Category Archive: 3.) Personal Finance

Some UN consultants thought their income was tax free. They were wrong.

Some United Nations consultants haven’t paid taxes on their income, thinking it was exempt. When the tax authorities catch up with them they’ll risk paying back taxes and fines. As a general rule, foreign UN functionaries are not required to pay local taxes on their income. On the other hand UN consultants must.

Read More »

Read More »

A fifth of Swiss can’t cope with an unexpected expense of 2,500 francs

In 2015, 21.7% of Switzerland’s population was unable to cover an unexpected expense of CHF 2,500 within a month, says a report from the Swiss Federal Statistics Office. Single parent families were the least able to cope with 46.1% of them falling into this camp. Single parent families were followed by single people under 65 (27.1%) and two-parent families (24.0%).

Read More »

Read More »

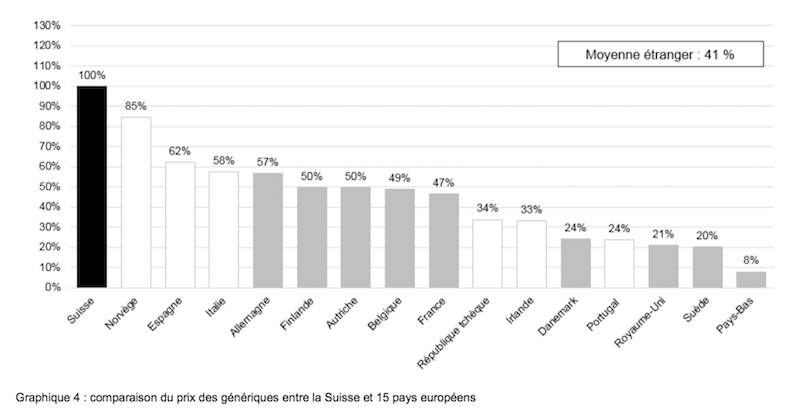

Swiss drug prices more than double european average – “Mr Price” takes aim

Switzerland’s public price watchdog chief, Stefan Meierhans, also know as “Mr Price”, has taken aim at high Swiss drug prices. A report published last week shows prices of generic drugs are nearly 2.4 times more expensive in Switzerland compared to the average price across 15 european countries.

Read More »

Read More »

A recent purchase shows how hard it is to trust product packaging

Volkswagen shocked the world when it was revealed it was cheating on emissions tests on a grand scale. Now some television makers may be gaming the energy efficiency ratings of some of their televisions, according to the Economist.

Read More »

Read More »

More than 3,000 state beneficiaries in Geneva admit not declaring assets or other income

Last October, Geneva state councillor Mauro Poggia, had his department send out close to 91,000 letters to those receiving social benefits, asking them to contact the authorities if they had failed to declare any assets or income. Laurent Paoliello, a spokesperson from the DEAS, said they received 3,200 letters back. So far, we haven’t been through all the letters, he said.

Read More »

Read More »

Those over 25 may pay more for Swiss health insurance

The Swiss States Council commission on public health endorsed a plan that could lead to higher health insurance premiums for those over 25. Swiss health insurance providers are required to pay into a communal pot to spread risk between insurance companies.

Read More »

Read More »

Changes to health insurance zones could lead to steep premium rises for some

In Switzerland, how much you pay for compulsory health insurance depends on where you live. Premiums vary hugely by canton. For 2016, average monthly adult premiums in Basel City are CHF 545.60, Switzerland’s most expensive, compared to CHF 326.70, in lowest-cost Appenzell-Innerhoden. The difference between the two cantons is 40%.

Read More »

Read More »

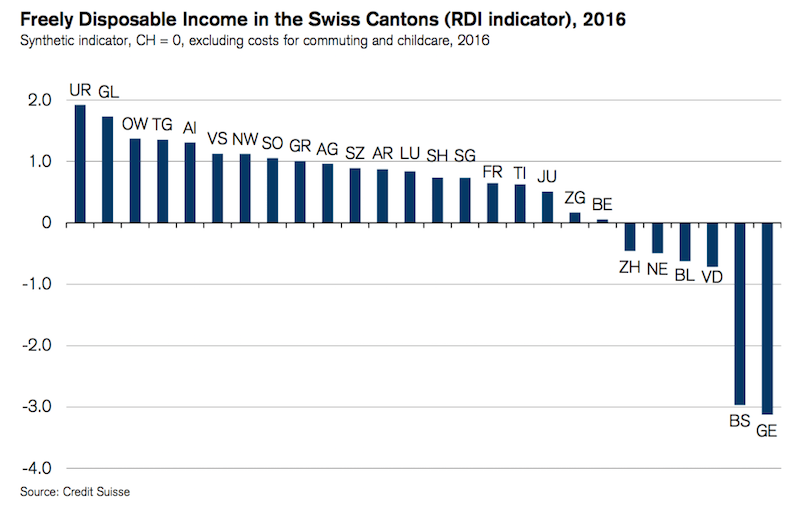

Switzerland’s costliest cantons for tax, housing, health, commuting, and childcare

This week the bank Credit Suisse published its cantonal cost of living report. Its ranking considers a typical household’s biggest expenses: tax, housing, commuting, basic health insurance and childcare. It takes income and deducts all of these costs to arrive at a measure of disposable income.

Read More »

Read More »

Swiss mortgage rates climb in 4th quarter

After reaching a historical low in the third quarter of 2016, rates started rising in the fourth quarter. Rate increases hit mortgage tenors of five and ten years. Compared to Q3, fixed mortgage rates on loans of ten years went up an average 0.2% to 1.62% according to price comparison website Comparis.ch.

Read More »

Read More »

Swiss government plan to reduce doctors’ visits

Some Swiss politicians would like to focus minds on the costs of going to the doctor to reduce the number going for the most minor of reasons. Their plan would require deductibles to rise annually in line with increases in the cost of basic health insurance. Higher deductibles, they think, would put people off going to the doctor unecessarily, reducing pressure on the health system.

Read More »

Read More »