 25,000 per child, up from CHF 12,100. This would allow parents to deduct up to this amount from their income for federal tax purposes but would not affect canton and commune taxes. Deductions could not exceed the amount spent.

Read More »

Read More »

Some Swiss train fares to fall in June

This week, ch-direct, an association of public transport providers that sets ticket prices, announced there would be no ticket price rises in 2019. Instead the prices of some tickets will fall slightly on 1 June 2018. The price small cuts on standard fares in June relate to the shift from 8.0% to 7.7% VAT at the beginning of the year.

Read More »

Read More »

Food consumes far less of Swiss budgets than it did 25 years ago

Comparing the most recent statistics on Swiss consumer inflation to those in 1993 reveals a steep drop in the percentage of spending allocated to food. When statisticians calculate consumer price rises they look at the prices of a standard basket of goods. In 1993, food and non-alcoholic beverages made up 14.3% of the value of this standard basket. By 2018, the percentage had fallen to 10.4%, a 27% drop.

Read More »

Read More »

Tax and spend – canton of Geneva generates a surprise budget surplus

When Geneva’s finances make the news it is typically bad. At the end of 2016, the canton had debts of CHF 12.5 billion, equal to 153% of its income. In January 2018, the rating agency Standard and Poors gave Geneva a negative outlook citing risks related to the canton’s poorly funded public pension scheme.

Read More »

Read More »